The feds’ buddies at the IMF have proposed a new Canadian civil service expansion plan:

Two key steps are worth considering.

First, providing a mandate for macroprudential oversight of the financial system as a whole to a single entity would strengthen accountability and reinforce policymakers’ ability to identify and respond to future potential crises. Such a body should have participation broad enough to “connect the dots” and form a complete and integrated view of systemic risks with powers to collect the required data.

Second, putting in place a coordination framework to support timely decision-making and test the capacity of both federal and provincial authorities to respond to crisis scenarios would benefit crisis preparedness. Extending the institutional arrangements and frameworks along these lines can help support both the capacity and willingness to act, especially at times of financial stress, and strengthen Canada’s financial system and economy.

The loonie had a rough ride today:

The loonie has touched a high point of 79.37 cents (U.S.) and a low of 78.85 cents today, edging closer to its most recent low of 78.22 cents and, arguably, to the 75-cent level that [chief currency strategist of Bank of Nova Scotia] Ms. [Camilla] Sutton and others expect later this year.

By late afternoon, it stood at 78.87 cents.

The U.S. dollar, in turn, is on a roll, spurred on by stronger economic readings that suggest the Federal Reserve will launch its first interest rate hike soon, possibly in June.

Feeding into that were the uncertainties of Europe, specifically the fears over whether Greece could default on its hefty debts or even leave the euro zone.

And equities got hit:

A looming rate hike from the U.S. Federal Reserve is taking its toll on stocks, currencies and commodities. Markets were a sea of red on Tuesday as the Dow Jones industrial average shed more than 333 points, or 1.8 per cent, the S&P 500 fell 1.7 per cent and the S&P/TSX Composite index gave back more than 200 points, or 1.4 per cent.

The U.S. dollar index rose to its highest level since September, 2003, as the euro continued to crumble and the Canadian dollar retreated below 79 cents (U.S.). The U.S. dollar is soaring as investors anticipate the Fed will begin hiking rates some time this year amid consistently strong readings on the country’s labour market.

But the greenback’s surge is raising concerns about the bottom line for corporate America. A strong U.S. dollar poses a headwind for major U.S. multinational companies that generate a substantial portion of their revenues overseas.

My new favourite SEC Commissioner Daniel M. Gallagher really screwed up when talking about the bond markets today:

With a record notional amount of outstanding corporate debt and dealers unable to commit capital and hold significant inventories, there is a real liquidity crisis brewing. The significant risk is that when the Fed starts to hike interest rates, which some tea leaves tell us could happen as early as this June[13] — investors may rush to exit their positions in high yielding and less liquid debt and may have severe difficulty in doing so.

Interestingly, while the biggest banks have cut back on their positions in more risky debt, insurance companies and mutual funds have increased their positions in those assets.[14] These firms have boosted their holdings of corporate and foreign bonds to $5.1 trillion, a 65% increase since the end of 2008.[15] This has offset the $800 billion decline in holdings at banks and securities firms in the same period.[16] Rather than banks holding the inventory, there are now “ballooning bond funds that own more and more risky debt,” and it is unclear how institutional asset managers and their clients will react when interest rates rise.[17]

Although the SEC may not have a silver bullet to address these issues, there are some discrete steps the agency can take to address the liquidity risks that plague the debt markets. For example, the Commission should be looking at all options for facilitating electronic and on-exchange transactions of these products.

Electronic and on-exchange transactions of these products will harm liquidity, not help it; how many times does this need to be pointed out? Exchange trading leads to thinner, more brittle markets; if Gallagher is seeking to find ways in which a 1994-style bond bear market can be experienced in an orderly fashion, he needs to think more about how to encourage bond salesmen, dark markets and deep pools of opportunistic capital.

While this potential liquidity crisis is a serious risk that warrants serious attention, there is a more discrete and addressable issue in the fixed income markets, an issue that disproportionately impacts retail investors. That issue is the lack of transparency. Retail participation in the municipal and corporate bond market is very high: over 70% in the municipal markets and 40% in the corporate markets.[21] And yet, these markets are incredibly opaque to retail investors.

Footnote [21] See Fed Flow of Funds.

It’s not entirely clear where he gets his 40% figure from. If we examine Table L.212 in the Fed Flow of Funds, December 2014 we see that the Fed estimates there are $11,441.4-billion in Corporate and Foreign Bonds outstanding at the end of 14Q3. Classes of holder that might reasonably be classified as retail are:

- Household, 919.2

- Money market mutual funds, 71.1

- Mutual funds, 2,232.3

- Closed-end funds, 77.8

- Exchange-traded funds, 194.4

The total is $3,494.8-billion, which is 30.5% of the total. Maybe he’s also counting

- Private pension funds, 582.5

- State and local govt. retirement funds, 433.4

- Federal government retirement funds, 6.9

This would bring the total to $4,517.6-billion, or 39.5%, which agrees well with his figure.

Regrettably, if he is getting to his 40% figure like that and weeping hysterically over the poor sweet innocent retail investor ravaged by the evil secretive dealers, his argument isn’t even internally consistent. Only the Household holdings, of 919.2-billion, less than 10% of the total outstanding, are being traded by retail; all the rest enjoys the (sometimes dubious!) benefits of professional management and it really doesn’t matter whether or not the finer details of the market are opaque to retail.

I will also point out that share of holdings is by no means equivalent to share of trading. My guess is that retail turnover is lower than institutional turnover, but we’ll leave that question for another day.

If we repeat the exercise for Table L.211, Municipal Securities and Loans, we get a total of $3,631.1-billion, of which:

- Household, 1,557.6

- Money market mutual funds, 278.7

- Mutual funds, 645.4

- Closed-end funds, 84.2

- Exchange-traded funds, 13.4

- Private pension funds, 0

- State and local govt. retirement funds, 0

- Federal government retirement funds, 0

Total $2,579.3-billion, or 71.0%, against his claim of “over 70%”, so I suspect I’ve been able to reproduce his calculation.

Well, fine. Maybe the purpose of the corporate and municipal bond markets is, in fact, not the transfer of investment capital from savers to investors, as I have always (perhaps naively) thought. Maybe the purpose of these markets is “to be fair to Granny”. If this is the case, then the idea of exchange trading makes more sense – but let’s be explicit about this in advance of any rule-making, and let us continually bear in mind that changing the system to favour one group will act to the disadvantage of another group. The loss of liquidity and greater volatility that will result from a greater emphasis on exchange trading will result in increased yields; these increased yields will knock some issuers out of the market by rendering marginally profitable investment opportunities economically unfeasible.

Can we please think about what we’re doing, why we’re doing it, what we want to accomplish and just plain think things through a bit?

He redeems himself somewhat with a jab against FSOC, the Financial Stability Oversight Council:

The SEC is also bringing cases against state and local entities — San Diego, New Jersey, Illinois, and most recently Kansas — for making misleading disclosures about the funding of their pension plans. The failure by municipal issuers to provide adequate disclosures of underfunded pension plans is an unpardonable sin. Politically-powerful state workers’ unions, and state constitutional protections for benefits, make the reduction of these liabilities extremely difficult. The failure to set aside adequate funds to cover these liabilities creates a material risk that future payments to bondholders would need to be sacrificed. This risk is not merely theoretical; we have seen it play out already in Detroit’s bankruptcy.[30] Pension liabilities are a true systemic risk, but don’t hold your breath waiting for FSOC to address it. They are probably too busy with Stage 3 assessments of lemonade stands anyway![31]

Footnote [31] I’ll spare you the suspense. Lemonade stands will be designated as systemically important. Expert forecasts of global warming’s effects on summer temperatures create a risk that the sudden withdrawal of sweet, tangy liquid relief from the U.S. financial system could cause a sudden collapse. If you doubt me, this is at least as plausible as FSOC’s designation of insurance companies.

TransAlta Corporation, proud issuer of TA.PR.D, TA.PR.F, TA.PR.H and TA.PR.J, was confirmed at Pfd-3 by DBRS today:

DBRS Limited (DBRS) has today confirmed the Issuer Rating and Unsecured Debt/Medium-Term Notes rating of TransAlta Corporation (TAC or the Company) at BBB and the Preferred Shares rating at Pfd-3, all with Stable trends. The confirmations are based on DBRS’s expectation that TAC will further improve its relatively constrained key credit metrics over the near term to be more in line with the current rating category. Moreover, DBRS notes that TAC’s ratings reflect its high level of contracted output, strong position in the Alberta (the Province) market and reasonable level of geographic and fuel diversification, while also factoring in unplanned outage risks, the challenging wholesale market conditions over the next several years and TAC’s merchant exposure (including post-2020 power purchase agreement expiries in Alberta).

It was a poor day for the Canadian preferred share market, with PerpetualDiscounts losing 38bp, FixedResets down 12bp and DeemedRetractibles off 5bp. The Performance Highlights table is relatively short (by recent standards), with losing Floaters being prominent. Volume was above average.

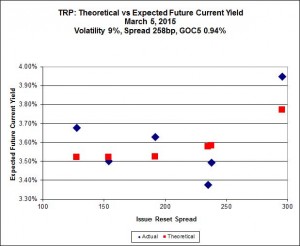

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 24.05 to be $1.12 rich, while TRP.PR.G, resetting 2020-11-30 at +296, is $1.11 cheap at its bid price of 24.72.

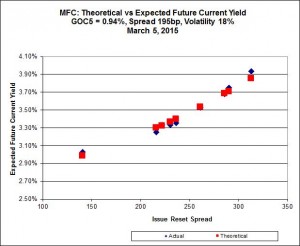

Another excellent fit, but the numbers are perplexing. Implied Volatility for MFC continues to be a conundrum, although it declined substantially today. It is still too high if we consider that NVCC rules will never apply to these issues; it is still too low if we consider them to be NVCC non-compliant issues (and therefore with Deemed Maturities in the call schedule).

Most expensive is MFC.PR.L, resetting at +216 on 2019-6-19, bid at 24.05 to be $0.50 rich, while MFC.PR.H, resetting at +313bp on 2017-3-19, is bid at 25.75 to be $0.51 cheap.

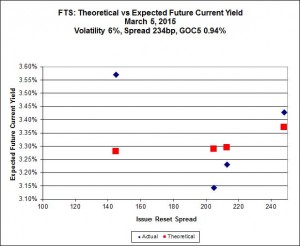

The fit on this series is actually quite reasonable – it’s the scale that makes it look so weird.

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 21.89 to be $0.36 cheap. BAM.PF.E, resetting at +255bp 2020-3-31 is bid at 24.20 and appears to be $0.49 rich.

This is just weird because the middle is expensive and the ends are cheap but anyway … FTS.PR.H, with a spread of +145bp, and bid at 16.36, looks $1.68 cheap and resets 2015-6-1. FTS.PR.K, with a spread of +205bp and resetting 2019-3-1, is bid at 23.71 and is $1.13 rich.

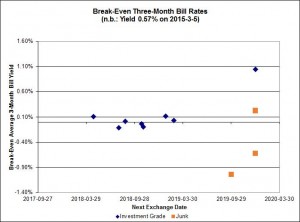

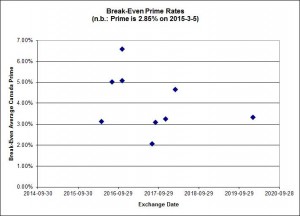

The cancellation of the previously announced deflationary environment had an immediate effect on the implied three month bill rate, with investment-grade pairs predicting an average over the next five years of a whopping 0.10%

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -3.4850 % | 2,324.8 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -3.4850 % | 4,064.7 |

| Floater | 3.24 % | 3.22 % | 72,163 | 19.11 | 3 | -3.4850 % | 2,471.4 |

| OpRet | 4.07 % | 0.98 % | 106,820 | 0.28 | 1 | -0.0397 % | 2,764.8 |

| SplitShare | 4.48 % | 4.62 % | 56,197 | 4.45 | 5 | -0.0359 % | 3,206.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0397 % | 2,528.1 |

| Perpetual-Premium | 5.29 % | 0.84 % | 56,545 | 0.08 | 25 | -0.0391 % | 2,519.9 |

| Perpetual-Discount | 4.98 % | 5.02 % | 154,748 | 15.40 | 9 | -0.3764 % | 2,793.8 |

| FixedReset | 4.41 % | 3.65 % | 233,337 | 16.51 | 81 | -0.1167 % | 2,421.1 |

| Deemed-Retractible | 4.91 % | 0.14 % | 106,338 | 0.14 | 37 | -0.0491 % | 2,655.2 |

| FloatingReset | 2.54 % | 2.98 % | 85,831 | 6.32 | 8 | -0.2352 % | 2,329.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.K | Floater | -6.75 % | Not real. The closing bid was 14.79, compared to a day’s range of 15.56-03, so the reported bid is about 5% below the day’s low. It is not clear whether this is due to inadequate Toronto Stock Exchange reporting or inadequate Toronto Stock Exchange supervision of market-makers. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 14.79 Evaluated at bid price : 14.79 Bid-YTW : 3.41 % |

| BAM.PR.C | Floater | -1.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 15.65 Evaluated at bid price : 15.65 Bid-YTW : 3.22 % |

| BAM.PR.B | Floater | -1.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 15.81 Evaluated at bid price : 15.81 Bid-YTW : 3.19 % |

| FTS.PR.H | FixedReset | -1.80 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 16.36 Evaluated at bid price : 16.36 Bid-YTW : 3.66 % |

| BAM.PR.N | Perpetual-Discount | -1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 22.66 Evaluated at bid price : 23.00 Bid-YTW : 5.24 % |

| BAM.PF.A | FixedReset | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 23.41 Evaluated at bid price : 25.34 Bid-YTW : 3.82 % |

| BAM.PR.R | FixedReset | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 21.53 Evaluated at bid price : 21.89 Bid-YTW : 3.90 % |

| CIU.PR.C | FixedReset | 5.78 % | A rebound from yesterday’s poor reported performance. There was also a problem on March 2 / March 3. This nonsense is brought to you courtesy of the Toronto Stock Exchange. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 16.65 Evaluated at bid price : 16.65 Bid-YTW : 3.58 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PF.D | FixedReset | 777,595 | New issue settled today. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 23.12 Evaluated at bid price : 24.95 Bid-YTW : 3.57 % |

| BMO.PR.S | FixedReset | 93,075 | TD crossed 30,000 at 24.97; RBC crossed 49,200 at 24.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 23.19 Evaluated at bid price : 24.89 Bid-YTW : 3.31 % |

| RY.PR.Z | FixedReset | 59,122 | Scotia crossed 50,000 at 24.85. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 23.14 Evaluated at bid price : 24.75 Bid-YTW : 3.23 % |

| ENB.PR.P | FixedReset | 53,541 | TD crossed 25,000 at 20.65. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 20.68 Evaluated at bid price : 20.68 Bid-YTW : 4.32 % |

| CM.PR.P | FixedReset | 47,505 | TD crossed 35,000 at 24.55. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 23.01 Evaluated at bid price : 24.55 Bid-YTW : 3.23 % |

| BMO.PR.T | FixedReset | 47,178 | TD crossed 30,000 at 24.67. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2045-03-10 Maturity Price : 23.07 Evaluated at bid price : 24.63 Bid-YTW : 3.27 % |

| There were 39 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PR.K | Floater | Quote: 14.79 – 15.90 Spot Rate : 1.1100 Average : 0.6382 YTW SCENARIO |

| TRP.PR.F | FloatingReset | Quote: 18.65 – 19.39 Spot Rate : 0.7400 Average : 0.5073 YTW SCENARIO |

| MFC.PR.M | FixedReset | Quote: 24.20 – 24.60 Spot Rate : 0.4000 Average : 0.2528 YTW SCENARIO |

| GWO.PR.I | Deemed-Retractible | Quote: 24.00 – 24.50 Spot Rate : 0.5000 Average : 0.3542 YTW SCENARIO |

| BAM.PR.N | Perpetual-Discount | Quote: 23.00 – 23.34 Spot Rate : 0.3400 Average : 0.2297 YTW SCENARIO |

| MFC.PR.H | FixedReset | Quote: 25.75 – 26.05 Spot Rate : 0.3000 Average : 0.2051 YTW SCENARIO |