Assiduous Reader louis made a very good suggestion in the comments to October 10 that is worthy of being highlighted – particularly in the light of the extraordinary policy actions taken by government to shore up teetering confidence.

“Unbelievable” indeed but my purpose here is not to cry over spilt milk (there is just so much tears one can produce) but to run by you a possible “solution” to the present turmoil since you are the most knowledgeable and reputable person I know on Economy and Financial matters patient enough to read and reply to its assiduous readers.

The underlying basic idea here is not from me but I will expand a bit on it. Should you find it worth to be explored, discussed and publicised in one of your blog’s daily comments or elsewhere, I would be more than happy. My only purpose here is trying to spread what I do verily believe would greatly assist a prompt mitigation of the damages the present crisis is causing all of us:

Well, I’ll give it a whirl! It is odd, you know, but I don’t consider myself a macro-guy at all; by which I mean somebody who studies the economy with a greater or lesser degree of competence and takes market action based on that analysis. In fact, I don’t think the macro-economic approach works at all in the long term – see, for example, my post on market timing, for instance.

My specialty is on the micro side … I simply weigh bundles of cash flows and try to buy the cheapest bundles. It makes for extremely boring justifications of why I have taken such-and-such market action, but it has, historically, resulted in outperformance against the benchmarks.

1. Whatever is the true cause of the current mess, it is clear to me that loss of confidence and panick is making things worse to a point that this is what be addressed to first.

Agreed. We have nothing to fear but fear itself! What is happening is that fear of asymmetrical information has taken over the valuation process … by which I mean that many investors, confronted with a drop in the price of stock they hold, are not shrugging it off or using it as an opportunity to buy more, they are taking it as evidence that somebody knows more than they do and are selling.

A bank might have to write off, say $1 per share due to the mark-to-market regime … and this is resulting in a $2 decline in their stock price.

2. Anedoctolly but not totally out of topic, the number #1 request received this week over and over by the legal department of a finanical institution here in the Province of Quebec was whether a type of deposit, GIC or other instrument was insured by the Canadian insurance deposit. In my humble opinion, the decision of the US and of some European States to increase deposit insurance to 200k or to an unlimited amount was not a good idea at all. While it may have been justified to increase deposit insurance to a certainl level when a bank in difficulty was raided. It should have been done on a bank by bank basis with a reasonable limit (The US 200k figure in the US is ok in that respect). This being said, I hereby grant the “how-to-exacerbate a panick award” to the Irish government and its followers. In my humble opinion, one effect of their unlimited guarantee on all bank deposits has been to put in everyone’s mind the fear that the banking situation must indeed be so bad that even bank deposits, in whichever bank they are, are in jeopardy. It is also my understanding that having huges some of money in bank deposits rather than directly invested by their depositors into securities (corporate obligations, shares, prefs, etc.) is far less beneficial to the economy since, unlike investors, banks must maintain minimal reserves for each amount deposited and simply do not have the staff to promptly re-invest the remainder of such monies into the market as investors normally do.

While the majority of the educated investors still believe that U.S bonds are an extremely safe investment there might very well be someone in China managing a couple of trillion dollars in value of US bonds who might (rightfully in my opinion) fear that the US deficits, war expenses and trillions invested to salvage their financial system will at some point cause a drop of the US notes credit dropping such that more and more people are now likely to seek shelter in bank deposits. I even read / heard “said to be renowned financial analysts” that putting your savings under your mattress was the safest thing to do… (those too deserve one of my awards, let’s call it the “I-did-help-too-scuttling-our-economy” award).

It used to be that virtually all investment was done through banks. Then, with the rise of mutual funds, reduction of stock commissions and the continued rise of the middle class, “disintermediation” became more normal and the banks started getting cut out of the loop (and the profits).

In bad times, people tend to retreat back to their banks – their good solid banks, that have a branch in the neighborhood and have their names on entertainment facilities – and reintermediation becomes normal. This has been discussed in the post Banks Advantage in Hedging Liquidity Risk.

3. Ironically, govermental insurance is the solution but not on deposits beyond the figure a normal houselhold / small cap company should maintain!

I agree. In fact, as I suggested in Synthetic Extended Deposit Insurance: The Critique, deposit insurance should be keyed to a large fraction of median household income. That will be enough that long lines of small depositors will not form when a bank runs into trouble, as occurred in the Northern Rock episode (I believe that European style minimalist deposit insurance is expecting too much financial analysis from the non-specialist public).

On the other hand, people seem to demand the right never to lose money on short term investments – particularly the ones in which they invested because they paid so much better than boring old bank deposits. Frankly, I was amazed at the enormous effect that the buck-breaking at Reserve Primary Fund (discussed on September 19) had on the commercial paper market.

You can’t educate people. It seems to me, now more than ever, that branded money market funds must attract a capital charge on the banks. This will, naturally, increase the costs of putting together such funds – since the bank will have to hold as much capital against the MMFs as against any other deposit – but so be it. If the public wants guaranteed investments, insists on guaranteed investments, and will destroy the financial system if they don’t get guaranteed investments … well, then, they can have guaranteed investments. But they have to pay.

4. If I understand correctly, the banking system is so nervous itself that banks do not lend to each other at a reasonable costs for short term interbank loans thus depriving again the market of large amounts of much needed liquidities. This situation has all the potential of plunging us in a quick and deep depression. If a company cannot have short term credit as a result of this, it can only lay off employees, cut spendings, what will in turn drag into the same situation their suppliers, etc…

I’m not convinced it’s so much nervousness about lending to each other as it is a desire to hoard cash. The banks have huge committments on undrawn credit lines – just credit cards is enormous, never mind HELOCs and billion-dollar lines to corporations – and they have to ensure that the cash is there should the lines be drawn.

The current experience might mean that undrawn lines should attract a higher capital charge than they do now. This had enormous repercussions in the ABCP market; for various historical reasons, there was a high capital charge against US & International ABCP contingency lines, but no capital charge for a greatly inferior line in Canada. The result was that when the market seized up, money was available for the US/International SIVs, but not for Canadian.

Another illustration was the informal liquidity support given to the auction rate market in the States. Since there was no formal arrangement and no capital charge, there was no money. And so that market siezed up.

The question of liquidity guarantees will keep the Basel Committee busy for some years to come!

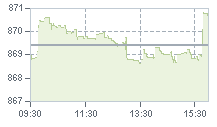

5. The TED spread, which is the difference between what banks charge each other for three-month dollar loans (three-month Libor) and what the government pays (three-month T-Bill) is now at 4.64%. For comparison, the TED spread averaged 0.36% in 2006. This is, in my humble opinion(and in the opinion of far more educated & knowledgeable people than I am), what has to be fixed WITHOUT ANY FURTHER DELAYS. Whatever are the merits of Paulson’s 700 billion plan which I still don’t fully understand, its effects are way too slow as evidenced by what we have been through this week.

Part of the problem with the TED spread is that the discount window is wide-open and cheap. But I agree that the enormous TED spread is symptiomatic of huge problems in the banking system.

6. Why then not provide governmental insurance to these interbank loans such that the money between banks resume flowing thus allowing them to resume lending more money at more reasonable prices?

Hmm … to a certain extent, this is what’s been happening for a while, sort of. Bank A has surplus cash; Bank B needs to borrow. However, instead of a direct deal, what is happening (to a certain extent) is that Bank B is borrowing from the Fed through one of its programmes – or the discount window – the Fed is neutralizing the cash injection via sale of T-Bills, and Bank A is buying the T-Bills.

However, I note that on the weekend:

France, Germany and Spain today committed 960 billion euros ($1.3 trillion) to guarantee lending between banks and take stakes in them.

The Guardian reports:

The British interbank guarantee, which looks likely to be adopted in part by Germany and France, effectively allows adequately recapitalised banks to seek government backing for short-term borrowings in return for a fee.

Britain said last week around 250 billion pounds would be available for this backstop. A draft of Germany’s plan on Monday outlined some 400 billion euros of bank borrowing guarantees and media reports said France would provide 300 billion.

There is more information available directly from the Bank of England and from HM Treasury:

Specifically the Government will make available to eligible institutions for an interim period as agreed and on appropriate commercial terms, a Government guarantee of new short and medium term debt issuance to assist in refinancing maturing, wholesale funding obligations as they fall due. Subject to further discussion with eligible institutions, the proposal envisages the issue of senior unsecured debt instruments of varying terms of up to 36 months, in any of sterling, US dollars or Euros. The current expectation is that the guarantee would be issued out of a specifically designated Government-backed English incorporated company. The Government expects the take-up of the guarantee to be of the order of £250bn, and will keep this under review alongside ongoing monitoring of capital positions and lending volumes.

To qualify for this support the relevant institution must raise Tier 1 capital by the amount and in the form the Government considers appropriate whether by Government subscription or from other sources. It is being made available immediately to the eight institutions named above in recognition of their commitment to strengthen their aggregate capital position.

Back to Assiduous Reader louis:

7. My limited contribution to this proposed solution is to expand on it suggesting that this governemental interbank (or inter-financial institutions) loan insurance would provide insurance of the interbank loans up to say 90 or 95% of the loan value (just to make sure that the banks do a little bit of their homeworks) PROVIDED that the loan is made at a maximum TED spread of say 0.50% plus say 0.10% as premium payable to the government for the provision of such insurance. This measure could overnight lower the TED spread from its current 4.6% to 0.60%, using my above figures pulled out from my hat. This would fix what the Central Banks’ joint rate cut of 0.50% of last week failed to achieve.

7. This solution could be put into place in a matter of days thus allowing banks to resume lending to the non-financial market in a more normal way.

Bloomberg reports that LIBOR has fallen:

Money-market rates in London fell after policy makers offered banks unlimited dollar funding and European governments pledged to take “all necessary steps” to shore up confidence among lenders.

The London interbank offered rate, or Libor, for three-month dollar loans dropped 7 basis points to 4.75 percent today, tied for the largest drop since March 17, the British Bankers’ Association said. The one-month dollar rate declined to 4.56 percent, while the one-week euro rate fell to 4.34 percent, the BBA said. There was no overnight dollar price today because of the Columbus Day holiday in the U.S.

… and the market’s on wheels:

Morgan Stanley surged 66 percent after changing terms of its $9 billion investment from Mitsubishi UFJ Financial Group Inc. UBS AG and ING Groep NV gained more than 17 percent in Europe after the region’s leaders said they would guarantee bank debt. The euro rose the most in three weeks against the dollar and yen on speculation the bailout may prevent more bank failures.

…

The Standard & Poor’s 500 Index rose 6.7 percent to 959.07 and the Dow Jones Industrial Average briefly topped 9,000 as of 12:22 p.m. in New York. Both tumbled 18 percent last week. The MSCI World Index added 6.8 percent. Europe’s Dow Jones Stoxx 600 Index advanced 9.9 percent for the biggest daily gain ever. The MSCI Asia Pacific excluding Japan Index rallied 7.4 percent.

Tomorrow should be a most interesting day in the Canadian markets!

Assiduous Reader Annette asks:

I take it that this is amongst the measures taken by the Europeans this Sunday to guarantee interbank loans. Is this something the US should do too?

Only if the fee is punitive, says I, and only if the guaranteed bank is well capitalized. For now, I still like the idea of capital injections via senior preferred shares. But I don’t think we’re yet at the stage where interbank lending needs to be guaranteed in the US, particularly with all the reintermediation being done by the Fed via the discount window and the TAF.

I’m worried about the moral hazard issues. I want the common shareholders – and maybe even the preferred shareholders and sub-debt holders – to take a permanent nasty hit.

Update: Bloomberg puts the total European package at USD 1.8-trillion:

In Germany, Chancellor Angela Merkel pledged to guarantee up to 400 billion euros of lending between banks and set aside 20 billion euros to cover potential losses. It will also provide as much as 80 billion euros to recapitalize banks, about 3.2 percent of the German economy, based on 2008 gross domestic product figures from the International Monetary Fund.

…

In France, President Nicolas Sarkozy said the state will guarantee 320 billion euros of bank debt and set up a fund allowed to spend up to 40 billion euros, or 2 percent of GDP, to recapitalize banks.

…

Spain’s cabinet today approved measures to guarantee up to 100 billion euros of bank debt this year and authorized the government to buy shares in banks in need of capital.

…

The Austrian government will set up an 85 billion-euro clearinghouse run by the Austrian Kontrollbank to provide cash by holding illiquid bank assets as collateral

…

The Dutch government will guarantee up to 200 billion euros of interbank loans, it said in a letter to parliament.

Italy will guarantee some bank debt and buy preferred stock in banks if necessary, Finance Minister Giulio Tremonti said in Rome, without providing any figures.

…

Royal Bank of Scotland, HBOS, and Lloyds TSB Group Plc will get an unprecedented 37 billion-pound ($64 billion) bailout from the U.K. government, equal to 2.5 percent of the economy.

The WSJ is speculating that there may be similar moves by Treasury:

The U.S. government is set to buy preferred equity stakes in nine top financial institutions as part of its new comprehensive plan to tackle the credit crisis, according to people familiar with the situation.

It’s unclear how much would be invested in each institution. The move is designed to remove any stigma that might come with a government investment.

Not all of the banks involved are happy with the move but agreed under pressure from the government.

…

One central plank of these new efforts is a plan for the Treasury to take approximately $250 billion in equity stakes in potentially thousands of banks, according to people familiar with the matter, using funds approved by Congress through the $700 billion bailout bill.