The Bank for International Settlements has released its BIS Quarterly Review, September 2010 with sections on:

- Overview: growth concerns take centre stage

- Highlights of international banking and financial market activity

- Debt reduction after crises

- The collapse of international bank finance during the crisis: evidence from syndicated loan markets

- Options for meeting the demand for international liquidity during financial crises

- Bank structure, funding risk and the transmission of shocks across countries: concepts and measurement

They note:

Increasing growth concerns led investors to remain cautious. Nevertheless, prices rose in both equity and corporate bond markets in response to the improved conditions in euro sovereign debt markets, positive US and European corporate earnings announcements and greater clarity on the regulatory agenda (Graph 5, left-hand panel). Equity volatility also declined (Graph 5, centre panel). Given the significant drops earlier in the year, however, North American and European equity markets remained flat or below their levels at the beginning of the year. In contrast, there were gains for some Latin American markets and large losses for Chinese, Japanese and Australian markets.

Despite unchanged credit spreads (Graph 5, right-hand panel), both investment grade and high-yield corporate bonds generated large returns due to falling risk-free rates (Graph 6, left-hand panel). The superior performance of bond markets relative to equity markets was mirrored in global investment flows. In the United States, large outflows from equity mutual funds from May to July were offset by large inflows to bond mutual funds (Graph 6, centre panel). These inflows picked up again during July.

And here’s an interesting tid-bit:

One of the few developed economies (in addition to Greece) that bucked the trend of lower net issuance was Canada. Canadian residents raised $30 billion on the international debt market, about three times as much as in the previous quarter and the highest since the second quarter of 2008. Canadian financial institutions issued approximately $19 billion. Canadian provincial governments, led by Ontario, also borrowed sizeable amounts ($9 billion), whereas non-financial corporations issued $2 billion, slightly less than in the previous quarter.

The paper on syndicated loans shows some trends that I consider rather alarming:

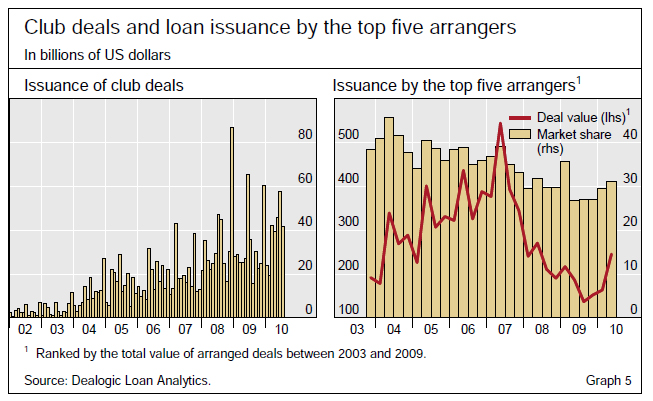

Changes in syndication arrangements may be indicative of credit supply constraints. For instance, syndicated loan transactions in the form of “club deals” gained importance, increasing from 12% of total issuance in 2008 to 17% in 2009 (Graph 5, left-hand panel). A club deal is a loan syndicated by a small number of participating banks, which are not entitled to transfer their portion of the loan to a third party (White & Case (2003)). Such smaller syndicates result in lower restructuring and monitoring costs, and are thus preferred by lead arrangers when default is more likely. From this perspective, greater use of club deals might be an indication of both growing bank risk aversion and higher credit risk at a time of greatly increased economic uncertainty. This is consistent with Esty and Megginson (2003), who find that syndicate size is positively related to the strength of creditor rights and the reliability of legal enforcement.

The concept of private placements, with issues being continually forced from the public into more private structures, increases the opacity of the securities market. Many issues are forced there as a result of prospectus and reporting requirements for the public markets; I don’t think anybody’s ever done a cost/benefit analysis for the addition of further pages to prospectuses or for things like Sarbox and TRACE: it sounds good at the time, so it just happens.

The authors conclude, in part:

The results raise at least two issues. The first concerns the extent to which constraints in syndicated loan supply can be expected to ease in the near term. dysfunctional securitisation markets might constrain the ability of banks to place syndicated loans in the secondary market for a while. Moreover, repairing bank balance sheets takes time. But the sensitivity of syndicated loan supply to changes in bank CDS spreads may suggest that measures that alleviate concerns about banks’ soundness and ease bank funding pressures could have significant positive effects on credit supply even in the near term.

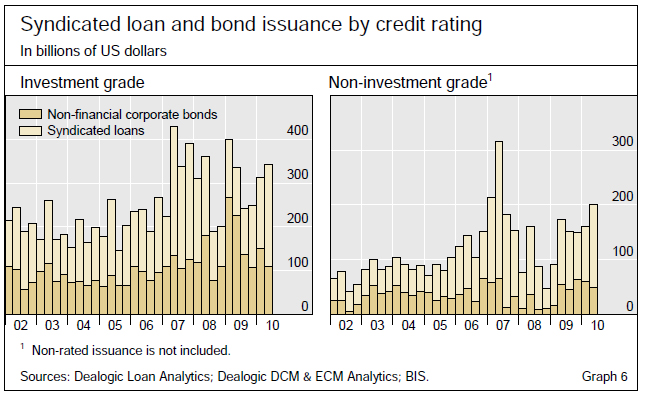

Second, recent developments in syndicated loan markets might be indicative of structural changes in credit markets. The gradual return to more normal functioning of the corporate bond markets could have eased funding constraints for banks and corporations. In particular, those with an investment grade rating might be more reliant on market finance in the future. Moreover, looking forward, emerging market banks may play a much bigger role in syndicated loan markets, and in international banking more generally, than in the past. The syndicated loan market with its role in financing trade and mergers and acquisitions might be one key area of expansion for these banks.

OK, so my question is: to what extent could making life easier for public issuers reduce the dependence of credit supply to non-financial firms on the (perceived) credit quality of the banks?