I am pleased to announce that the 2010 Audited Financial Statements and 2010 Transaction Detail for Malachite Aggressive Preferred Fund have been published.

SEC Market Structure Report a Disappointment

On February 18 – sorry, I’ve been busy – the SEC released the RECOMMENDATIONS REGARDING REGULATORY RESPONSES

TO THE MARKET EVENTS OF MAY 6, 2010, which is the Summary Report of the Joint CFTC-SEC Advisory Committee on Emerging Regulatory Issues.

I found it rather disappointing, but this is unsurprising. On February 7 I passed on a Reuters report in which it was stated:

While “Sunshine” laws have prevented the committee from regularly meeting, [Nobel Prize-winning finance professor at New York University Robert] Engle said the subcommittee has discussed a bevy of sometimes esoteric market structure issues

In other words, they knew that their process wouldn’t withstand scrutiny, so they hashed it all out in the back rooms instead.

The report in Bloomberg harshly criticized the recommendation for the “trade-at” rule:

Individual investors could be hurt should regulators alter an equities-trading rule limiting the prices at which brokers can execute orders away from public markets, an executive at TD Ameritrade Holding Corp. said.

An eight-member committee urged the Securities and Exchange Commission in a report yesterday to adopt a restriction called a trade-at rule. It would prevent venues and brokerages from executing orders within their walls unless they improve pricing by a specified amount versus the market’s best level.

…

“I was disappointed,” Nagy, a managing director for order routing, sales and strategy at the third-largest retail brokerage by client assets, said in an interview. “The report appears to be a politically motivated stalking horse to implement the trade-at rule. A trade-at would serve to increase costs for retail investors by creating an inconsistent trading experience.”

We never see TD criticizing the regulators so heartily in Canada. The regulatory-industry complex in Canada is way too cosy, as discussed on March 15.

Be that as it may, the committee was good enough to state the purpose of the report quite clearly:

One additional, specific point of background is appropriate to mention at the outset. The broad, visible, and often controversial, topic of High Frequency Trading (HFT)— including the definition of the practice, its impact on May 6, and potentially systemic benefits and problems that arise from the growing volume of HFT participants in all of our markets—has been pervasive in our discussions and in comments received from others. Rather than detail specific recommendations about HFT in this report, steps to address issues associated with this practice are evident throughout our report.

In other words, the committee was set up to do a hatchet job on HFT and eagerly went about its task of pleasing the established players, who are most upset that arrivistes are introducing competition to their comfortable lives. This serves – unsurprisingly – as a continuation of the intellectually dishonest Flash Crash report.

Anyway, back to the report – while skipping over the recommendations that don’t interest me! – which makes a point of telling the committee’s paymasters what an excellent job they’re doing:

The Committee supports the SEC’s “naked access” rulemaking and urges the SEC to work closely with FINRA and other Exchanges with examination responsibilities to develop effective testing of sponsoring broker-dealer risk management controls and supervisory procedures.

So what’s wrong with naked access? I mean, really? The official line:

According to the SEC: “The new rule prohibits broker-dealers from providing customers with ‘unfiltered’ or ‘naked’ access to an Exchange or ATS. It also requires brokers with market access – including those who sponsor customers’ access to an Exchange or ATS – to put in place risk management controls and supervisory procedures to help prevent erroneous orders, ensure compliance with regulatory requirements, and enforce pre-set credit and capital thresholds.”

I would like to see a lot more discussion of access as an economic transaction. Say we’ve got a small firm trading its own capital (call it $10-million) as principal. Why can’t the exchanges and marketplaces offer them direct access themselves? I have no idea what the requirements are for gaining such access, but I’ll bet it involves a lot of regulatory expense and rigamarole that is completely unnecessary in such a case.

Why isn’t it happening? What are the risks? What controls can be justified? And how would it interact with the rest of regulation?

Say, for instance, I am the risk manager at Very Big Brokerage Corp. (and I mean the real risk manager, not the clown with the title). And say, there is a marketplace (“Sleazy Trading Inc.”) that I’m not happy with, in terms of counterparty risk. I’ve looked at their controls and their access requirements and come to the conclusion that if I execute a big trade that makes a lot of money for me prior to settlement, I’m taking on too much exposure to the notion that the trade won’t settle. Or maybe I have made a decision on how much exposure I’m willing to take with Sleazy, and they’re currently over the limit.

Now, I’ve got a client order to sell 10-million shares of IBM and wouldn’t you know it, there’s a good bid – the best bid – for 10-million shares at Sleazy Trading. Will the regulations allow me to ignore it? I don’t believe so. And that is a problem.

In Canada, there are strong inducements that say that each “protected marketplace” is as good as any other protected marketplace.

We also applaud the CFTC requesting comment regarding whether it is appropriate to restrict large order execution design that results in disruptive trading. In particular, we believe there are questions whether it is ever appropriate to permit large order algorithms that employ unlimited use of market orders or that permit executions at prices which are a dramatic percentage below the present market price without a pause for human review.

Accordingly:

7. The Committee recommends that the CFTC use its rulemaking authority to impose strict supervisory requirements on DCMs or FCMs that employ or sponsor firms implementing algorithmic order routing strategies and that the CFTC and the SEC carefully review the benefits and costs of directly restricting “disruptive trading activities “with respect to extremely large orders or strategies.

Note how careful they are in restricting their concerns to “large orders”. In other words Stop-Loss orders, beloved of the brokerage community because they’re so insanely profitable, are not in the scope of this recommendation.

But, as I argued in the November, 2010, edition of PrefLetter, Stop-Loss orders appear to have been the exacerbating cause that turned a sharp decline into a rout. But the sheer size of the Stop-Loss avalanche only made it into one insignificant speech – never into any official report of any kind. Ms. Schapiro’s speech was reported on PrefBlog in an update to the post The Flash Crash: The Impact of High Frequency Trading on an Electronic Market.

Perhaps the committee’s most laughable recommendation is:

We therefore believe that the Commission should consider encouraging, through incentives or regulation, persons who regularly implement marker maker strategies to maintain best buy and sell quotations which are “reasonably related to the market.”

…

We recognize that many High Frequency Traders are not even broker-dealers and therefore their compliance with quoting requirements would have to be addressed primarily through pricing incentives. We note that these incentives might be effectively interconnected with the peak load pricing discussed above.

Accordingly:

9. The Committee recommends that the SEC evaluate whether incentives or regulations can be developed to encourage persons who engage in market making strategies to regularly provide buy and sell quotations that are “reasonably related to the market.”

Earth to Committee: Market Making loses money in a directional market. There is no amount of exchange pricing incentive that can possibly counteract this fact.

The original Flash Crash report makes some useful classifications of market participants:

In order to examine what may have triggered the dynamics in the E-Mini on May 6, over 15,000 trading accounts that participated in transactions on that day were classified into six categories: Intermediaries, HFTs, Fundamental Buyers, Fundamental Sellers, Noise Traders, and Opportunistic Traders.

…

Opportunistic Traders are defined as those traders who do not fall in the other five categories. Traders in this category sometimes behave like the intermediaries (both buying and selling around a target position) and at other times behave like fundamental traders (accumulating a directional long or short position). This trading behavior is consistent with a number of trading strategies, including momentum trading, cross-market arbitrage, and other arbitrage strategies.

It seems to me that if you want to encourage tranquility of market prices, you should be concentrating on the potential for getting contra-flow orders from Opportunistic Traders, rather than market makers; and the only way I can see that being done by regulators is encouraging the development and execution of opportunistic algorithms by “real money” accounts, rather than discouraging this process.

The committee has another recommendation good for not much more than a laugh:

Accordingly:

10. The Committee recommends that the SEC and CFTC explore ways to fairly allocate the costs imposed by high levels of order cancellations, including perhaps requiring a uniform fee across all Exchange markets that is assessed based on the average of order cancellations to actual transactions effected by a market participant.

Central planning at its finest, complete with the implicit assertion that prices can only be fair if they are both uniform and approved by the central planners. If data flow from order cancellations gets to be a problem, it’s easy enough to sever connection with the offending marketplace – which should be sufficient to ensure that fees are put in place to charge the cancellers and rebate the other participants. But, oops, sorry, not possible to sever connections. One market’s as good as any other – just ask the regulators.

The “Trade-At” recommendation is number 11; the committee’s justification is:

We believe, however, that the impact of the substantial growth of internalizing and preferencing activity on the incentives to submit priced order flow to public exchange limit order books deserves further examination. While the SEC has properly concluded in the past that permitting internalization and preferencing, even accompanied by payment for order flow agreements, increases competition and potentially reduces transaction costs, we believe the dramatic growth argues for further analysis. Notable in the trading activity of May 6 was the redirection of order flow by internalizing and preferencing firms to Exchange markets during the most volatile periods of trading. While these firms provide significant liquidity during normal trading periods, they provided little to none at the peak of volatility.

The last sentence is simply so much horseshit. The original Flash Crash report makes it quite clear that orders were routed to the public exchanges only when the internalizers has provided so much liquidity that they were up to their position limits.

The recommendation simply shows the committee’s total lack of comprehension of the market maker’s role; additionally, they didn’t waste their precious Nobel Prize-winning brain power discussing – or even considering – the possibility that such requirements will make internalization less profitable, therefore (surprise!) leading to a lower allocation of capital and therefore (surprise!) increasing the odds that another market break will exhaust that capital.

Update: Public comments are available.

Update: The CME comment letter recommends that regulators keep their cotton-picking hands off algorithms:

Large orders represent demand for liquidity and that demand necessarily informs price discovery. Participants typically rely on algorithms to execute large orders today precisely because sophisticated algorithms can employ intelligent real time analytics that allow traders to significantly reduce the market impact of their orders and enhance the quality of their execution. As discussed in our previously referenced letter on this topic, we do not believe the Commissions are equipped or should be involved in regulating the design of algorithms, and should instead focus on regulating conduct that is shown to be harmful to the market.

It also points out:

CME Group does not believe that high frequency traders, however such traders are in fact defined, should be required by third parties to put their own capital at risk when it is unprofitable to do so. High frequency traders, like other independent traders who are uncompensated by the trading venue, should quote responsibly based upon their ability to responsibly manage the risks associated with the orders they place. It would be extremely irresponsible for a high frequency trader, or any other trader, to continue to operate an algorithm under conditions in which it was not designed to operate or when the inputs to the algorithm are not reliable. Doing so could potentially put the firm itself at risk and arguably subject the firm to regulatory exposure if their algorithm malfunctioned and created or exacerbated a disruption in the market.

…

Rules that would undermine a trading firm’s own risk management processes by creating affirmative trading obligations in highly volatile periods are misguided. Assuming participants in fact complied with such obligations, which they likely would not, this “cure” would simply lead to the depletion of market making capital and result in less liquid and more volatile markets.

With respect to cancellation fees:

As an initial matter, the Committee has not identified how the market will be served by this proposal or how it will enhance the stability of markets. Other than apparently seeking to impose a tax on a high frequency trading, the objective is unclear.

…

CME Group additionally employs a CME Globex Messaging Policy that is broadly designed to encourage responsible messaging practices and ensure that the trading system maintains the responsiveness and reliability that supports efficient trading. Under this policy, CME Group establishes messaging benchmarks based on a per-product volume ratio which measures the number of messages submitted to the volume executed in a given product. These benchmarks are tailored to the liquidity profile of the contract to ensure that contract liquidity is not compromised. CME Group works with firms who exceed the benchmarks to refine their messaging practices and failure to correct excessive messaging results in a surcharge billed to the clearing firm.

Knight Capital’s letter commits lese majeste by asking for data:

Many have posed the following question time and again:

“What is the quantitative and qualitative justification for taking steps to change or slow internalization?”

To date, there has been no answer offered and no credible data presented to support such a dramatic shift in market structure.

and with respect to Trade-At:

In short, there has been no qualitative or quantitative data offered to suggest that such shift in market structure is warranted. Rather, the evidence offered in support has been anecdotal at best. As a result, we strongly encourage the SEC to proceed with the same thoughtful consideration that has guided its decisions in the past. It should demand empirical data, and thoroughly vet that data before making any determination to propose such a rule.

March 25, 2011

Portugal doesn’t need a rescue, Prime Minister Jose Socrates said in Brussels, seeking to counter speculation of a bailout as talks began in Lisbon to end the political limbo after lawmakers rejected his budget cuts.

Portuguese bonds fell, driving their yield to a euro-era record as investors anticipated that the country would follow Ireland and Greece in seeking a financial lifeline. A bailout may total as much as 70 billion euros ($99 billion), two European officials with direct knowledge of the matter said yesterday.

…

The political deadlock comes as downgrades to Portugal’s credit rating threaten to deepen its debt woes. Standard & Poor’s and Fitch Ratings both cut Portugal’s rating yesterday.

…

Portugal’s 10-year yield advanced as much as 14 basis points to 7.80 percent. The difference in yield that investors demand to hold the securities instead of German bunds widened 10 basis points to 451 basis points, the most since November. The Portuguese two-year yield increased as much as 38 basis points to 7.09 percent.Opposition parties united to reject additional cuts that were the equivalent of 4.5 percent of gross domestic product over three years. The package included a reduction in pensions of more than 1,500 euros a month and further decreases in tax benefits. The government said the extra measures were needed to trim the deficit to 4.6 percent of GDP this year and within the EU’s 3 percent limit in 2012.

The Invisible Man would like us to believe that he has finally grown a pair:

The second minority government of Stephen Harper has fallen.

Early Friday afternoon, 156 opposition MPs – all of the Liberals, New Democrats and Bloquistes present in the House of Commons – rose to support a motion of no-confidence.

It was also a motion that declared the government to be in contempt of Parliament for its refusal to share information that opposition members said they needed to properly assess legislation put before them.

… but they’re probably just tied on with string.

There was a slight upward trend in the Canadian preferred share market today, with PerpetualDiscounts exactly flat (!) and both FixedResets and DeemedRetractibles up 4bp. Volatility increased a little, but volume remains anemic.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3241 % | 2,394.6 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3241 % | 3,601.4 |

| Floater | 2.51 % | 2.32 % | 41,382 | 21.43 | 4 | 0.3241 % | 2,585.5 |

| OpRet | 4.88 % | 3.67 % | 57,169 | 1.14 | 9 | 0.1206 % | 2,402.1 |

| SplitShare | 5.08 % | 2.96 % | 136,712 | 0.99 | 5 | 0.2171 % | 2,490.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1206 % | 2,196.5 |

| Perpetual-Premium | 5.73 % | 5.65 % | 134,406 | 6.12 | 10 | -0.0040 % | 2,037.2 |

| Perpetual-Discount | 5.51 % | 5.54 % | 124,155 | 14.50 | 14 | 0.0000 % | 2,131.9 |

| FixedReset | 5.16 % | 3.51 % | 237,235 | 2.94 | 57 | 0.0431 % | 2,283.9 |

| Deemed-Retractible | 5.22 % | 5.15 % | 332,538 | 8.26 | 53 | 0.0398 % | 2,088.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.R | FixedReset | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-25 Maturity Price : 23.38 Evaluated at bid price : 25.81 Bid-YTW : 4.67 % |

| TRI.PR.B | Floater | 1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-25 Maturity Price : 22.99 Evaluated at bid price : 23.26 Bid-YTW : 2.22 % |

| POW.PR.D | Perpetual-Discount | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-25 Maturity Price : 23.21 Evaluated at bid price : 23.45 Bid-YTW : 5.33 % |

| BNA.PR.E | SplitShare | 1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2017-12-10 Maturity Price : 25.00 Evaluated at bid price : 24.75 Bid-YTW : 5.10 % |

| TRP.PR.C | FixedReset | 1.38 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-02-29 Maturity Price : 25.00 Evaluated at bid price : 25.75 Bid-YTW : 3.87 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| W.PR.H | Perpetual-Discount | 74,300 | RBC crossed blocks of 25,000 shares, 22,500 and 22,600, all at 24.30. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-25 Maturity Price : 23.79 Evaluated at bid price : 24.09 Bid-YTW : 5.81 % |

| TD.PR.K | FixedReset | 54,899 | Scotia crossed 26,900 at 27.60; TD crossed 24,500 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.58 Bid-YTW : 3.36 % |

| BMO.PR.Q | FixedReset | 51,745 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.81 Bid-YTW : 3.90 % |

| POW.PR.A | Perpetual-Discount | 50,810 | RBC crossed 45,000 at 24.44. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-25 Maturity Price : 24.18 Evaluated at bid price : 24.44 Bid-YTW : 5.73 % |

| PWF.PR.I | Perpetual-Premium | 44,150 | Desjardins crossed 41,500 at 25.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-05-30 Maturity Price : 25.00 Evaluated at bid price : 25.36 Bid-YTW : 5.55 % |

| SLF.PR.F | FixedReset | 42,370 | Desjardins crossed 39,300 at 26.80. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.90 Bid-YTW : 3.58 % |

| There were 18 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| IAG.PR.C | FixedReset | The market-maker was probably overwhelmed by the 400-share volume.

See Update Below Quote: 26.75 – 28.25 YTW SCENARIO |

| FTS.PR.H | FixedReset | Quote: 25.05 – 25.74 Spot Rate : 0.6900 Average : 0.4413 YTW SCENARIO |

| BAM.PR.O | OpRet | Quote: 25.86 – 26.48 Spot Rate : 0.6200 Average : 0.4023 YTW SCENARIO |

| FTS.PR.G | FixedReset | Quote: 26.00 – 26.49 Spot Rate : 0.4900 Average : 0.2971 YTW SCENARIO |

| TDS.PR.C | SplitShare | Quote: 10.43 – 10.86 Spot Rate : 0.4300 Average : 0.2882 YTW SCENARIO |

| PWF.PR.K | Perpetual-Discount | Quote: 23.70 – 24.02 Spot Rate : 0.3200 Average : 0.2123 YTW SCENARIO |

Update, 2011-3-29: It took four days, but I was finally able to get Trades & Quotes data from the TMX – they had to recover it manually because their software isn’t working properly, as far as I can see.

Anyway, in the period from 15:47:31, when 400 shares traded at 26.80, until the close at 16:00:00, there were 214 different quotes, all with a bid for 300 shares at 26.75 as algorithms jockeyed for position on the offer side. In this period the lowest offer was at 27.03, the highest at 28.25. There were nine instances of the offer side being 28.25.

The Closing Quote was 26.75-16, 3×1. At 16:15:03 the offer of 100 shares at 27.16 was cancelled, resulting in a Last Quote of 26.75-28.25, 3×4.

March 24, 2011

Pressure on Spain is increasing:

Thirty of Spain’s smaller banks had their senior debt and deposit ratings downgraded, as Moody’s Investors Service reviews whether governments are willing to support all their lenders in a crisis.

Citing heightened financial pressure on the country’s sovereign rating and “many weak banks,” the New York-based ratings firm cut 15 lenders by two levels and five by three or four, according to a statement today. The outlook on most banks’ senior and deposit ratings remains negative, Moody’s said.

…

In Denmark, where senior bondholders of Amagerbanken A/S were forced to take losses, the firm cut the grades of five lenders and may cut them again.

…

Spain’s credit rating was cut to Aa2 on March 10 by Moody’s, which said the cost of shoring up the banking industry will eclipse government estimates. The ratings company said then that Spanish lenders may need as much as 50 billion euros ($70.3 billion) to meet new capital requirements, a figure that compares with the Bank of Spain’s estimate that 12 lenders will need 15.2 billion euros.

The Amagerbanken failure is causing some debate:

Denmark is trying to persuade the rest of Europe to match rules exposing bondholders to losses after the failure of a regional bank last month left lenders in the Nordic country risking higher funding costs.

The collapse of Amagerbanken A/S on Feb. 6 forced a 41 percent loss on unsecured senior bonds and prompted Moody’s Investors Service 10 days later to cut ratings on five Danish lenders, including Denmark’s biggest, Danske Bank A/S, as it factored out state protection. The insolvency was the first to test rules Denmark put in place in October and set a European Union precedent for senior creditor losses amid a region-wide debate on burden sharing.

…

Denmark is arguing the financial crisis hasn’t adequately stemmed risk-taking amongst bond investors and wants the EU to enforce the “possibility of debt writedowns” to discipline markets, according to a March 4 letter sent to the European Commission. EU financial services chiefMichel Barnier in January said bank regulators should be able to write down lenders’ senior debt, though a final agreement has yet to be reached.European leaders are trying to put in place measures to protect taxpayers from having to rescue failing banks after Ireland guaranteed six lenders in 2008.

There are already measures in place to protect taxpayers from having to rescue failing banks: it’s called bankruptcy. The problem only arises because governments are desperate to pretend that everything is normal, and to keep their failed banks lending merrily away – as long as it’s for socially uselful purposes, of course.

But the punchline of the story came, naturally enough, at the end:

Denmark, home to the world’s third-largest mortgage-backed bond market after the U.S. and Germany, is trying to persuade the EU that the debt deserves a higher liquidity grade than the Basel Committee for Banking Supervision agreed on in December.

The covered-bond market may also become more liquid as investors spooked by the threat of losses on other debt classes turn to bonds backed by collateral, according to Fitch Ratings Ltd.

“The growing use of covered bond funding by banks is a trend set to continue,” Fitch analysts Helene M. Heberlein, Bridget Gandy and Jan Seemann said in a March 10 note. Issuers are also adding surplus collateral to the pool backing the bonds to attract investors, leaving less behind to cover other debt classes, Fitch said.

“There must be no doubt that holders of covered bonds and junior covered bonds always will receive timely payment,” Denmark’s government said in the March 4 letter. “It should therefore be made clear that covered bonds and junior covered bonds should not be subject to debt write downs.”

Hey – if the rules can be changed retroactively for senior debt, why can’t they be changed retroactively for covered bonds? What has Denmark done to defend the primacy of the rule of law?

With all that, Europe is taking decisive action:

As speculation swirled that Portugal will be the next victim of the crisis, the leaders bowed to German Chancellor Angela Merkel’s call to pare the fund’s paid-in capital as of 2013 to 16 billion euros ($23 billion), less than the 40 billion euros foreseen in a March 21 accord.

“It was a difficult debate with Germany,” Luxembourg Prime Minister Jean-Claude Juncker told reporters after the first session of an EU summit in Brussels early today. “Germany found that in the compromise agreed last Monday it would have to pay in too much. So we had to tackle that issue.”

…

Standard & Poor’s might take struggling countries down another notch, since the future fund — known as the European Stability Mechanism — will outrank private bondholders, said Moritz Kraemer, managing director of European sovereign ratings in Frankfurt.Ratings Reassessment

“We would reassess the ratings specifically of Greece and Portugal, which we think are the most likely potential customers of the ESM,” Kraemer said on Bloomberg Television today.Portuguese bonds fell for a fourth day today, pushing the 10-year yield up 13 basis points to 7.79 percent. The extra yield over German bonds, a sign of the risk of investing in Portugal, rose 10 basis points to 452 basis points.

It’s a bit like problems with US Health Care:

Aetna Inc. (AET) is suing six New Jersey doctors over medical bills it calls “unconscionable,” including $56,980 for a bedside consultation and $59,490 for an ultrasound that typically costs $74.

The lawsuits could help determine what pricing limits insurers can impose on ”out-of-network” physicians who don’t have contracts with health plans that spell out how much a service or procedure can cost.

Shouldn’t be any limits on doctors at all. The limits should be on how much the insurer will reimburse the insuree … “If you need an ultrasound, we’ll reimburse you 100% of the amount under $75 and 50% of the amount between $75 and $125, and 0% of the amount over $125, and here’s a list of places where you can get it done for $74.” But then insurers, companies, doctors, patients and politicians wouldn’t be able to pretend everything was free.

It was another good day on the Canadian preferred share market with PerpetualDiscounts up 11bp, FixedResets gaining 8bp and DeemedRetractibles winning 7bp. Volatility was muted, with only two entries in the Performance Highlights table; volume was anemic. Is it Christmas, or what?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0480 % | 2,386.8 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0480 % | 3,589.8 |

| Floater | 2.52 % | 2.32 % | 43,100 | 21.43 | 4 | 0.0480 % | 2,577.2 |

| OpRet | 4.89 % | 3.71 % | 56,988 | 1.14 | 9 | 0.0172 % | 2,399.2 |

| SplitShare | 5.09 % | 3.00 % | 142,344 | 0.99 | 5 | 0.0412 % | 2,484.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0172 % | 2,193.9 |

| Perpetual-Premium | 5.73 % | 5.56 % | 136,252 | 6.12 | 10 | 0.0754 % | 2,037.3 |

| Perpetual-Discount | 5.51 % | 5.56 % | 124,258 | 14.49 | 14 | 0.1123 % | 2,131.9 |

| FixedReset | 5.16 % | 3.48 % | 239,090 | 2.94 | 57 | 0.0793 % | 2,282.9 |

| Deemed-Retractible | 5.22 % | 5.15 % | 335,421 | 8.27 | 53 | 0.0659 % | 2,087.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| SLF.PR.F | FixedReset | -1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.85 Bid-YTW : 3.64 % |

| BAM.PR.R | FixedReset | 2.15 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2016-07-30 Maturity Price : 25.00 Evaluated at bid price : 26.15 Bid-YTW : 4.40 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| BNS.PR.P | FixedReset | 130,545 | TD crossed 50,000 at 26.16; RBC crossed 75,000 at 26.15. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-05-25 Maturity Price : 25.00 Evaluated at bid price : 26.12 Bid-YTW : 3.18 % |

| BMO.PR.Q | FixedReset | 107,050 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.80 Bid-YTW : 3.90 % |

| TD.PR.G | FixedReset | 95,306 | RBC crossed blocks of 50,000 shares, 10,000 and 25,000, all at 27.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.51 Bid-YTW : 3.28 % |

| HSE.PR.A | FixedReset | 49,870 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-24 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 4.30 % |

| BNS.PR.K | Deemed-Retractible | 37,029 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.56 Bid-YTW : 5.13 % |

| NA.PR.P | FixedReset | 28,985 | Issuer bid. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-17 Maturity Price : 25.00 Evaluated at bid price : 28.30 Bid-YTW : 2.30 % |

| There were 18 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| POW.PR.C | Perpetual-Discount | Quote: 25.00 – 25.33 Spot Rate : 0.3300 Average : 0.2392 YTW SCENARIO |

| GWO.PR.M | Deemed-Retractible | Quote: 25.15 – 25.63 Spot Rate : 0.4800 Average : 0.3963 YTW SCENARIO |

| POW.PR.D | Perpetual-Discount | Quote: 23.18 – 23.49 Spot Rate : 0.3100 Average : 0.2273 YTW SCENARIO |

| CM.PR.L | FixedReset | Quote: 27.45 – 27.70 Spot Rate : 0.2500 Average : 0.1764 YTW SCENARIO |

| PWF.PR.L | Perpetual-Discount | Quote: 23.88 – 24.25 Spot Rate : 0.3700 Average : 0.2977 YTW SCENARIO |

| PWF.PR.P | FixedReset | Quote: 25.53 – 25.87 Spot Rate : 0.3400 Average : 0.2744 YTW SCENARIO |

YLO: DBRS Confirms Rating on Asset Sale

Yellow Media has announced:

that it has reached a definitive agreement to sell Trader Corporation (“Trader”) to funds advised by Apax Partners for a purchase price consideration of $745M. Closing of the contemplated transaction is expected to occur in June 2011, subject to regulatory approvals and other customary conditions.

…

The purchase price consideration of $745M, subject to working capital and other adjustments, will be payable in cash at closing. The transaction has fully committed financing, consisting of equity provided by Apax Partners and financing commitments provided by RBC Capital Markets. The proceeds from this divestiture will be largely used to reduce indebtedness and for general corporate purposes.Concurrent with this announcement, Standard & Poor’s and DBRS confirmed their credit ratings for Yellow Media Inc.

DBRS has announced that it:

has today confirmed the ratings of Yellow Media Inc. (Yellow Media or the Company), including its Medium-Term Notes at BBB (high) and Commercial Paper at R-1 (low), following the announcement that it has reached an agreement with Apax Partners to sell the automotive assets of Trader Corporation (Trader) for a purchase price of approximately $745 million. The agreement includes the sale of Trader’s print and online automotive businesses and its 30% stake in Dealer.com (results were consolidated). The trends are Stable.

The confirmation of Yellow Media’s ratings reflects the following:

(1) An acceleration of the Company’s goal to improve its financial risk profile as DBRS expects cash proceeds of approximately $745 million from the sale of Trader’s automotive businesses (the majority of its Vertical Media segment) to be mainly used to reduce debt.

(2) Its leading position in Directories, the Company’s principal segment, and the significant risks this segment continues to face as it transforms itself from a print-placement organization into an online/digital media and marketing service provider.

I would not ordinarily consider an affirmation to be worthy of comment, but there is a story in today’s Globe by John Heinzl titled Yellow Media’s dividend under the microscope:

Since peaking at more than $17 in 2006, the shares have plunged nearly 70 per cent, closing Thursday at $5.29. Adding to the pain, the directories publisher has chopped its dividend twice as it grappled with the financial crisis, its transition from print to digital media and a recent conversion from an income trust to a corporation.

Now some investors are asking: Is another dividend cut in the cards? The sky-high yield of 12.2 per cent isn’t a comforting sign.

…

The company doesn’t have a lot wiggle room with its credit ratings. Standard & Poor’s rates Yellow Media’s senior unsecured debt at triple-B-minus, which is one notch above speculative status. DBRS rates it triple-B (high), which is three notches above speculative.Underlining the dangers, S&P has said it would like to see Yellow Media reduce its net debt by $450-million this year and that “downward pressure on the ratings would likely come from a failure to reduce debt levels as noted … as well as a failure to improve adjusted debt leverage as targeted.”

The company has been repurchasing its preferred shares:

Under its normal course issuer bid, Yellow Media Inc. intends to purchase for cancellation up to but not more than 1,174,691 and 720,000 of its outstanding preferred shares, Series 1 and preferred shares, Series 2, respectively, representing 10% of the public float of each series of preferred shares outstanding on June 8, 2010

During 2010, Yellow Media Inc. purchased for cancellation 635,714 preferred shares, Series 1 for a total cash consideration of $15.8 million including brokerage fees at an average price of $24.78 per share and 501,490 preferred shares, Series 2 for a total cash consideration of $10.4 million including brokerage fees at an average price of $20.79 per share. The carrying value of these preferred shares, Series 1 and Series 2 was $15.7 million and $12.3 million, respectively. A gain of $1.8 million was recorded in net earnings in financial charges.

Since June 11, 2009, the total cost of repurchasing preferred shares amounted to $39.9 million, including brokerage fees.

The company has four public issues of preferred shares outstanding:

| YLO Preferreds | |||

| Ticker | Quote 2011-3-24 |

Bid YTW |

YTW Scenario |

| YLO.PR.A | 24.85-90 | 4.57% | Soft Maturity 2012-12-30 |

| YLO.PR.B | 19.95-00 | 9.37% | Soft Maturity 2017-06-29 |

| YLO.PR.C | 23.38-43 | 7.18% | Limit Maturity |

| YLO.PR.D | 24.55-74 | 6.95% | Limit Maturity |

YLO was last mentioned on PrefBlog when the ticker changed from YPG.

Update: Tom Kiladze of the Globe comments in Yellow Media buys some breathing room:

As for the deal metrics, the assets are getting sold for $745-million, but all together they were acquired for about $1.2-billion, according to Desjardins Securities analyst Maher Yaghi. He also noted that the divested assets generated about $69-million of EBITDA last year. That translates into a 10.8 times multiple for the sale, better than Yellow Media’s current market multiple of 6.7 times.

Yellow Media also indicated the Trader Corp. assets were sold for about 10 times EV to EBITDA, equating to $600-million, while the Dealer.com stake was sold for about 15 times, amounting to the remaining $145-million of the total price, Mr. Yaghi noted.

March 23, 2011

Portuguese Prime Minister Jose Socrates tendered his resignation after plans to cut the budget were rejected by parliament, pushing the country closer to an international bailout.

…

Portugal has already raised taxes and implemented the deepest spending cuts in more than three decades to convince investors it can reduce its budget shortfall. Additional cuts, announced on March 11, prompted a political backlash and failed to persuade investors.The spread between Portuguese and German 10-year bond yields widened 16 basis points to 438 basis points yesterday after reaching a euro-era record of 484 on Nov. 11.

It was another positive day on the Canadian preferred share market,with PerpetualDiscounts up 17bp, FixedResets up 2bp and DeemedRetractibles winning 9bp. Volume was average.

PerpetualDiscounts now yiel 5.59%, equivalent to 7.27% interest at the now standard equivalency factor of 1.3x. Long corporates now yield about 5.5% (OK, maybe a little bit less) so the pre-tax interest-equivalent spread is now about 180bp, not much different from the 175bp reported on March 9.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1805 % | 2,385.7 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1805 % | 3,588.1 |

| Floater | 2.52 % | 2.33 % | 43,783 | 21.40 | 4 | 0.1805 % | 2,575.9 |

| OpRet | 4.89 % | 3.62 % | 57,306 | 1.15 | 9 | 0.1380 % | 2,398.8 |

| SplitShare | 5.09 % | 3.04 % | 148,036 | 0.99 | 5 | 0.1249 % | 2,483.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1380 % | 2,193.5 |

| Perpetual-Premium | 5.74 % | 5.57 % | 137,172 | 6.21 | 10 | 0.0278 % | 2,035.8 |

| Perpetual-Discount | 5.51 % | 5.59 % | 124,979 | 14.52 | 14 | 0.1694 % | 2,129.5 |

| FixedReset | 5.16 % | 3.50 % | 233,993 | 2.95 | 57 | 0.0225 % | 2,281.1 |

| Deemed-Retractible | 5.22 % | 5.16 % | 338,534 | 8.27 | 53 | 0.0935 % | 2,086.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.X | FixedReset | -1.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-23 Maturity Price : 22.83 Evaluated at bid price : 24.26 Bid-YTW : 4.44 % |

| GWO.PR.I | Deemed-Retractible | -1.45 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.82 Bid-YTW : 6.14 % |

| BMO.PR.J | Deemed-Retractible | -1.06 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.18 Bid-YTW : 4.96 % |

| GWO.PR.M | Deemed-Retractible | 1.16 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-04-30 Maturity Price : 25.00 Evaluated at bid price : 25.39 Bid-YTW : 5.58 % |

| FTS.PR.F | Perpetual-Discount | 1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-23 Maturity Price : 23.14 Evaluated at bid price : 23.35 Bid-YTW : 5.29 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSE.PR.A | FixedReset | 126,131 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-23 Maturity Price : 24.95 Evaluated at bid price : 25.00 Bid-YTW : 4.30 % |

| W.PR.H | Perpetual-Discount | 103,400 | RBC crossed blocks of 50,000 and 45,000, both at 24.30. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-23 Maturity Price : 23.83 Evaluated at bid price : 24.13 Bid-YTW : 5.80 % |

| TD.PR.I | FixedReset | 54,523 | TD crossed 50,000 at 27.55. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.56 Bid-YTW : 3.38 % |

| TD.PR.N | OpRet | 51,400 | Nesbitt crossd 50,000 at 25.66. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-05-30 Maturity Price : 25.25 Evaluated at bid price : 25.66 Bid-YTW : 3.72 % |

| RY.PR.X | FixedReset | 46,853 | Desjardins bought 18,300 from National at 27.41, then crossed 20,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 27.45 Bid-YTW : 3.48 % |

| TD.PR.A | FixedReset | 40,271 | RBC crossed 24,800 at 26.16. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-02 Maturity Price : 25.00 Evaluated at bid price : 26.09 Bid-YTW : 3.70 % |

| There were 32 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| SLF.PR.G | FixedReset | Quote: 25.35 – 26.15 Spot Rate : 0.8000 Average : 0.4881 YTW SCENARIO |

| FTS.PR.F | Perpetual-Discount | Quote: 23.35 – 23.70 Spot Rate : 0.3500 Average : 0.2506 YTW SCENARIO |

| IAG.PR.E | Deemed-Retractible | Quote: 25.50 – 25.85 Spot Rate : 0.3500 Average : 0.2510 YTW SCENARIO |

| BAM.PR.X | FixedReset | Quote: 24.26 – 24.58 Spot Rate : 0.3200 Average : 0.2241 YTW SCENARIO |

| ALB.PR.B | SplitShare | Quote: 22.12 – 22.39 Spot Rate : 0.2700 Average : 0.1772 YTW SCENARIO |

| CIU.PR.B | FixedReset | Quote: 27.44 – 27.95 Spot Rate : 0.5100 Average : 0.4354 YTW SCENARIO |

TXT.PR.A: Big Partial Redemption on Term Extension

Top 10 Split Trust has announced:

that the Fund will effect a partial redemption of its preferred securities (“Preferred Securities”) in order to maintain an equal number of Preferred Securities and capital units (“Capital Units”) of the Fund outstanding. The partial redemption of Preferred Securities is being made in connection with the recent approval by holders of the Capital Units and the Preferred Securities (collectively, the “Securityholders”) of a proposal to extend the term of the Fund for an additional five-year term until March 31, 2016 and for automatic successive five-year terms thereafter.

Pursuant to the special retraction right granted to Securityholders in connection with the extension of the Fund, 284,227 Preferred Securities and 741,330 Capital Units were surrendered for retraction. In order to maintain an equal number of Preferred Securities and Capital Units, the Fund will redeem an aggregate of 457,103 Preferred Securities on a pro rata basis from all holders of record of Preferred Securities on March 31, 2011 (the “Repayment Date”), representing approximately 19.8% of the issued and outstanding Preferred Securities. Each Preferred Security that is redeemed pursuant to the partial redemption will be redeemed at a price equal to $12.50, being the principal amount per Preferred Security, plus all accrued and unpaid interest thereon (the “Repayment Price”). The Repayment Price will be paid to holders whose Preferred Securities are redeemed by the Fund within 10 business days following the Repayment Date.

I don’t know how I missed the reorg, but I did!

On February 15, the fund announced:

that the Board of Directors of Mulvihill Capital Management Inc. (“MCM”), the manager of the Fund, has approved a proposal, subject to securityholder approval, to extend the term of the Fund for five years beyond its scheduled termination date of March 31, 2011, and for successive five-year terms after March 31, 2016. If the extension is approved, holders of capital units (“Capital Units”) and preferred securities (“Preferred Securities”) of the Fund (“Securityholders”) will be given a special right to redeem their Capital Units or Preferred Securities at net asset value (“NAV”) per Capital Unit or at the repayment price per Preferred Security on March 31, 2011.

…

The Fund is also proposing to: (i) provide a special redemption right to enable holders of Capital Units and Preferred Securities to retract their securities on March 31, 2011 on the same terms that would have applied had the Fund retracted or repaid all Capital Units and Preferred Securities in accordance with the existing terms of such securities; (ii) change the monthly retraction prices for the Capital Units such that monthly retraction prices are calculated by reference to market price in addition to NAV and to change the notice period and payment period for the exercise of such rights and the payment of the retraction amount relating thereto; and (iii) consolidate the Capital Units or redeem the Preferred Securities on a pro rata basis, as the case may be, in order to maintain the same number of Capital Units and Preferred Securities outstanding.

The meeting date was then changed to March 21. The reorg was approved:

Top 10 Split Trust (the “Fund”) is pleased to announce that holders of capital units (“Capital Units”) and holders of preferred securities (“Preferred Securities”) of the Fund (collectively, the “Securityholders”) have approved a proposal to extend the term of the Fund for five years beyond its scheduled termination date of March 31, 2011, and for automatic successive five-year terms after March 31, 2016.

…

Holders of Preferred Securities have the opportunity to benefit from: (i) fixed quarterly cash interest payments equal to 6.25% per annum on the $12.50 principal amount of a Preferred Security and (ii) an attractive five-year term with automatic successive five-year term extensions after March 31, 2016.

NAV is 17.28 as of March 17 giving Asset Coverage of 1.4-:1. TXT.PR.A was last mentioned on PrefBlog when the rating of Pfd-4(high) was withdrawn by DBRS at the company’s request. TXT.PR.A is not tracked by HIMIPref™.

March 22, 2011

Looks like an election is in the wind:

Opposition leaders have signalled they will not support the Conservative budget, making a spring election all but inevitable.

The budget’s debt management strategy was interesting:

The government said in the debt management strategy that it released with the federal budget that it’s taking the step to ensure that it always has enough cash to pay one month of bills, which incidentally is the same requirement that will be in place for banks under the new Basel rules. The money will be stashed in interest bearing accounts and foreign exchange reserves and shouldn’t add to the deficit in a “material” way.

Irish notes slid, leading bonds of Europe’s most indebted nations lower, and the euro fell on concern the region’s leaders are struggling to fix the government-finance crisis. Oil rallied, while U.S. and European stocks retreated following a rebound in Japanese shares.

Irish 2-year note yields surged 62 basis points to 9.87 percent and rose as high as 10.18 percent, the most since Bloomberg began collecting the data in 2003. Yields on similar- maturity Portuguese and Greek debt climbed at least 26 basis points.

U.K. inflation accelerated more than economists forecast in February to the fastest pace in more than two years, adding pressure on the Bank of England to increase its benchmark interest rate.

Consumer prices rose 4.4 percent from a year earlier after a 4 percent increase in January, the Office for National Statistics said today in London. That’s the most since October 2008. The median forecast of 32 economists in a Bloomberg News survey was 4.2 percent. A separate report showed the budget deficit unexpectedly widened as government revenue fell.

But I may have been wrong about the long term effects of Credit Crunch politics on the UK financial sector:

Goldman Sachs Group Inc. (GS) employs almost as many people in London today as it did in 2007, before Lehman Brothers Holdings Inc. (LEHMQ) filed for the biggest bankruptcy in history, sparking a global recession.

Goldman Sachs isn’t alone. Royal Bank of Scotland Group Plc (RBS), recipient of the world’s biggest bank bailout, has more workers in its securities unit than four years ago. Barclays Capital, under Robert Diamond, hired 1,800 in 2010.

Investment banks in Europe’s financial capital are adding jobs, helping to bolster headcounts at law and accounting firms across London, as the rest of Britain struggles to recover from the worst economic contraction since the 1930s. Chancellor of the Exchequer George Osborne, who delivers his budget today, has little alternative except to do all he can to keep companies such as Barclays Plc (BARC) and HSBC Holdings Plc (HSBA) from leaving London.

“We want London to remain a global financial center, and one that will continue to flourish and grow because of the employment it brings,” Treasury minister Mark Hoban said at a conference in the City of London last week. “We want to see more employment in the U.K., not less and I think a blooming financial services sector can help deliver that.”

Nevertheless, DBRS is worried:

- • Some investors have expressed increasing concern about Euro zone countries suffering from high and rising debt burdens, uncertain bank recapitalization needs, low competitiveness or political instability.

- • In addition to low investor confidence, deterioration in global economic and political conditions – the Japanese nuclear crisis, popular unrest in Bahrain, energy supply disruptions in Libya – could slow Europe’s economic recovery and thereby delay fiscal adjustment and debt stabilization.

- • Greater clarity on European policies came on March 11, the first in a series of meetings through March 25, with a set of initiatives that if approved may help restore confidence and provide countries with time to implement fiscal austerity programs and return to growth.

- • However, DBRS believes that the final announcements may continue to leave doubts about Europe’s policy stance regarding debt restructuring. The unstable macroeconomic environment however increases the need for greater policy clarity.

- • DBRS would be encouraged by policies that address not only liquidity needs, but also reduce debt servicing costs. Clearer policies would further help to stabilize DBRS’s sovereign ratings in Europe.

One can’t help but wonder what will ultimately happen to Detroit:

The population in Detroit plunged 25 percent during the last decade, falling to the lowest level since 1910, according to 2010 Census figures.

The number of city residents fell to 713,777 last year, compared with 951,270 in 2000, the U.S. Census Bureau said today in Washington.

…

Detroit’s overall population has fallen steadily since 1950, when it peaked at 1.8 million.

There’s a fascinating development in workplace computer privacy law:

A judgment on Tuesday from the Ontario Court of Appeal broke new ground on an issue that is exploding into the court system – the extent to which Internet information is private and beyond the reach of the law.

The case involved a Northern Ontario high school teacher charged with possessing child pornography. The judges said that police breached his Charter rights by viewing his computer files without a warrant.

…

Toronto lawyer Scott Hutchison, a privacy expert, said that the court has given a sound answer to a vital question. “This case comes down firmly on the side of privacy and holds that employers cannot give police investigators access to a workplace computer,” he said.“This case makes it clear that the employer may own the computer, but that doesn’t give them the power to waive the employee’s privacy rights,” Mr. Hutchison added.

…

Writing on behalf of Chief Justice Warren Winkler and Mr. Justice Robert Sharpe, Madam Justice Andromache Karakatsanis said the board employee did not breach the Charter protection against unreasonable search and seizure because he was mandated to do so.However, the police search was an entirely different matter.

DBRS has released six methodological updates. Of primary interest are Life Insurance companies and P&C Insurance companies.

The Globe’s John Heinzl had a good piece titled Getting a grip on the dividend gross-up.

It was another strong day in the Canadian preferred share market, with PerpetualDiscounts up 26bp, FixedResets winning 13bp and DeemedRetractibles gaining 9bp. Volume continued to be light.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3017 % | 2,381.4 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3017 % | 3,581.6 |

| Floater | 2.53 % | 2.34 % | 45,607 | 21.40 | 4 | 0.3017 % | 2,571.3 |

| OpRet | 4.90 % | 3.60 % | 53,053 | 1.15 | 9 | 0.0302 % | 2,395.5 |

| SplitShare | 5.10 % | 3.21 % | 154,141 | 0.99 | 5 | 0.2502 % | 2,480.8 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0302 % | 2,190.5 |

| Perpetual-Premium | 5.74 % | 5.64 % | 138,608 | 6.21 | 10 | 0.0734 % | 2,035.2 |

| Perpetual-Discount | 5.50 % | 5.54 % | 121,417 | 14.37 | 14 | 0.2581 % | 2,125.9 |

| FixedReset | 5.16 % | 3.50 % | 241,891 | 2.95 | 57 | 0.1328 % | 2,280.5 |

| Deemed-Retractible | 5.22 % | 5.17 % | 342,129 | 8.27 | 53 | 0.0936 % | 2,084.3 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| GWO.PR.G | Deemed-Retractible | 1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.63 Bid-YTW : 5.40 % |

| BMO.PR.N | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-27 Maturity Price : 25.00 Evaluated at bid price : 27.63 Bid-YTW : 2.99 % |

| BAM.PR.R | FixedReset | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-22 Maturity Price : 25.40 Evaluated at bid price : 25.45 Bid-YTW : 4.89 % |

| BNS.PR.O | Deemed-Retractible | 1.43 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2017-05-26 Maturity Price : 25.00 Evaluated at bid price : 26.17 Bid-YTW : 4.90 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSE.PR.A | FixedReset | 201,177 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-22 Maturity Price : 24.90 Evaluated at bid price : 24.95 Bid-YTW : 4.31 % |

| PWF.PR.L | Perpetual-Discount | 95,794 | RBC crossed 93,200 at 23.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-22 Maturity Price : 23.58 Evaluated at bid price : 23.81 Bid-YTW : 5.43 % |

| SLF.PR.B | Deemed-Retractible | 82,928 | Nesbitt crossed 50,000 at 22.95; Desjardins crossed 25,000 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.91 Bid-YTW : 5.87 % |

| PWF.PR.I | Perpetual-Premium | 53,000 | Desjardins crossed blocks of 26,300 and 25,000, both at 25.40. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-05-30 Maturity Price : 25.00 Evaluated at bid price : 25.33 Bid-YTW : 5.61 % |

| NA.PR.P | FixedReset | 51,320 | Issuer bid. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-17 Maturity Price : 25.00 Evaluated at bid price : 28.29 Bid-YTW : 2.31 % |

| PWF.PR.G | Perpetual-Premium | 50,400 | RBC crossed blocks of 36,300 and 13,700, both at 25.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-03-22 Maturity Price : 24.93 Evaluated at bid price : 25.15 Bid-YTW : 5.96 % |

| There were 25 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| CU.PR.B | Perpetual-Premium | Quote: 25.25 – 25.61 Spot Rate : 0.3600 Average : 0.2256 YTW SCENARIO |

| CM.PR.G | Deemed-Retractible | Quote: 25.40 – 25.70 Spot Rate : 0.3000 Average : 0.1893 YTW SCENARIO |

| TD.PR.G | FixedReset | Quote: 27.40 – 27.66 Spot Rate : 0.2600 Average : 0.1608 YTW SCENARIO |

| SLF.PR.A | Deemed-Retractible | Quote: 22.66 – 22.96 Spot Rate : 0.3000 Average : 0.2011 YTW SCENARIO |

| CIU.PR.B | FixedReset | Quote: 27.36 – 27.80 Spot Rate : 0.4400 Average : 0.3537 YTW SCENARIO |

| RY.PR.P | FixedReset | Quote: 27.20 – 27.54 Spot Rate : 0.3400 Average : 0.2612 YTW SCENARIO |

LBS.PR.A Warrants In the Money; Expire Thursday

Brompton Group has announced that the warrants to purchase Whole Units containing LBS.PR.A are in the money, with a NAV of 19.29 as of March 21 (assuming all warrants are exercised) vs. an exercise price of 18.87.

This is an improvement from the March 17 value of 19.06.

Brompton points out that:

Warrants which are not exercised or sold will expire on March 24, 2011. Investors should contact their investment advisor to exercise or sell their warrants.

LBS.PR.A was last mentioned on PrefBlog when the warrant offering was finalized. LBS.PR.A is tracked by HIMIPref™ but is relegated to the Scraps index on credit concerns.

BoE Quarterly Bulletin, 2011Q1

The Bank of England has released its 2011 Quarterly Bulletin, filled with the usual high quality analysis.

In addition to the Markets and Operations review, there are articles on:

- Understanding the recent weakness in broad money growth

- Understanding labour force participation in the United Kingdom

- China’s changing growth pattern

- Summaries of recent Bank of England working papers

- Wage rigidities in an estimated DSGE model of the UK labour market

- The contractual approach to sovereign debt restructuring

- Are EME indicators of vulnerability to financial crises decoupling from global factors?

- Low interest rates and housing booms: the role of capital inflows, monetary policy

and financial innovation - Mapping systemic risk in the international banking network

- A Bayesian approach to optimal monetary policy with parameter and model uncertainty

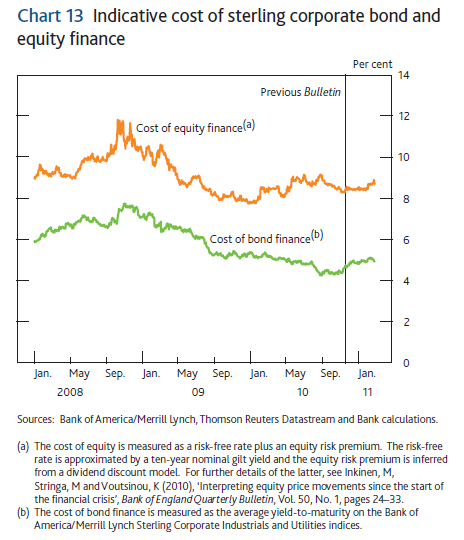

In the United Kingdom, despite the reduction in sterling corporate bond spreads, the cost of corporate bond finance for investment-grade non-financial companies increased slightly, on account of the rise in government bond yields. An indicative measure of the nominal cost of equity finance for UK companies had also risen slightly (Chart 13).