The Bank of Canada released its October 2008 Monetary Policy Report on Thursday …

Core inflation is projected to remain below 2 per cent until the end of 2010. Assuming oil prices in a range of US$81 to US$88 per barrel, consistent with recent futures prices, total CPI inflation should peak in the third quarter of 2008, and is projected to fall below 1 per cent in mid-2009 before returning to the 2 per cent target by the end of 2010.

…

In line with the new outlook, some further monetary stimulus will likely be required to achieve the 2 per cent inflation target over the medium term.

…

Over the 1978–2004 period, which is long enough for cyclical and irregular effects to wash out, the growth in labour productivity for the total economy averaged 1.2 per cent per year. Recently, this trend appears to have fallen to slightly below 1.0 per cent, owing partly to the considerable amount of structural adjustment under way in the economy and perhaps partly to firms hiring additional labour, given concerns about tightening labour markets (Chart A). As these factors dissipate, aggregate productivity growth should pick up.

…

As a simple illustration, major Canadian banks have an average asset-to-capital multiple of 18. The comparable figure for U.S. investment banks is over 25, for European banks, in the 30s, and for some major global banks, over 40.

…

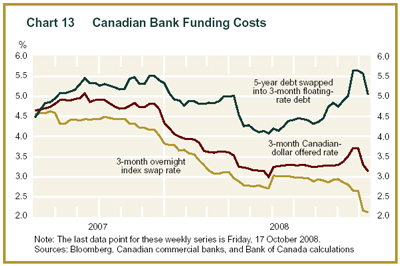

Credit spreads for financial institutions, as measured by the difference between a weighted average of borrowing rates across the term structure and the expected overnight rate, spiked to around 200 basis points in early October. While strong actions taken by governments and central banks to support financial institutions have led to some retracement in these spreads, it is expected that spreads will be reduced only slowly as confidence is gradually rebuilt. Since the onset of the financial market turbulence in August 2007, effective borrowing costs for Canadian financial institutions have eased somewhat, with the rise in credit spreads more than offset by the 225-basis-point cumulative reduction in the target overnight rate (Chart 13). These indicative borrowing costs likely do not, however, adequately take account of the decreased availability coming from illiquid and risk-averse interbank markets.

The huge spread on 5-year money may go a long way to explain why Royal Bank was willing to issue Fixed-Resets at 5.60%+267. Who knows … with a new fiscal year on the way, we may see more issues like that …

[…] PrefBlog Canadian Preferred Shares – Data and Discussion « BoC Monetary Policy Report, 2008-10-23 […]