In the comments to another post, Assiduous Reader mpisni asks:

Hi James, Recently we have seen issues rated at lower ratings take some big hits ( FTS, SLF, ) but the recent issues in the 5.6% to 6 % range have remained relatively unaffected.

Is this because of the dividend rate, higher ratings ?

How will these issues prices be effected down the road and how much will rates have to increase to see negative effects on their prices

Thanks James

I don’t really have a LOT of time to deal with this right now, but …

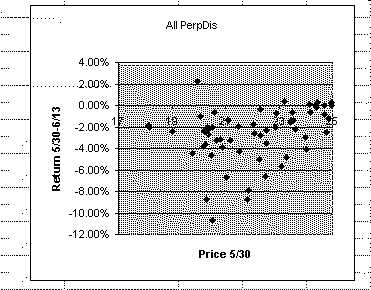

I’ve uploaded an Excel Spreadsheet showing the following data:

- ticker

- 5/30 YTW

- 5/30 Price

- DBRS Rating

- Total Return 5/30-6/13 (bid side)

The spreadsheet includes a graph!

You can play with these data as much as you like … and if anybody can answer any of mpisni‘s questions (particularly the implicit “When will this be over?” part) … let me know!

If I had to give an answer and if my answer had to assume rationality of the market over any given two-week period (both of these are rather big ifs), I’d suggest that one hypothesis to test would be that

- The market is anticipating further increases in long yields

- Therefore, it is marking the “negative convexity” yield-premium down really low, since it assumes that there is no potential for capital gains being given up

See my article on convexity if you don’t have a clue what I’m blathering about.

Update: Note that this is a hot issue because it appears the preferred share market has hit a new 15-month trough … particularly, I think, when today is finally over!

Update: OK, there are two more possibilities:

- The price paid for convexity was too much on 5/30; the market’s just readjusting … well … all I can say is: I don’t buy it.

- Brokers are dumping their losers. Retail stockbrokers seek to avoid criticism. They’ve been getting worried calls from unsophisticated clients all year about ‘How come that new issue you sold me is down so much?’ They’re making the judgement that, at the very least, recovery is not imminent and simply dumping it. The near-par stuff isn’t getting dumped because they’re not getting any calls about that stuff.

Update: Yet another possibility! I know of at least one stockbroker who, last November, was aggressively getting his clients into preferreds on the grounds that when the BCE issues got redeemed, a tsunami of money would boost prices of existing issues.

Some such clients might be getting a little dubious about the “when”.

Home-made Indices with Intra-Day Updating

Thursday, April 17th, 2008Assiduous Reader kaspu has complained about the volatility of the S&P/TSX Preferred Share Index (TXPR on Bloomberg) – or, at least, the reported volatility.

The problem is that this index is based on actual trades; hence, it can bounce around a lot when 100 shares trade at the ask, $1 above the bid. For instance, today:

This sort of behaviour is endemic to indices created by small shops without much market knowledge or experience. Readers in need of indices with more precision may wish to use the HIMIPref™ Indices, which are, of course, based on much less volatile bid prices.

“Gummy” has announced a new spreadsheet, available from his website. This spreadsheet allows the download of bid and ask prices – and lots of other information – for stocks reported (with a 20 minute delay) by Yahoo. It strikes me that with minimal effort, one could reproduce TXPR (using the defined basket of CPD) and update the index at the touch of a button, with minimal set-up time required.

The Gummy Stuff website, by the way, is reliable AS FAR AS IT GOES. Dr. Ponzo is math-oriented to a much greater degree than investment-oriented and does not always respect hallowed fixed income market conventions. In other words, I have found that things are properly calculated in accordance with the (usually stated) assumptions, but these assumptions are not necessarily the ones I might make when performing a calculation with the same purpose.

With respect to Kaspu‘s question about other indices … the latest CPD literature references the “Desjardins Preferred Share Universe Index”, which is new to me … and I have no further information. Claymore may be preparing for a showdown with the TSX about licensing fees (you should find out what they want for DEX bond data … it’s a scandal).

Additionally, there is the BMO Capital Markets “50” index, but that is available only to Nesbitt clients … maybe at a library, if you have a really good one nearby that gets their preferred share reports.

Update, 2008-5-1: “Gummy” has announced a spreadsheet that does exactly this! Just watch out for dividend ex-Dates!

Posted in Index Construction / Reporting, Miscellaneous News, Reader Initiated Comments | 2 Comments »