The US government is creaking slowly towards GSE reform:

A Dodd-Frank mandated Treasury study on Fannie Mae and Freddie Mac is almost certain to be the first step in federal legislation to reform government-sponsored enterprises and the secondary mortgage market. The study, which must be submitted to Congress by the end of January 2011, was mandated by an amendment offered by Senator Chris Dodd, Chair of the Banking Committee, codified as section 1074, as the Senate was beating back an amendment offered by Senator John McCain that would have either ended the conservatorship of Fannie and Freddie or disbanded them with no reasonable alternative offered.

All that being said, there is a growing consensus that the 112th Congress must pass legislation reforming the GSEs.

Mary Schapiro spoke about market structure today:

May 6 was clearly a market failure, and it brought to the fore concerns about our equity market structure. The staffs of the SEC and CFTC are finalizing a joint report on our inquiry into the day’s events that will be published in the coming weeks.

But we have not waited for the report to begin taking steps to address weaknesses identified on May 6.

There will doubtless be some who consider this admirable.

To understand where individual investors are coming from, we must truly recognize the impact of severe price volatility on their interests: one example is the use and impact of stop loss orders on May 6. Stop loss orders are designed to help limit losses by selling a stock when it drops below a specified price, and are a safety tool used by many individual investors to limit losses.

The fundamental premise of these orders is to rely on the integrity of market prices to signal when the investor should sell a holding. On May 6, this reliance proved misplaced and the use of this tool backfired.

A staggering total of more than $2 billion in individual investor stop loss orders is estimated to have been triggered during the half hour between 2:30 and 3 p.m. on May 6. As a hypothetical illustration, if each of those orders were executed at a very conservative estimate of 10 percent less than the closing price, then those individual investors suffered losses of more than $200 million compared to the closing price on that day.

This is the first time I’ve seen a number. OK, so users of stop loss orders lost a lot of money, which is now in the hands of less stupid people better able to allocate capital. So what? Isn’t this what markets are supposed to do?

We should consider the relevance today of a basic premise of the old specialist obligations — that the professional trading firms with the best access to the markets (and therefore the greatest capacity to affect trading for good or for ill) should be subject to obligations to trade in ways that support the stability and fairness of the markets.

For example, the stocks with broken trades on May 6 highlight the fact that the order book liquidity in those stocks completely disappeared, if only briefly, and caused trades to occur at absurd prices. Where were the high frequency trading firms that typically dominate liquidity provision in those stocks?

I anticipate that the May 6 report will discuss the reasons that caused these firms to pull back, which they believed to be in their interest. The issue, however, is whether the firms that effectively act as market makers during normal times should have any obligation to support the market in reasonable ways in tough times.

This is craziness. In the first place, specialists and market-makers have a lot more advantages than mere “access”. In the second place, it will be remembered that these paragons of virtue stepped back during the crash of 1987, as well.

It looks like the established order of do-nothing incompetents has renewed its hegemony over the SEC!

Reverberations over Greek debt continue:

Four months after the 110 billion- euro ($140 billion) bailout for Greece, the nation still hasn’t disclosed the full details of secret financial transactions it used to conceal debt.

“We have not seen the real documents,” Walter Radermacher, head of the European Union’s statistics agency Eurostat, said in a Sept. 2 interview in his Luxembourg office. Eurostat first requested the contracts in February.

Radermacher vows new toughness when officials from his staff head to Greece this month to come up with a “solid estimate” of the total value of debt hidden by the opaque contracts. “This is a new era,” he said.

Greece is the only euro country that lied about using these complex swap contracts after Eurostat told countries to report them in 2008, Radermacher, 58, said.

…

“You might say this is triumph of hope over experience,” [Yannis Stournaras, director general of the Foundation for Economic and Industrial Research in Athens] said, adding that the blame should be shared with the European Commission, which didn’t intervene despite years of warnings by Eurostat of problems with Greek data.

“We addressed the issue several times in meetings of finance ministers and we asked for enhanced powers for Eurostat in 2005, which we didn’t receive at the time,” said Amadeu Altafaj, a spokesman for the Commission.

…

In April 2009, the European Central Bank identified a Greek swap operation of unusual terms, according to a confidential ECB document dated March 3, 2010, obtained by Bloomberg News. The ECB said its executive board prepared internal reports on the swaps. ECB spokesman Niels Buenemann declined to comment on it.

Greece began using this type of contract for the 2001 budget year to avoid recording a spike in debt the first year after it adopted the euro, Stournaras said. It continued to use them after 2001 and increased their use after 2004, he said.

Under guidance set out in 2008 by Eurostat, any upfront payments linked to a swap must be counted as a loan.

Germany, Italy, Poland and Belgium, like Greece, received upfront payments from derivatives, Radermacher said at a hearing at the European Parliament in April. The difference, he said in the September interview, was that when Eurostat asked the other countries about the contracts in 2008, they provided the data and adjusted their debt figures.

See? As I said at the time, this was a case of willful blindness by European bureaucrats and politicians, for which they frantically tried to blame Goldman Sachs when the shit finally hit the fan.

On September 2 I indulged myself with a rant on the Lori Douglas case and found it remarkable that tenure-track law professors couldn’t mount an actual argument. An ink-stained wretch, Judith Timson, managed it in the Globe on Friday, arguing (arguing!) in a column titled The net killed sexual privacy that Douglas showed poor judgment in allowing the photos to be taken and that this poor judgment disqualifies her from the judiciary.

Well, it’s a murky area and it’s very easy to add increments to the situation until most people will agree that the conduct is inappropriate, with nobody agreeing on which increment tipped the scale. But to stick with the situation as it is, I have to disagree and I’m going to disagree on the grounds that “judgment” is too broad a term – even if I allow for the sake of an argument that her judgment was poor in that instance and I’m not convinced it was.

Judgment is not fungible. There are lots of people whose judgment I would trust absolutely on some matters, but not on others. I see fixed income portfolios from lots of people that simply don’t make any sense at all – and it doesn’t affect my respect for their knowledge within their field of specialization. If Ms. Douglas showed “poor judgment” in the matter of her sexual relationship with her spouse (and I’m not saying she did), I don’t believe you can draw any conclusions about her judgment on the bench.

BUt OK. For the sake of an argument, let’s concede not just the first point – that allowing risque pictures to be take shows poor judgment – but the second one as well – that this poor judgment will be reflected in the judge’s judicial skills. I’m still not convinced that the Ms. Douglas deserves to lose her job, because I’m not sure whether there’s a net benefit to this.

If we insist on asking about the bare existence of naughty pictures as part of a prospective judge’s background check, we’re going to get lied to. A lot. Some people will honestly forget, some will figure it’s so long ago it doesn’t matter, some will figure it’s none of our business and some honestly won’t know. In such a case, what we are doing is increasing the chance for blackmail: if the pictures come to light, the judge will lose his job. I am by no means convinced that the change in standards is a net benefit.

Additionally, by loading down the process with many specific rules, we’re in danger of establishing “Gotcha Regulation”, the same that exists in the securities business. Do the bosses want to get rid of somebody? Put enough people on the case and it’s easy enough to find some rule that was broken.

Still: well done Ms. Timson for providing an actual argument! I wonder if she’s considered applying to law school? Not as a student; I mean, for a tenured position, job for life. status, pay, benefits … she could do a lot worse, and can obviously apply logic better than many of the incumbents.

Why am I spending time on this issue? Why is it is important? Because bureaucrats have contempt for the judicial process:

Wendy Vanstralen, 47, has been charged under the province’s stunt driving legislation.

Her truck has been impounded for a week, and she has also lost her licence for seven days.

Ms. Vanstralen is due in court Nov. 2.

… and that’s a scary thing. Especially when bank regulation is heading the same way.

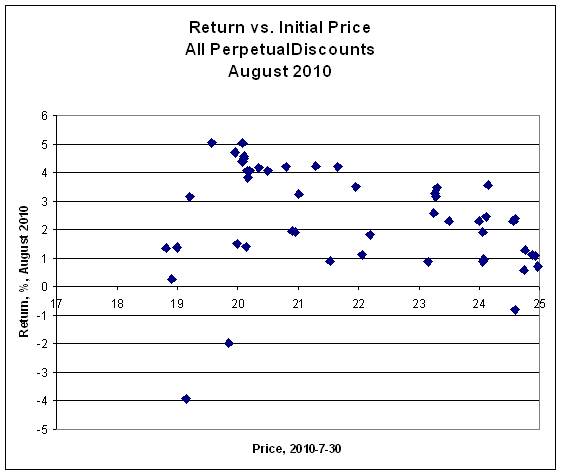

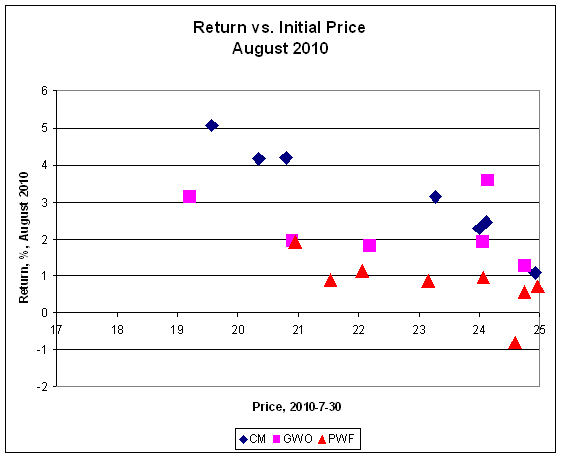

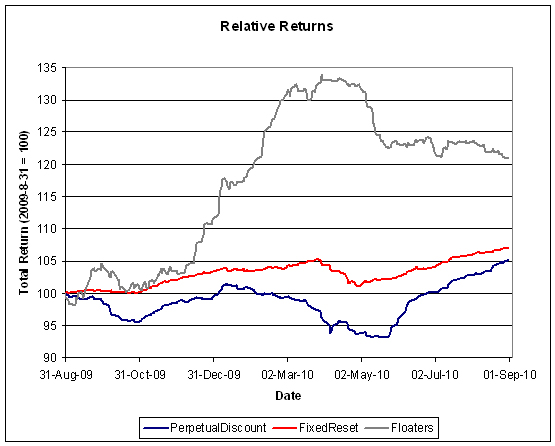

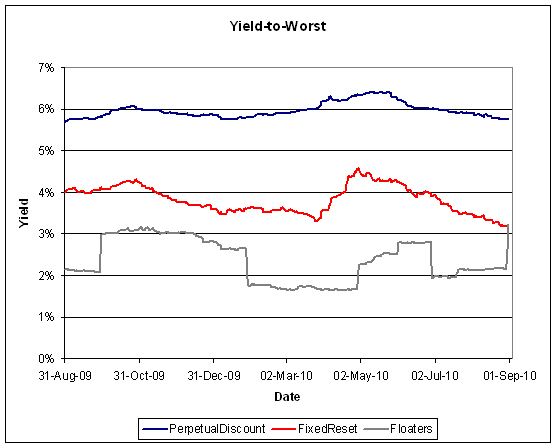

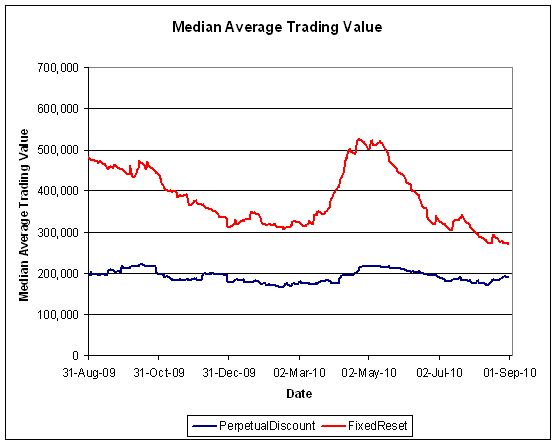

It was quite a good day on the Canadian preferred share market; volume was good, with PerpetualDiscounts gaining 16bp and FixedResets gaining 13bp … taking the YTW on the latter index down to 3.08%. Next stop: three percent! MFC continued to be highlighted on the volume table.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0756 % |

2,036.5 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0756 % |

3,085.0 |

| Floater |

2.73 % |

3.24 % |

56,932 |

19.05 |

3 |

0.0756 % |

2,198.9 |

| OpRet |

4.88 % |

2.93 % |

95,608 |

0.23 |

9 |

0.0601 % |

2,359.2 |

| SplitShare |

5.97 % |

-37.64 % |

65,698 |

0.09 |

2 |

0.3099 % |

2,357.3 |

| Interest-Bearing |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.0601 % |

2,157.2 |

| Perpetual-Premium |

5.74 % |

5.55 % |

123,348 |

5.38 |

14 |

0.1044 % |

1,971.4 |

| Perpetual-Discount |

5.68 % |

5.75 % |

189,036 |

14.21 |

63 |

0.1625 % |

1,914.9 |

| FixedReset |

5.26 % |

3.08 % |

271,205 |

3.33 |

47 |

0.1299 % |

2,259.6 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| SLF.PR.E |

Perpetual-Discount |

1.27 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-07

Maturity Price : 19.16

Evaluated at bid price : 19.16

Bid-YTW : 5.89 % |

| GWO.PR.J |

FixedReset |

1.48 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 27.40

Bid-YTW : 2.92 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| MFC.PR.A |

OpRet |

248,948 |

Nesbitt crossed two blocks of 100,000 each, both at 25.00. Nesbitt bought 14,200 from anonymous at 25.00; Desjardins crossed 17,800 at the same price.

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2015-12-18

Maturity Price : 25.00

Evaluated at bid price : 24.98

Bid-YTW : 4.11 % |

| MFC.PR.C |

Perpetual-Discount |

70,512 |

TD crossed 30,900 at 18.34.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2040-09-07

Maturity Price : 18.33

Evaluated at bid price : 18.33

Bid-YTW : 6.17 % |

| BNS.PR.Q |

FixedReset |

58,400 |

Desjardins crossed 15,900 at 26.60; TD crossed 15,200 at the same price.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2013-11-24

Maturity Price : 25.00

Evaluated at bid price : 26.62

Bid-YTW : 2.98 % |

| RY.PR.X |

FixedReset |

57,500 |

RBC crossed 55,000 at 28.05.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-09-23

Maturity Price : 25.00

Evaluated at bid price : 28.00

Bid-YTW : 3.17 % |

| GWO.PR.J |

FixedReset |

57,210 |

RBC crossed 53,900 at 27.35.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 27.40

Bid-YTW : 2.92 % |

| CIU.PR.B |

FixedReset |

56,675 |

RBC crossed blocks of 35,300 and 20,700, both at 28.25.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-01

Maturity Price : 25.00

Evaluated at bid price : 28.16

Bid-YTW : 3.22 % |

| There were 36 other index-included issues trading in excess of 10,000 shares. |