Manulife Financial Corporation has announced:

a Canadian public offering of Non-cumulative Rate Reset Class 1 Shares Series 17 (“Series 17 Preferred Shares”). Manulife will issue 10 million Series 17 Preferred Shares priced at $25 per share to raise gross proceeds of $250 million. The offering will be underwritten by a syndicate of investment dealers co-led by Scotia Capital Inc., RBC Capital Markets and TD Securities and is anticipated to qualify as Tier 1 capital for Manulife. The expected closing date for the offering is August 15, 2014. Manulife intends to file a prospectus supplement to its June 23, 2014 base shelf prospectus in respect of this issue.

Holders of the Series 17 Preferred Shares will be entitled to receive a non-cumulative quarterly fixed dividend yielding 3.90 per cent annually, as and when declared by the Board of Directors of Manulife, for the initial period ending December 19, 2019. Thereafter, the dividend rate will be reset every five years at a rate equal to the 5-year Government of Canada bond yield plus 2.36 per cent.

Holders of Series 17 Preferred Shares will have the right, at their option, to convert their shares into Non-cumulative Rate Reset Class 1 Shares Series 18 (“Series 18 Preferred Shares”), subject to certain conditions, on December 19, 2019 and on December 19 every five years thereafter. Holders of the Series 18 Preferred Shares will be entitled to receive non-cumulative quarterly floating dividends, as and when declared by the Board of Directors of Manulife, at a rate equal to the three-month Government of Canada Treasury Bill yield plus 2.36 per cent.

Manulife intends to use the net proceeds from the offering to partially fund the redemption of Manulife’s Non-cumulative Rate Reset Class 1 Shares Series 1 (the “Series 1 Preferred Shares”) on September 19, 2014.

that as a result of strong investor demand for its previously announced Canadian public offering of Non-cumulative Rate Reset Class 1 Shares Series 17 (“Series 17 Preferred Shares”), the size of the offering has been increased to 14 million shares. The gross proceeds of the offering will now be $350 million. The offering will be underwritten by a syndicate of investment dealers co-led by Scotia Capital Inc., RBC Capital Markets and TD Securities and is anticipated to qualify as Tier 1 capital for Manulife. The expected closing date for the offering is August 15, 2014. Manulife intends to file a prospectus supplement to its June 23, 2014 base shelf prospectus in respect of this issue.

Manulife intends to use the net proceeds from the offering to fund the redemption of Manulife’s Non-cumulative Rate Reset Class 1 Shares Series 1 (the “Series 1 Preferred Shares”) on September 19, 2014.

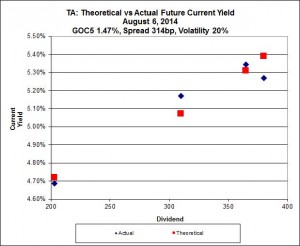

This issue is priced in-line with extant issues, according to Implied Volatility theory:

I continue to be puzzled about why the Implied Volatility for MFC FixedResets is so high.