Multiple well-informed sources have advised me that TLM.PR.A, a 4.20%+277 Fixed Reset announced December 5 and which closed on December 13 to general disdain, is being blown out at 23.75.

January 9, 2012

Another negative bill rate for the textbooks:

Germany sold six-month treasury bills at a negative yield for the first time amid demand for the debt securities of Europe’s biggest economy as a haven from the sovereign debt crisis roiling the region.

The government auctioned 3.9 billion euros ($4.98 billion) of securities maturing in July at an average yield of minus 0.0122 percent, the Federal Finance Agency said in an e-mailed statement today. It was the first time it sold the securities at a negative yield, Joerg Mueller, a spokesman in Frankfurt, said in a telephone interview. The Netherlands sold 107-day bills at minus 0.007 percent on Dec. 12.

Merkozy wants to eliminate trading in the EU:

French President Nicolas Sarkozy won the backing of German Chancellor Angela Merkel for a tax on financial transactions, a levy that Britain maintains won’t work unless it’s applied worldwide.

The French government, long a proponent of the tax, stepped up its campaign last week, going so far as to suggest that France would impose the levy even if others didn’t. At a joint press conference in Berlin with Sarkozy today, Merkel threw her weight behind the tax.

“Personally, I’m in favor of thinking about such a tax in the euro zone,” Merkel said. “Germany and France both equally view the financial transaction tax as a correct response.”

The European Commission in September suggested a tax of 0.1 percent on equity and bond transactions, and 0.01 percent on derivatives, which it said could raise 55 billion euros ($71 billion) a year. European Union finance ministers are due to discuss the levy in March.

All the trading will move to London … or Geneva … or Dubai … or Singapore. If they try to apply it to settlement, they’ll lose all their settlement business as well.

It was another strong day for the Canadian preferred share market, with PerpetualDiscounts winning 37bp, FixedResets flat and DeemedRetractibles gaining 30bp. The Bozo Spread (Current Yield PerpetualDiscounts less Current Yield FixedResets) is now at a mere 2bp! There was a good amount of volatility, with insurers again being notable among the winners. Volume remained very light. Enbridge issues were very active, presumably due to portfolio shuffling inspired by the new issue.

It’s not clear to me what has caused this burst of good performance, but it would not surprise me to learn that a decision has been made to apply the NVCC rules to insurers and insurance holding companies, and that word of this decision has been leaked. Pure speculation of course – and I strongly advise against anybody taking a position based on the thought – but … interesting.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.8880 % | 2,210.0 |

| FixedFloater | 4.78 % | 4.52 % | 34,819 | 17.15 | 1 | -0.1508 % | 3,223.2 |

| Floater | 3.01 % | 3.20 % | 67,478 | 19.26 | 3 | 0.8880 % | 2,386.2 |

| OpRet | 4.97 % | 1.72 % | 65,312 | 1.35 | 7 | 0.1764 % | 2,487.8 |

| SplitShare | 5.39 % | 0.99 % | 70,381 | 0.91 | 4 | 0.1886 % | 2,593.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1764 % | 2,274.8 |

| Perpetual-Premium | 5.43 % | 0.74 % | 85,060 | 0.09 | 23 | -0.0271 % | 2,203.5 |

| Perpetual-Discount | 5.10 % | 5.02 % | 146,206 | 15.42 | 7 | 0.3666 % | 2,373.1 |

| FixedReset | 5.08 % | 2.77 % | 191,381 | 2.39 | 64 | 0.0042 % | 2,365.1 |

| Deemed-Retractible | 4.94 % | 3.70 % | 185,463 | 2.89 | 46 | 0.3018 % | 2,278.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| ENB.PR.B | FixedReset | -1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 23.25 Evaluated at bid price : 25.35 Bid-YTW : 3.60 % |

| TRP.PR.B | FixedReset | -1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 23.41 Evaluated at bid price : 25.31 Bid-YTW : 2.55 % |

| TRP.PR.C | FixedReset | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 23.41 Evaluated at bid price : 25.53 Bid-YTW : 2.83 % |

| RY.PR.H | Deemed-Retractible | 1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-05-24 Maturity Price : 26.00 Evaluated at bid price : 27.45 Bid-YTW : 1.80 % |

| FTS.PR.C | OpRet | 1.12 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-02-08 Maturity Price : 25.50 Evaluated at bid price : 26.19 Bid-YTW : -19.29 % |

| ELF.PR.F | Perpetual-Discount | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 22.94 Evaluated at bid price : 23.33 Bid-YTW : 5.69 % |

| SLF.PR.B | Deemed-Retractible | 1.30 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.46 Bid-YTW : 5.66 % |

| BAM.PR.K | Floater | 1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 16.26 Evaluated at bid price : 16.26 Bid-YTW : 3.24 % |

| SLF.PR.H | FixedReset | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.90 Bid-YTW : 4.75 % |

| MFC.PR.B | Deemed-Retractible | 1.56 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.81 Bid-YTW : 5.89 % |

| BAM.PR.R | FixedReset | 1.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 23.64 Evaluated at bid price : 26.60 Bid-YTW : 3.51 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| ENB.PR.D | FixedReset | 387,560 | Anonymous crossed 20,000 at 25.30. TD sold 16,900 to RBC at 25.25, and another 20,000 to Nesbitt at the same price. RBC crossed 37,200 at 25.25 and TD crossed 25,000 at the same price again. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 23.19 Evaluated at bid price : 25.26 Bid-YTW : 3.57 % |

| GWO.PR.N | FixedReset | 130,400 | RBC crossed blocks of 64,100 shares, 40,000 and 20,000, al at 23.50. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.48 Bid-YTW : 3.76 % |

| ENB.PR.B | FixedReset | 91,300 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-09 Maturity Price : 23.25 Evaluated at bid price : 25.35 Bid-YTW : 3.60 % |

| TD.PR.O | Deemed-Retractible | 83,186 | National sold 60,600 to anonymous at 25.88. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-02-08 Maturity Price : 25.75 Evaluated at bid price : 25.97 Bid-YTW : -9.05 % |

| SLF.PR.G | FixedReset | 81,250 | Nesbitt crossed blocks of 30,000 and 19,300, both at 22.60. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.60 Bid-YTW : 4.52 % |

| NA.PR.M | Deemed-Retractible | 80,000 | TD crossed blocks of 50,000 and 11,900, both at 27.28. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-05-15 Maturity Price : 26.00 Evaluated at bid price : 27.30 Bid-YTW : 2.63 % |

| There were 23 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.A | Floater | Quote: 19.50 – 20.34 Spot Rate : 0.8400 Average : 0.6308 YTW SCENARIO |

| ELF.PR.G | Perpetual-Discount | Quote: 21.41 – 21.98 Spot Rate : 0.5700 Average : 0.4303 YTW SCENARIO |

| MFC.PR.G | FixedReset | Quote: 24.15 – 24.47 Spot Rate : 0.3200 Average : 0.1950 YTW SCENARIO |

| ENB.PR.A | Perpetual-Premium | Quote: 26.29 – 26.63 Spot Rate : 0.3400 Average : 0.2541 YTW SCENARIO |

| PWF.PR.F | Perpetual-Premium | Quote: 25.01 – 25.25 Spot Rate : 0.2400 Average : 0.1620 YTW SCENARIO |

| TD.PR.R | Deemed-Retractible | Quote: 27.08 – 27.30 Spot Rate : 0.2200 Average : 0.1467 YTW SCENARIO |

New Issue: ENB FixedReset 4.00%+251

Enbridge Inc. has announced:

that it has entered into an agreement with a group of underwriters to sell 12 million cumulative redeemable preference shares, series F (the “Series F Preferred Shares”) at a price of $25.00 per share for distribution to the public. Closing of the offering is expected on January 18, 2012.

The holders of Series F Preferred Shares will be entitled to receive fixed cumulative dividends at an annual rate of $1.00 per share, payable quarterly on the 1st day of March, June, September and December, as and when declared by the Board of Directors of Enbridge, yielding 4.00 per cent per annum, for the initial fixed rate period to but excluding June 1, 2018. The first quarterly dividend payment date is scheduled for June 1, 2012. The dividend rate will reset on June 1, 2018 and every five years thereafter at a rate equal to the sum of the then five-year Government of Canada bond yield plus 2.51 per cent. The Series F Preferred Shares are redeemable by Enbridge, at its option, on June 1, 2018 and on June 1 of every fifth year thereafter.

The holders of Series F Preferred Shares will have the right to convert their shares into cumulative redeemable preference shares, series G (the “Series G Preferred Shares”), subject to certain conditions, on June 1, 2018 and on June 1 of every fifth year thereafter. The holders of Series G Preferred Shares will be entitled to receive quarterly floating rate cumulative dividends, as and when declared by the Board of Directors of Enbridge, at a rate equal to the sum of the then 90-day Government of Canada treasury bill rate plus 2.51 per cent.

Enbridge has granted to the underwriters an option, exercisable at any time up to 48 hours prior to the closing of the offering, to purchase up to an additional 2 million Series F Preferred Shares at a price of $25.00 per share.

The offering is being made only in Canada by means of a prospectus. Proceeds will be used to partially fund capital projects, to reduce existing indebtedness and for other general corporate purposes of the Corporation and its affiliates.

The syndicate of underwriters is co-led by Scotia Capital Inc., RBC Capital Markets and TD Securities Inc.

January 6, 2012

U.S. employers added more workers to payrolls than forecast in December and the jobless rate declined to an almost three-year low, showing that the labor market gained momentum heading into 2012.

The 200,000 increase followed a revised 100,000 rise in November that was smaller than first estimated, Labor Department figures showed in Washington. The median projection in a Bloomberg News survey called for a December gain of 155,000. The unemployment rate unexpectedly fell to 8.5 percent, the lowest since February 2009, while hours worked and earnings climbed.

Less rosy is Canada’s employment news:

Canada’s unemployment rate (CANLXEMR) rose for a third month in December, the longest advance in two years, as a gain in jobs trailed growth of the labor force.

The jobless rate increased to 7.5 percent from November’s 7.4 percent and the recent low of 7.1 percent in September, Statistics Canada said today in Ottawa. Employment (CANLNETJ) rose by 17,500, the first gain in three months. Over the past six months, the number of jobs has grown by 7,400, compared with a gain of 191,800 in the first half of 2011.

Fitch has joined the other major agencies – Hungary is junk:

Fitch became the third ratings agency to downgrade Hungary’s debt to “junk” status on Friday, invoking further deterioration in the country’s fiscal and external financing and growth outlook and the government’s “unorthodox” economic policies.

Banks in euro zone countries have significant exposure to Hungary, with Austrian financial institutions having more than $40 billion in the country, Italian banks nearly $25 billion, German banks a little over $20 billion and Belgian banks over $15 billion, according to figures by the Bank of International Settlements and ING estimates.

…

Earlier on Friday, controversial Prime Minister Viktor Orban said both his government and the central bank want a fast deal with the International Monetary Fund.The IMF, the EU and the ECB have criticized the Hungarian government for wanting to curb the central bank’s independence.

Since coming to power in 2010, Orban’s government took over private pension funds, set a fixed exchange rate for loans in foreign currency taken during the boom years before 2008 — forcing banks to take the losses due to the national currency’s depreciation — and imposed the biggest tax in Europe on banks, sparking investors’ protests.

Fitch said the government’s policies, popular with voters but which have prompted foreign investors’ fury and have attracted international criticism, were part of the reason for the downgrade.

Officials at OSFI are taking steps to help their future employers retain hegemony over Canadian financial markets:

OSFI strongly believes additional exemptions from the restrictions on proprietary trading should be given to foreign government securities, at least for banking groups whose parent bank is located outside of the US. Many foreign banks play important market-making roles in the trading of government securities in their home jurisdictions. They also actively rely on government securities of their home jurisdiction to efficiently manage their liquidity and funding requirements at a global enterprise-wide level; a practice that will be further reinforced in the future by new bank liquidity requirements that have been proposed by the Basel Committee on Banking Supervision. Thus, OSFI believes a failure to include these additional exemptions at least for banking entities whose parent bank is located outside of the US would undermine the liquidity of government debt markets outside of the US and could significantly impede the ability of foreign banks to efficiently manage their liquidity and funding requirements at an enterprise-wide level.

It was another very good day for the Canadian preferred share market, with PerpetualDiscounts winning 39bp (won’t be too many of the them left soon!), FixedResets up 10bp and DeemedRetractibles gaining 26bp. I remain on tenterhooks waiting to see whether the Bozo Spread (Current Yield PerpetualDiscounts less Current Yield FixedResets) will go negative! There was good volatility, with insurance DeemedRetractibles doing quite well. Volume remains low after the holiday break.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.2016 % | 2,190.6 |

| FixedFloater | 4.77 % | 4.21 % | 35,177 | 16.91 | 1 | 0.5051 % | 3,228.1 |

| Floater | 3.04 % | 3.23 % | 67,892 | 19.20 | 3 | -1.2016 % | 2,365.2 |

| OpRet | 4.98 % | 1.46 % | 64,753 | 1.35 | 7 | 0.1989 % | 2,483.4 |

| SplitShare | 5.40 % | 1.30 % | 72,751 | 0.92 | 4 | 0.1225 % | 2,588.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1989 % | 2,270.8 |

| Perpetual-Premium | 5.42 % | 0.70 % | 88,080 | 0.09 | 23 | 0.0500 % | 2,204.1 |

| Perpetual-Discount | 5.12 % | 5.04 % | 145,957 | 14.61 | 7 | 0.3911 % | 2,364.5 |

| FixedReset | 5.08 % | 2.79 % | 196,776 | 2.39 | 64 | 0.0986 % | 2,365.0 |

| Deemed-Retractible | 4.96 % | 3.63 % | 184,881 | 1.88 | 46 | 0.2570 % | 2,271.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.A | Floater | -1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-06 Maturity Price : 19.40 Evaluated at bid price : 19.40 Bid-YTW : 2.73 % |

| BAM.PR.B | Floater | -1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-06 Maturity Price : 16.35 Evaluated at bid price : 16.35 Bid-YTW : 3.23 % |

| SLF.PR.C | Deemed-Retractible | 1.12 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.76 Bid-YTW : 6.25 % |

| SLF.PR.E | Deemed-Retractible | 1.25 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.87 Bid-YTW : 6.24 % |

| GWO.PR.H | Deemed-Retractible | 1.26 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.17 Bid-YTW : 5.32 % |

| SLF.PR.A | Deemed-Retractible | 1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.88 Bid-YTW : 5.92 % |

| BAM.PR.P | FixedReset | 1.43 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-30 Maturity Price : 25.00 Evaluated at bid price : 27.67 Bid-YTW : 2.97 % |

| POW.PR.D | Perpetual-Discount | 1.49 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-31 Maturity Price : 25.00 Evaluated at bid price : 25.27 Bid-YTW : 4.57 % |

| SLF.PR.D | Deemed-Retractible | 1.54 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.74 Bid-YTW : 6.26 % |

| SLF.PR.B | Deemed-Retractible | 1.98 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.16 Bid-YTW : 5.82 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.B | Deemed-Retractible | 57,021 | Nesbitt crossed 50,000 at 22.50. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.46 Bid-YTW : 6.08 % |

| CM.PR.M | FixedReset | 50,749 | TD crossed 50,000 at 27.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-31 Maturity Price : 25.00 Evaluated at bid price : 27.32 Bid-YTW : 2.59 % |

| BNS.PR.P | FixedReset | 47,743 | TD crossed 25,000 at 25.90; RBC crossed 12,800 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-04-25 Maturity Price : 25.00 Evaluated at bid price : 25.86 Bid-YTW : 2.03 % |

| ENB.PR.D | FixedReset | 40,267 | RBC crossed 20,000 at 25.55. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-06 Maturity Price : 23.26 Evaluated at bid price : 25.50 Bid-YTW : 3.55 % |

| IGM.PR.B | Perpetual-Premium | 33,900 | Desjardins crossed 30,000 at 26.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2018-12-31 Maturity Price : 25.00 Evaluated at bid price : 26.09 Bid-YTW : 5.12 % |

| PWF.PR.O | Perpetual-Premium | 26,756 | TD crossed 25,000 at 26.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2016-10-31 Maturity Price : 25.50 Evaluated at bid price : 26.52 Bid-YTW : 4.69 % |

| There were 22 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| MFC.PR.C | Deemed-Retractible | Quote: 21.91 – 22.44 Spot Rate : 0.5300 Average : 0.3461 YTW SCENARIO |

| FTS.PR.H | FixedReset | Quote: 25.56 – 25.98 Spot Rate : 0.4200 Average : 0.2588 YTW SCENARIO |

| PWF.PR.A | Floater | Quote: 19.40 – 19.95 Spot Rate : 0.5500 Average : 0.4015 YTW SCENARIO |

| BAM.PR.J | OpRet | Quote: 26.38 – 26.83 Spot Rate : 0.4500 Average : 0.3114 YTW SCENARIO |

| PWF.PR.O | Perpetual-Premium | Quote: 26.52 – 26.85 Spot Rate : 0.3300 Average : 0.2118 YTW SCENARIO |

| CM.PR.M | FixedReset | Quote: 27.32 – 27.68 Spot Rate : 0.3600 Average : 0.2489 YTW SCENARIO |

January 5, 2012

They don’t issue preferreds, but this is interesting anyway – S&P downgraded Sears by two notches:

- The decline in operating performance at U.S. retailer Sears accelerated in 2011, and we expect operating performance to remain pressured in 2012, potentially resulting in negative EBITDA.

- Sears’ liquidity sources will narrow, given the negative EBITDA we expect and the need to fund operating losses, capital spending, and pension contributions.

- We are lowering our corporate credit rating on the company to ‘CCC+’ from ‘B’ and the short-term and commercial paper ratings for Sears Roebuck Acceptance to ‘C’ from ‘B-2’.

- The negative outlook reflects our expectation that Sears’ liquidity could diminish in 2013.

This means that Eddy Lampert could be in trouble:

Edward Lampert’s hedge fund cut its stake in AutoZone (AZO) Inc. late last month to meet client redemptions amid a series of setbacks at Sears Holdings Corp. (SHLD), one of its biggest and highest-profile investments.

ESL Investments Inc., the firm run by Lampert, distributed about $1.02 billion worth of AutoZone stock to investors in connection with the closing of one investment partnership and the restructuring of another, according to a regulatory filing yesterday. The Greenwich, Connecticut-based firm also used $351.4 million of shares in AutoZone and AutoNation Inc. (AN) as payment in kind to meet year-end redemptions from its main fund, ESL Partners LP, the filing showed.

Lampert has been selling AutoZone and AutoNation shares while holding onto his entire stake in Sears, a strategy that could leave his main hedge fund further concentrated in the Hoffman Estates, Illinois-based retailer. AutoZone rose 19 percent last year and AutoNation shares gained 31 percent, while Sears shares plummeted 56 percent.

It was a good day for the Canadian preferred share market, with PerpetualDiscounts winning 29bp, FixedResets up 7bp and DeemedRetractibles gaining 22bp. For the second successive day there was a lengthy list of issues gaining more than 1% – with SLF issues notable for their presence among the better performers, while Floaters continued to signal retail expectations of inflationary times ahead. Volume remained significantly below average, but it is recovering.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 2.1828 % | 2,217.2 |

| FixedFloater | 4.80 % | 4.54 % | 35,102 | 17.14 | 1 | 0.0000 % | 3,211.9 |

| Floater | 3.00 % | 3.19 % | 67,934 | 19.28 | 3 | 2.1828 % | 2,394.0 |

| OpRet | 4.99 % | 1.70 % | 65,434 | 1.36 | 7 | 0.2714 % | 2,478.5 |

| SplitShare | 5.41 % | 1.29 % | 69,503 | 0.92 | 4 | 0.4924 % | 2,585.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2714 % | 2,266.3 |

| Perpetual-Premium | 5.41 % | 0.64 % | 86,367 | 0.09 | 23 | 0.1640 % | 2,203.0 |

| Perpetual-Discount | 5.13 % | 5.05 % | 141,654 | 15.37 | 7 | 0.2899 % | 2,355.3 |

| FixedReset | 5.08 % | 2.86 % | 198,782 | 2.40 | 64 | 0.0744 % | 2,362.7 |

| Deemed-Retractible | 4.97 % | 3.70 % | 186,228 | 2.24 | 46 | 0.2161 % | 2,265.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| GWO.PR.L | Deemed-Retractible | 1.00 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 26.17 Bid-YTW : 5.09 % |

| SLF.PR.I | FixedReset | 1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-12-31 Maturity Price : 25.00 Evaluated at bid price : 24.60 Bid-YTW : 4.41 % |

| BAM.PR.P | FixedReset | 1.04 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-30 Maturity Price : 25.00 Evaluated at bid price : 27.28 Bid-YTW : 3.54 % |

| BAM.PR.R | FixedReset | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-05 Maturity Price : 23.57 Evaluated at bid price : 26.30 Bid-YTW : 3.60 % |

| MFC.PR.B | Deemed-Retractible | 1.04 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.32 Bid-YTW : 6.16 % |

| BNA.PR.E | SplitShare | 1.11 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 23.65 Bid-YTW : 6.06 % |

| SLF.PR.A | Deemed-Retractible | 1.16 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.58 Bid-YTW : 6.09 % |

| PWF.PR.K | Perpetual-Discount | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-05 Maturity Price : 24.83 Evaluated at bid price : 25.12 Bid-YTW : 5.00 % |

| SLF.PR.E | Deemed-Retractible | 1.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.60 Bid-YTW : 6.40 % |

| SLF.PR.D | Deemed-Retractible | 1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.41 Bid-YTW : 6.45 % |

| SLF.PR.C | Deemed-Retractible | 1.75 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.52 Bid-YTW : 6.39 % |

| BAM.PR.K | Floater | 2.54 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-05 Maturity Price : 16.15 Evaluated at bid price : 16.15 Bid-YTW : 3.27 % |

| BAM.PR.B | Floater | 4.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-05 Maturity Price : 16.52 Evaluated at bid price : 16.52 Bid-YTW : 3.19 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| SLF.PR.G | FixedReset | 118,952 | Nesbitt crossed 115,000 at 22.55. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.50 Bid-YTW : 4.60 % |

| IFC.PR.A | FixedReset | 68,416 | Desjardins bought 20,000 from RBC. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.04 Bid-YTW : 3.75 % |

| ENB.PR.D | FixedReset | 57,475 | Desjardins crossed 25,000 at 25.52. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-05 Maturity Price : 23.26 Evaluated at bid price : 25.51 Bid-YTW : 3.55 % |

| BNS.PR.Q | FixedReset | 56,259 | Nesbitt crossed 50,000 at 25.95. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-10-25 Maturity Price : 25.00 Evaluated at bid price : 25.85 Bid-YTW : 2.87 % |

| MFC.PR.G | FixedReset | 54,034 | Recent fire sale. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.05 Bid-YTW : 4.85 % |

| BNS.PR.Y | FixedReset | 51,831 | TD crossed 49,500 at 25.20. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.15 Bid-YTW : 2.75 % |

| There were 24 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PR.N | Perpetual-Discount | Quote: 23.46 – 23.85 Spot Rate : 0.3900 Average : 0.2793 YTW SCENARIO |

| GWO.PR.M | Deemed-Retractible | Quote: 25.75 – 26.10 Spot Rate : 0.3500 Average : 0.2444 YTW SCENARIO |

| IAG.PR.C | FixedReset | Quote: 26.35 – 26.65 Spot Rate : 0.3000 Average : 0.2158 YTW SCENARIO |

| GWO.PR.N | FixedReset | Quote: 23.19 – 23.53 Spot Rate : 0.3400 Average : 0.2588 YTW SCENARIO |

| TD.PR.C | FixedReset | Quote: 26.33 – 26.57 Spot Rate : 0.2400 Average : 0.1673 YTW SCENARIO |

| FTS.PR.C | OpRet | Quote: 26.00 – 26.50 Spot Rate : 0.5000 Average : 0.4293 YTW SCENARIO |

BNA 2011 Annual Report

BAM Split Corp., issuer of BNA.PR.B, BNA.PR.C, BNA.PR.D and BNA.PR.E, has released its Annual Report to September 30, 2011.

Figures of interest are:

MER: (excluding dividends on preferred shares, issue costs and Class A Preferred Share redemption premium) 0.0%. You don’t see that number very often! A more precise calculation from the Income Statement shows that the expenses totalled $312,000 for the year, or about 2bp p.a. on assets.

The expenses are wel itemized, however, and are a delight for voyeurs. I found the Listing Fees of $101,000 and Rating Fees of $20,000 to be most interesting.

Average Net Assets: This must be calculated if we’re to find the second decimal point on the MER. On 2011-9-30, total assets were 1.541-billion; on 2010-9-30, 1.547-billion. I used the lower figure.

Underlying Portfolio Yield: Given the fund’s portfolio composition and investment policy, deviations from the raw yield on BAM.A will not be material. This is currently 1.865%

Income Coverage: Dividends & Interest of $27.307-million less expenses (before amortization of issue costs) of $0.312-million is $26.995-million, to cover preferred dividends of $24.297-million is 111%.

A noteworthy disclosure in the report is:

0n December 8, 2011, the board of directors authorized the company to exchange $200 million capital shares for $200 million newly created Junior Preferred Shares. The Junior Preferred Shares will be retractable at the option of the holder, will pay a noncumulative quarterly dividend at an annual rate of 5.00% and will rank junior to the publicly held Class A, Class AA and Class AAA Preferred Shares. The company expects to complete the exchange of capital shares for Junior Preferred Shares in January 2012.

There is no further information available on these Junior Preferreds, but it’s probably safe to assume that the new shares will have a par value of $25, and that the capital units outstanding will be adjusted so that a Unit continues to be one preferred and one capital unit.

This means that the $200-million in new preferreds will be comprised of 8-million shares, so there will be 8-million new units outstanding with no new money in the fund. There are now 19.713-million units outstanding, so there will soon be 27.713-million units outstanding and the NAVPU will decline so that it is 19713 / 27713 of its current value, or 71.1%.

Thus, the “diluted NAVPU” will decline to about 53.78 from its Dec. 30 level of 75.65 and Asset Coverage will therefore decline to 2.2-:1 from its current level of 3.0+:1.

This is nasty stuff. BNA has always been notable for its extremely high Asset Coverage and now it’s being smacked down to levels that are simply adequate for its investment-grade rating. More insidiously, it seems to me that the junior preferreds are retractible at any time; in times of trouble they could sneak ahead of the senior issues which are retractible for cash only at a given time in the future.

However, DBRS confirmed the preferreds at Pfd-2(low) on December 13 and must have known about the plans at that time:

The downside protection available to the Class AA Preferred Shares is approximately 66.0%, based on the market value of the BAM Shares as of November 25, 2011. The dividend coverage ratio is approximately 1.1 times. As a result, the Company will initially be able to fund the Class AA Preferred Shares distributions without relying on other methods for generating income or reverting to the sale of common shares in the Portfolio. In the event of a shortfall, the Company will sell some of the BAM Shares or write covered call options to generate sufficient income to satisfy its obligations to pay the Class AA Preferred Shares dividends.

The Pfd-2 (low) ratings of the Class AA Preferred Shares are primarily based on the downside protection and dividend coverage available to the Class AA Preferred Shares.

The main constraints to the ratings are the following:

(1) The downside protection available to holders of the Class AA Preferred Shares depends solely on the market value of the BAM Shares held in the Portfolio, which will fluctuate over time.

(2) There is a lack of diversification as the Portfolio is entirely made up of BAM Shares.

(3) Changes in the dividend policy of BAM may result in reductions in Class AA Preferred Shares dividend coverage.

(4) As the BAM Shares pay dividends in U.S. dollars, the Company is exposed to foreign currency risk relating to the Canadian-U.S. exchange rate – specifically, the appreciation of the Canadian dollar versus the U.S. dollar – which may have a negative impact on the dividend coverage ratio of the Class AA Preferred Shares as these dividends are paid in Canadian dollars.

BNA has the following preferred share issues outstanding: BNA.PR.B, BNA.PR.C, BNA.PR.D and BNA.PR.E.

January 4, 2012

Have we seen this movie before? Esoteric assets are being securitized in volume:

Sales of bonds backed by everything from timeshare rentals to shipping containers to entertainment royalties are poised to rise this year as investors seek to boost returns with interest rates at about record lows.

So-called esoteric asset-backed securities issuance may soar 12.9 percent to $35 billion, compared with debt linked to more traditional collateral such as auto and credit-card loans, which will grow 8.75 percent to $87 billion, according to a forecast from Credit Suisse Group AG.

…

Investors willing to hold BBB rated bonds backed by franchise royalty fees of the Sonic Corp. (SONC) fast- food chain may receive as much as 2 percentage points more annually than similarly rated securities tied to auto loans, according to Barclays Capital’s Cory Wishengrad in New York.

…

Cronos Containers Ltd. boosted the size of its November offering of bonds tied to shipping container lease payments by $50 million to $200 million, according to data compiled by Bloomberg. An A rated $170 million portion maturing in five years priced to yield 5 percent.

It was quite a good day for the Canadian preferred share market, with PerpetualDiscounts – what are left of them! – winning 53bp, FixedResets up 9bp and DeemedRetractibles gaining 19bp. Floating Rate issues also appear to be celebrating the new year. Good volatility – all winners! Volume was quite low, but better than the comatose levels of the last week.

PerpetualDiscounts now yield 5.08%, equivalent to 6.60% interest at the standard conversion factor of 1.4x. 1.3x. Long corporates now yield about 4.65%, so the pre-tax interest-equivalent spread (also called the Seniority Spread) is now about 195bp, significantly narrower than the 205bp reported December 30.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.1234 % | 2,169.8 |

| FixedFloater | 4.80 % | 4.54 % | 36,535 | 17.14 | 1 | 1.0204 % | 3,211.9 |

| Floater | 3.07 % | 3.34 % | 67,638 | 18.94 | 3 | 1.1234 % | 2,342.9 |

| OpRet | 5.00 % | 1.34 % | 65,635 | 1.36 | 7 | 0.4228 % | 2,471.8 |

| SplitShare | 5.44 % | 1.71 % | 70,190 | 0.93 | 4 | 0.0924 % | 2,573.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4228 % | 2,260.2 |

| Perpetual-Premium | 5.41 % | -6.07 % | 85,510 | 0.09 | 23 | 0.2211 % | 2,199.4 |

| Perpetual-Discount | 5.15 % | 5.08 % | 142,236 | 15.29 | 7 | 0.5343 % | 2,348.5 |

| FixedReset | 5.08 % | 2.87 % | 201,174 | 2.39 | 64 | 0.0872 % | 2,360.9 |

| Deemed-Retractible | 4.98 % | 3.69 % | 183,734 | 1.89 | 46 | 0.1922 % | 2,260.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.G | FixedFloater | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-04 Maturity Price : 25.00 Evaluated at bid price : 19.80 Bid-YTW : 4.54 % |

| MFC.PR.B | Deemed-Retractible | 1.05 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.09 Bid-YTW : 6.29 % |

| BAM.PR.B | Floater | 1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-04 Maturity Price : 15.81 Evaluated at bid price : 15.81 Bid-YTW : 3.34 % |

| SLF.PR.E | Deemed-Retractible | 1.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.34 Bid-YTW : 6.55 % |

| MFC.PR.C | Deemed-Retractible | 1.40 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.71 Bid-YTW : 6.35 % |

| POW.PR.D | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-04 Maturity Price : 24.49 Evaluated at bid price : 24.97 Bid-YTW : 5.00 % |

| BAM.PR.I | OpRet | 1.92 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-02-03 Maturity Price : 25.25 Evaluated at bid price : 25.50 Bid-YTW : -5.75 % |

| BAM.PR.K | Floater | 2.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-04 Maturity Price : 15.75 Evaluated at bid price : 15.75 Bid-YTW : 3.35 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| GWO.PR.M | Deemed-Retractible | 233,800 | Nesbitt crossed blocks of 185,000 and 25,000, both at 25.60. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.60 Bid-YTW : 5.53 % |

| CM.PR.I | Deemed-Retractible | 90,330 | RBC crossed 29,300 at 25.95. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-01-31 Maturity Price : 25.75 Evaluated at bid price : 25.95 Bid-YTW : 3.51 % |

| CM.PR.L | FixedReset | 54,069 | Nesbitt crossed 50,000 at 27.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-04-30 Maturity Price : 25.00 Evaluated at bid price : 27.35 Bid-YTW : 2.13 % |

| BNS.PR.T | FixedReset | 52,980 | Nesbitt crossed 50,000 at 27.15. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-04-25 Maturity Price : 25.00 Evaluated at bid price : 27.11 Bid-YTW : 2.27 % |

| BAM.PR.O | OpRet | 35,400 | RBC crossed blocks of 20,000 and 15,000 at 25.50. YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.50 Bid-YTW : 3.66 % |

| SLF.PR.G | FixedReset | 33,837 | RBC crossed 30,000 at 22.55. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.47 Bid-YTW : 4.61 % |

| There were 18 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.H | Perpetual-Premium | Quote: 25.55 – 26.88 Spot Rate : 1.3300 Average : 0.7773 YTW SCENARIO |

| TCA.PR.Y | Perpetual-Premium | Quote: 52.65 – 53.94 Spot Rate : 1.2900 Average : 0.8248 YTW SCENARIO |

| FTS.PR.C | OpRet | Quote: 25.90 – 26.47 Spot Rate : 0.5700 Average : 0.3518 YTW SCENARIO |

| GWO.PR.L | Deemed-Retractible | Quote: 25.91 – 26.50 Spot Rate : 0.5900 Average : 0.3948 YTW SCENARIO |

| BMO.PR.K | Deemed-Retractible | Quote: 26.47 – 26.98 Spot Rate : 0.5100 Average : 0.3468 YTW SCENARIO |

| CIU.PR.A | Perpetual-Discount | Quote: 24.50 – 25.18 Spot Rate : 0.6800 Average : 0.5168 YTW SCENARIO |

January 3, 2012

Nothing happened today.

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts roaring ahead 34bp, while FixedResets were down 4bp and DeemedRetractibles gained 8bp. Volatility was quite good, with Floaters doing particularly well. Volume continued to be abyssmally low.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 2.5051 % | 2,145.7 |

| FixedFloater | 4.85 % | 4.53 % | 38,039 | 17.36 | 1 | 0.5128 % | 3,179.4 |

| Floater | 3.10 % | 3.37 % | 67,834 | 18.85 | 3 | 2.5051 % | 2,316.8 |

| OpRet | 5.02 % | 3.87 % | 66,519 | 1.36 | 7 | -0.3713 % | 2,461.4 |

| SplitShare | 5.44 % | 1.71 % | 70,787 | 0.93 | 4 | -0.0821 % | 2,570.7 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.3713 % | 2,250.7 |

| Perpetual-Premium | 5.43 % | -3.89 % | 88,898 | 0.09 | 23 | 0.2054 % | 2,194.6 |

| Perpetual-Discount | 5.18 % | 5.12 % | 137,518 | 15.27 | 7 | 0.3412 % | 2,336.0 |

| FixedReset | 5.08 % | 2.91 % | 203,530 | 2.39 | 64 | -0.0424 % | 2,358.9 |

| Deemed-Retractible | 4.99 % | 3.55 % | 184,520 | 1.89 | 46 | 0.0785 % | 2,256.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | -2.34 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.02 Bid-YTW : 5.44 % |

| CM.PR.M | FixedReset | -1.37 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-31 Maturity Price : 25.00 Evaluated at bid price : 27.27 Bid-YTW : 2.66 % |

| GWO.PR.N | FixedReset | -1.32 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.16 Bid-YTW : 3.94 % |

| MFC.PR.C | Deemed-Retractible | -1.15 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.41 Bid-YTW : 6.53 % |

| BAM.PR.P | FixedReset | -1.06 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-30 Maturity Price : 25.00 Evaluated at bid price : 27.07 Bid-YTW : 3.84 % |

| SLF.PR.B | Deemed-Retractible | 1.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.45 Bid-YTW : 6.22 % |

| PWF.PR.K | Perpetual-Discount | 1.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-03 Maturity Price : 24.22 Evaluated at bid price : 24.70 Bid-YTW : 5.07 % |

| SLF.PR.I | FixedReset | 1.46 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-12-31 Maturity Price : 25.00 Evaluated at bid price : 24.35 Bid-YTW : 4.53 % |

| PWF.PR.A | Floater | 1.80 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-03 Maturity Price : 19.75 Evaluated at bid price : 19.75 Bid-YTW : 2.68 % |

| BAM.PR.B | Floater | 2.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-03 Maturity Price : 15.64 Evaluated at bid price : 15.64 Bid-YTW : 3.37 % |

| BAM.PR.K | Floater | 3.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-01-03 Maturity Price : 15.35 Evaluated at bid price : 15.35 Bid-YTW : 3.44 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| PWF.PR.I | Perpetual-Premium | 75,403 | Desjardins crossed 25,000 at 25.95; RBC crossed 50,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-02-02 Maturity Price : 25.25 Evaluated at bid price : 25.94 Bid-YTW : -14.17 % |

| BAM.PR.O | OpRet | 52,156 | RBC crossed 50,000 at 25.50. YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.37 Bid-YTW : 4.02 % |

| RY.PR.A | Deemed-Retractible | 36,852 | Scotia crossed 10,000 at 25.82; RBC crossed 24,400 at 25.85. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-05-24 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 3.48 % |

| SLF.PR.H | FixedReset | 23,091 | Nesbitt crossed 10,000 at 22.60. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.51 Bid-YTW : 4.98 % |

| MFC.PR.G | FixedReset | 23,025 | Recent fire sale. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.96 Bid-YTW : 4.89 % |

| SLF.PR.I | FixedReset | 17,060 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-12-31 Maturity Price : 25.00 Evaluated at bid price : 24.35 Bid-YTW : 4.53 % |

| There were 7 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PR.I | OpRet | Quote: 25.02 – 26.00 Spot Rate : 0.9800 Average : 0.7092 YTW SCENARIO |

| RY.PR.X | FixedReset | Quote: 27.41 – 28.08 Spot Rate : 0.6700 Average : 0.4060 YTW SCENARIO |

| W.PR.J | Perpetual-Premium | Quote: 25.22 – 25.78 Spot Rate : 0.5600 Average : 0.4364 YTW SCENARIO |

| MFC.PR.C | Deemed-Retractible | Quote: 21.41 – 21.85 Spot Rate : 0.4400 Average : 0.3177 YTW SCENARIO |

| NA.PR.P | FixedReset | Quote: 27.10 – 27.48 Spot Rate : 0.3800 Average : 0.2715 YTW SCENARIO |

| BMO.PR.H | Deemed-Retractible | Quote: 25.92 – 26.23 Spot Rate : 0.3100 Average : 0.2035 YTW SCENARIO |

UST.PR.A Refunded by UST.PR.B

On November 17, First Asset Management announced:

that at an adjourned special meeting of the holders of Capital Units of the Fund held today, Capital Unitholders approved (i) a five year extension of the Fund’s termination date from December 31, 2011 to December 31, 2016, and (ii) a special retraction right to enable Capital Unitholders who do not wish to extend their investment in the Fund to retract their Capital Units prior to December 31, 2011 on the same terms that would have applied had the Fund redeemed all of the Capital Units as originally contemplated on the scheduled termination date of December 31, 2011.

…

Holders of the Fund’s Preferred Securities do not need to take any action. The Preferred Securities will be repaid on the same terms as originally contemplated by the trust indenture. In particular, each holder of a Preferred Security on December 31, 2011 will be paid an amount equal to the Repayment Price, being the original subscription price of $10 per Preferred Security together with any accrued and unpaid interest thereon. Payment is expected to be made on or about January 3, 2012. The Preferred Securities will be delisted from the TSX as at the close of business on Friday, December 30, 2011.

On December 19, they announced:

that it has completed its offering of Class B Preferred Securities. The Fund issued 1,203,576 Class B Preferred Securities for gross proceeds of approximately $12 million. The Class B Preferred Securities are listed on the Toronto Stock Exchange (“TSX”) under the symbol UST.PR.B. The Class B Preferred Securities have been rated Pfd-2 (low) by DBRS Limited.

DBRS has confirmed the Pfd-2(low) rating:

Dividends received on the Portfolio will be used by the Fund to make quarterly fixed cumulative distributions of $0.13125 per Class B Preferred Security to yield 5.25% annually. Based on the current dividend yields on the underlying portfolio entities, the initial dividend coverage ratio (net of expenses) is approximately 1.58 times. As a result, currently the Class B Preferred Security distributions (Interest Amount) are funded entirely from the dividends and distributions received on the securities in the Portfolio. Holders of the Capital Units are expected to receive all excess dividend income after the Class B Preferred Security distributions and other expenses of the Fund have been paid. The initial downside protection available to holders of the Class B Preferred Securities is approximately 56.4%.

The Pfd-2 (low) rating of the Class B Preferred Securities is based primarily on the downside protection and dividend coverage available, as well as on the measures in place to protect the distributions to and repayment of the Class B Preferred Securities (i.e., the Class B Preferred Securities Test, which does not permit any distributions to the Capital Unit holders if the NAV of the Portfolio is less than 1.5 times the outstanding principal amount for the Class B Preferred Securities).

The main constraints to the rating are the following:

(1) The downside protection available to holders of the Class B Preferred Securities is dependent on the value of the shares in the Fund, which are determined by supply and demand factors for utility issuers

(2) The concentration of the entire Portfolio in the utility and energy sector.

(3) The weighted-average yield from the underlying Portfolio holdings could change from time to time, which could result in reductions in interest coverage.

UST.PR.B will not be tracked by HIMIPref™ as it is too small.

MAPF Performance: December 2011

The fund probably underperformed in December, although comparators are not yet available.

The fund’s Net Asset Value per Unit as of the close December 30 was $10.0793 after distribution of $0.162247 dividends and $0.299965 capital gains.

| Returns to December 30, 2011 | |||

| Period | MAPF | Index | CPD according to Claymore |

| One Month | +0.87% | +1.48% | +1.35% |

| Three Months | +2.63% | +2.50% | +2.29% |

| One Year | +1.78% | +7.80% | +5.23% |

| Two Years (annualized) | +8.80% | +8.95% | N/A |

| Three Years (annualized) | +25.33% | +15.38% | +12.29% |

| Four Years (annualized) | +17.29% | +6.44% | |

| Five Years (annualized) | +13.24% | +3.79% | |

| Six Years (annualized) | +12.15% | +3.87% | |

| Seven Years (annualized) | +11.24% | +3.87% | |

| Eight Years (annualized) | +11.51% | +4.13% | |

| Nine Years (annualized) | +13.77% | +4.48% | |

| Ten Years (annualized) | +12.44% | +4.47% | |

| The Index is the BMO-CM “50” | |||

| MAPF returns assume reinvestment of distributions, and are shown after expenses but before fees. | |||

| CPD Returns are for the NAV and are after all fees and expenses. | |||

| * CPD does not directly report its two-year returns. | |||

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +1.13%, +2.19% and +5.55%, respectively, according to Morningstar after all fees & expenses. Three year performance is +13.35%. | |||

| Figures for Jov Leon Frazer Preferred Equity Fund Class I Units (which are after all fees and expenses) for 1-, 3- and 12-months are +1.04%, +1.91% and +3.43% respectively, according to Morningstar | |||

| Figures for Manulife Preferred Income Fund (formerly AIC Preferred Income Fund) (which are after all fees and expenses) for 1-, 3- and 12-months are +1.22%, +1.80% & +4.66%, respectively | |||

| Figures for Horizons AlphaPro Preferred Share ETF (which are after all fees and expenses) for 1-, 3- and 12-months are +1.61%, +2.57% & +6.36%, respectively. | |||

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page. The fund is available either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited.

My assumption that the fund underperformed in December is based on the performance of the S&P/TSX Preferred Share Index (TXPR) Total Return Index, for which preliminary figures show a return of +1.37% for the month (although the quarter was OK, with the fund gaining 2.63%, vs. +2.35% for TXPR). However, this return is based on the closing price, not the closing bid, and these figures were significantly different this year.

| Closing Prices vs. Last Bid for Some Preferred Share Positions Held by MAPF | |||

| Ticker | Proportion of MAPF Holdings | Last Bid | Closing Price |

| BNA.PR.C | 9.9% | 21.98 | 22.10 |

| GWO.PR.H | 9.3% | 23.70 | 23.92 |

| MFC.PR.C | 8.5% | 21.66 | 21.74 |

| GWO.PR.I | 8.5% | 22.55 | 22.56 |

| SLF.PR.D | 7.8% | 20.81 | 20.85 |

In all, the difference in valuation for the whole fund is about $25,000, or about 0.5% of fund value.

Naturally, this is not a full explanation – ideally, we would know what the difference was at November month-end and compare the two differences. I will say, however, that in the course of valuing the fund I was surprised at the size of the discrepency, which is a number I usually just glance at and discard, since it has no real meaning.

Fund returns in December were dragged down by poor performance in low-coupon DeemedRetractibles. SLF, in particular, has been afflicted in recent months by relatively poor financial results and bouts of selling (see Who’s Selling all the SLF Preferreds? and Moody’s puts SLF on Review-Negative) and has not yet shown significant signs of recovery.

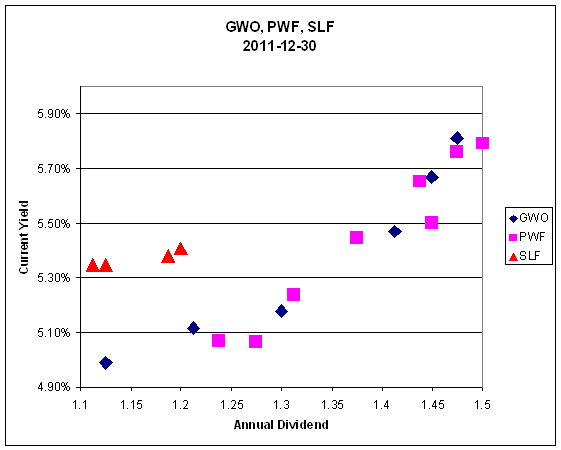

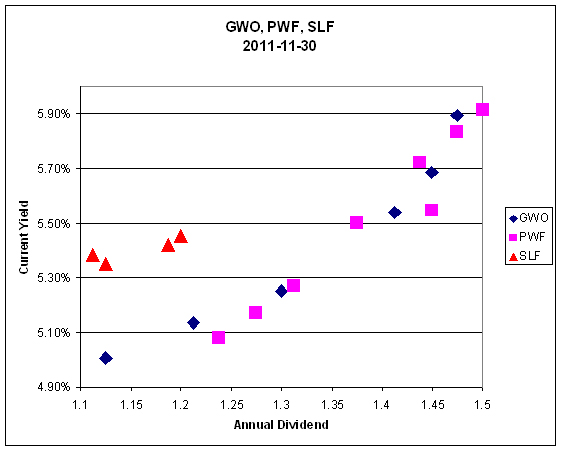

SLF issues may be compared with PWF and GWO:

Now, I certainly agree that GWO is a better credit than SLF and deserves a little bit of premium pricing – but the current situation goes far beyond what I consider reasonable. What is also very interesting is the observation that the market is sharply differentiating between SLF and GWO, but not between GWO and its unregulated parent, PWF.

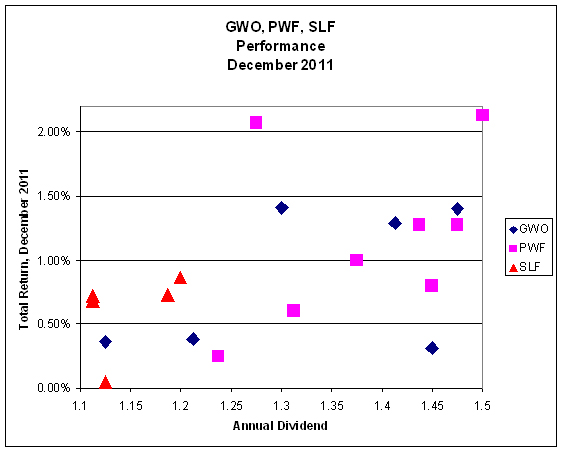

The import of the above charts becomes more clear when we examine the December performance for the same issues:

While the SLF issues did fairly well when compared against other insurance and insurance-related Straight Perpetuals, there was a clear bias towards higher returns for the higher coupon issues – and the fund is concentrated in the low-coupon issues.

Further, I consider the comparison between SLF and WN to be absolutely fascinating:

| SLF vs WN Straight Perpetuals 2011-12-30 |

|||

| Ticker | Dividend | Bid | Current Yield |

| SLF.PR.A | 1.1875 | 22.07 | 5.38% |

| SLF.PR.B | 1.20 | 22.20 | 5.41% |

| SLF.PR.C | 1.1125 | 20.81 | 5.35% |

| SLF.PR.D | 1.1125 | 20.81 | 5.35% |

| SLF.PR.E | 1.125 | 21.04 | 5.35% |

| WN.PR.A | 1.45 | 25.46 | 5.70% |

| WN.PR.C | 1.30 | 25.01 | 5.20% |

| WN.PR.D | 1.30 | 24.95 | 5.21% |

| WN.PR.E | 1.1875 | 23.93 | 4.96% |

Aside from the outlier WN.PR.A, which is currently redeemable at 25.00, it is clear that the WN issues are trading at lower Current Yields than the SLF issues (there’s minimal jiggery-pokery regarding the next dividend; the SLF issues go ex-dividend on about February 21, while WN.PR.A is at the end of February and the other WN issues go ex in mid-March).

In order to rationalize the relationship between the Current Yields we are asked to believe:

- That the additional credit quality of SLF is worthless

- It is possible, of course, to argue that WN is actually a better credit than SLF, or that the scarcity value of a non-financial preferred outweighs the difference in credit. I have not yet heard these arguments being made

- The option value of the issuer’s call is worthless

- This can be phrased as ‘The potential capital gain for the SLF issues prior to a call, relative to that of the WN issues, is worthless’

- The potential of a regulatory inspired call for the SLF issues is worthless

- the SLF issues are currently Tier 1 Capital at the holding company level, but do not have an NVCC clause

All in all, this is a good indication of what I don’t understand about what the market has been doing this year and a big factor in the fund’s underperformance.

Another factor, for the year and for December, has been the performance of the YLO issues. These performed poorly in December and reduced the fund’s return for the month by about 36bp. I continue to be surprised at just how poorly these issues are surprising: I will certainly agree that YLO was never the best of all possible credits, and will also agree that their financial position has deteriorated over the year – but the company remains significantly profitable (on an operating basis) and cash-flow positive; but the preferreds are trading as if they are on the steps of bankruptcy court.

According to me, the worst-case realistic scenario for YLO is not bankruptcy court, but a reorganization in which the bond holders take over the company. This will be bad news for the common shareholders, and for holders of the two issues which can be converted by the company into common (YLO.PR.A and YLO.PR.B), but the prospects for the two FixedResets (YLO.PR.C and YLO.PR.D) are much less clear even given further financial deterioration and angry bondholders.

Sometimes everything works … sometimes the trading works, but sectoral shifts overwhelm the increment … sometimes nothing works – and in 2011 circumstances were closer to the third possibility than they have generally been in the past. The fund seeks to earn incremental return by selling liquidity (that is, taking the other side of trades that other market participants are strongly motivated to execute), which can also be referred to as ‘trading noise’. There were a lot of strongly motivated market participants during the Panic of 2007, generating a lot of noise! Unfortunately, the conditions of the Panic may never be repeated in my lifetime … but the fund will simply attempt to make trades when swaps seem profitable, without worrying about the level of monthly turnover.

There’s plenty of room for new money left in the fund. I have shown in recent issues of PrefLetter that market pricing for FixedResets is demonstrably stupid and I have lots of confidence – backed up by my bond portfolio management experience in the markets for Canadas and Treasuries, and equity trading on the NYSE & TSX – that there is enough demand for liquidity in any market to make the effort of providing it worthwhile (although the definition of “worthwhile” in terms of basis points of outperformance changes considerably from market to market!) I will continue to exert utmost efforts to outperform but it should be borne in mind that there will almost inevitably be periods of underperformance in the future.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit | ||||||

| Month | NAVPU | Portfolio Average YTW |

Leverage Divisor |

Securities Average YTW |

Capital Gains Multiplier |

Sustainable Income per current Unit |

| June, 2007 | 9.3114 | 5.16% | 1.03 | 5.01% | 1.3240 | 0.3524 |

| September | 9.1489 | 5.35% | 0.98 | 5.46% | 1.3240 | 0.3773 |

| December, 2007 | 9.0070 | 5.53% | 0.942 | 5.87% | 1.3240 | 0.3993 |

| March, 2008 | 8.8512 | 6.17% | 1.047 | 5.89% | 1.3240 | 0.3938 |

| June | 8.3419 | 6.034% | 0.952 | 6.338% | 1.3240 | $0.3993 |

| September | 8.1886 | 7.108% | 0.969 | 7.335% | 1.3240 | $0.4537 |

| December, 2008 | 8.0464 | 9.24% | 1.008 | 9.166% | 1.3240 | $0.5571 |

| March 2009 | $8.8317 | 8.60% | 0.995 | 8.802% | 1.3240 | $0.5872 |

| June | 10.9846 | 7.05% | 0.999 | 7.057% | 1.3240 | $0.5855 |

| September | 12.3462 | 6.03% | 0.998 | 6.042% | 1.3240 | $0.5634 |

| December 2009 | 10.5662 | 5.74% | 0.981 | 5.851% | 1.1141 | $0.5549 |

| March 2010 | 10.2497 | 6.03% | 0.992 | 6.079% | 1.1141 | $0.5593 |

| June | 10.5770 | 5.96% | 0.996 | 5.984% | 1.1141 | $0.5681 |

| September | 11.3901 | 5.43% | 0.980 | 5.540% | 1.1141 | $0.5664 |

| December 2010 | 10.7659 | 5.37% | 0.993 | 5.408% | 1.0298 | $0.5654 |

| March, 2011 | 11.0560 | 6.00% | 0.994 | 5.964% | 1.0298 | $0.6403 |

| June | 11.1194 | 5.87% | 1.018 | 5.976% | 1.0298 | $0.6453 |

| September | 10.2709 | 6.10% Note |

1.001 | 6.106% | 1.0298 | $0.6090 |

| December, 2011 | 10.0793 | 5.63% Note |

1.031 | 5.805% | 1.0000 | $0.5851 |

| NAVPU is shown after quarterly distributions of dividend income and annual distribution of capital gains. Portfolio YTW includes cash (or margin borrowing), with an assumed interest rate of 0.00% The Leverage Divisor indicates the level of cash in the account: if the portfolio is 1% in cash, the Leverage Divisor will be 0.99 Securities YTW divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings. The Capital Gains Multiplier adjusts for the effects of Capital Gains Dividends. On 2009-12-31, there was a capital gains distribution of $1.989262 which is assumed for this purpose to have been reinvested at the final price of $10.5662. Thus, a holder of one unit pre-distribution would have held 1.1883 units post-distribution; the CG Multiplier reflects this to make the time-series comparable. Note that Dividend Distributions are not assumed to be reinvested. Sustainable Income is the resultant estimate of the fund’s dividend income per current unit, before fees and expenses. Note that a “current unit” includes reinvestment of prior capital gains; a unitholder would have had the calculated sustainable income with only, say, 0.9 units in the past which, with reinvestment of capital gains, would become 1.0 current units. |

||||||

| DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company (definition refined in May). These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31, in addition to the call schedule explicitly defined. See OSFI Does Not Grandfather Extant Tier 1 Capital, CM.PR.D, CM.PR.E, CM.PR.G: Seeking NVCC Status and the January, February, March and June, 2011, editions of PrefLetter for the rationale behind this analysis. | ||||||

| Yields for September, 2011, to December, 2011, were calculated by imposing a cap of 10% on the yields of YLO issues held, in order to avoid their extremely high calculated yields distorting the calculation and to reflect the uncertainty in the marketplace that these yields will be realized. | ||||||

Significant positions were held in DeemedRetractible and FixedReset issues on December 30; all of the former and most of the latter currently have their yields calculated with the presumption that they will be called by the issuers at par prior to 2022-1-31. This presents another complication in the calculation of sustainable yield. The fund also holds a position in SplitShare issues (mainly BNA.PR.C) and an OperatingRetractible Scrap (YLO.PR.B) which also have their yields calculated with the expectation of a maturity at par, a somewhat dubious assumption in the latter case.

However, if the entire portfolio except for the PerpetualDiscounts were to be sold and reinvested in these issues, the yield of the portfolio would be the 5.69% shown in the MAPF Portfolio Composition: December 2011 analysis (which is greater than the 5.12% index yield on November 30). Given such reinvestment, the sustainable yield would be ($10.0793 + 0.162247) * 0.0569 = $0.5827 (note the adjustment for the dividend distribution, which makes the figure more comparable to November’s), down somewhat from the $10.4511 * 0.0579 / 1.0298 = 0.5876 (note the adjustment for capital gains reinvestment) reported for November.

Still, I am pleased that although the market value of the portfolio has not kept up with expectations, the sustainable income per unit (adjusted for capital gains) did increase by $0.02 over the year … do that often enough and eventually market value will reflect the underlying performance!

Different assumptions lead to different results from the calculation, but the overall positive trend is apparent. I’m very pleased with the results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to constant exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.