If I don’t give myself a way of finding this article quickly, I’m going to go out of my mind! I think this is a very good exposition of the stocks/bonds conundrum, and regularly spend half an hour looking up the reference – no more!

How Long is a Long-Term Investment? was written by Pu Shen of the Kansas City Fed and published in the Spring 2005 edition of their Economic Review.

Unfortunately, the source-file is copy-protected (why do they do that?) but I can recommend this article as part of the asset allocation process; it has many fascinating graphs. The laboriously re-typed conclusion is:

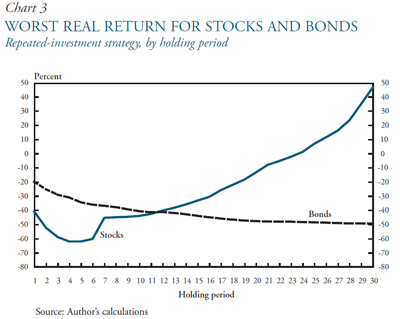

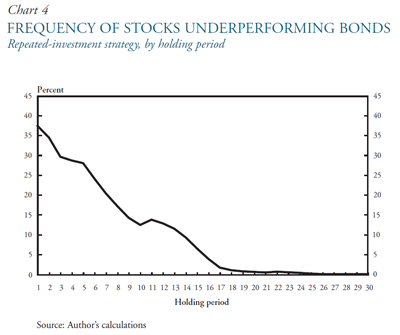

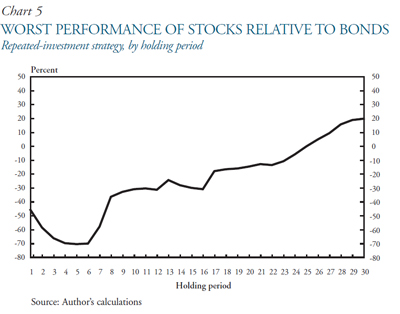

This article confirms the conventional wisdom that in the United States stocks historically have been safer than long-term government bonds for investors with long holding periods. But the article also shows that the conventional wisdom has only been true for investors who held their portfolios for more than 25 years. For practical purposes, that may be too long a holding period for most investors. Over the years, for investors who have held their portfolios for shorter periods, both stocks and bonds were exposed to substantial risks, and stocks did not necessarily outperform government bonds. This implies that in making asset allocation decisions, investors should think carefully about how long they will be able to hold their portfolios undisturbed and how much risk they are willing to bear.

Update: A little bird has sent me an unlocked version of the paper, so I can reproduce my three favourite graphs:

[…] for Inflation-Indexed Government Securities: Lessons from Earlier Experiences by Pu, Shen, whose work on long term relative return of stocks vs. 20-year Treasuries has been previously highlighted on […]