James Hamilton of Econbrowser wrote a very good post on the weekend, Money Creation and the Fed, addressing the near-vertical increase in the monetary base since September 2008 when the credit crunch really started crunching. Of particular interest were remarks by Charles Plosser of the Philadelphia Fed:

However, under current circumstances, the Fed has substituted less liquid assets for Treasuries. It is true that a number of the Fed’s new programs will unwind naturally and fairly quickly as they are terminated because they involve primarily short-term assets. Yet we must anticipate that special interests and political pressures may make it harder to terminate these programs in a timely manner, thus making it difficult to shrink our balance sheet when the time comes. Moreover, some of these programs involve longer-term assets — like the agency MBS. Such assets may prove difficult to sell for an extended period of time if markets are viewed as “fragile” or specific interest groups are strongly opposed, which could prove very damaging to our longer-term objective of price stability. Thus, we must ensure that our current credit policies do not constrain our ability to conduct appropriate monetary policy in the future.

Even more important, credit allocation decisions, in my view, should be under the purview of the fiscal authority, not the monetary authority, since they involve using the public’s money to affect the allocation of resources. The mixing of monetary policy and fiscal policy increases the number of entities that might try to influence Fed decision-making in their favor. Both economic theory and practice indicate that central banks should operate independently from such pressures and resist them when they arise so that their policies benefit society at large over the longer term and not any particular constituency in the near term.

…

Today, an accord to substitute Treasuries for non-Treasury debt on our balance sheet would similarly help ensure that the Fed will be able to implement its policy decisions. After all, the time will come when the Fed will want to begin raising interest rates to achieve its goals. With Treasuries back on the balance sheet, the Fed will be able to drain reserves in a timely fashion with minimal concerns about disrupting particular credit allocations or the pressures from special interests.

Dr. Hamilton concludes on a sanguine note:

Which brings me back to the original question. Does the explosive growth of the monetary base in Figure 1 imply uncontrollable inflationary pressures? My answer: not yet, but stay tuned.

I am confident that the Fed will retain its independence and sell its assets back to the public as soon as the public wishes to pay a reasonable price; I am also confident that most of what the Fed is doing is exactly what central banks are supposed to do: making liquidity available in times of stress at a penalty rate against good collateral.

I will justify the “penalty rate” part of that assertion by noting that, given the excess reserves are on the books paying 0.25%, a 4.5%-5.0% rate on mortgage assets is punitive by any normal measure.

However, I do agree with Mr. Plosser to the extent that direct ownership of assets by the Fed is a nervous thing, and that it should be Treasury stepping up and taking actual ownership risk. In the Fed’s efforts to make credit available, it should always have some degree of first-loss protection, whether that protection is given (explicitly!) by Treasury or by the private sector is immaterial.

Dr. Hamilton followed up his first post with another one, The Fed’s New Balance Sheet:

I am uncomfortable on a general level with the suggestion that unelected Fed officials are better able to make such decisions than private investors who put their own capital where they think it will earn the highest reward. Apart from that general unease, I have a particular concern about the motivation for the Term Asset-Backed Securities Loan Facility, whose goal is to generate up to $1 trillion of lending for businesses and households by catalyzing a revival of loan securitization.

…

But the whole premise behind those Aaa ratings– that securitization could isolate a “safe” component of a pool of fundamentally risky loans– was deeply flawed. It is impossible to diversify away aggregate or systemic risk. All that the device did was to mislead investors into thinking they were protected from those nondiversifiable risks and push those risks onto the taxpayers and the Fed. Before we decide that securitization is the road out of our present difficulties, I would like a detailed and convincing explanation of why the past mistakes are not going to be repeated again.

Dr. Hamilton … you’re going to be deeply disappointed. Financial fads are as old as the concept of money and when we do enough stupid things it requires a recession to show us the error of our ways.

I do not believe that securitization is not “the road out of our present difficulties” nor, I suggest, is the Fed intending to send that signal. What we have now is an ice dam blocking the flow of credit; the pendulum has swung more than half-way; investors are refusing point-blank to invest in securitization paper regardless of the nature of the underlying assets or the credit quality of the paper.

Rational views on credit risk will return – they always do – but the current blind fear is just as far removed from rationality as the recent blind adoration. The Fed must blow up the ice dam to prevent unnecessary damage to the economy as a whole and allow the credit markets to find a new balance gradually.

As stated, however, I do believe that direct purchase of assets by the Fed is a Bad Thing. Loans against assets, with overcollateralization, are good; but direct purchase should indeed be an explicitly political decision.

Bloomberg News points out that the joint Fed/Treasury press release (reported by PrefBlog on March 23) could have more implications than have been commonly discussed:

The release said that while the Fed collaborates with other agencies to preserve financial stability, it alone is in charge of keeping consumer prices stable, its independence “critical.”

The statement was the culmination of a behind-the-scenes, two-month long debate involving the Fed’s Open Market Committee, as well as the Treasury. The discussions were driven by Chairman Ben S. Bernanke’s concern that work with the Bush and Obama administrations on repairing banks and markets not lead to attempts at political pressure later that would delay the start of measures to combat inflation.

Mark-to-Market accounting is being eviscerated, not without controversy:

Four days after U.S. lawmakers berated Financial Accounting Standards Board Chairman Robert Herz and threatened to take rulemaking out of his hands, FASB proposed an overhaul of fair-value accounting that may improve profits at banks such as Citigroup Inc. by more than 20 percent.

The changes proposed on March 16 to fair-value, also known as mark-to-market accounting, would allow companies to use “significant judgment” in valuing assets and reduce the amount of writedowns they must take on so-called impaired investments, including mortgage-backed securities. A final vote on the resolutions, which would apply to first-quarter financial statements, is scheduled for April 2.

…

By letting banks use internal models instead of market prices and allowing them to take into account the cash flow of securities, FASB’s change could boost bank industry earnings by 20 percent, [tax & accounting advisor Robert] Willens said.

The Treasury Market Practices Group has released a few adjustments to its recommended fails charge procedure to lower the administrative burden on implementation.

Bank of Canada Governor Carney today delivered a speech that was remarkable for it’s degree of ass-covering and blame-shifting:

We now face important policy questions about which activities banks should perform, which should be located in sustainable, continuously-open markets, and which should be prohibited.

Markets might be sustainable and continuously open, but that is no guarantee they’re going to be doing any business.

First, banks have become increasingly heavy users of markets to fund their activities. In recent years, many international banks borrowed in short-term markets to finance asset growth and, in the process, to substantially increase their leverage. This made them increasingly dependent on continuous access to liquidity in money and capital markets. In the process, banks conflated a reliance on market liquidity with their access to central bank liquidity.

…

Banks often sold securities to “arms-length” conduits that they were later forced to reintermediate or held onto AAA tranches of structures that proved far from risk-free.

Reliance on liquidity was not regulated by the Basel Committee on which the Bank of Canada has a vote. Forced reintermediation without adequate capital is a fault of the Basel Committee and the national regulators. AAA is an opinion – no more. Why did the Basel Committee interpret this opinion as “risk-free”?

In many banks, a culture that rewarded innovation and opacity over risk management and transparency eventually undermined its creators. Senior managers and shareholders of banks discovered that actual risks were much greater than originally thought. By that time, the more junior traders who had assumed the risks had already been paid, largely in cash. Many large, complex institutions learned too late that there can be principal-agent problems within firms, as well as between firms and their shareholders.

In other words, the Basel Committee failed to assess sufficient capital charges based on size and concentration.

The growth in financial activity and the increasingly complex array of financial players have prompted a dramatic increase in claims within the financial system, as opposed to between the financial system and the real economy, which created risks that were difficult to identify and evaluate.

And therefore ignored by the Basel Committee.

In essence, the shadow banking system practiced maturity transformation without a safety net – that is, it was wholly reliant on the continuous availability of funding markets. The collapse in market liquidity that began in August 2007 crystallized these risks.

The regulatory system neither appreciated the scale of this activity nor adequately adapted to the new risks created by it. The shadow banking system was not supported, regulated, or monitored in the same fashion as the banking system. With hindsight, the shift towards the shadow banking system that emerged in other countries was allowed to go too far for too long.

The problem is not the size of the shadow banking system per se, but that the banks were permitted to rely upon it and that the regulators ignored the risks.

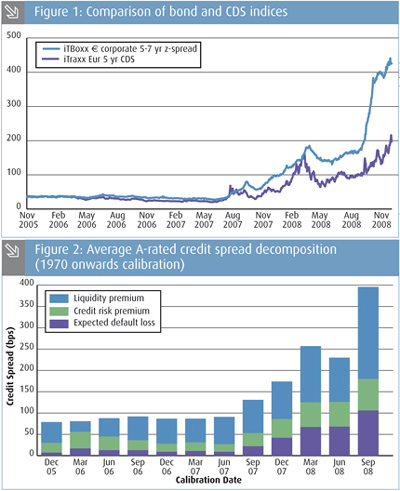

Reopening markets will ultimately require a series of measures to improve the infrastructure of core funding markets, securitization, and credit default swaps (CDS).

A bare assertion, unsupported by anything in the speech.

The U.S. Federal Reserve has improved clearing and settlement arrangements, and has encouraged the move of CDS onto clearing houses. This will encourage the standardization of these products, while making CDS counterparties – often banks – less systemically important at the margin.

If I buy a bond on margin, I’ve got to put up about 10% and give it to the dealer as collateral. If I write a CDS, giving credit protection to a bank, I’m doing the same thing – but Mr. Carney’s Basel Committee decided this was a virtually risk-free banking transaction.

Third, the crisis has demonstrated that there are many firms that have been deemed systemic and worthy of rescue even though they were not deposit-taking banks.

Only because the exposure of the banking system to these firms was not adequately regulated.

Equities were crushed:

Canadian stocks had their biggest drop in four weeks as U.S. Treasury Secretary Timothy Geithner said banks will need more government help and oil’s retreat pushed energy producers lower.

…

Royal Bank of Canada, the country’s largest bank by assets, slid 3.2 percent to C$35.80. Toronto-Dominion fell 4.2 percent to C$42. Manulife lost 8.5 percent to C$13.72.

A measure of 38 financial stocks in the S&P/TSX index retreated 4.1 percent, the steepest decline among 10 industries.

Decent volume today amidst all the equity wreckage, with moderate price movement; PerpetualDiscounts down a bit, fixed-Resets up. If this relative movement makes sense to anybody, let me know, because I don’t understand it at all. Sure, you can always construct an argument that will explain anything; that is the bread and butter of the average stock broker: “Well, the market is assuming huge monetary and fiscal stimulus will cause rampant inflation without an increase in credit risk”; but it’s not all that convincing, really.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.5212 % |

863.0 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.5212 % |

1,395.7 |

| Floater |

4.58 % |

5.52 % |

63,920 |

14.63 |

3 |

-0.5212 % |

1,078.2 |

| OpRet |

5.25 % |

4.77 % |

128,892 |

3.87 |

15 |

-0.1349 % |

2,065.3 |

| SplitShare |

6.95 % |

10.00 % |

49,241 |

4.78 |

6 |

-3.3045 % |

1,600.6 |

| Interest-Bearing |

6.19 % |

10.07 % |

33,235 |

0.73 |

1 |

-0.4111 % |

1,925.6 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.2514 % |

1,500.8 |

| Perpetual-Discount |

7.23 % |

7.43 % |

154,721 |

12.07 |

71 |

-0.2514 % |

1,382.2 |

| FixedReset |

6.13 % |

5.87 % |

577,701 |

13.66 |

32 |

0.3592 % |

1,816.8 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| LFE.PR.A |

SplitShare |

-7.78 % |

Crushed, but the day’s low was set by small trades in the mid-afternoon. Traded 6,500 shares in a range of 6.57-05 before closing at 6.64-99, 2×1. Asset coverage of 1.0+:1 as of March 13, according to the company.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2012-12-01

Maturity Price : 10.00

Evaluated at bid price : 6.64

Bid-YTW : 18.36 % |

| MFC.PR.B |

Perpetual-Discount |

-4.38 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 15.05

Evaluated at bid price : 15.05

Bid-YTW : 7.82 % |

| BNA.PR.A |

SplitShare |

-4.21 % |

Asset coverage of 1.7-:1 as of February 28 according to the company.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2010-09-30

Maturity Price : 25.00

Evaluated at bid price : 22.75

Bid-YTW : 13.45 % |

| DFN.PR.A |

SplitShare |

-4.07 % |

Asset coverage of 1.5+:1 as of March 13 according to the company.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2014-12-01

Maturity Price : 10.00

Evaluated at bid price : 8.01

Bid-YTW : 10.00 % |

| RY.PR.W |

Perpetual-Discount |

-3.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 18.30

Evaluated at bid price : 18.30

Bid-YTW : 6.81 % |

| CIU.PR.A |

Perpetual-Discount |

-3.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 17.00

Evaluated at bid price : 17.00

Bid-YTW : 6.86 % |

| MFC.PR.C |

Perpetual-Discount |

-2.66 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 14.62

Evaluated at bid price : 14.62

Bid-YTW : 7.79 % |

| HSB.PR.D |

Perpetual-Discount |

-2.35 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 16.21

Evaluated at bid price : 16.21

Bid-YTW : 7.78 % |

| GWO.PR.H |

Perpetual-Discount |

-2.22 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 15.84

Evaluated at bid price : 15.84

Bid-YTW : 7.72 % |

| SBN.PR.A |

SplitShare |

-1.96 % |

Asset coverage of 1.6+:1 as of March 19 according to Mulvihill.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2014-12-01

Maturity Price : 10.00

Evaluated at bid price : 8.49

Bid-YTW : 8.77 % |

| BAM.PR.J |

OpRet |

-1.96 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2018-03-30

Maturity Price : 25.00

Evaluated at bid price : 17.50

Bid-YTW : 10.75 % |

| BAM.PR.K |

Floater |

-1.84 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 7.47

Evaluated at bid price : 7.47

Bid-YTW : 5.88 % |

| BAM.PR.H |

OpRet |

-1.70 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2012-03-30

Maturity Price : 25.00

Evaluated at bid price : 23.10

Bid-YTW : 8.73 % |

| BNA.PR.C |

SplitShare |

-1.52 % |

Asset coverage of 1.7-:1 as of February 28 according to the company.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2019-01-10

Maturity Price : 25.00

Evaluated at bid price : 11.00

Bid-YTW : 16.01 % |

| CM.PR.P |

Perpetual-Discount |

-1.40 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 18.31

Evaluated at bid price : 18.31

Bid-YTW : 7.53 % |

| BNS.PR.O |

Perpetual-Discount |

-1.38 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 20.66

Evaluated at bid price : 20.66

Bid-YTW : 6.92 % |

| BNS.PR.N |

Perpetual-Discount |

-1.35 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 19.06

Evaluated at bid price : 19.06

Bid-YTW : 7.04 % |

| NA.PR.K |

Perpetual-Discount |

-1.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 20.50

Evaluated at bid price : 20.50

Bid-YTW : 7.27 % |

| BAM.PR.I |

OpRet |

-1.16 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2013-12-30

Maturity Price : 25.00

Evaluated at bid price : 21.30

Bid-YTW : 9.50 % |

| TD.PR.P |

Perpetual-Discount |

-1.15 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 19.77

Evaluated at bid price : 19.77

Bid-YTW : 6.78 % |

| BAM.PR.O |

OpRet |

-1.14 % |

YTW SCENARIO

Maturity Type : Option Certainty

Maturity Date : 2013-06-30

Maturity Price : 25.00

Evaluated at bid price : 21.75

Bid-YTW : 8.78 % |

| W.PR.J |

Perpetual-Discount |

1.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 19.86

Evaluated at bid price : 19.86

Bid-YTW : 7.09 % |

| SLF.PR.B |

Perpetual-Discount |

1.12 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 15.40

Evaluated at bid price : 15.40

Bid-YTW : 7.86 % |

| GWO.PR.G |

Perpetual-Discount |

1.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 17.25

Evaluated at bid price : 17.25

Bid-YTW : 7.60 % |

| PWF.PR.H |

Perpetual-Discount |

1.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 17.96

Evaluated at bid price : 17.96

Bid-YTW : 8.20 % |

| SLF.PR.C |

Perpetual-Discount |

1.39 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 14.55

Evaluated at bid price : 14.55

Bid-YTW : 7.72 % |

| BNS.PR.R |

FixedReset |

1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 21.36

Evaluated at bid price : 21.65

Bid-YTW : 4.62 % |

| RY.PR.R |

FixedReset |

1.54 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-26

Maturity Price : 25.00

Evaluated at bid price : 25.75

Bid-YTW : 5.82 % |

| TD.PR.C |

FixedReset |

1.60 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 24.16

Evaluated at bid price : 24.20

Bid-YTW : 4.99 % |

| PWF.PR.E |

Perpetual-Discount |

1.72 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 18.31

Evaluated at bid price : 18.31

Bid-YTW : 7.68 % |

| IAG.PR.C |

FixedReset |

1.85 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 21.96

Evaluated at bid price : 22.00

Bid-YTW : 6.18 % |

| ACO.PR.A |

OpRet |

1.92 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2009-04-29

Maturity Price : 26.00

Evaluated at bid price : 26.55

Bid-YTW : -14.14 % |

| CM.PR.K |

FixedReset |

1.95 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 21.96

Evaluated at bid price : 22.00

Bid-YTW : 4.90 % |

| PWF.PR.K |

Perpetual-Discount |

3.90 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 16.00

Evaluated at bid price : 16.00

Bid-YTW : 7.92 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BNS.PR.X |

FixedReset |

61,652 |

RBC crossed 54,300 at 25.40.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-25

Maturity Price : 25.00

Evaluated at bid price : 25.40

Bid-YTW : 6.16 % |

| BMO.PR.O |

FixedReset |

60,374 |

Recent new issue.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 24.95

Evaluated at bid price : 25.00

Bid-YTW : 6.41 % |

| TD.PR.M |

OpRet |

54,100 |

Desjardins bought blocks of 20,000 and 30,000 shares from National, both at 25.87.

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2013-10-30

Maturity Price : 25.00

Evaluated at bid price : 25.77

Bid-YTW : 4.16 % |

| PWF.PR.K |

Perpetual-Discount |

51,190 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 16.00

Evaluated at bid price : 16.00

Bid-YTW : 7.92 % |

| RY.PR.R |

FixedReset |

50,343 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-26

Maturity Price : 25.00

Evaluated at bid price : 25.75

Bid-YTW : 5.82 % |

| CM.PR.H |

Perpetual-Discount |

43,948 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-30

Maturity Price : 16.07

Evaluated at bid price : 16.07

Bid-YTW : 7.48 % |

| There were 27 other index-included issues trading in excess of 10,000 shares. |