| Quadravest SplitShare Corporations |

|||

| Ticker | Income Coverage 1H09 |

Asset Coverage 2009-7-15 |

Last PrefBlog Mention |

| LFE.PR.A | 1.2+:1 | 1.5+:1 | Capital Unit Dividends Reinstated |

BK.PR.A : Semi-Annual Financials

| Quadravest SplitShare Corporations |

|||

| Ticker | Income Coverage 1H09 |

Asset Coverage 2009-7-15 |

Last PrefBlog Mention |

| BK.PR.A | 1.5+:1 | 1.9+:1 | Ticker Change from PPL.PR.A |

DF.PR.A & DFN.PR.A : Semi-Annual Financials

| Quadravest SplitShare Corporations |

|||

| Ticker | Income Coverage 1H09 |

Asset Coverage 2009-7-15 |

Last PrefBlog Mention |

| DFN.PR.A | 1.4-:1 | 1.9-:1 | Downgraded Pfd-3 |

DF.PR.A | 1.2-:1 | 1.6+ | Downgraded Pdf-3(low) |

July 30, 2009

The campaign to ensure that retail’s choice of investment be restricted (or, at least, attract a blizzard of paper) has gained some ground, with American brokerages restricting sales:

Morgan Stanley and Wells Fargo & Co. are reviewing whether to continue sales of leveraged and inverse exchange-traded funds as regulators caution that the securities might not be suitable for individual investors.

…

UBS AG’s brokerage unit in New York, St. Louis-based Edward Jones and Ameriprise Financial Inc. of Minneapolis have halted sales of leveraged ETFs.

…

David Weiskopf, a Schwab spokesman, said the San Francisco- based company’s representatives don’t recommend leveraged ETFs.

…

Individual investors at Bank of America Corp. have been permitted to buy leveraged and inverse ETFs from its brokerage unit since 2006 only when they specifically request them, said Selena Morris, a spokeswoman for the Charlotte, North Carolina- based company.

Felix Salmon writes a review of High Frequency Trading that I found rather shallow; but some people like it. However, it looks like Flash orders will be prohibited:

NYSE Euronext, the world’s largest owner of stock exchanges, told the SEC in May that flash orders result in most investors getting worse prices. The practice is used by some high-frequency traders, who stream hundreds of bids and offers a minute and help pair off investor orders.

Analysts including Raymond James Financial Inc.’s Patrick O’Shaughnessy said earlier this week that regulators’ response to flash orders might result in restrictions on computer-driven trading, which could hurt profit for exchanges.

John Nester, a spokesman for the SEC, didn’t immediately return a telephone call seeking comment.

Bats CEO Joe Ratterman said today in an e-mail to clients that the Kansas City, Missouri-based exchange would support an industrywide ban on flash orders. Nasdaq CEO Robert Greifeld told Schumer July 28 that Nasdaq would also support a prohibition, according to a statement issued by the New York senator’s office.

Both introduced the systems over the past three months to compete against Direct Edge, which has gained market share through its three-year-old Enhanced Liquidity Provider program.

“If regulators get rid of it, or do anything to significantly circumscribe the program, it will hurt Direct Edge and help Nasdaq and NYSE,” Justin Schack, vice president of market structure analysis at New York-based Rosenblatt Securities Inc., said in an interview. “It takes away a big competitive weapon that Direct Edge used to gain market share.”

U.S. Senator Charles E. Schumer (D-NY) announced Tuesday that the head of the NASDAQ stock exchange supports his call to ban the practice of so-called “flash trading” that gives advance knowledge of stock orders to certain traders. Schumer said he was assured by Robert Greifeld, the CEO of NASDAQ, that the exchange, which has long prided itself on bringing transparency to public markets, began reluctantly offering the practice only after competing marketplaces did so.

I profoundly doubt whether anybody knows one way or the other whether pricing and liquidity are positively or negatively affected by Flash Orders; I don’t even know whether it would be possible to generalize about such a thing. But hell, facts don’t matter, right?

But it should be obvious that this is all about money anyway – who cares about trivialities like market efficiency?:

Both introduced the systems over the past three months to compete against Direct Edge, the trading platform that has gained market share through its three-year-old Enhanced Liquidity Provider program. Direct Edge, which is not regulated by the SEC, more than doubled its market share since November to 11.9 percent of the total volume traded in the U.S. in June by using revenue from its ELP program to cut other costs.

Preferred shares had another very good day, with PerpetualDiscounts rocketting up 72bp, with FixedResets putting in a decent performance of +10bp. Volume continued to be high (a nice day for RBC), with FixedResets again locked out of the volume highlights table … is the bloom off the rose?

It will be most fascinating to see what happens once we hit September and new issue season. I’m really not sure if issuers will be able to get anywhere near market rates for FixedResets … a rate of, say 4.25%+150 might find takers to be less enthusiastic than normal. On the other hand, recent market improvements suggest that they should be able to issue straight perpetuals at around 6%. Even paying 5%+225 would be a good improvement on that, but that would indicate a huge concession to market … we shall see!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.7004 % | 1,205.4 |

| FixedFloater | 7.13 % | 5.32 % | 38,119 | 16.88 | 1 | 1.6667 % | 2,153.6 |

| Floater | 3.16 % | 3.75 % | 73,226 | 17.94 | 3 | 0.7004 % | 1,505.9 |

| OpRet | 4.91 % | -3.63 % | 141,138 | 0.10 | 15 | 0.2972 % | 2,249.1 |

| SplitShare | 5.87 % | 6.65 % | 98,747 | 4.13 | 3 | 0.2752 % | 1,974.5 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2972 % | 2,056.6 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.7277 % | 1,846.6 |

| Perpetual-Discount | 6.01 % | 6.06 % | 162,458 | 13.82 | 71 | 0.7277 % | 1,700.7 |

| FixedReset | 5.50 % | 4.08 % | 558,129 | 4.16 | 40 | 0.0952 % | 2,097.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| SLF.PR.B | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 19.36 Evaluated at bid price : 19.36 Bid-YTW : 6.28 % |

| BAM.PR.M | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 16.35 Evaluated at bid price : 16.35 Bid-YTW : 7.38 % |

| GWO.PR.X | OpRet | 1.06 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2009-10-30 Maturity Price : 26.00 Evaluated at bid price : 26.74 Bid-YTW : -5.06 % |

| TD.PR.R | Perpetual-Discount | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 24.05 Evaluated at bid price : 24.25 Bid-YTW : 5.80 % |

| TD.PR.S | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 4.01 % |

| CM.PR.D | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 23.70 Evaluated at bid price : 24.00 Bid-YTW : 6.02 % |

| CM.PR.P | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 22.35 Evaluated at bid price : 22.91 Bid-YTW : 6.01 % |

| W.PR.J | Perpetual-Discount | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 22.31 Evaluated at bid price : 22.58 Bid-YTW : 6.25 % |

| CM.PR.J | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 18.88 Evaluated at bid price : 18.88 Bid-YTW : 6.00 % |

| MFC.PR.C | Perpetual-Discount | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 18.81 Evaluated at bid price : 18.81 Bid-YTW : 6.07 % |

| PWF.PR.F | Perpetual-Discount | 1.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 21.26 Evaluated at bid price : 21.26 Bid-YTW : 6.22 % |

| IAG.PR.C | FixedReset | 1.25 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 27.45 Bid-YTW : 3.96 % |

| HSB.PR.D | Perpetual-Discount | 1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 20.30 Evaluated at bid price : 20.30 Bid-YTW : 6.24 % |

| SLF.PR.A | Perpetual-Discount | 1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 19.21 Evaluated at bid price : 19.21 Bid-YTW : 6.27 % |

| BAM.PR.J | OpRet | 1.43 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 23.41 Bid-YTW : 6.48 % |

| CM.PR.H | Perpetual-Discount | 1.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 19.94 Evaluated at bid price : 19.94 Bid-YTW : 6.06 % |

| CIU.PR.A | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 20.36 Evaluated at bid price : 20.36 Bid-YTW : 5.75 % |

| GWO.PR.G | Perpetual-Discount | 1.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 21.50 Evaluated at bid price : 21.50 Bid-YTW : 6.13 % |

| BAM.PR.G | FixedFloater | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 25.00 Evaluated at bid price : 15.25 Bid-YTW : 5.32 % |

| CM.PR.I | Perpetual-Discount | 1.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 19.62 Evaluated at bid price : 19.62 Bid-YTW : 6.03 % |

| PWF.PR.K | Perpetual-Discount | 1.89 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 20.48 Evaluated at bid price : 20.48 Bid-YTW : 6.09 % |

| GWO.PR.I | Perpetual-Discount | 1.92 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 18.56 Evaluated at bid price : 18.56 Bid-YTW : 6.14 % |

| BAM.PR.B | Floater | 1.93 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 10.56 Evaluated at bid price : 10.56 Bid-YTW : 3.76 % |

| POW.PR.B | Perpetual-Discount | 2.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 21.70 Evaluated at bid price : 21.70 Bid-YTW : 6.23 % |

| POW.PR.A | Perpetual-Discount | 2.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 22.27 Evaluated at bid price : 22.54 Bid-YTW : 6.26 % |

| W.PR.H | Perpetual-Discount | 3.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 21.76 Evaluated at bid price : 22.06 Bid-YTW : 6.28 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.H | Perpetual-Discount | 144,352 | RBC crossed two blocks of 30,000 each at 19.97. Nesbitt bought blocks of 12,500 and 10,000 from anonymous at 20.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 19.94 Evaluated at bid price : 19.94 Bid-YTW : 6.06 % |

| POW.PR.C | Perpetual-Discount | 103,691 | RBC crossed 67,700 at 23.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 22.69 Evaluated at bid price : 22.93 Bid-YTW : 6.38 % |

| SLF.PR.A | Perpetual-Discount | 74,461 | Desjardins bought 25,000 from Nesbitt at 19.15. RBC crossed 25,000 at 19.16. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 19.21 Evaluated at bid price : 19.21 Bid-YTW : 6.27 % |

| BNS.PR.N | Perpetual-Discount | 61,990 | Nesbitt crossed 20,700 at 22.35. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 22.25 Evaluated at bid price : 22.36 Bid-YTW : 5.91 % |

| BAM.PR.B | Floater | 61,400 | RBC crossed 35,000 at 10.55. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 10.56 Evaluated at bid price : 10.56 Bid-YTW : 3.76 % |

| BMO.PR.L | Perpetual-Discount | 58,260 | RBC crossed 30,000 at 25.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-30 Maturity Price : 24.79 Evaluated at bid price : 25.01 Bid-YTW : 5.90 % |

| There were 42 other index-included issues trading in excess of 10,000 shares. | |||

FBS.PR.B: Capital Unit Dividend Reinstated

5Banc Split Inc. has announced:

that it has declared a quarterly dividend on its Preferred Shares of $0.11875 per Preferred Share and on its Capital Shares of $0.05 per Capital Share. The Capital Share dividend has been reinstated due to improved market conditions for the underlying portfolio securities. The dividends on both the Preferred Shares and Capital Shares are payable on September 15, 2009 to holders of record on August 31, 2009.

Capital Unitholders have missed two dividends, the dividend suspension was announced in January. The NAV of the company was reported to be $15.74 as of July 23.

FBS.PR.B was last mentioned on PrefBlog when it was downgraded to Pfd-4 by DBRS as part of the February mass-downgrade. It is tracked by HIMIPref™, but has been relegated to the Scraps index on credit concerns.

July 29, 2009

Good column by Jane Bryant Quinn on Bloomberg, Money Funds Are Ripe for ‘Radical Surgery.

Quadravest has announced semi-annual results for most of its funds (DF, DFN, FTN, FFN …), but neither the announcements nor the semi-annual statements are yet available. I’ll post links when this situation changes.

I’ve been very pleased with the response to yesterday‘s plea for reviews of my essay on Preferred Shares and GICs. There is definitely more work to be done on the essay … more comments will be appreciated, and those who would like to review the first draft may still eMail me to receive it.

Another very good day for the Canadian preferred share market, with PerpetualDiscounts posting a gain of 0.45%, bringing their median YTW to 6.10%. This is equivalent to 8.54% interest at the standard equivalency factor of 1.4x, while long corporates remain at about 6.4%, having returned +1.36% month-to-date and +19.15% year-to-date. The pre-tax interest-equivalent spread is thus about 215bp, tightening in about 15bp in the week since July 22, but still above the Credit Crunch norm of about 200bp and, of course, well above the pre-Credit Crunch range of 100-150bp.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.1349 % | 1,197.0 |

| FixedFloater | 7.25 % | 5.42 % | 36,209 | 16.74 | 1 | 1.2146 % | 2,118.3 |

| Floater | 3.18 % | 3.78 % | 72,718 | 17.89 | 3 | 0.1349 % | 1,495.4 |

| OpRet | 4.92 % | -0.92 % | 141,549 | 0.09 | 15 | 0.2955 % | 2,242.4 |

| SplitShare | 5.89 % | 6.75 % | 98,111 | 4.13 | 3 | 0.5096 % | 1,969.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2955 % | 2,050.5 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4504 % | 1,833.3 |

| Perpetual-Discount | 6.06 % | 6.10 % | 163,397 | 13.75 | 71 | 0.4504 % | 1,688.4 |

| FixedReset | 5.50 % | 4.10 % | 565,938 | 4.19 | 40 | 0.0731 % | 2,095.2 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.P | FixedReset | -1.15 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 26.75 Bid-YTW : 5.73 % |

| BMO.PR.L | Perpetual-Discount | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 24.68 Evaluated at bid price : 24.90 Bid-YTW : 5.93 % |

| GWO.PR.F | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 23.72 Evaluated at bid price : 24.00 Bid-YTW : 6.21 % |

| NA.PR.L | Perpetual-Discount | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 5.94 % |

| TD.PR.O | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 21.15 Evaluated at bid price : 21.15 Bid-YTW : 5.77 % |

| CM.PR.J | Perpetual-Discount | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 18.65 Evaluated at bid price : 18.65 Bid-YTW : 6.07 % |

| RY.PR.W | Perpetual-Discount | 1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 21.11 Evaluated at bid price : 21.11 Bid-YTW : 5.82 % |

| BAM.PR.G | FixedFloater | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 25.00 Evaluated at bid price : 15.00 Bid-YTW : 5.42 % |

| PWF.PR.E | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 21.82 Evaluated at bid price : 22.15 Bid-YTW : 6.23 % |

| BAM.PR.J | OpRet | 1.45 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 23.08 Bid-YTW : 6.69 % |

| GWO.PR.H | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 19.60 Evaluated at bid price : 19.60 Bid-YTW : 6.27 % |

| MFC.PR.C | Perpetual-Discount | 2.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 18.58 Evaluated at bid price : 18.58 Bid-YTW : 6.15 % |

| IGM.PR.A | OpRet | 2.42 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2009-08-28 Maturity Price : 26.00 Evaluated at bid price : 27.51 Bid-YTW : -50.28 % |

| POW.PR.D | Perpetual-Discount | 2.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 20.60 Evaluated at bid price : 20.60 Bid-YTW : 6.13 % |

| BNA.PR.C | SplitShare | 2.57 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 17.56 Bid-YTW : 9.30 % |

| BMO.PR.H | Perpetual-Discount | 2.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 22.49 Evaluated at bid price : 23.20 Bid-YTW : 5.78 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.E | FixedReset | 96,748 | RBC crossed blocks of 30,000 and 25,000 shares at 27.62 and bought two blocks (10,000 and 12,000 shares) from National at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.63 Bid-YTW : 3.90 % |

| TD.PR.K | FixedReset | 48,602 | Desjardins crossed 11,300 at 27.54 and bought 11,100 from National at 27.58. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.59 Bid-YTW : 4.03 % |

| BMO.PR.L | Perpetual-Discount | 45,530 | Scotia crossed 24,200 shares at 24.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 24.68 Evaluated at bid price : 24.90 Bid-YTW : 5.93 % |

| BMO.PR.P | FixedReset | 42,385 | Scotia crossed 23,700 at 26.60. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 4.25 % |

| RY.PR.G | Perpetual-Discount | 39,815 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-29 Maturity Price : 19.27 Evaluated at bid price : 19.27 Bid-YTW : 5.85 % |

| RY.PR.Y | FixedReset | 37,420 | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-24 Maturity Price : 25.00 Evaluated at bid price : 27.40 Bid-YTW : 4.07 % |

| There were 41 other index-included issues trading in excess of 10,000 shares. | |||

Covered Calls

I’ve been interested in this topic for a while (due to the prevalence of covered call writing strategies in SplitShare corporations) and now (with a hat tip to Financial Webring Forum) I’ve found a study on historical index performance, Passive Options-based Investment Strategies: The Case of the CBOE S&P 500 BuyWrite Index:

This paper assesses the investment value of the CBOE S&P 500 BuyWrite (BXM) Index and its covered call investment strategy to an investor from the total portfolio perspective. Whaley [2002] finds risk-adjusted performance improvement based on the BXM Index in individual comparison to the S&P 500. We replicate this work with a longer history for the BXM Index and with the short but meaningful history of the Rampart Investment Management investable version of the BXM. We use the Stutzer [2000] index and Leland’s [1999] alpha to assess risk-adjusted performance taking the skew and kurtosis of the covered call strategy into account. Additionally, we compare standard investor portfolios to portfolios where BXM has been substituted for large cap assets and find significant risk-adjusted performance improvement.

The compound annual return of the BXM Index over the almost 16-year history of this study is 12.39%, compared to 12.20% for the S&P 500. Risk-adjusted performance, as measured by the Stutzer index, is 0.22 for the BXM versus 0.16 for the S&P 500 [monthly]. Leland’s alpha is 2.81%/yr. The tracking error of the Rampart investable version of the BXM (1.27%/yr) is found to be credible evidence of the investability of the BXM Index.

Known sources of BXM return are reviewed and behavioral factors that may have enhanced BXM performance are considered.

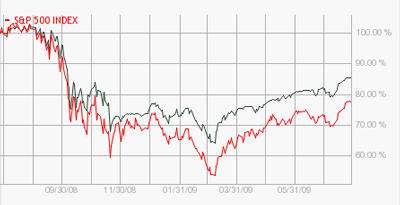

Surprisingly – to me – performance relative to the S&P 500 seems to have held up through the massive gyrations of this spring:

Five Year Chart

One Year Chart

The CBOE has a web page devoted to their BXM index. There is another index created through cash covered put writing.

Update, 2009-9-29: Assiduous Reader prefhound has commented on BXM on another thread.

July 28, 2009

A bit more on Flash Order controversy:

But critics, notably Charles Schumer, a senior Democrat on the Senate banking panel, contend that flash orders are not being shown to all investors at the same time, creating a two-tier market. This, they say, favours traders with faster and more powerful trading systems.

…

But calls to ban flash orders have met resistance from Direct Edge, a leading market provider. William O’Brien, chief executive of Direct Edge, said: “If these types of programs are banned, it will drive liquidity away from exchanges and perpetuate a two-tier market.” The Direct Edge system was available to any brokerage that wished to participate, he said.BATS also said any trading firm could submit flash orders with its system and it was “ready to participate in an industry review of potential issues associated with them, including the possibility that they create a two-tier market”.

Imagine, a system that favours sellers of trading systems who offer their clients fast, powerful trading systems! Scandalous!

There’s an article on Bloomberg giving a defense of HFT:

About 46 percent of daily volume is handled through high- frequency strategies, according to estimates by NYSE Euronext, the world’s largest owner of stock exchanges. The transactions are made by about 400 of the 20,000 firms trading stocks in the U.S., according to Tabb Group LLC, a New York-based financial services consultant. Each makes bets in hundredths of a second to exploit tiny price swings in equities and discrepancies in futures, options and exchange-traded funds.

The firms compete for $21.8 billion in annual profits, according to Tabb. Among the largest are hedge funds Citadel Investment Group LLC, D.E. Shaw & Co. and Renaissance Technologies Corp., as well as the automated brokerages Getco LLC, Hudson River Trading LLC and Wolverine Trading LLC. Rapid- fire strategies helped equity volume more than double in the U.S. since 2006 to a record 10.8 billion shares a day last year, Nasdaq OMX Group Inc. data show.

High-frequency programs look for patterns in securities markets. A typical strategy is based on the likelihood that a stock that rose over the past 20 hours will pare its gain, said Irene Aldridge, managing partner at Toronto-based Able Alpha Trading Ltd., a high-speed proprietary trading firm. Others sift through thousands of quotes to calculate the probability of a shift in the market.

$21.8-billion! Assiduous Readers will note that all these trades are nothing more than an attempt to provide liquidity to the markets better, cheaper and faster than other attempts. Liquidity is good; liquidity means that Joe Retail can buy at 21.05 rather than the 21.15 he’d have to pay without it.

There’s a story by Ivy Schmerken on Advanced Trading:

Nasdaq is offering a second order type, called the INET-Only Flash, which exposes the order to participants for execution, without routing out to the public markets. “This will give customers the ability to get very aggressive and flash an order out to our ITCH participants or (market data) vendors, (i.e., Bloomberg or Reuters) and stay there for up to 500 milliseconds. If there is no execution, it will most likely cancel back to them,” according to Hyndman.

But the topic of flash orders is sparking considerable debate in the industry over whether holding these orders for fractions of a second and showing them to a large class of market participants and market data vendors is fair to investors. In a letter filed with the SEC on Friday, NYSE Euronext, operator of the New York Stock Exchange, opposed the practice, and asked the regulator to intervene in Nasdaq’s and BATS’s plans.

In the letter, NYSE Euronext argues that the Nasdaq Stock Market and BATS Exchange filings, “each propose to modify their respective routing strategies to provide preferential treatment for their own market participants before routing orders to away markets. “

…

However, Hyndman rejects the notion that orders are being flashed via a private network. “It’s not a private network, because anyone can become an ITCH participant if they choose it,” said Hyndman.

On the general topic of trade mechanics, the NYSE has announced fee changes:

The New York Stock Exchange will charge a fee of at least 5 cents per 100 shares for trades executed during the opening and closing auctions starting next month. Opening trades, which were previously executed at no cost, will have a fee cap of $10,000 a month, the exchange said in an e-mailed notice to clients.

The Big Board will also reduce its trading fees for customers that handle at least 130 million shares a month. Those clients will pay a transaction fee of 17 cents per 100 shares, down 1 cent from before.

I admit to being perplexed by the special charges on opening and closing transactions. If anybody has insight, let me know!

Remember Jerome Kerviel? He was last mentioned on PrefBlog on April 29 – he’s the guy who was left holding SocGen’s incompetent management hot potato when everything blew up and is now being scapegoated. Anyway, a decision is imminent regarding whether or not he will go to trial:

The defense’s response is the final step before investigating judges Renaud Van Ruymbeke and Francoise Desset decide early September whether Kerviel should stand trial. Any trial wouldn’t be before 2010. The probe began less than a week after Societe Generale disclosed the loss on Jan. 24, 2008, after selling his positions.

“In 2007, he was making money and they let him go on,” Metzner said. “In 2008, it all went bad, the machine was exposed, they unwound the positions in a panic and they created losses.”

The FDIC’s proposals on rules regarding private-equity purchases of banks, discussed on July 3, have drawn fire from a player:

“I assure you that my firm will never again bid if the proposed policy statement is adopted in its present form,” he wrote in a letter to the FDIC as part of the regulator’s public- comment process for the rules issued July 2. Ross’s firm was among the buyers of failed BankUnited Financial Corp. in May.

…

Terms proposed by the FDIC include requiring banks bought by private-equity firms to maintain a Tier 1 capital ratio of 15 percent, almost twice the level usually required for a startup bank. Tier 1 capital is a measure of a bank’s ability to absorb losses. The agency would also require the firms to hold onto their investments for at least three years.Private-equity managers including Ross are balking at the higher capital requirement, saying it will lower the price they’re willing to pay or cause them to pass on transactions. The Private Equity Council, a Washington-based industry trade group, said July 2 the guidelines may curtail investors’ interest.

Ross, 71, teamed up with Blackstone Group LP, Carlyle Group and Centerbridge Capital Partners LLC to buy the assets of BankUnited Financial after the Florida lender was seized by the FDIC. The buyers agreed to a capital ratio of about 8 percent and told regulators they wouldn’t sell their interests in the bank for 18 months.

Sensing which way the wind is blowing, and with a very good idea of which side their bread is buttered on, the CFTC has decided speculators are evil:

The Commodity Futures Trading Commission will next month say speculators played a role in driving changes in crude oil prices, the Wall Street Journal reported citing an interview with Commissioner Bart Chilton.

The report will reverse findings from last year that attributed volatile oil price movements to supply and demand, the Journal reported. That analysis was based on “deeply flawed data,” the newspaper said, citing Chilton.

I’ve just completed an essay titled Preferred Shares and GICs, which I intend to use for advertising purposes. If anybody would care for a review copy – by which I mean, I would appreciate pre-publication comments – please eMail me. Note that this essay is aimed at relatively unsophisticated investors and has the objective of emphasizing that fixed income doesn’t begin and end with 5-year GIC ladders.

PerpetualDiscounts roared ahead today in the Canadian preferred market on heavy volume. For a wonder, FixedResets were entirely locked out of the volume highlights table!

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 1.4782 % | 1,195.4 |

| FixedFloater | 7.34 % | 5.50 % | 36,463 | 16.64 | 1 | -1.2000 % | 2,092.8 |

| Floater | 3.19 % | 3.81 % | 75,238 | 17.82 | 3 | 1.4782 % | 1,493.4 |

| OpRet | 4.94 % | -0.35 % | 137,070 | 0.09 | 15 | 0.0986 % | 2,235.8 |

| SplitShare | 5.92 % | 6.83 % | 98,874 | 4.13 | 3 | 0.9555 % | 1,959.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0986 % | 2,044.4 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4212 % | 1,825.1 |

| Perpetual-Discount | 6.08 % | 6.13 % | 161,223 | 13.70 | 71 | 0.4212 % | 1,680.9 |

| FixedReset | 5.51 % | 4.09 % | 585,235 | 4.20 | 40 | -0.0194 % | 2,093.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| CM.PR.K | FixedReset | -2.18 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 26.01 Bid-YTW : 4.45 % |

| BMO.PR.H | Perpetual-Discount | -1.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 22.09 Evaluated at bid price : 22.55 Bid-YTW : 5.97 % |

| TD.PR.P | Perpetual-Discount | -1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 22.85 Evaluated at bid price : 23.00 Bid-YTW : 5.73 % |

| BNS.PR.R | FixedReset | -1.28 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-02-25 Maturity Price : 25.00 Evaluated at bid price : 25.52 Bid-YTW : 4.49 % |

| BAM.PR.G | FixedFloater | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 25.00 Evaluated at bid price : 14.82 Bid-YTW : 5.50 % |

| GWO.PR.J | FixedReset | -1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.95 Bid-YTW : 4.22 % |

| SLF.PR.B | Perpetual-Discount | 1.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 19.15 Evaluated at bid price : 19.15 Bid-YTW : 6.35 % |

| BAM.PR.J | OpRet | 1.02 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2018-03-30 Maturity Price : 25.00 Evaluated at bid price : 22.75 Bid-YTW : 6.91 % |

| BMO.PR.L | Perpetual-Discount | 1.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 24.43 Evaluated at bid price : 24.65 Bid-YTW : 5.99 % |

| HSB.PR.C | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 21.12 Evaluated at bid price : 21.12 Bid-YTW : 6.12 % |

| IAG.PR.C | FixedReset | 1.17 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.91 Bid-YTW : 4.46 % |

| BAM.PR.H | OpRet | 1.19 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2012-03-30 Maturity Price : 25.00 Evaluated at bid price : 25.56 Bid-YTW : 5.06 % |

| BAM.PR.P | FixedReset | 1.39 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 27.06 Bid-YTW : 5.46 % |

| BNA.PR.D | SplitShare | 1.43 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-07-09 Maturity Price : 25.00 Evaluated at bid price : 25.56 Bid-YTW : 6.83 % |

| SLF.PR.A | Perpetual-Discount | 1.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 18.99 Evaluated at bid price : 18.99 Bid-YTW : 6.34 % |

| PWF.PR.I | Perpetual-Discount | 1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 23.60 Evaluated at bid price : 23.90 Bid-YTW : 6.31 % |

| W.PR.J | Perpetual-Discount | 1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 22.07 Evaluated at bid price : 22.30 Bid-YTW : 6.33 % |

| NA.PR.K | Perpetual-Discount | 1.74 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 23.67 Evaluated at bid price : 23.97 Bid-YTW : 6.11 % |

| MFC.PR.B | Perpetual-Discount | 1.80 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 19.25 Evaluated at bid price : 19.25 Bid-YTW : 6.13 % |

| ELF.PR.G | Perpetual-Discount | 2.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 6.90 % |

| TRI.PR.B | Floater | 2.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 16.30 Evaluated at bid price : 16.30 Bid-YTW : 2.43 % |

| PWF.PR.G | Perpetual-Discount | 4.02 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 23.27 Evaluated at bid price : 23.57 Bid-YTW : 6.29 % |

| W.PR.H | Perpetual-Discount | 4.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 21.35 Evaluated at bid price : 21.35 Bid-YTW : 6.51 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| ACO.PR.A | OpRet | 210,120 | Desjardins crossed three blocks, 53,000 shares, 50,000 and 106,100, all at 26.50. YTW SCENARIO Maturity Type : Call Maturity Date : 2009-08-27 Maturity Price : 26.00 Evaluated at bid price : 26.35 Bid-YTW : -0.35 % |

| PWF.PR.H | Perpetual-Discount | 139,679 | RBC crossed 134,000 at 22.95. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 22.71 Evaluated at bid price : 22.95 Bid-YTW : 6.30 % |

| SLF.PR.D | Perpetual-Discount | 48,174 | RBC crossed 38,100 at 18.40. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 18.26 Evaluated at bid price : 18.26 Bid-YTW : 6.17 % |

| RY.PR.G | Perpetual-Discount | 44,145 | Anonymous crossed (?) 12,000 at 19.23. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 19.19 Evaluated at bid price : 19.19 Bid-YTW : 5.88 % |

| CM.PR.H | Perpetual-Discount | 42,198 | RBC crossed 20,000 at 19.50. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 19.48 Evaluated at bid price : 19.48 Bid-YTW : 6.20 % |

| SLF.PR.A | Perpetual-Discount | 39,176 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-28 Maturity Price : 18.99 Evaluated at bid price : 18.99 Bid-YTW : 6.34 % |

| There were 52 other index-included issues trading in excess of 10,000 shares. | |||

July 27, 2009

The latest controversy is Flash Trading:

Charles Schumer, the third-ranking Democrat in the U.S. Senate, asked the Securities and Exchange Commission to ban so-called flash orders for stocks, saying they give high-speed traders an unfair advantage.

Schumer’s letter to SEC Chairman Mary Schapiro yesterday raised the stakes in a debate over the practice offered by Nasdaq OMX Group Inc., Bats Global Markets and Direct Edge Holdings LLC, which handle more than two-thirds of the shares traded in the U.S. With flash orders, exchanges wait up to half a second before they publish bids and offers on competing platforms, giving their own customers an opportunity to gauge demand before other traders.

The NYSE letter to the SEC has more details, but I must say I just don’t get it. As far as I can make out, the NYSE believes that Flash Trading will put traders who don’t work hard enough at a disadvantage. To which I say: So?

The Globe had a story on Saturday claiming regulators are seeking record settlements with respect to the ABCP fiasco:

Much of the regulatory attention is being paid to banks that sold the commercial paper. On July 24, 2007, dealers received an e-mail from Coventree disclosing some of its trusts’ exposures to U.S. subprime mortgage assets. Regulators have been focused on when institutions learned that ABCP had become infected by the troubled mortgages, and whether they profited by selling the notes from their own inventories to clients.

Settlements, eh? Regarding disclosure? Now, I’m certainly not going to take a stand in favour of incomplete disclosure, but I have a really hard time comprehending why that is the major issue. The way I see it, the major issues are:

- Portfolio Concentration, particularly with respect to retail clients putting an enormous chunk of their portfolios into a single name

- Portfolio Manager independence, as discussed on August 20, 2007

- Related to the above, the question of whether investment recommendations and actions were genuinely distinct from decisions in other parts of firms to invest in packagers of ABCP

- Why implicit bank guarantees are not included in their Risk-Weighted Assets (a matter of bank regulation rather than securities regulation, but I’ll put it in the list anyway)

- Why are there cash settlements? I’m sick and bloody tired of charlatans buying ‘their way out of trouble. If any advisor put any client into ABCP to the extent of more than 10% of net worth, that advisor should be in serious jeopordy of losing his license. His firm should be fined, certainly, for it’s dim-bulb supervision, but the advisor should be gone … and those responsible for compliance should be pretty damn nervous. But watch. It will just be fines, the only question being whether it’s one day’s profit, or two.

There shouldn’t be much surprise regarding hedge fund mobility news:

— David Butler, who advises hedge funds on tax issues, says he helped 23 firms leave London in the past 18 months, most of them for Switzerland.

“Managers do not feel there is a good relationship with politicians,” said Butler, founder of Kinetic Partners LLP in London. “When it is announced that taxes will go up, without any consultations, people understand there may be more on the way and they think the lifestyle they can have somewhere else is better than in London.”

Nova Scotia Power, proud issuers of NSI.PR.D, announced a 30-year bond issue today:

Nova Scotia Power Inc. completed the issue of $200 million Series W Medium Term Notes. The Series W Notes bear interest at the rate of 5.95% and yield 5.974% per annum until July 27, 2039.

The Offering was made to the public through a syndicate of agents co-led by TD Securities Inc. and RBC Dominion Securities Inc., and included CIBC World Markets Inc., Scotia Capital Inc., BMO Nesbitt Burns Inc., Merrill Lynch Canada Inc. and National Bank Financial Inc.

The net proceeds of the Offering will be used to repay short term borrowings.

Another good trading day for Canadian preferred shares, with high volume, not much direction (PerpetualDiscounts were off just a tad; FixedResets up very slightly) and a fair amount of price volatility.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2730 % | 1,178.0 |

| FixedFloater | 7.25 % | 5.43 % | 36,031 | 16.73 | 1 | 0.0000 % | 2,118.3 |

| Floater | 3.23 % | 3.84 % | 76,103 | 17.75 | 3 | -0.2730 % | 1,471.7 |

| OpRet | 4.94 % | -5.08 % | 138,814 | 0.09 | 15 | 0.2340 % | 2,233.6 |

| SplitShare | 6.04 % | 6.70 % | 89,340 | 4.12 | 4 | 0.1613 % | 1,940.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.2340 % | 2,042.4 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0499 % | 1,817.4 |

| Perpetual-Discount | 6.11 % | 6.15 % | 160,145 | 13.68 | 71 | -0.0499 % | 1,673.8 |

| FixedReset | 5.51 % | 4.07 % | 582,083 | 4.20 | 40 | 0.0750 % | 2,094.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| W.PR.H | Perpetual-Discount | -4.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 6.78 % |

| PWF.PR.G | Perpetual-Discount | -3.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 22.37 Evaluated at bid price : 22.66 Bid-YTW : 6.54 % |

| W.PR.J | Perpetual-Discount | -2.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 21.69 Evaluated at bid price : 21.94 Bid-YTW : 6.43 % |

| TRI.PR.B | Floater | -2.15 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 15.90 Evaluated at bid price : 15.90 Bid-YTW : 2.49 % |

| IAG.PR.A | Perpetual-Discount | -1.30 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 17.52 Evaluated at bid price : 17.52 Bid-YTW : 6.65 % |

| PWF.PR.H | Perpetual-Discount | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 22.35 Evaluated at bid price : 22.76 Bid-YTW : 6.34 % |

| MFC.PR.C | Perpetual-Discount | -1.20 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 18.15 Evaluated at bid price : 18.15 Bid-YTW : 6.29 % |

| IAG.PR.C | FixedReset | -1.19 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.60 Bid-YTW : 4.76 % |

| PWF.PR.I | Perpetual-Discount | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 23.25 Evaluated at bid price : 23.53 Bid-YTW : 6.41 % |

| BAM.PR.P | FixedReset | -1.04 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-30 Maturity Price : 25.00 Evaluated at bid price : 26.69 Bid-YTW : 5.77 % |

| CM.PR.M | FixedReset | 1.09 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.76 Bid-YTW : 4.11 % |

| TD.PR.O | Perpetual-Discount | 1.21 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 20.93 Evaluated at bid price : 20.93 Bid-YTW : 5.83 % |

| RY.PR.C | Perpetual-Discount | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 5.76 % |

| BAM.PR.I | OpRet | 1.61 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 25.30 Bid-YTW : 5.33 % |

| BAM.PR.B | Floater | 1.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 10.32 Evaluated at bid price : 10.32 Bid-YTW : 3.84 % |

| GWO.PR.J | FixedReset | 1.98 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 27.25 Bid-YTW : 3.94 % |

| BAM.PR.O | OpRet | 2.14 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 24.86 Bid-YTW : 5.30 % |

| CIU.PR.A | Perpetual-Discount | 3.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 5.85 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| SLF.PR.A | Perpetual-Discount | 197,978 | Somebody’s selling a bucketful of these; they have been a fixture on the volume chart for over a week, with yields way over the other SunLifes. National crossed two blocks of 21,000, both at 18.73, and bought 20,000 from anonymous at the same price. National bought another 10,000 from anonymous at 18.74. Nesbitt crossed 15,000 at 18.73. RBC crossed 50,000 at 18.74. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 18.71 Evaluated at bid price : 18.71 Bid-YTW : 6.43 % |

| BNS.PR.N | Perpetual-Discount | 117,300 | Scotia bought 50,000 from Nesbitt at 22.15; Nesbitt crossed 40,000 and Desjardins crossed 10,000 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 22.06 Evaluated at bid price : 22.16 Bid-YTW : 5.96 % |

| TD.PR.O | Perpetual-Discount | 66,908 | National bought 25,000 from anonymous at 20.74, then crossed the same amount at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 20.93 Evaluated at bid price : 20.93 Bid-YTW : 5.83 % |

| CM.PR.H | Perpetual-Discount | 48,492 | RBC crossed 30,000 at 19.50. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 19.44 Evaluated at bid price : 19.44 Bid-YTW : 6.21 % |

| RY.PR.B | Perpetual-Discount | 39,005 | Anonymous crossed (?) 23,000 at 19.99. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-07-27 Maturity Price : 20.00 Evaluated at bid price : 20.00 Bid-YTW : 5.89 % |

| BNA.PR.D | SplitShare | 36,275 | Recent new issue. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2014-07-09 Maturity Price : 25.00 Evaluated at bid price : 25.20 Bid-YTW : 7.18 % |

| There were 47 other index-included issues trading in excess of 10,000 shares. | |||

FIG.PR.A: Rights Offering on Capital Units

Faircourt Asset Management has announced:

the final terms of the distribution to its unitholders of rights (the “Rights”) exercisable for units (“Units”) of the Trust (the “Rights Offering”). Each Unit consists of one trust unit of the Trust (a “Trust Unit”) and one transferable warrant to acquire a Trust Unit (a “Warrant”). Each Warrant entitles the holder thereof to purchase one Trust Unit on, and only on, June 25, 2010 at a subscription price of $4.00. The distribution is being made pursuant to a short form prospectus dated July 14, 2009. TD Securities Inc. is the dealer manager for the Rights Offering.

Under the Rights Offering, holders of the Trust Units as of the close of business on July 22, 2009 received one Right for each Trust Unit held as of the record date. Each Right will entitle the holder thereof to purchase one Unit at a subscription price of $2.30. The Rights will expire at 4:00 pm (Toronto time) on August 27, 2009.

The Rights Offering included an additional subscription privilege under which holders of Rights who fully exercise their Rights will be entitled to subscribe for additional Units, if available, that were not otherwise subscribed for in the Rights Offering.

The Trust will use the net proceeds of this issue to increase capital for investment.

As of July 24, the NAV of each Capital Unit was $3.96 and as of Dec. 31, 2008:

the Trust had 5,344,946 Trust Units Fund Performance outstanding and trading at $0.80 per Trust Unit, a discount to the underlying NAV of 59%. Closed end trusts may trade above, at or below their NAV per unit.

As at December 31, 2008, the Trust had 9,964,308 Preferred Securities outstanding representing a total liability of $99.64 million.

Income coverage of the FIG.PR.A distribution in 2008 was 1.4-:1; asset coverage at year-end was originally reported as 1.1-:1, and adjusted later. Assuming there have been no changes in outstanding shares, asset coverage (from the NAV provided) is currently 1.2+:1 before giving effect to any rights subscriptions.

FIG.PR.A was last mentioned on PrefBlog when it was downgraded to Pfd-5 as part of the February Massacre; a planned rights offering was cancelled last November.

FIG.PR.A is tracked by HIMIPref™ but was relegated to the ‘Scraps’ index as part of the February 2009 rebalancing on credit concerns.