The Inflation Risk Premium in the Term Structure of Interest Rates, Peter Hördahl, BIS Quarterly Review, September 2008:

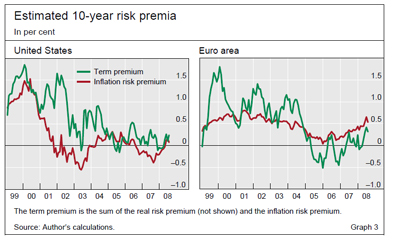

A dynamic term structure model based on an explicit structural macroeconomic framework is used to estimate inflation risk premia in the United States and the euro area. On average over the past decade, inflation risk premia have been relatively small but positive. They have exhibited an increasing pattern with respect to maturity for the euro area and a flatter one for the United States. Furthermore, the estimates imply that risk premia vary over time, mainly in response to fluctuations in economic growth and inflation.

…

This article estimates inflation risk premia using a dynamic term structure model based on an explicit structural macroeconomic model. The identification and quantification of such premia are important because they introduce a wedge between break-even inflation rates and investors’ expectations of future inflation. In addition, inflation risk premia per se may provide useful information to policymakers with respect to market participants’ aversion to inflation risks as well as to their perceptions about such risks.The results show that inflation risk premia in the United States and in the euro area are on average positive, but relatively small. Moreover, the estimated premia vary over time, mainly in response to changes in economic activity, as measured by the output gap, and inflation. The estimates suggest that fluctuations in output drive much of the cyclical variation in inflation premia, while high-frequency premia fluctuations are mostly due to changes in the level of inflation.