On July 8, Quadravest announced:

Canadian Life Companies Split Corp. (the “Company”) is providing the following update to its shareholders. The net asset value (NAV) of the Company has grown over the past number of months due to increasing valuations of its underlying portfolio of life insurance companies. The Company invests primarily in the common shares of Manulife Financial, Sun Life Financial, Great-West Lifeco, and Industrial Alliance. The NAV of the Company today is approximately $14.50 ($13.68 fully diluted). This provides an intrinsic value for the Class A shareholder (LFE) of approximately $4.50 ($3.68 fully diluted). The Company would also like to take this opportunity to re-iterate its dividend policy on its Class A shares. The Company is restricted from paying dividends on its Class A shares until the undiluted NAV reaches $15.00. When, and if, the undiluted NAV exceeds $15.00, dividends will be re-instated.

On July 23, Quadravest announced:

– As stated in a previously disseminated press release on July 8, 2013, Canadian Life Companies Split Corp. (“the Company”) intends to reinstate dividends on its Class A share (TSX: LFE) when the undiluted net asset value (NAV) per unit of the Company exceeds $15. The NAV as of July 23, 2013 is above $14.75.

The Board of Directors indicates that the initial dividend, if and when reinstated, will be in the amount of $0.05 per month ($0.60 per annum). This dividend once reinstated will provide a current dividend yield of 17% based on the latest closing price of LFE on the Toronto Stock Exchange. The directors have taken into account the cash flow and sustainability of the dividend in determining the amount of the dividend. Due to the Company’s unique structure, the additional return to fund this payment is equivalent to a 4% return on the underlying portfolio. Future market value increases and cash flow increases will be used to increase this dividend up to $0.10 per month ($1.20 per annum) as circumstances warrant.

The Company invests primarily in the common shares of Manulife Financial, Sun Life Financial, Great-West Lifeco, and Industrial Alliance. As stated above, the current NAV of the Company today exceeds $14.75 ($13.88 fully diluted). This provides an intrinsic value for the Class A shareholder (LFE) of approximately $4.75 ($3.88 fully diluted).

According to the company, the undiluted NAV was 14.33 on July 31, and 13.69 fully diluted.

They have also released the 13H1 Financials for LFE, whence the following information can be extracted:

MER: The “Base Management Expense Ratio”, which excludes issuance costs and dividends paid on preferreds, is 1.05%.

Average Net Assets: Calculation of this figure is complicated by the exercise of warrants. Assets were 148.3-million at May 31 and 103.7-million at November 30. Giving the latter figure double weight (as the big warrant exercise was at the end of March) provides an average of 118.6-million. Considering dividends paid on the preferreds were $3.342-million and the preferreds pay 0.625 p.a., this implies an average of 10.69-million units outstanding, with an average NAVPU of (13.56 + 12.48) / 2 = 13.02, for a total of 13.02 x 10.69-million = 139.2-million. Taking the average of these two estimates provides a guess of Average Net Assets = 128.9-million.

Underlying Portfolio Yield: Dividends received of 2.178-million time 2 (semi-annual) divided by average net assets of 128.9-million is 3.38%. The main holdings of the fund are the Big Four Insurers:

| Guess at LFE Portfolio Yield | |

| Issuer | Yield (as of 2013-8-2) |

| IAG | 2.29% |

| MFC | 2.80% |

| GWO | 4.05% |

| SLF | 4.32% |

| Average | 3.36% |

The agreement is astonishing (there have to be compensating errors in there somewhere) and justifies the use of 3.36% portfolio yield.

Income Coverage: Net Investment Income of 1,424,271 divided by Preferred Share Distributions of 3,342,072 is 42%. This figure is undoubtedly brought down by delays in investing the proceeds of the warrant exercise, and therefore of earning dividend income. If we say that the fully diluted NAV is 13.69 (as at 7/31) and the portfolio earns 3.36% (calculated above), that’s $0.4600 p.a. before about 0.10 expenses to pay 0.625 preferred dividends, is about 58%, which sounds like a better guess.

Given all this computation, we can now take a stab at estimated credit quality:

| Credit Quality of LFE.PR.B | ||

| Parameter | 0.60 Cap Unit Dividend | 1.20 Cap Unit Dividend |

| Returns template | SLF | |

| Data Collection Period | 2002-12-8 to 2010-12-8 | |

| Expected Annualized Return | 7.00% | |

| Underlying Dividend Yield | 3.36% | |

| Initial NAV | 13.69 | |

| Pfd Redemption Value | 10.00 | |

| Pfd Coupon | 0.625 | |

| MER | 1.05% | |

| Cap Unit Div (above test) | 0.60 | 1.20 |

| Cap Unit Div (below test) | 0.00 | |

| NAV Test | 15.00 | |

| Whole Unit Par Value | 25.00 | |

| Months to Redemption | 64 | |

| Probability of Default | 27.58% | 29.95% |

| Loss Given Default | 27.29% | 26.11% |

| Expected Loss | 7.53% | 7.82% |

| Yield to Maturity 9.96 bid on 8/2 |

6.30% | |

| Expected Redemption Price | 9.25 | 9.22 |

| Yield to Expectations | 5.07% | 5.02% |

Note that there are some problems with the above calculation, beyond all the estimates discussed above: Capital Unit dividends will be paid based on the undiluted NAV and hence will generally be more than estimated by the credit quality calculator, which is based on diluted NAV.

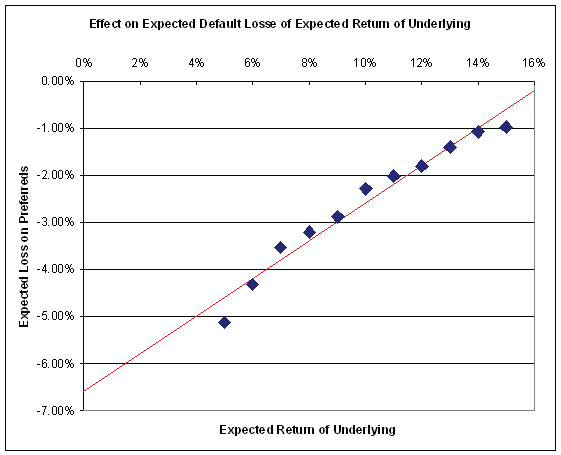

Update: Assiduous Reader prefhound asks in the comments about the sensitivity of the Expected Default Loss to the expected total return. Actually it’s surprisingly little:

The above chart is taken from the December, 2010, edition of PrefLetter, in which the model is discussed in detail. This is part of the PrefLetter 2010 Collection, sold on the PrefLetter website for the low, low price of only $50. That’s right, only $50! Click on PrefLetter right now to purchase the 2010 Collection for only $50! My server is standing by!

Since there is a cash drag, the big problem is sensitivity to return distribution assumptions; see Split Share Credit Quality; as might be expected, sensitivity to everything increases as the NAV declines; see It’s All About Sequence.

So, the manager is being pretty aggressive here, trying to tart up the capital units with a huge and unsustainable dividend. This calculation just estimates loss and default to the pref shares: loss and default to the capital units will be faster and earlier!

I’m wondering what the sensitivity of this calculation is to the expected annualized return assumption (7% here). Is this the total return to the underlying portfolio (i.e. 3.36% dividends plus 3.64% capital appreciation)? Or is it the much more optimistic 7% capital appreciation (so total return would be 10.36%)?

What effect does plus or minus 3% change to the expected return assumption do to the final estimate for the prefs? This could be a huge effect which is essentially another big element of risk to split share prefs — even with $5 of downside protection from capital unit dividends.

For normal corporate prefs, it makes no difference whether the expected common return is 0%, 7% or 15%, and default is only likely to occur in 5 years if that return is -15% or worse.

Finally, I have to ask what the tax treatment of pref and capital unit dividends is when the payout is 160 to >200% of dividends actually received. Isn’t some of this going to end up being return of capital (even for pref shares) — which ought to be a red flag of its own?

Why not look at this as $13.68 fully diluted, paying out to pref owners 26 cents per year more than earned and losing another 16 cents to MER, which adds up to a 5-year drag of $2. So, absent future portfolio price or dividend increases, the ending pref protection is more like $1.68 than $3.68 or $5, which should make pref owners nervous.

Is this the total return to the underlying portfolio (i.e. 3.36% dividends plus 3.64% capital appreciation)?

Yes.

What effect does plus or minus 3% change to the expected return assumption do to the final estimate for the prefs?

I’ve added an update to the main post. The big problem, which may come as a surprise to some and will certainly astonish the regulators, is not the exoected return, but the volatility of the interim returns. This is the same source of underperformance – and essentially the same transmission mechanism – as leveraged ETFs.

Finally, I have to ask what the tax treatment of pref and capital unit dividends is when the payout is 160 to >200% of dividends actually received.

As far as tax is concerned, the dividends on LFE.PR.B in 2012 were entirely ‘eligible dividend’, as were the 2012 dividends on its predecessor, LFE.PR.A. This is kind of a cute trick, seeing as the preferred dividends weren’t even covered by gross investment income in 2012, never mind expenses. I don’t know how they did that.