Teachers’ supports the TMX / LSE deal:

Specifically, we support the proposed merger for the following reasons:

- It is important to ensure that Teachers’ and other investors have access to an effective, low cost trading platform to execute both cash and derivative trades. The combined exchange operator should be able to achieve economies of scale, lowering the cost of capital and trading costs.

- …

What? Judging a company by what it does for its customers rather that the quality of jobs it provides its employees and suppliers? Why, that’s … that’s un-Canadian! The More-Subsidies government should revoke their citizenship, immediately and retroactively!

The Fed has relaxed dividend restrictions on large US bank holding companies:

The Federal Reserve on Friday announced it has completed the Comprehensive Capital Analysis and Review (CCAR), its cross-institution study of the capital plans of the 19 largest U.S. bank holding companies.

As a result of the CCAR, some firms are expected to increase or restart dividend payments, buy back shares, or repay government capital. The Federal Reserve on Friday will discuss the reviews and its decisions with firms that requested a capital action. All 19 firms will receive more detailed assessments of their capital planning processes next month.

In February 2009, the Federal Reserve advised bank holding companies that safety and soundness considerations required that dividends be substantially reduced or eliminated. Since that time, the Federal Reserve has indicated that increased capital distributions would generally not be considered prudent in the absence of a well-developed capital plan and a capital position that would remain strong even under adverse conditions.

There was immediate reaction:

JPMorgan Chase & Co. (JPM) and Wells Fargo & Co. (WFC) increased dividends and authorized share buybacks after the Federal Reserve reviewed the ability of the largest U.S. lenders to withstand another economic slump. Bank stocks rallied in New York trading.

…

Goldman Sachs Group Inc. (GS) said it got permission to buy back $5 billion of preferred stock sold to Warren Buffett’s Berkshire Hathaway Inc. in 2008.

And some took advantage of the market’s reaction:

KeyCorp (KEY), Ohio’s second-biggest bank, raised $625 million selling shares as part of a plan to repay a U.S. bailout after a Federal Reserve review of the company’s capital strength.

KeyCorp, based in Cleveland, sold 70.6 million shares of common stock at $8.85 each, the bank said today in a statement.

The Federal Reserve told KeyCorp it didn’t object to a plan to sell stock and issue debt to help repurchase $2.5 billion of preferred shares sold to the U.S. Treasury in 2008 as part of the Troubled Asset Relief Program, the company said in a statement. KeyCorp paid about $282 million in dividends to Treasury during the investment period.

KeyCorp advanced 7 cents to $8.92 as of 4 p.m. today in New York Stock Exchange composite trading before the announcement.

… and so did SunTrust:

SunTrust Banks Inc. (STI) raised $1.04 billion selling shares as part of a plan to repay $4.85 billion in U.S. bailout funds.

The lender, based in Atlanta, sold 35.3 million shares of common stock for $29.50 each, data compiled by Bloomberg show.

The Federal Reserve, which reviewed the financial strength of the largest U.S. lenders, didn’t object to SunTrust’s capital plan to sell the stock and issue a further $1 billion of debt, the bank said today in a statement. Repayment to the Troubled Asset Relief Program, which will also draw on “other available funds,” is subject to approval by the U.S. Treasury Department, the bank said.

SunTrust advanced $1.34, or 4.7 percent, to $29.59 as of 4 p.m. today in New York Stock Exchange composite trading before the announcement.

Regulators world-wide are seeking to expand their empires:

Michael Oxley, the former congressman who co-wrote the Sarbanes-Oxley Act of 2002, has registered as a lobbyist for the Financial Industry Regulatory Authority to promote self-regulation of investment advisers.

Oxley, a partner at Baker Hostetler LLP in Washington, registered this week as a Finra lobbyist, saying he would work on securities regulation and the “harmonization of regulation of broker-dealers and investment advisers,” according to his registration form. Finra oversees about 4,560 brokerage firms and is interested in expanding to investment advisers.

Salesmen should not have the same regulator as asset managers.

Today’s embarrassing news release is:

GMP Capital Inc. (“GMP”) (TSX: GMP and GMP.PR.B) announced that it has re-filed its audited financial statements and accompanying management’s discussion and analysis for the year ended December 31, 2010 to correct a calculation error relating to earnings per common share for 2009.

The correction relates to amounts recorded in connection with the redemption of GMP’s Series A preferred shares in December 2009. The amounts were charged to retained earnings, as required, but were not deducted in computing net income available to common shareholders. The earnings per common share (“EPS”) for 2009 has accordingly been revised from $0.64 per basic EPS and $0.59 per diluted EPS, as originally reported, to $0.52 per basic EPS and $0.48 per diluted EPS. The correction and re-filing has no effect on EPS for 2010 and does not otherwise affect GMP’s financial statements for the years ended 2010 and 2009.

On the whole, I would say that’s on a par with the Toronto Society of Financial Analysts repeated problems with their financial statements! It was just yesterday that Harris Fricker, CEO of GMP Capital, wrote an incomprehensible essay in the Globe trying to tell the TMX how to manage its business.

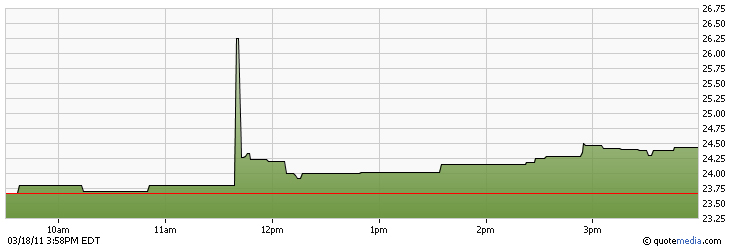

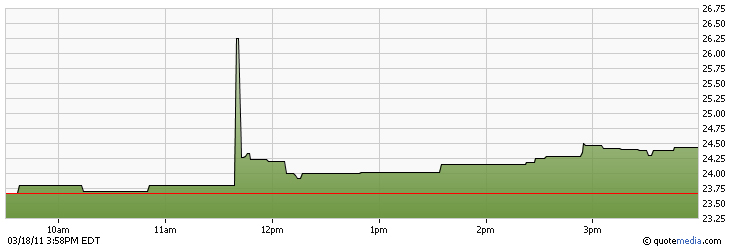

It was quite the day for BMO.PR.J!

Click for big

Click for bigBMO.PR.J was the best performing index-included preferred share for the day, trading 89,346 shares in a range of 23.78-26.25 (!) [It’s been a while seen we’ve seen $2+ ranges!] before closing at 24.20-43, 10×18. Thanks to Assiduous Reader GA for bringing this to my attention.

Was it Algos Gone Wild? Fat Finger? One way or another, Desjardins bought 19,500 shares at an average price of 24.60 in 24 pieces from 11:40:36 to 11:40:37 – the first piece executed at 23.81, the last at 26.23. Then two odd-lots traded at 26.25 (presumably the offering price, but I haven’t bought that data), indicating a separate order. The next batch of Desjardins’ buying was another 20,200 shares at an average price of 25.75 in 9 pieces from 11:40:37 to 11:40:48, starting at 24.20 (an algo coming in with a new offer?) and ending at 26.25. This sequence included 16,400 shares at the high for the day of 26.25. Kudos to Goldman Sachs, who – I’m guessing, but it’s a pretty confident kind of guess – has an algorithm trolling the alleyways just looking for this sort of thing and were the seller of the last four lots at 26.25, totalling 9,500 shares.

Or maybe it wasn’t a Goldman algorithm, but an iceberg, placed well off the market price some time every morning? Either way, they made about $20-grand.

Oh, and when I say “Desjardins” and “Goldman”, it might not have been their prop desks acting as principal – this might all have been client orders.

The Canadian preferred share market was strong today, with PerpetualDiscounts up 9bp, FixedResets gaining 14bp and DeemedRetractibles winning 37bp. Volume was light.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.3250 % |

2,372.2 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.3250 % |

3,567.8 |

| Floater |

2.54 % |

2.35 % |

46,650 |

21.37 |

4 |

-0.3250 % |

2,561.4 |

| OpRet |

4.91 % |

3.51 % |

54,639 |

0.36 |

9 |

0.0605 % |

2,391.0 |

| SplitShare |

5.11 % |

3.54 % |

160,538 |

1.00 |

5 |

-0.1964 % |

2,474.7 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0605 % |

2,186.3 |

| Perpetual-Premium |

5.75 % |

5.63 % |

129,733 |

13.90 |

10 |

0.0656 % |

2,032.4 |

| Perpetual-Discount |

5.52 % |

5.55 % |

121,975 |

14.40 |

14 |

0.0944 % |

2,117.1 |

| FixedReset |

5.17 % |

3.57 % |

246,947 |

2.96 |

57 |

0.1367 % |

2,275.2 |

| Deemed-Retractible |

5.24 % |

5.27 % |

350,128 |

8.28 |

53 |

0.3727 % |

2,078.3 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| W.PR.H |

Perpetual-Discount |

-1.03 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-03-18

Maturity Price : 23.71

Evaluated at bid price : 24.01

Bid-YTW : 5.82 % |

| CM.PR.I |

Deemed-Retractible |

1.00 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.15

Bid-YTW : 5.22 % |

| GWO.PR.G |

Deemed-Retractible |

1.07 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.51

Bid-YTW : 5.45 % |

| RY.PR.G |

Deemed-Retractible |

1.08 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.50

Bid-YTW : 5.30 % |

| BAM.PR.R |

FixedReset |

1.10 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2016-07-30

Maturity Price : 25.00

Evaluated at bid price : 25.65

Bid-YTW : 4.81 % |

| CM.PR.J |

Deemed-Retractible |

1.10 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 23.81

Bid-YTW : 5.18 % |

| RY.PR.B |

Deemed-Retractible |

1.17 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.14

Bid-YTW : 5.18 % |

| CIU.PR.C |

FixedReset |

1.63 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-03-18

Maturity Price : 24.85

Evaluated at bid price : 24.90

Bid-YTW : 3.92 % |

| SLF.PR.F |

FixedReset |

1.72 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-30

Maturity Price : 25.00

Evaluated at bid price : 27.16

Bid-YTW : 3.25 % |

| BMO.PR.J |

Deemed-Retractible |

2.28 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.20

Bid-YTW : 4.94 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| HSE.PR.A |

FixedReset |

540,247 |

New issue settled today.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-03-18

Maturity Price : 24.80

Evaluated at bid price : 24.85

Bid-YTW : 4.37 % |

| BMO.PR.J |

Deemed-Retractible |

89,346 |

Algos gone wild? See main post above for commentary. There were no blocks reported.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.20

Bid-YTW : 4.94 % |

| NA.PR.P |

FixedReset |

83,515 |

Issuer bid.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-17

Maturity Price : 25.00

Evaluated at bid price : 28.27

Bid-YTW : 2.33 % |

| NA.PR.N |

FixedReset |

81,700 |

Issuer bid.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-09-14

Maturity Price : 25.00

Evaluated at bid price : 26.98

Bid-YTW : 2.23 % |

| BMO.PR.Q |

FixedReset |

75,020 |

Nesbitt bought 27,600 from Anonymous at 24.75.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.71

Bid-YTW : 3.97 % |

| PWF.PR.I |

Perpetual-Premium |

40,800 |

Desjardins crossed 28,600 at 25.27.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2012-05-30

Maturity Price : 25.00

Evaluated at bid price : 25.31

Bid-YTW : 5.63 % |

| There were 26 other index-included issues trading in excess of 10,000 shares. |

| Wide Spread Highlights |

| Issue |

Index |

Quote Data and Yield Notes |

| TRI.PR.B |

Floater |

Quote: 22.90 – 23.75

Spot Rate : 0.8500

Average : 0.5422

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-03-18

Maturity Price : 22.66

Evaluated at bid price : 22.90

Bid-YTW : 2.26 % |

| W.PR.H |

Perpetual-Discount |

Quote: 24.01 – 24.37

Spot Rate : 0.3600

Average : 0.2670

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-03-18

Maturity Price : 23.71

Evaluated at bid price : 24.01

Bid-YTW : 5.82 % |

| FTS.PR.H |

FixedReset |

Quote: 25.00 – 25.30

Spot Rate : 0.3000

Average : 0.2097

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2041-03-18

Maturity Price : 24.95

Evaluated at bid price : 25.00

Bid-YTW : 4.08 % |

| BNS.PR.Z |

FixedReset |

Quote: 24.27 – 24.85

Spot Rate : 0.5800

Average : 0.5009

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.27

Bid-YTW : 4.20 % |

| BAM.PR.P |

FixedReset |

Quote: 27.07 – 27.37

Spot Rate : 0.3000

Average : 0.2214

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-10-30

Maturity Price : 25.00

Evaluated at bid price : 27.07

Bid-YTW : 4.45 % |

| NA.PR.L |

Deemed-Retractible |

Quote: 24.55 – 24.85

Spot Rate : 0.3000

Average : 0.2230

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2022-01-31

Maturity Price : 25.00

Evaluated at bid price : 24.55

Bid-YTW : 5.15 % |