The inherent contradictions of the brokerage business continue to cause problems:

Social media sites such as LinkedIn and Twitter are redefining the way businesses reach their customers. Securities firms are largely absent from the revolution.

…

The U.S. Securities and Exchange Commission, which regulates the securities industry, says all broker stock recommendations must be ‘‘suitable” for individual clients by measuring their risk tolerance, security holdings, income, net worth and investment objectives, according to the agency’s website. Tweeting a stock pick or posting it on Facebook generally breaks this rule, said David Sobel, executive vice president and compliance officer at New York-based Abel/Noser Corp., which helps clients lower trading costs and does allow its employees to use LinkedIn for networking.

Stockbrokers are salesmen; the “suitability” rule is nonsense. One step forward would be to change their registration title to “Salesman” and prohibit their use of any other title. Anybody who wants to think about “suitability” or “advice” should be a fiduciary and be required to publish their track record.

As suggested yesterday, the debt panel’s recommendations did not win enough of a supermajority:

The seven votes against the plan were enough to sink it, even though 11 of the 18 members voted in favor, because 14 were needed to forward the proposal to Congress for consideration. Five of the six senators on the panel backed the plan, as did five of the six unelected officials. Five of six House members opposed it, with the sole support coming from South Carolina Democrat John Spratt, who was defeated in the Nov. 2 election.

I continue to believe the US will not take its fiscal problems seriously until the President gets a call from the Treasury secretary asking him to play bond salesman. The Hot Air blog which, as far as I can tell, is a mouthpiece for the Republican party, claims to want to reduce the deficit but only if it’s done through spending cuts. That would be nice, folks, and it may even be the best solution, but nothing will last until there is a bipartisan consensus.

Meanwhile, Baucus (who was on the committee and voted no) has been busy:

U.S. Senate Finance Committee Chairman Max Baucus, a Montana Democrat, omitted a provision to boost tax rates on so- called carried interest from a bill to extend Bush-era tax cuts for middle-income Americans that is set for a Senate vote tomorrow. The bill also would renew dozens of expired business tax breaks to which the carried interest proposal had been attached as a budget-balancing measure.

…

Since winning control of Congress in 2006, Democrats have made taxing such income at ordinary rates a priority. The House voted in May to tax three quarters of carried interest as wages. While the Senate trimmed it back further to a 50-50 split in June, objections from Republicans and some Democrats blocked the proposal from being considered on the floor.The Obama administration has proposed taxing carried interest as ordinary income in each of its annual budget proposals.

Can’t be too smug about all this, though, because there’s no plan for balancing the books in Canada either – although, with Spend-Every-Penny in charge, that’s scarcely a surprise.

Spain’s Cabinet yesterday raised tax on tobacco and set a date for a pension overhaul, two days after saying it plans to raise about 14 billion euros ($18.4 billion) from selling stakes in the airport operator and lottery company.

“Time has run out; we have been talking for months,” Deputy Prime Minister Alfredo Perez Rubalcaba told reporters, referring to the pension plan. “We are going to work even harder to reach agreements.”

The Basel Committee has announced that it:

agreed on the details of the Basel III rules text, which includes global regulatory standards on capital adequacy and liquidity. The liquidity coverage ratio and the net stable funding ratio will be subject to an observation period and will include a review clause to address any unintended consequences.

…

The Committee expects to publish the Basel III rules text by the end of this year.

…

In addition, the Committee reviewed issues related to globally systemic banking institutions. Such banks should have loss-absorbing capacity beyond the Basel III standards and work on this topic continues in the Committee and the Financial Stability Board (FSB). The Committee reviewed a provisional methodology comprising both quantitative and qualitative indicators to assist national authorities in assessing the systemic importance of financial institutions at the global level. It will send a paper on these topics to the FSB by the end of this year for its review. The Committee will complete by mid-2011 a study of the magnitude of additional loss absorbency that global systemically important banks should have. It is also assessing the extent of going-concern loss absorbency that could be provided by different instruments. This review will be completed by mid-2011.Taking account of comments received during a recent public consultation, the Committee agreed on key elements of the proposal to ensure the loss absorbency of regulatory capital at the point of non-viability and will elaborate the rules concerning transitional arrangements and grandfathering.

Mention of a leverage cap is conspicuous by its absence. DBRS has concluded there will be no credit effect on Canadian banks.

BIS has also published a working paper by Ilhyock Shim and Haibin Zhu titled The impact of CDS trading on the bond market: evidence from Asia:

This paper investigates the impact of CDS trading on the development of the bond market in Asia. In general, CDS trading has lowered the cost of issuing bonds and enhanced the liquidity in the bond market. The positive impact is stronger for smaller firms, non-financial firms and those firms with higher liquidity in the CDS market. These empirical findings support the diversification and information hypotheses in the literature. Nevertheless, CDS trading has also introduced a new source of risk. There is strong evidence that, at the peak of the recent global financial crisis, those firms included in CDS indices faced higher bond yield spreads than those not included.

Very soon trading will become a cooperative game and everybody will win without risk – if only the CFTC enforces enough rules:

The CFTC in October said it was seeking public comment on whether and how to regulate potentially disruptive practices including algorithmic trading and “spoofing,” in which someone enters a bid or offer with the intent of canceling it before the trade is carried out.

…

Though the Dodd-Frank law expressly prohibits spoofing, Joel Hasbrouck, a professor at New York University, said that a rule tailored to that practice would likely be too narrow. “I think it is going to be based on intent,” he said. “And I would not be in the position of wanting to have to define it.”

The CFTC request for comments takes particular aim at algorithms:

15. Should the Commission consider promulgating rules to regulate the use of algorithmic or automated trading systems to prevent disruptive trading practices? If so, what kinds of rules should the Commission consider?

16. Should the Commission consider promulgating rules to regulate the design of algorithmic or automated trading systems to prevent disruptive trading practices? If so, what kinds of rules should the Commission consider?

17. Should the Commission consider promulgating rules to regulate the supervision and monitoring of algorithmic or automated trading systems to prevent disruptive trading practices? If so, what kinds of rules should the Commission consider?

18. Should the Commission promulgate additional rules specifically applicable to the use of algorithmic trading methodologies and programs that are reasonably necessary to prevent algorithmic trading systems from disrupting fair and equitable markets? If so, what kinds of rules should the Commission consider?

19. Should algorithmic traders be held accountable if they disrupt fair and equitable trading? If so, how?

Last I heard, there needed to be two parties to a trade. If they have agreed on the price, what’s unfair?

Themis Trading notes approvingly:

A new front has been opened up by the CFTC on the battle against HFT.

Police Chief Blair has admitted that his remarks on the arrest of Adam Nobody were completely devoid of factual basis:

Toronto Police Chief Bill Blair publicly apologized Friday to G20 protester Adam Nobody for suggesting he was armed and violent when arrested by police.

Chief Blair said there is no evidence Mr. Nobody was armed at the time of his arrest.

He also said he regretted that his comments in a radio interview created a false impression that the video of Mr. Nobody’s takedown, captured in two segments by bank employee John Bridge, had been doctored in an attempt to mislead.

So that’s how seriously the Toronto Police Force takes well-supported allegations of excessive force: automatic denial, blaming of the victim and making no effort whatsoever to ascertain the facts. We are poorly served and protected.

And, as long as I’m updating that story (discussed December 1, I’ll also update the Emil Cohen story:

The principal’s decision to suspend Cohen, 17, was one Northern’s principal made with a “heavy heart,” said Supt. Ian Allison.

“The issue here is not the speech itself,” he said. “The issue is there was a process and he didn’t follow through.”

…

The school has countered that the speech he read wasn’t an approved version and he disobeyed his teacher.

I love the contradiction there. ‘The issue isn’t censorship, the issue is that we think he didn’t submit to the censorship process to our satisfaction.’ Never mind, Emil – even if you aren’t on the way to university, most of your classmates are, and there you will all be able to criticize your professors and the administration to your heart’s content – generally speaking, they feel secure enough in their competence to avoid hysterical responses to criticism (informed and otherwise; respectful and otherwise). It’s just too bad Toronto’s secondary school system hasn’t done anything to help you learn to deal with that freedom.

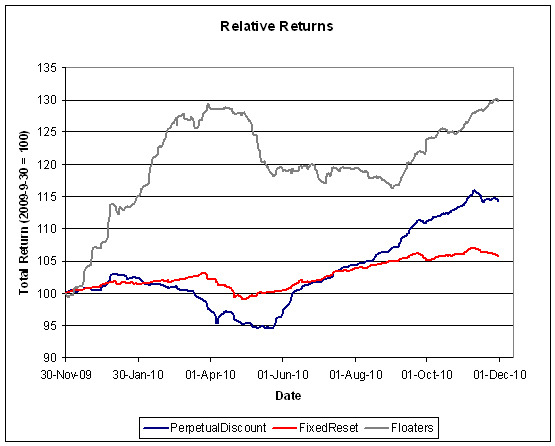

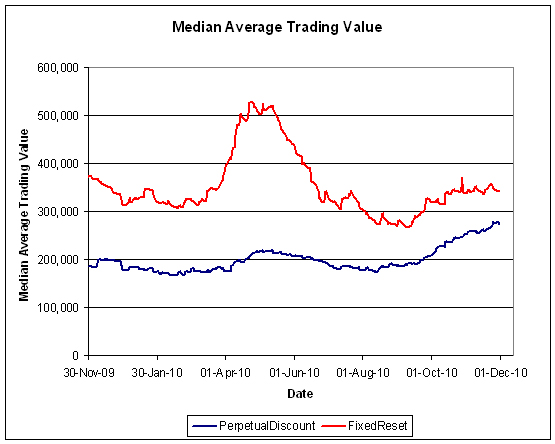

The Canadian preferred share market bounced today and recovered a portion of yesterday’s losses, with PerpetualDiscounts gaining 12 bp (down 38bp yesterday) and Fixed Resets up 13bp (down 58bp yesterday). However, the FixedReset index would have lost today if it hadn’t been for the reinstatement of a reasonable quote for GWO.PR.J, so don’t break out the champagne just yet. Volume was down from yesterday’s peak, but still quite heavy.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2497 % | 2,276.6 |

| FixedFloater | 4.73 % | 3.19 % | 28,358 | 19.06 | 1 | 1.0984 % | 3,559.0 |

| Floater | 2.62 % | 2.35 % | 53,182 | 21.37 | 4 | 0.2497 % | 2,458.1 |

| OpRet | 4.80 % | 3.50 % | 81,172 | 2.42 | 8 | -0.2062 % | 2,370.9 |

| SplitShare | 5.47 % | 1.37 % | 121,161 | 1.01 | 3 | 0.0603 % | 2,460.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2062 % | 2,168.0 |

| Perpetual-Premium | 5.70 % | 5.47 % | 155,220 | 5.39 | 27 | 0.1290 % | 2,011.0 |

| Perpetual-Discount | 5.36 % | 5.40 % | 284,327 | 14.79 | 51 | 0.1155 % | 2,030.6 |

| FixedReset | 5.23 % | 3.45 % | 354,103 | 3.13 | 52 | 0.1283 % | 2,260.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.I | OpRet | -2.41 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 25.13 Bid-YTW : 5.70 % |

| MFC.PR.B | Perpetual-Discount | -1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 20.65 Evaluated at bid price : 20.65 Bid-YTW : 5.65 % |

| TD.PR.O | Perpetual-Discount | -1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 23.50 Evaluated at bid price : 23.75 Bid-YTW : 5.15 % |

| BAM.PR.G | FixedFloater | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 22.84 Evaluated at bid price : 23.01 Bid-YTW : 3.19 % |

| MFC.PR.E | FixedReset | 1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 26.67 Bid-YTW : 3.69 % |

| PWF.PR.K | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 22.80 Evaluated at bid price : 23.00 Bid-YTW : 5.44 % |

| RY.PR.N | FixedReset | 1.28 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-26 Maturity Price : 25.00 Evaluated at bid price : 27.60 Bid-YTW : 2.96 % |

| GWO.PR.I | Perpetual-Discount | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 21.20 Evaluated at bid price : 21.20 Bid-YTW : 5.32 % |

| GWO.PR.L | Perpetual-Premium | 1.46 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2019-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.00 Bid-YTW : 5.62 % |

| CIU.PR.A | Perpetual-Discount | 1.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 21.55 Evaluated at bid price : 21.90 Bid-YTW : 5.27 % |

| GWO.PR.J | FixedReset | 8.42 % | A bounce from yesterday’s nonsense. To my complete astonishment, the Toronto Stock Exchange has not yet responded to my queries regarding yesterday’s quote. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.90 Bid-YTW : 3.27 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| FTS.PR.H | FixedReset | 235,422 | Nesbitt crossed blocks of 50,000 and 150,000, both at 25.55. TD crossed 25,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-07-01 Maturity Price : 25.00 Evaluated at bid price : 25.54 Bid-YTW : 3.73 % |

| BNS.PR.Q | FixedReset | 212,876 | Desjardins crossed blocks of 115,000 and 89,600, both at 26.20. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-11-24 Maturity Price : 25.00 Evaluated at bid price : 26.23 Bid-YTW : 3.36 % |

| TRP.PR.A | FixedReset | 147,361 | Nesbitt crossed 100,000 at 25.85. RBC crossed 35,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.85 Bid-YTW : 3.62 % |

| FTS.PR.E | OpRet | 101,000 | Nesbitt crossed 100,000 at 27.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-07-01 Maturity Price : 25.75 Evaluated at bid price : 26.92 Bid-YTW : 2.94 % |

| CIU.PR.C | FixedReset | 100,200 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 23.13 Evaluated at bid price : 25.00 Bid-YTW : 3.56 % |

| RY.PR.F | Perpetual-Discount | 97,031 | Nesbitt bought 10,000 from RBC at 22.14. RBC crossed 23,900 and Nesbitt crossed 50,000, both at 22.10. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2040-12-03 Maturity Price : 22.03 Evaluated at bid price : 22.15 Bid-YTW : 5.05 % |

| There were 52 other index-included issues trading in excess of 10,000 shares. | |||