It’s official – Yellen is the nominee for Fed governor:

President Barack Obama will nominate Janet Yellen as chairman of the Federal Reserve, which would put the world’s most powerful central bank in the hands of a key architect of its unprecedented stimulus program and the first female leader in its 100-year history.

Obama will announce the nomination at 3 p.m. today in Washington, a White House official said in an e-mailed statement. Yellen, 67, would succeed Ben S. Bernanke, whose term expires on Jan. 31.

Bernanke says:

President Obama has made an outstanding choice in nominating my colleague and friend Janet Yellen to chair the Federal Reserve Board. Janet is exceptionally well qualified for the position, with stellar academic credentials and a strong record as a leader and a policymaker.

Yellen says:

Thank you, Mr. President, I am honored and humbled by the faith you have placed in me. If confirmed by the Senate, I pledge to do my utmost to keep that trust and meet the great responsibilities that Congress has entrusted to the Federal Reserve–to promote maximum employment, stable prices, and a strong and stable financial system.

I’d also like to thank my spouse, George, and my son, Robert. I couldn’t imagine taking on this new challenge without their love and support.

The past six years have been tumultuous for the economy and challenging for many Americans. While I think we all agree, Mr. President, that more needs to be done to strengthen this recovery, particularly for those hardest hit by the Great Recession, we have made progress. The economy is stronger and the financial system sounder. As you said, Mr. President, considerable credit for that goes to Chairman Bernanke for his wise, courageous, and skillful leadership. It has been my privilege to serve with him and learn from him.

While we have made progress, we have farther to go. The mandate of the Federal Reserve is to serve all the American people, and too many Americans still can’t find a job and worry how they will pay their bills and provide for their families. The Federal Reserve can help, if it does its job effectively. We can help ensure that everyone has the opportunity to work hard and build a better life. We can ensure that inflation remains in check and doesn’t undermine the benefits of a growing economy. We can and must safeguard the financial system.

The Fed has powerful tools to influence the economy and the financial system, but I believe its greatest strength rests in its capacity to approach important decisions with expertise and objectivity, to vigorously debate diverse views, and then to unite behind its response. The Fed’s effectiveness depends on the commitment, ingenuity, and integrity of the Fed staff and my fellow policymakers. They serve America with great dedication.

Mr. President, thank you for giving me this opportunity to continue serving the Federal Reserve and carrying out its important work on behalf of the American people.

Iceland has foreign exchange problems:

Iceland’s private sector is running out of cash to repay its foreign currency debt, according to the nation’s central bank.

Non-krona debt owed by entities besides the Treasury and the central bank due through 2018 totals about 700 billion kronur ($5.8 billion), the bank said yesterday. The projected current account surpluses over the next five years aren’t estimated to reach even half of that and will equal a shortfall of about 20 percent of gross domestic product.

…

Prime Minister Sigmundur David Gunnlaugsson has said Iceland’s foreign exchange shortfall is “a matter of huge concern” as he tries to scale back currency controls in place since 2008. The government’s biggest challenge is to allow capital to flow freely without triggering a krona sell-off that would cause Iceland’s foreign debt to spike and undermine the nation’s economic recovery.

I find it hard to get excited about the US debt shennanigans and tapering … the real problem is in the real economy:

The U.S. Federal Reserve has tripled the size of its balance sheet by “printing” an ocean of money. But despite the hand-wringing of the gold bugs, recent data proves that deflation, not inflation, remains the biggest threat to the U.S. economy.

The loan-to-deposit ratio for U.S. banks explains why Fed stimulus is not translating into inflationary pressure – the added funds remain trapped in the banking system and are not reaching the real economy.

…

The intention behind the Fed’s stimulus program was that by expanding bank balance sheets, customer lending would rise, and this would create consumer and corporate demand for products and services. The loan-to-deposit ratio illustrates that the process is stalled at step two – big bank balance sheets are bloated but aggregate demand in the U.S. economy has barely improved. The output gap remains.

I suggest that investors in long-term fixed income should be cheering the dysfunction and sending large donations to the Republican Party. While long-term fixed income is priced on expected inflation, it realizes based on realized inflation. Recessions are good! Depressions are wonderful! And here’s what the OECD honcho has to say:

“We still see the probability of failing to raise the debt ceiling as low, but as the government shutdown drags on, the level of concern is ratcheting up,” said [secretary-general of the Organization for Economic Co-Operation and Development] Mr [Angel] Gurria.

“If the debt ceiling is not raised – or, better still, abolished – our calculations suggest that the OECD region as a whole will be pushed back into recession next year, and emerging economies will experience a sharp slowdown.”

The OECD projects U.S. government consumption would contract immediately by the equivalent of at least four percentage points of gross domestic product, shaving that amount from economic growth next year.

A default, of course, would be even worse, he warned, and would hit other countries hard.

Meanwhile, DBRS has put the US under Review-Negative:

This action reflects the growing risk of a selective default by the federal government on its debt securities as a result of the lack of an agreement to raise the statutory limit on federal debt (the debt ceiling). According to the U.S. Treasury, its ability to borrow will be exhausted no later than October 17, 2013, leaving a cash balance of approximately $30 billion. If the debt ceiling is not raised or eliminated by October 17, it is unclear how the Treasury would operate. While a low probability, missing payments on selected government securities cannot be ruled out. In the view of DBRS, the longer it takes for an agreement to be reached on the debt ceiling, the greater the risk of missed payments.

The review for downgrade reflects the increasing uncertainty over the debt ceiling outcome, combined with the potential lingering repercussions on both domestic and international investor sentiment, and therefore the U.S. economy and financial markets. DBRS notes that the magnitude of these repercussions could increase each day this impasse continues.

If by October 17 there is still no agreement to raise the debt ceiling and the United States subsequently misses a debt payment, DBRS would assign a Selective Default rating to the affected securities, as long as we expect the Treasury to meet its other obligations in a timely manner. If there is a full-fledged default involving a wide array of securities, the magnitude of the downgrade would be greater.

It is an article of faith that Congress’ dysfunction is due to gerrymandering and the consequent importance of primaries. There’s at least some evidence that polarization of Congress reflects polarization of the electorate – extending beyond ideology to geography:

The real reason for our increasingly divided political system is much simpler: The right wing of the Republican Party has embraced a fundamentalist version of free-market capitalism and succeeded in winning elections. (The Democrats have moved to the left, but less so.)

The Republican shift is the result of several factors. The realignment of Southern white voters into the Republican Party, the branch of conservative activism created by Barry Goldwater’s 1964 presidential campaign and the party’s increasingly firm stance on issues such as income inequality and immigration, can all be important to Republicans’ rightward shift.

The “blame it on the gerrymanders” argument mistakenly assumes that because redistricting created more comfortable seats for each party, polarization became inevitable. Our research, however, casts serious doubt on that idea.

…

Many districts are safe for one party or the other because of how Americans have sorted themselves geographically — choosing to live closer to people who are politically or culturally like-minded. In Florida, for example, Palm Beach County will be reliably Democratic and the Panhandle will consistently vote for Republicans. These geographic shifts mean that state legislatures, which approve congressional district lines, can tweak but not fundamentally alter the ideological makeup of Congress.

The research cited is a paper titled Does Gerrymandering Cause Polarization?

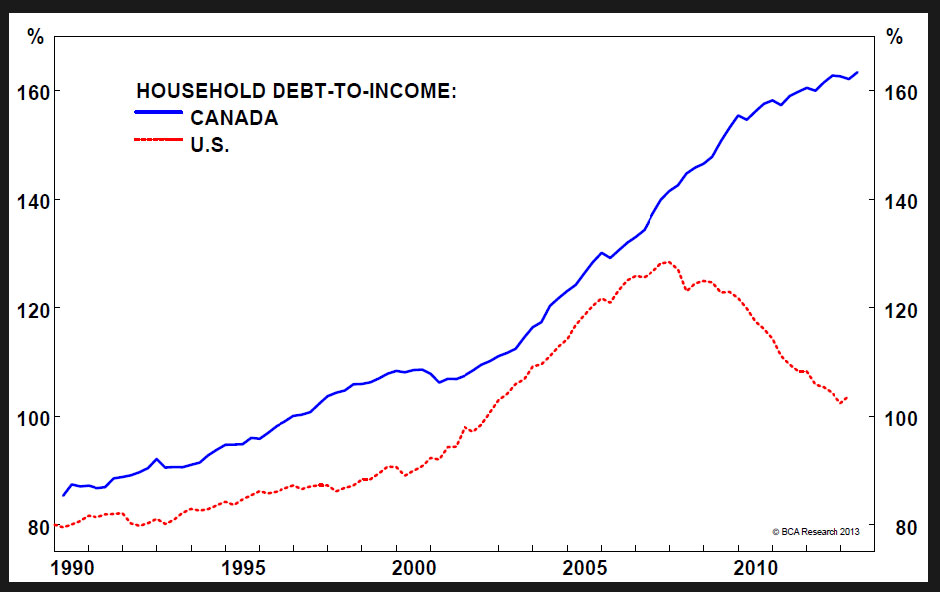

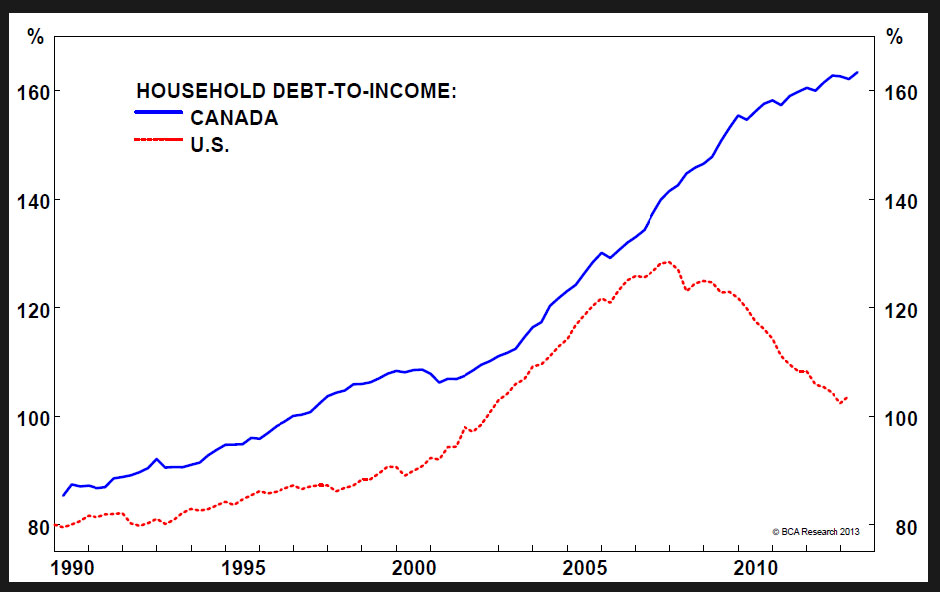

Arthur Heinmaa of Toron observes:

This chart continues to really worry me. There is no stopping the Canadian trend.

Click for Big

Click for Big

I will laugh through my tears if popping our bubble is as painful (and my guess would be more painful) than it was in America. That would put paid to the ‘Canadian financial stability due to wise regulation’ argument, which I consider ridiculous.

Louis Vachon, CEO of National Bank, the man who led the bank while it was stuffing its Money Market Fund to the nuts with ABCP issued by related companies, is now touting his Capital Markets unit:

The knock on National Bank has long been that it is too Quebec-focused, and that its capital markets earnings, which comprise 38 per cent of its net income, are inherently volatile. For these reasons, the bank trades at a lower price-earnings multiple than its Big Six peers.

Mr. Vachon is now on a crusade of sorts to “demystify” the financial markets arm. While he is realistic about his efforts – “we cannot turn lead to gold” – he argues a major point: “All we’re saying is [the unit] does not deserve the extensive discount” it receives relative to the retail operation.

Prior to 2004, he elaborates, there was never a discount for wholesale banking. And although it is understandable why the financial crisis altered that, much has changed since those tumultuous years. Any argument in favour of a discount is “passé,” he said. “If you look forward now, we’re back to more normal times and client-driven activities,” like corporate lending.

It was another negative day for the Canadian preferred share market, with PerpetualDiscounts down 24bp, FixedResets flat and DeemedRetractibles off 14bp. A lengthy Performance Highlights table is dominated by losers. Volume was low.

PerpetualDiscounts now yield 5.57%, equivalent to 7.24% interest at the standard equivalency factor of 1.3x. Long corporates continue to yield about 4.8% (OK, a smidgen more), so the pre-tax interest-equivalent spread is now about 245bp, with everything basically unchanged from the October 2 report.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-1.1845 % |

2,492.0 |

| FixedFloater |

4.28 % |

3.60 % |

30,776 |

18.08 |

1 |

1.1384 % |

3,882.1 |

| Floater |

2.71 % |

2.94 % |

63,781 |

19.90 |

5 |

-1.1845 % |

2,690.7 |

| OpRet |

4.63 % |

3.16 % |

61,098 |

0.63 |

3 |

-0.1156 % |

2,636.4 |

| SplitShare |

4.78 % |

5.05 % |

65,829 |

4.01 |

6 |

-0.3453 % |

2,935.9 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.1156 % |

2,410.8 |

| Perpetual-Premium |

5.80 % |

0.26 % |

105,518 |

0.10 |

8 |

-0.1071 % |

2,278.2 |

| Perpetual-Discount |

5.59 % |

5.57 % |

158,188 |

14.46 |

30 |

-0.2430 % |

2,329.4 |

| FixedReset |

4.96 % |

3.71 % |

234,017 |

3.60 |

85 |

-0.0013 % |

2,452.1 |

| Deemed-Retractible |

5.15 % |

4.49 % |

187,711 |

6.83 |

43 |

-0.1358 % |

2,372.7 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| PWF.PR.A |

Floater |

-1.98 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 22.07

Evaluated at bid price : 22.30

Bid-YTW : 2.35 % |

| FTS.PR.J |

Perpetual-Discount |

-1.71 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 22.18

Evaluated at bid price : 22.47

Bid-YTW : 5.34 % |

| BAM.PR.K |

Floater |

-1.39 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 17.80

Evaluated at bid price : 17.80

Bid-YTW : 2.96 % |

| BNA.PR.E |

SplitShare |

-1.25 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2017-12-10

Maturity Price : 25.00

Evaluated at bid price : 24.45

Bid-YTW : 5.60 % |

| FTS.PR.F |

Perpetual-Discount |

-1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 22.82

Evaluated at bid price : 23.11

Bid-YTW : 5.36 % |

| BAM.PR.C |

Floater |

-1.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 17.73

Evaluated at bid price : 17.73

Bid-YTW : 2.97 % |

| MFC.PR.B |

Deemed-Retractible |

-1.21 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 21.29

Bid-YTW : 6.60 % |

| TRP.PR.A |

FixedReset |

-1.04 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 23.34

Evaluated at bid price : 23.83

Bid-YTW : 4.02 % |

| GWO.PR.P |

Deemed-Retractible |

-1.01 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.40

Bid-YTW : 5.75 % |

| BAM.PR.G |

FixedFloater |

1.14 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 22.56

Evaluated at bid price : 22.21

Bid-YTW : 3.60 % |

| FTS.PR.H |

FixedReset |

1.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 21.03

Evaluated at bid price : 21.03

Bid-YTW : 4.08 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| GWO.PR.L |

Deemed-Retractible |

95,200 |

Nesbitt crossed blocks of 48,800 and 40,000, both at 25.10.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.90

Bid-YTW : 5.76 % |

| PWF.PR.R |

Perpetual-Discount |

86,551 |

Nesbitt crossed two blocks of 40,000 each, both at 24.75.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 24.29

Evaluated at bid price : 24.70

Bid-YTW : 5.56 % |

| BAM.PR.B |

Floater |

60,083 |

Nesbitt crossed 50,000 at 17.95.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 17.94

Evaluated at bid price : 17.94

Bid-YTW : 2.94 % |

| TD.PR.Y |

FixedReset |

54,359 |

Will reset at 3.5595%.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.75

Bid-YTW : 3.71 % |

| BNS.PR.Q |

FixedReset |

38,583 |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.60

Bid-YTW : 3.81 % |

| TD.PR.C |

FixedReset |

26,955 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-31

Maturity Price : 25.00

Evaluated at bid price : 25.19

Bid-YTW : 2.07 % |

| There were 23 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| PWF.PR.A |

Floater |

Quote: 22.30 – 23.30

Spot Rate : 1.0000

Average : 0.7840

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 22.07

Evaluated at bid price : 22.30

Bid-YTW : 2.35 % |

| CU.PR.F |

Perpetual-Discount |

Quote: 20.77 – 21.21

Spot Rate : 0.4400

Average : 0.3020

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2043-10-09

Maturity Price : 20.77

Evaluated at bid price : 20.77

Bid-YTW : 5.49 % |

| GWO.PR.P |

Deemed-Retractible |

Quote: 24.40 – 24.67

Spot Rate : 0.2700

Average : 0.1636

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.40

Bid-YTW : 5.75 % |

| BNA.PR.E |

SplitShare |

Quote: 24.45 – 24.74

Spot Rate : 0.2900

Average : 0.1844

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2017-12-10

Maturity Price : 25.00

Evaluated at bid price : 24.45

Bid-YTW : 5.60 % |

| TD.PR.P |

Deemed-Retractible |

Quote: 25.67 – 25.92

Spot Rate : 0.2500

Average : 0.1464

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2016-11-01

Maturity Price : 25.00

Evaluated at bid price : 25.67

Bid-YTW : 4.22 % |

| MFC.PR.B |

Deemed-Retractible |

Quote: 21.29 – 21.64

Spot Rate : 0.3500

Average : 0.2512

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2025-01-31

Maturity Price : 25.00

Evaluated at bid price : 21.29

Bid-YTW : 6.60 % |