The FDIC has released the 3Q08 Quarterly Banking Profile.

The headlines of the text give the flavour:

- More Institutions Report Declining Earnings, Quarterly Losses

- Lower Asset Values Add to the Downward Pressure on Earnings

- Margin Improvement Provides a Boost to Net Interest Income

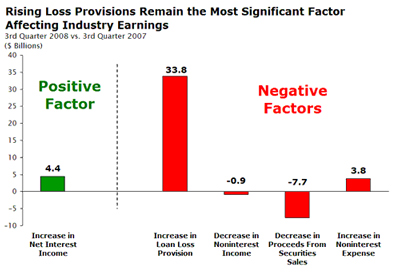

- Loan Losses Continue to Mount

- Growth in Reported Noncurrent Loans Remains High

- Reserve Coverage of Noncurrent Declines

- Failure-Related Restructuring Contributes to a Decline in Reported Capital

- Liquidity Program Provides a Boost to Asset Growth

- Discount Window Borrowings Fuel a Surge in Nondeposit Liabilities

- Nine Failures in Third Quarter Include Washington Mutual Bank

The 2Q08 Report was previously noted on PrefBlog.