The Cleveland Fed has released the July edition of Economic Trends with articles on:

- May Price Statistics

- The Yield Curve, June 2009

- A Global Fiscal Crisis?

- The Employment Situation, June 2009

- Real GDP: First-Quarter 2009 Final Estimate

- Gross Domestic Product Growth across States

- Fourth District Employment Conditions

- Consumer Credit Markets

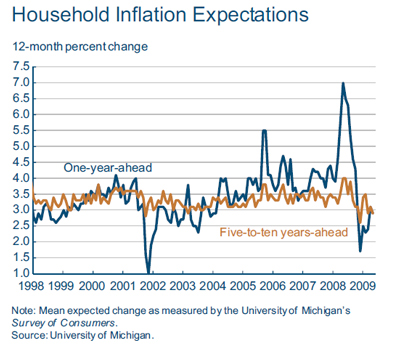

Excluding food and energy prices (core CPI), the index rose just 1.7 percent in May, compared to 2.3 percent over the past three months and 1.8 percent over the past year. Alternative measures of underlying inflation trends—the median CPI and the 16 percent trimmed-mean CPI—increased 0.6 percent and 1.1 percent, respectively in May. The sluggish gain in the median CPI was the smallest increase in the measure since April 2003. The longer-term (12-month) trends in the underlying inflation measures all ticked down in May and are now ranging between 1.8 percent and 2.4 percent.

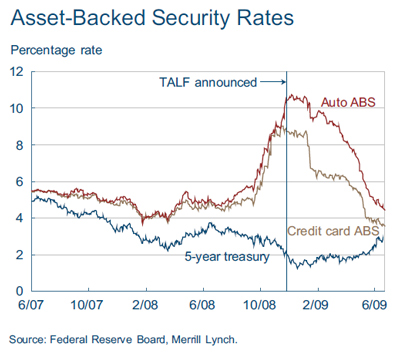

Indications so far suggest that the TALF is having a positive impact on consumer credit markets. In September 2008, the market for consumer ABS eff ectively shut down. This was particularly true for student loan ABS and credit card ABS. After the introduction of the TALF, the market began to revert to levels seen before the market’s collapse. For instance, total consumer ABS issuance in November was merely $0.5 billion, while six months later it had risen to $14.4 billion. This increase was not due entirely to Federal Reserve actions—the total increase in ABS issuance was larger than the amount lent under TALF. This would imply that banks are becoming less risk averse as they once again engage in securitization.