The Bank of Canada has released its Winter 2010/2011 Review with articles:

- Competition in the Canadian Mortgage Market

- Adverse Selection and Financial Crises

- Payment Networks: A Review of Recent Research

- Conference Summary: Financial Globalization and Financial Instability

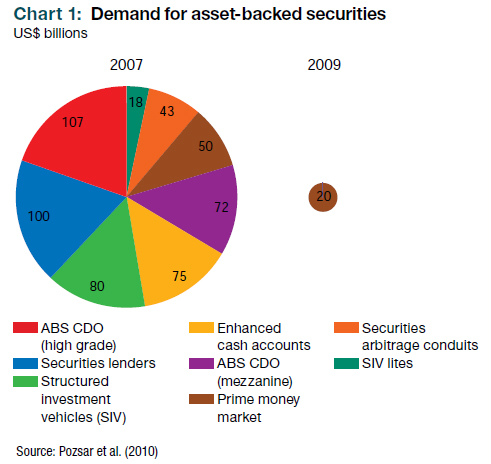

The second article, Adverse Selection and Financial Crises by Koralai Kirabaeva has an interesting chart:

The market for subprime mortgages was relatively small, comprising only about 25 per cent of the outstanding amount in the US$6 trillion mortgage-backed securities (MBS) market and about 30 per cent of total nonagency MBS issuance in the years before the crisis (Gorton 2008b). Direct losses from household defaults on subprime mortgages are estimated to be about US$500 billion, but the subprime crisis triggered losses in the U.S. stock market that reached US$8 trillion in October 2008 (Brunnermeier 2009).

In explaining the disproportionate effect of the subprime-mortgage crisis on the financial system, one can identify a number of amplification mechanisms that can significantly increase the initial impact of adverse selection: an increase in uncertainty about asset values, a flight to liquidity, and a misassessment of systemic risk. Increasing uncertainty about asset values contributes to the decline in demand for these assets, while a flight to liquidity and an underestimation of systemic risk cause a shortage of liquid assets in the market.

Direct loss estimates during the crisis ranged from $175-billion to $565-billion. It’s a pity Kirabaeva didn’t footnote his $500-billion figure. The Brunnermeier paper confines itself to “several hundred billion dollars”.

And I am still waiting for somebody, anybody, to estimate how much of these losses were borne by the senior (AAA) tranches of securitized subprime, that (although subjected to very major credit rating downgrades) may well have passed through the cataclysm with only minor losses.

The higher preference for liquid assets during a crisis can be viewed as precautionary liquidity hoarding because of a tightening in funding liquidity. A higher preference for liquidity may alleviate the problem of adverse selection, since assets are more likely to be sold because the seller needs to raise liquidity rather than because of an asset’s low quality. Nevertheless, a higher demand for liquid assets also implies a lower demand for illiquid assets. If the demand for illiquid assets is sufficiently low, then the asset’s price will be determined by the liquidity available in the market rather than by the expected return on the asset (Allen and Gale 2004). Hence, an increase in liquidity preference can lead to fire-sale pricing and possibly to a market freeze.

Government intervention during crises may create a moral hazard problem: if market participants anticipate such interventions, then their optimal holdings of risky assets are larger. Government bailouts (debt guarantees) can be inevitable during crises, and as a result, they lead to the inefficient allocation of capital towards risky investments. The pre-emptive policy response is an ex-ante requirement for larger holdings of safe assets (e.g., capital requirements), which offsets systemic externalities and reduces the probability of market breakdowns during crises (Kirabaeva 2010).

I am disappointed to see that there is no discussion of the possibility that a better policy response might be the provision of liquidity at a penalty rate.

Update: The mortgage article made the Financial Post, in a piece by John Greenwood titled Why do mortgage rates rise fast, fall slowly?