There is now quantitative easing in the UK:

Bank of England Governor Mervyn King will take the unprecedented step of printing money to buy assets after cutting the interest rate by a half point to almost zero, the latest move by officials to combat the recession.

The bank said it will pump money into the economy by purchasing as much as 150 billion pounds ($211 billion) in government and corporate bonds, sparking a rally across the debt market. The central bank’s nine-member panel also reduced the benchmark interest rate to 0.5 percent, the lowest since the bank was founded in 1694.

As has been previously noted, this is the first severe contraction the world has ever seen in the presence of a deep and functional CDS market. The large negative basis has also been noted. And now, Dr. Hu’s debt-decoupling (at issue in the Lyondell bankruptcy) is having further reaching effects:

Amusement-park operator Six Flags Inc. and automaker Ford Motor Co. may be pushed toward bankruptcy by bondholders trying to profit from credit-default swaps that protect against losses on their high-yield debt.

By employing a so-called negative-basis trade, investors could buy Six Flags bonds at 20.5 cents on the dollar and credit- default swaps at 71 cents. If the New York-based chain defaults, the creditors would receive the face value of the debt, minus costs. In a Feb. 27 note, Citigroup Inc.’s high-yield strategists put that profit at 6 percentage points, or $600,000 on a $10 million purchase.

…

“Before, you really had to worry mostly about where you were in the” company’s capital structure, [Matthew Eagan, an investment manager at Boston-based Loomis Sayles & Co.] said. “Now, you have to consider the possibility that you might have this large holder of CDS incentivized to see it go into bankruptcy. It’s something that’s going to come up more and more.”

A rather odd research paper was published by the Boston Fed today:Another Hidden Cost of Incentives: The Detrimental Effect on Norm Enforcement:

Monetary incentives are often considered as a way to foster contributions to public goods in society and firms. This paper investigates experimentally the effect of monetary incentives in the presence of a norm enforcement mechanism. Norm enforcement through peer punishment has been shown to be effective in raising contributions by itself. We test whether and how monetary incentives interact with punishment and how this in turn affects contributions. Our main findings are that free riders are punished less harshly in the treatment with incentives, and as a consequence, average contributions to the public good are no higher than without incentives. This finding ties to and extends previous research on settings in which monetary incentives may fail to have the desired effect.

There is one slight problem with the paper: I don’t believe a word of it. The trouble is that there is perfect transparency regarding decisions made by each participant and perfect clarity regarding the group effect of these decisions. In the real world, I believe that Norm Enforcement will become a tool of random backbiting; although I will concede that for some people in some situations, it will work better than incentives. There’s also the matter of self selection: give me a choice between Firm A with its group hugs, and Firm B with its massive bonuses for performance and you won’t wait long for my decision!

However, this paper is destined to become a central part of the campaign against Evil Bonuses.

Equities got hammered again today, especially financials:

Canadian stocks fell to the lowest in five years, led by energy and financial shares, after China signaled it won’t increase stimulus spending and Moody’s Investors Service said it may downgrade the biggest U.S. banks.

…

Manulife Financial Corp., Canada’s largest insurer, fell 8.3 percent as declining equities worldwide fanned concern that insurance companies’ investment losses will increase.

…

The Standard & Poor’s/TSX Composite Index fell 185.58 points, or 2.4 percent, to 7,629.17 in Toronto, the lowest value since October 2003. The benchmark erased yesterday’s rally and has tumbled 15 percent in 2009.

…

A gauge of financial shares plunged 4.9 percent, led by Royal Bank of Canada, the country’s largest lender. JPMorgan Chase & Co., the largest U.S. bank by market value, had its ratings outlook cut by Moody’s to negative from stable.

Moody’s said it will review the long-term debt ratings of Wells Fargo, the second-largest U.S. bank, and Bank of America, ranked third, on concern that higher credit costs may damage capital ratios.

…

Canadian Imperial Bank of Commerce, the country’s fifth- biggest bank by assets, fell 4.5 percent to C$37.86, after saying it will sell C$1.6 billion in notes to bolster its balance sheet. Bank of Nova Scotia fell 4.7 percent to C$26.21. Royal Bank of Canada declined 4.5 percent to C$29.22.

Manulife dropped 91 cents to C$10. Sun Life Financial Inc. slumped 10 percent to C$16.12.

… and Preferreds were not immune, although volume was light ….

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.7620 % |

812.5 |

| FixedFloater |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-0.7620 % |

1,314.0 |

| Floater |

4.80 % |

6.10 % |

66,417 |

13.64 |

3 |

-0.7620 % |

1,015.0 |

| OpRet |

5.32 % |

5.01 % |

147,765 |

3.93 |

15 |

-0.4533 % |

2,026.5 |

| SplitShare |

6.99 % |

9.08 % |

55,546 |

4.84 |

6 |

-0.1738 % |

1,588.8 |

| Interest-Bearing |

6.21 % |

11.60 % |

38,650 |

0.78 |

1 |

0.3115 % |

1,890.5 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

-1.3749 % |

1,450.8 |

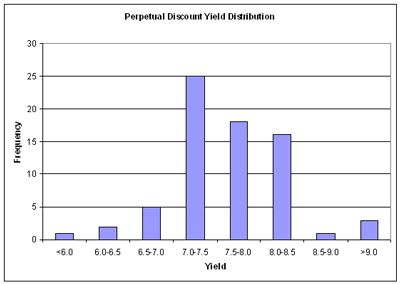

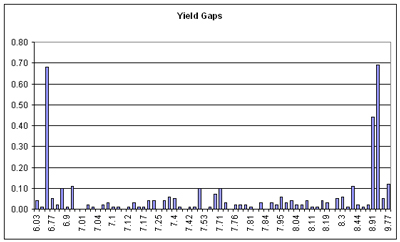

| Perpetual-Discount |

7.44 % |

7.43 % |

172,255 |

12.00 |

71 |

-1.3749 % |

1,336.1 |

| FixedReset |

6.19 % |

5.67 % |

472,718 |

13.94 |

28 |

0.2146 % |

1,784.4 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| BAM.PR.J |

OpRet |

-7.90 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2018-03-30

Maturity Price : 25.00

Evaluated at bid price : 17.03

Bid-YTW : 11.37 % |

| SLF.PR.D |

Perpetual-Discount |

-6.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 13.26

Evaluated at bid price : 13.26

Bid-YTW : 8.42 % |

| PWF.PR.E |

Perpetual-Discount |

-5.47 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.60

Evaluated at bid price : 16.60

Bid-YTW : 8.44 % |

| POW.PR.D |

Perpetual-Discount |

-5.41 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.38

Evaluated at bid price : 15.38

Bid-YTW : 8.31 % |

| BMO.PR.H |

Perpetual-Discount |

-5.23 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 18.48

Evaluated at bid price : 18.48

Bid-YTW : 7.25 % |

| SLF.PR.A |

Perpetual-Discount |

-4.47 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 14.10

Evaluated at bid price : 14.10

Bid-YTW : 8.45 % |

| ELF.PR.F |

Perpetual-Discount |

-4.39 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 14.15

Evaluated at bid price : 14.15

Bid-YTW : 9.60 % |

| PWF.PR.F |

Perpetual-Discount |

-3.94 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.33

Evaluated at bid price : 16.33

Bid-YTW : 8.19 % |

| PWF.PR.G |

Perpetual-Discount |

-3.64 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 18.51

Evaluated at bid price : 18.51

Bid-YTW : 8.11 % |

| GWO.PR.G |

Perpetual-Discount |

-3.61 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.27

Evaluated at bid price : 16.27

Bid-YTW : 8.02 % |

| SLF.PR.E |

Perpetual-Discount |

-3.55 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 13.60

Evaluated at bid price : 13.60

Bid-YTW : 8.30 % |

| SLF.PR.C |

Perpetual-Discount |

-3.37 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 13.78

Evaluated at bid price : 13.78

Bid-YTW : 8.10 % |

| POW.PR.B |

Perpetual-Discount |

-3.35 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.16

Evaluated at bid price : 16.16

Bid-YTW : 8.47 % |

| POW.PR.C |

Perpetual-Discount |

-3.18 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 18.26

Evaluated at bid price : 18.26

Bid-YTW : 8.12 % |

| LFE.PR.A |

SplitShare |

-3.15 % |

Downgraded to Pfd-4 today – finally! Asset coverage of 1.0+:1 as of February 27, according to the company.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2012-12-01

Maturity Price : 10.00

Evaluated at bid price : 6.15

Bid-YTW : 20.73 % |

| BNS.PR.L |

Perpetual-Discount |

-2.87 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.27

Evaluated at bid price : 16.27

Bid-YTW : 7.03 % |

| BMO.PR.K |

Perpetual-Discount |

-2.86 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 17.01

Evaluated at bid price : 17.01

Bid-YTW : 7.81 % |

| POW.PR.A |

Perpetual-Discount |

-2.57 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 17.79

Evaluated at bid price : 17.79

Bid-YTW : 8.04 % |

| BAM.PR.K |

Floater |

-2.54 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 7.30

Evaluated at bid price : 7.30

Bid-YTW : 6.10 % |

| GWO.PR.H |

Perpetual-Discount |

-2.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.60

Evaluated at bid price : 15.60

Bid-YTW : 7.80 % |

| SLF.PR.B |

Perpetual-Discount |

-2.38 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 14.75

Evaluated at bid price : 14.75

Bid-YTW : 8.16 % |

| MFC.PR.C |

Perpetual-Discount |

-2.32 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 14.34

Evaluated at bid price : 14.34

Bid-YTW : 7.89 % |

| IAG.PR.A |

Perpetual-Discount |

-2.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 14.46

Evaluated at bid price : 14.46

Bid-YTW : 7.98 % |

| HSB.PR.D |

Perpetual-Discount |

-2.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.62

Evaluated at bid price : 16.62

Bid-YTW : 7.71 % |

| ENB.PR.A |

Perpetual-Discount |

-2.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 22.67

Evaluated at bid price : 22.91

Bid-YTW : 6.04 % |

| PWF.PR.I |

Perpetual-Discount |

-1.94 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 19.72

Evaluated at bid price : 19.72

Bid-YTW : 7.74 % |

| TD.PR.P |

Perpetual-Discount |

-1.86 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 18.50

Evaluated at bid price : 18.50

Bid-YTW : 7.21 % |

| CM.PR.G |

Perpetual-Discount |

-1.76 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 17.29

Evaluated at bid price : 17.29

Bid-YTW : 7.95 % |

| MFC.PR.D |

FixedReset |

-1.62 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 24.26

Evaluated at bid price : 24.30

Bid-YTW : 6.67 % |

| BMO.PR.J |

Perpetual-Discount |

-1.60 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.35

Evaluated at bid price : 15.35

Bid-YTW : 7.41 % |

| CM.PR.I |

Perpetual-Discount |

-1.55 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.26

Evaluated at bid price : 15.26

Bid-YTW : 7.84 % |

| CM.PR.E |

Perpetual-Discount |

-1.52 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 18.11

Evaluated at bid price : 18.11

Bid-YTW : 7.87 % |

| BNS.PR.J |

Perpetual-Discount |

-1.52 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 18.82

Evaluated at bid price : 18.82

Bid-YTW : 7.09 % |

| GWO.PR.I |

Perpetual-Discount |

-1.51 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 14.99

Evaluated at bid price : 14.99

Bid-YTW : 7.53 % |

| RY.PR.F |

Perpetual-Discount |

-1.50 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.74

Evaluated at bid price : 15.74

Bid-YTW : 7.15 % |

| BMO.PR.M |

FixedReset |

-1.45 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 20.45

Evaluated at bid price : 20.45

Bid-YTW : 4.70 % |

| CM.PR.H |

Perpetual-Discount |

-1.39 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.59

Evaluated at bid price : 15.59

Bid-YTW : 7.84 % |

| PWF.PR.D |

OpRet |

-1.38 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2012-10-30

Maturity Price : 25.00

Evaluated at bid price : 24.95

Bid-YTW : 5.44 % |

| CM.PR.J |

Perpetual-Discount |

-1.33 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 14.80

Evaluated at bid price : 14.80

Bid-YTW : 7.74 % |

| RY.PR.W |

Perpetual-Discount |

-1.30 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 18.25

Evaluated at bid price : 18.25

Bid-YTW : 6.79 % |

| RY.PR.E |

Perpetual-Discount |

-1.17 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.01

Evaluated at bid price : 16.01

Bid-YTW : 7.11 % |

| PWF.PR.K |

Perpetual-Discount |

-1.16 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.30

Evaluated at bid price : 15.30

Bid-YTW : 8.24 % |

| RY.PR.B |

Perpetual-Discount |

-1.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 16.30

Evaluated at bid price : 16.30

Bid-YTW : 7.29 % |

| CM.PR.K |

FixedReset |

-1.09 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 21.45

Evaluated at bid price : 21.76

Bid-YTW : 5.10 % |

| MFC.PR.B |

Perpetual-Discount |

-1.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 15.50

Evaluated at bid price : 15.50

Bid-YTW : 7.54 % |

| BNS.PR.P |

FixedReset |

-1.07 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 22.03

Evaluated at bid price : 22.11

Bid-YTW : 4.69 % |

| GWO.PR.E |

OpRet |

1.02 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2014-03-30

Maturity Price : 25.00

Evaluated at bid price : 24.65

Bid-YTW : 4.96 % |

| TD.PR.S |

FixedReset |

1.05 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 20.27

Evaluated at bid price : 20.27

Bid-YTW : 4.71 % |

| NA.PR.N |

FixedReset |

1.08 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 22.45

Evaluated at bid price : 22.51

Bid-YTW : 4.71 % |

| RY.PR.H |

Perpetual-Discount |

1.24 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 20.37

Evaluated at bid price : 20.37

Bid-YTW : 7.01 % |

| BNA.PR.B |

SplitShare |

1.70 % |

Asset coverage of 1.7-:1 as of February 28 according to the company.

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2016-03-25

Maturity Price : 25.00

Evaluated at bid price : 20.95

Bid-YTW : 8.05 % |

| BNS.PR.R |

FixedReset |

1.94 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 21.00

Evaluated at bid price : 21.00

Bid-YTW : 4.85 % |

| RY.PR.L |

FixedReset |

2.17 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 23.51

Evaluated at bid price : 23.55

Bid-YTW : 5.10 % |

| TD.PR.A |

FixedReset |

2.33 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 21.96

Evaluated at bid price : 22.00

Bid-YTW : 4.69 % |

| TD.PR.C |

FixedReset |

2.34 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 24.01

Evaluated at bid price : 24.05

Bid-YTW : 5.07 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| MFC.PR.D |

FixedReset |

249,494 |

New issue settled yesterday.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 24.26

Evaluated at bid price : 24.30

Bid-YTW : 6.67 % |

| CM.PR.A |

OpRet |

81,300 |

Scotia crossed 74,500 at 25.75.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2009-11-30

Maturity Price : 25.25

Evaluated at bid price : 25.55

Bid-YTW : 4.36 % |

| CM.PR.L |

FixedReset |

50,367 |

Desjardins bought two blocks of 10,000 shares each from National at 25.00.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 24.86

Evaluated at bid price : 24.91

Bid-YTW : 6.45 % |

| RY.PR.R |

FixedReset |

44,536 |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-03-26

Maturity Price : 25.00

Evaluated at bid price : 25.29

Bid-YTW : 6.16 % |

| RY.PR.P |

FixedReset |

40,160 |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 25.27

Evaluated at bid price : 25.32

Bid-YTW : 6.09 % |

| TD.PR.G |

FixedReset |

39,970 |

National crossed 10,000 at 25.21.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-03-05

Maturity Price : 25.15

Evaluated at bid price : 25.20

Bid-YTW : 6.23 % |

| There were 18 other index-included issues trading in excess of 10,000 shares. |