Goldman Sachs is making tons of money:

Goldman Sachs Group Inc. made more than $100 million in trading revenue on a record 46 separate days during the second quarter, or 71 percent of the time, breaking the previous high of 34 days in the prior three months.

Trading losses occurred on two days during the months of April, May and June, down from eight in the first quarter, the New York-based bank said today in a filing with the U.S. Securities and Exchange Commission. The company made at least $50 million on 58 of the 65 trading days during the quarter, or 89 percent of the time.

…

Banks such as Goldman Sachs are benefiting from lower borrowing costs after the Federal Deposit Insurance Corp. in October started guaranteeing bank debt issues that mature within three years. Goldman Sachs said in today’s filing it had $25.1 billion of debt guaranteed by the FDIC under the agency’s Temporary Liquidity Guarantee Program. The bank sold about $30 billion of the FDIC-backed securities between November and March, according to company filings.

There will be howls of outrage when they announce their bonuses next year! How much of this is due to the skill and salesmanship of their traders and sales desks and how much is due to the fact that smiley-boy has a big whack of capital behind him? You can bet that the politics of envy will be a major political theme in the coming year.

However, we must be fair. Particularly with respect to Flash Orders. It is only fair that large, politically connected companies be protected from that horrible competition stuff. Competition, you know, leads to bonuses:

The U.S. Securities and Exchange Commission’s move to ban so-called flash orders may help NYSE Euronext take back market share of U.S. stock trading at the expense of three-year-old rival Direct Edge Holdings LLC.

The debate regarding position limits in commodity futures is getting interesting:

John Hyland, chief investment officer for the world’s largest exchange-traded fund in natural gas, said assertions his company helped drive up energy prices were “self-serving statistical gibberish.”

…

Hyland’s Alameda, California-based U.S. Commodity Funds LLC owns a family of exchange-traded funds that invest in oil, gasoline, heating oil and natural gas. One of them, the United States Natural Gas Fund, has grown 11-fold since the start of the year, to 347.4 million shares outstanding.The fund ran out of new shares on July 7 and is seeking permission from the Securities and Exchange Commission to sell a billion more.

The $4.8 billion natural gas fund has at times owned almost 20 percent of the open interest in the near-month natural gas contract on the New York Mercantile Exchange, plus hundreds of thousands of natural gas swaps on the InterContinental Exchange.

Hyland said government-imposed caps would splinter large exchange-traded funds like his into smaller funds, reducing liquidity they provide to the futures market.

…

[CFTC Chairman Gary] Gensler said in the hearings last week that there is a consensus that position limits are needed in derivatives markets, leaving regulators to answer three questions: What should the limits be, who will set and monitor the rules, and who needs to be exempt?

…

“Position limits on financial contracts will decrease liquidity, increase transaction costs and increase volatility associated with expiration — all without achieving any of the reforms that the commission seeks,” said [John] Arnold, the founder of $5 billion energy hedge fund Centaurus Advisors LLC in Houston.

It depends a lot on what, precisely, is meant by “Exchange Traded Fund”. If it’s a straight pass-through, with one-share being equal to one barrel of oil, or one cubic meter of natural gas, or whatever, then I have no problems with it being exempt from the position limits. However, if it is indeed a straight pass-through, than this makes a mockery of the notion that it provides liquidity. You do not provide liquidity by taking a position, you suck it up. You do not provide liquidity by holding a position. You only provide liquidity by taking discretionary market action to offset actions of other market participants … and if you do that, you’re not an exchange-traded fund, you’re just another speculator and you should be subject to position limits.

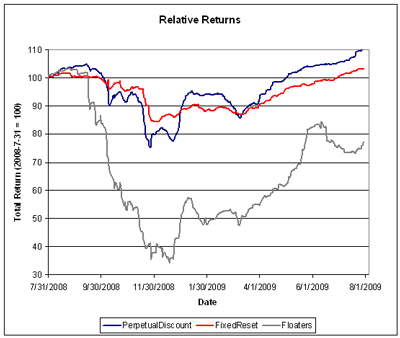

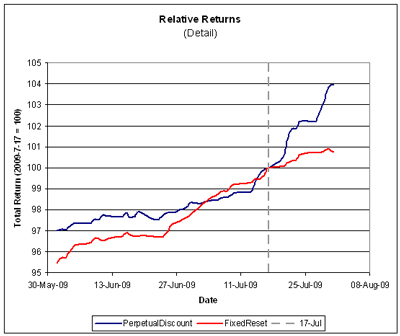

Another rip-roaring day for PerpetualDiscounts, which gained just over 84bp in total return (BMO went ex-dividend) to bring the weighted median YTW below 6% for the first time since September 12, 2008, just before Lehman’s bankruptcy. Very good volume today and FixedReset issues made it back to their accustomed (well, accustomed in the last six months, anyway) dominance of the volume highlights table.

PerpetualDiscounts now yield 5.99%, equivalent to 8.40% interest at the standard conversion factor of 1.4x. Long Corporates now yield 6.1%, so the pre-tax interest equivalent spread is now about 230bp, a widening from the 215bp estimate of July 31 and July 29.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.6047 % | 1,252.3 |

| FixedFloater | 7.02 % | 5.20 % | 42,513 | 17.01 | 1 | 1.3072 % | 2,188.9 |

| Floater | 3.64 % | 3.67 % | 71,438 | 18.12 | 2 | 0.6047 % | 1,564.5 |

| OpRet | 4.88 % | -4.14 % | 139,113 | 0.09 | 15 | 0.2772 % | 2,264.2 |

| SplitShare | 5.76 % | 6.45 % | 97,712 | 4.12 | 3 | 0.9449 % | 2,014.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2772 % | 2,070.4 |

| Perpetual-Premium | 5.74 % | 5.58 % | 78,203 | 13.92 | 4 | 0.3505 % | 1,852.2 |

| Perpetual-Discount | 5.93 % | 5.99 % | 173,449 | 13.89 | 67 | 0.8442 % | 1,732.2 |

| FixedReset | 5.49 % | 4.03 % | 548,833 | 4.17 | 40 | 0.1093 % | 2,101.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CIU.PR.A | Perpetual-Discount | -1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 20.10 Evaluated at bid price : 20.10 Bid-YTW : 5.83 % |

| PWF.PR.L | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 21.02 Evaluated at bid price : 21.02 Bid-YTW : 6.12 % |

| RY.PR.G | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 19.77 Evaluated at bid price : 19.77 Bid-YTW : 5.71 % |

| RY.PR.B | Perpetual-Discount | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 20.61 Evaluated at bid price : 20.61 Bid-YTW : 5.72 % |

| TD.PR.M | OpRet | 1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2009-09-04 Maturity Price : 26.00 Evaluated at bid price : 26.74 Bid-YTW : -26.92 % |

| GWO.PR.F | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 24.46 Evaluated at bid price : 24.75 Bid-YTW : 6.03 % |

| CM.PR.J | Perpetual-Discount | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 19.20 Evaluated at bid price : 19.20 Bid-YTW : 5.91 % |

| POW.PR.D | Perpetual-Discount | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 20.85 Evaluated at bid price : 20.85 Bid-YTW : 6.06 % |

| PWF.PR.F | Perpetual-Discount | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 21.62 Evaluated at bid price : 21.62 Bid-YTW : 6.12 % |

| RY.PR.H | Perpetual-Discount | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 24.68 Evaluated at bid price : 24.90 Bid-YTW : 5.68 % |

| GWO.PR.H | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 6.00 % |

| CM.PR.G | Perpetual-Discount | 1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 22.45 Evaluated at bid price : 22.61 Bid-YTW : 6.01 % |

| SLF.PR.E | Perpetual-Discount | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 19.04 Evaluated at bid price : 19.04 Bid-YTW : 5.99 % |

| SLF.PR.C | Perpetual-Discount | 1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 18.75 Evaluated at bid price : 18.75 Bid-YTW : 6.02 % |

| BAM.PR.G | FixedFloater | 1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 25.00 Evaluated at bid price : 15.50 Bid-YTW : 5.20 % |

| SLF.PR.B | Perpetual-Discount | 1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 20.14 Evaluated at bid price : 20.14 Bid-YTW : 6.04 % |

| PWF.PR.I | Perpetual-Discount | 1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 24.44 Evaluated at bid price : 24.75 Bid-YTW : 6.10 % |

| HSB.PR.D | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 6.01 % |

| TD.PR.Q | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 24.39 Evaluated at bid price : 24.61 Bid-YTW : 5.72 % |

| BNS.PR.J | Perpetual-Discount | 1.49 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 22.37 Evaluated at bid price : 23.09 Bid-YTW : 5.69 % |

| BAM.PR.P | FixedReset | 1.50 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 27.00 Bid-YTW : 5.54 % |

| MFC.PR.C | Perpetual-Discount | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 19.36 Evaluated at bid price : 19.36 Bid-YTW : 5.91 % |

| MFC.PR.B | Perpetual-Discount | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 19.83 Evaluated at bid price : 19.83 Bid-YTW : 5.96 % |

| BAM.PR.J | OpRet | 1.64 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 24.15 Bid-YTW : 6.03 % |

| TD.PR.R | Perpetual-Discount | 1.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 24.46 Evaluated at bid price : 24.68 Bid-YTW : 5.71 % |

| SLF.PR.D | Perpetual-Discount | 1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 18.78 Evaluated at bid price : 18.78 Bid-YTW : 6.01 % |

| BAM.PR.M | Perpetual-Discount | 1.86 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 17.01 Evaluated at bid price : 17.01 Bid-YTW : 7.10 % |

| BAM.PR.N | Perpetual-Discount | 2.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 16.90 Evaluated at bid price : 16.90 Bid-YTW : 7.14 % |

| IAG.PR.A | Perpetual-Discount | 2.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 18.42 Evaluated at bid price : 18.42 Bid-YTW : 6.34 % |

| MFC.PR.A | OpRet | 2.26 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2010-07-19 Maturity Price : 26.25 Evaluated at bid price : 26.66 Bid-YTW : 2.79 % |

| BNA.PR.C | SplitShare | 2.55 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 18.51 Bid-YTW : 8.57 % |

| RY.PR.F | Perpetual-Discount | 2.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 19.85 Evaluated at bid price : 19.85 Bid-YTW : 5.62 % |

| W.PR.J | Perpetual-Discount | 2.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 22.77 Evaluated at bid price : 23.05 Bid-YTW : 6.13 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| HSB.PR.E | FixedReset | 109,703 | Nesbitt crossed 60,000 at 27.80 and 40,000 at 27.81. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 27.80 Bid-YTW : 4.30 % |

| ACO.PR.A | OpRet | 102,553 | Desjardins crossed 100,000 at 26.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2009-09-04 Maturity Price : 26.00 Evaluated at bid price : 26.50 Bid-YTW : -5.86 % |

| RY.PR.A | Perpetual-Discount | 68,050 | RBC crossed blocks of 40,000 and 10,000 shares, both at 19.75. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 19.76 Evaluated at bid price : 19.76 Bid-YTW : 5.65 % |

| BMO.PR.O | FixedReset | 64,100 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-06-24 Maturity Price : 25.00 Evaluated at bid price : 27.77 Bid-YTW : 3.97 % |

| MFC.PR.D | FixedReset | 64,030 | RBC crossed 50,000 at 28.00. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-19 Maturity Price : 25.00 Evaluated at bid price : 28.02 Bid-YTW : 4.13 % |

| BNS.PR.L | Perpetual-Discount | 61,581 | RBC crossed 50,200 at 19.92. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-08-05 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 5.67 % |

| There were 54 other index-included issues trading in excess of 10,000 shares. | |||