Turnover declined somewhat in December to about 40%. This is yet another indication that things are slowly returning to normal – although I still think that spreads to bonds are elevated!

Trades were, as ever, triggered by a desire to exploit transient mispricing in the preferred share market (which may the thought of as “selling liquidity”), rather than any particular view being taken on market direction, sectoral performance or credit anticipation.

| MAPF Sectoral Analysis 2009-12-31 | |||

| HIMI Indices Sector | Weighting | YTW | ModDur |

| Ratchet | 0% | N/A | N/A |

| FixFloat | 0% | N/A | N/A |

| Floater | 0% | N/A | N/A |

| OpRet | 0% | N/A | N/A |

| SplitShare | 4.2% (-0.1) | 8.34% | 7.05 |

| Interest Rearing | 0% | N/A | N/A |

| PerpetualPremium | 0.0% (-0.5) | N/A | N/A |

| PerpetualDiscount | 72.7% (+0.1) | 5.97% | 13.98 |

| Fixed-Reset | 16.6% (-1.6) | 3.62% | 3.89 |

| Scraps (OpRet) | 4.6% (+0.1) | 9.77% | 5.92 |

| Cash | 1.9% (+2.1) | 0.00% | 0.00 |

| Total | 100% | 5.74% | 11.38 |

| Totals and changes will not add precisely due to rounding. Bracketted figures represent change from November month-end. Cash is included in totals with duration and yield both equal to zero. | |||

The “total” reflects the un-leveraged total portfolio (i.e., cash is included in the portfolio calculations and is deemed to have a duration and yield of 0.00.). MAPF will often have relatively large cash balances, both credit and debit, to facilitate trading. Figures presented in the table have been rounded to the indicated precision.

Credit distribution is:

| MAPF Credit Analysis 2009-12-31 | |

| DBRS Rating | Weighting |

| Pfd-1 | 0 (0) |

| Pfd-1(low) | 82.5% (+4.2) |

| Pfd-2(high) | 0.1% (-4.8) |

| Pfd-2 | 1.1% (-1.3) |

| Pfd-2(low) | 9.7% (-0.4) |

| Pfd-3(high) | 4.6% (-0.1) |

| Cash | +1.9% (+2.1) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from November month-end. | |

The decline in holdings of issues rated Pfd-2(high) was due largely to the sale of HSB.PR.E:

| MAPF & HSB.PR.E | |||||

| Date | HSB.PR.E | NA.PR.P | RY.PR.X | RY.PR.R | CM.PR.L |

| 11/30 Bid Bid YTW |

28.06 4.02% |

27.80 3.86% |

27.70 3.85% |

27.62 3.68% |

27.86 3.88% |

| 12/8 | Bot More 28.12 |

Sold 27.99 |

|||

| 12.23 | Sold 28.05 |

Bot 27.95 |

|||

| 12/24 | Sold 28.12 |

Bot 27.98 |

|||

| 12/29 | Sold 28.15 |

Bot 27.88 |

|||

| 12/31 Bid Bid YTW |

28.10 3.71% |

28.06 3.72% |

28.06 3.63% |

28.07 3.35% |

27.92 3.55% |

| Dividends | 12/11 Earned 0.4125 |

12/23 Missed 0.40625 | |||

| This table attempts to present fairly the larger elements of a series of trades. Full disclosure of the 2009 trades will be made at the time the audited 2009 Financials are published. | |||||

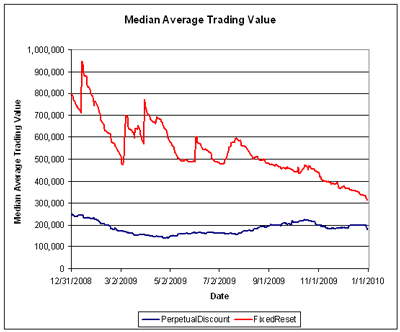

Liquidity Distribution is:

| MAPF Liquidity Analysis 2009-12-31 | |

| Average Daily Trading | Weighting |

| <$50,000 | 0.0% (0) |

| $50,000 – $100,000 | 0.0% (-5.0) |

| $100,000 – $200,000 | 18.9% (+12.0) |

| $200,000 – $300,000 | 45.1% (-12.8) |

| >$300,000 | 34.0% (+3.5) |

| Cash | +1.9% (+2.1) |

| Totals will not add precisely due to rounding. Bracketted figures represent change from November month-end. | |

MAPF is, of course, Malachite Aggressive Preferred Fund, a “unit trust” managed by Hymas Investment Management Inc. Further information and links to performance, audited financials and subscription information are available the fund’s web page. A “unit trust” is like a regular mutual fund, but is sold by offering memorandum rather than prospectus. This is cheaper, but means subscription is restricted to “accredited investors” (as defined by the Ontario Securities Commission) and those who subscribe for $150,000+. Fund past performances are not a guarantee of future performance. You can lose money investing in MAPF or any other fund.

A similar portfolio composition analysis has been performed on the Claymore Preferred Share ETF (symbol CPD) as of August 17 and published in the September PrefLetter. When comparing CPD and MAPF:

- MAPF credit quality is better

- MAPF liquidity is a little better

- MAPF Yield is higher

- Weightings in

- MAPF is much more exposed to PerpetualDiscounts

- MAPF is much less exposed to Operating Retractibles

- MAPF is more exposed to SplitShares

- MAPF is less exposed to FixFloat / Floater / Ratchet

- MAPF weighting in FixedResets is much lower