Yet another banner day for preferreds, although Fixed-Resets are (not surprisingly) reacting poorly to the flood of new issuance (RY, 6.25%+419, NA, 6.60%+463, TD, 6.25%+437) at higher coupons.

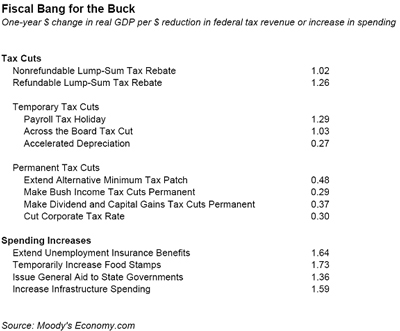

Formatting of the tables is horrible today. Yesterday’s fiddling may be on the right track programatically, but definitely a step backward esthetically. Sorry, guys! I’d like to write more (especially with Spend-Every-Penny mumbling about putting Canada into a permanent structural deficit, just like Mr. Bush) … but I have to do some more fiddling …

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| MFC.PR.B |

Perpetual-Discount |

-3.11 % |

Yield-to-Worst (at Bid) : 6.52 %

Evaluated at bid price : 18.0400

Limit Maturity 2039-01-06 YTM: 6.52 % [Restricted: 6.52 %] (Prob: 100.00 %)

Yield to Worst : 6.5218 % |

| RY.PR.L |

FixedReset |

-2.55 % |

Yield-to-Worst (at Bid) : 5.09 %

Evaluated at bid price : 24.1200

Call 2014-03-26 YTM: 6.64 % [Restricted: 6.64 %] (Prob: 28.03 %)

Call 2019-03-26 YTM: 5.74 % [Restricted: 5.74 %] (Prob: 0.19 %)

Limit Maturity 2039-01-06 YTM: 5.09 % [Restricted: 5.09 %] (Prob: 71.77 %)

Yield to Worst : 5.0876 % |

| PWF.PR.F |

Perpetual-Discount |

-2.54 % |

Yield-to-Worst (at Bid) : 6.99 %

Evaluated at bid price : 19.2000

Limit Maturity 2039-01-06 YTM: 6.99 % [Restricted: 6.99 %] (Prob: 100.00 %)

Yield to Worst : 6.9945 % |

| BNS.PR.N |

Perpetual-Discount |

-2.44 % |

Yield-to-Worst (at Bid) : 6.59 %

Evaluated at bid price : 20.0000

Limit Maturity 2039-01-06 YTM: 6.59 % [Restricted: 6.59 %] (Prob: 100.00 %)

Yield to Worst : 6.5864 % |

| CM.PR.K |

FixedReset |

-2.22 % |

Yield-to-Worst (at Bid) : 5.03 %

Evaluated at bid price : 22.0000

Call 2014-08-30 YTM: 8.02 % [Restricted: 8.02 %] (Prob: 7.32 %)

Limit Maturity 2039-01-06 YTM: 5.03 % [Restricted: 5.03 %] (Prob: 92.68 %)

Yield to Worst : 5.0268 % |

| RY.PR.N |

FixedReset |

-1.92 % |

Yield-to-Worst (at Bid) : 5.67 %

Evaluated at bid price : 25.0200

Call 2014-03-26 YTM: 6.35 % [Restricted: 6.35 %] (Prob: 40.08 %)

Call 2019-03-26 YTM: 5.94 % [Restricted: 5.94 %] (Prob: 0.10 %)

Limit Maturity 2039-01-06 YTM: 5.67 % [Restricted: 5.67 %] (Prob: 59.82 %)

Yield to Worst : 5.6744 % |

| BNS.PR.Q |

FixedReset |

-1.77 % |

Yield-to-Worst (at Bid) : 4.40 %

Evaluated at bid price : 22.2000

Call 2013-11-24 YTM: 7.71 % [Restricted: 7.71 %] (Prob: 8.22 %)

Call 2018-11-24 YTM: 5.82 % [Restricted: 5.82 %] (Prob: 0.53 %)

Limit Maturity 2039-01-06 YTM: 4.40 % [Restricted: 4.40 %] (Prob: 91.25 %)

Yield to Worst : 4.3984 % |

| BNA.PR.B |

SplitShare |

-1.23 % |

Yield-to-Worst (at Bid) : 8.90 %

Evaluated at bid price : 20.0000

Hard Maturity 2016-03-25 YTM: 8.90 % [Restricted: 8.90 %] (Prob: 100.00 %)

Yield to Worst : 8.9015 % |

| GWO.PR.J |

FixedReset |

-1.01 % |

Yield-to-Worst (at Bid) : 5.40 %

Evaluated at bid price : 24.5000

Call 2014-01-30 YTM: 6.62 % [Restricted: 6.62 %] (Prob: 32.96 %)

Call 2019-01-30 YTM: 5.90 % [Restricted: 5.90 %] (Prob: 0.26 %)

Limit Maturity 2039-01-06 YTM: 5.40 % [Restricted: 5.40 %] (Prob: 66.78 %)

Yield to Worst : 5.3987 % |

| BNS.PR.J |

Perpetual-Discount |

1.00 % |

Yield-to-Worst (at Bid) : 6.53 %

Evaluated at bid price : 20.1600

Limit Maturity 2039-01-06 YTM: 6.53 % [Restricted: 6.53 %] (Prob: 100.00 %)

Yield to Worst : 6.5339 % |

| PWF.PR.J |

OpRet |

1.01 % |

Yield-to-Worst (at Bid) : 4.84 %

Evaluated at bid price : 25.1000

Call 2009-04-06 YTM: 23.48 % [Restricted: 5.79 %] (Prob: 7.08 %)

Call 2009-05-30 YTM: 13.71 % [Restricted: 5.40 %] (Prob: 6.56 %)

Call 2010-05-30 YTM: 6.49 % [Restricted: 6.49 %] (Prob: 8.27 %)

Call 2011-05-30 YTM: 5.34 % [Restricted: 5.34 %] (Prob: 0.66 %)

Soft Maturity 2013-07-30 YTM: 4.84 % [Restricted: 4.84 %] (Prob: 77.43 %)

Yield to Worst : 4.8432 % |

| BCE.PR.R |

FixedFloater |

1.01 % |

Yield-to-Worst (at Bid) : 7.64 %

Evaluated at bid price : 15.0000

Limit Maturity 2039-01-06 YTM: 7.64 % [Restricted: 7.64 %] (Prob: 100.00 %)

Yield to Worst : 7.6367 % |

| CM.PR.P |

Perpetual-Discount |

1.05 % |

Yield-to-Worst (at Bid) : 7.14 %

Evaluated at bid price : 19.3300

Limit Maturity 2039-01-06 YTM: 7.14 % [Restricted: 7.14 %] (Prob: 100.00 %)

Yield to Worst : 7.1438 % |

| CM.PR.I |

Perpetual-Discount |

1.07 % |

Yield-to-Worst (at Bid) : 6.92 %

Evaluated at bid price : 17.0500

Limit Maturity 2039-01-06 YTM: 6.92 % [Restricted: 6.92 %] (Prob: 100.00 %)

Yield to Worst : 6.9199 % |

| LBS.PR.A |

SplitShare |

1.10 % |

Yield-to-Worst (at Bid) : 9.88 %

Evaluated at bid price : 8.2500

Hard Maturity 2013-11-29 YTM: 9.88 % [Restricted: 9.88 %] (Prob: 100.00 %)

Yield to Worst : 9.8799 % |

| POW.PR.B |

Perpetual-Discount |

1.11 % |

Yield-to-Worst (at Bid) : 7.01 %

Evaluated at bid price : 19.2100

Limit Maturity 2039-01-06 YTM: 7.01 % [Restricted: 7.01 %] (Prob: 100.00 %)

Yield to Worst : 7.0113 % |

| TD.PR.N |

OpRet |

1.11 % |

Yield-to-Worst (at Bid) : 3.55 %

Evaluated at bid price : 26.0000

Call 2009-05-30 YTM: 3.71 % [Restricted: 1.46 %] (Prob: 26.43 %)

Call 2010-05-30 YTM: 3.55 % [Restricted: 3.55 %] (Prob: 5.03 %)

Soft Maturity 2014-01-30 YTM: 3.68 % [Restricted: 3.68 %] (Prob: 68.54 %)

Yield to Worst : 3.5548 % |

| TD.PR.O |

Perpetual-Discount |

1.23 % |

Yield-to-Worst (at Bid) : 6.43 %

Evaluated at bid price : 18.9100

Limit Maturity 2039-01-06 YTM: 6.43 % [Restricted: 6.43 %] (Prob: 100.00 %)

Yield to Worst : 6.4318 % |

| GWO.PR.F |

Perpetual-Discount |

1.25 % |

Yield-to-Worst (at Bid) : 7.36 %

Evaluated at bid price : 20.2600

Limit Maturity 2039-01-06 YTM: 7.36 % [Restricted: 7.36 %] (Prob: 100.00 %)

Yield to Worst : 7.3584 % |

| CM.PR.D |

Perpetual-Discount |

1.27 % |

Yield-to-Worst (at Bid) : 7.22 %

Evaluated at bid price : 20.0000

Limit Maturity 2039-01-06 YTM: 7.22 % [Restricted: 7.22 %] (Prob: 100.00 %)

Yield to Worst : 7.2188 % |

| SLF.PR.E |

Perpetual-Discount |

1.31 % |

Yield-to-Worst (at Bid) : 7.33 %

Evaluated at bid price : 15.5100

Limit Maturity 2039-01-06 YTM: 7.33 % [Restricted: 7.33 %] (Prob: 100.00 %)

Yield to Worst : 7.3309 % |

| PWF.PR.H |

Perpetual-Discount |

1.31 % |

Yield-to-Worst (at Bid) : 7.32 %

Evaluated at bid price : 20.1100

Limit Maturity 2039-01-06 YTM: 7.32 % [Restricted: 7.32 %] (Prob: 100.00 %)

Yield to Worst : 7.3202 % |

| CM.PR.G |

Perpetual-Discount |

1.33 % |

Yield-to-Worst (at Bid) : 7.14 %

Evaluated at bid price : 19.0000

Limit Maturity 2039-01-06 YTM: 7.14 % [Restricted: 7.14 %] (Prob: 100.00 %)

Yield to Worst : 7.1357 % |

| BNS.PR.P |

FixedReset |

1.33 % |

Yield-to-Worst (at Bid) : 4.54 %

Evaluated at bid price : 22.8000

Call 2013-05-25 YTM: 7.29 % [Restricted: 7.29 %] (Prob: 12.60 %)

Call 2018-05-25 YTM: 5.66 % [Restricted: 5.66 %] (Prob: 1.18 %)

Limit Maturity 2039-01-06 YTM: 4.54 % [Restricted: 4.54 %] (Prob: 86.22 %)

Yield to Worst : 4.5434 % |

| PWF.PR.E |

Perpetual-Discount |

1.37 % |

Yield-to-Worst (at Bid) : 7.31 %

Evaluated at bid price : 19.2600

Limit Maturity 2039-01-06 YTM: 7.31 % [Restricted: 7.31 %] (Prob: 100.00 %)

Yield to Worst : 7.3108 % |

| RY.PR.F |

Perpetual-Discount |

1.37 % |

Yield-to-Worst (at Bid) : 6.37 %

Evaluated at bid price : 17.7600

Limit Maturity 2039-01-06 YTM: 6.37 % [Restricted: 6.37 %] (Prob: 100.00 %)

Yield to Worst : 6.3707 % |

| TD.PR.A |

FixedReset |

1.41 % |

Yield-to-Worst (at Bid) : 4.68 %

Evaluated at bid price : 22.0500

Call 2014-03-02 YTM: 7.74 % [Restricted: 7.74 %] (Prob: 7.39 %)

Call 2019-03-02 YTM: 6.03 % [Restricted: 6.03 %] (Prob: 0.26 %)

Limit Maturity 2039-01-06 YTM: 4.68 % [Restricted: 4.68 %] (Prob: 92.35 %)

Yield to Worst : 4.6754 % |

| RY.PR.C |

Perpetual-Discount |

1.45 % |

Yield-to-Worst (at Bid) : 6.44 %

Evaluated at bid price : 18.1600

Limit Maturity 2039-01-06 YTM: 6.44 % [Restricted: 6.44 %] (Prob: 100.00 %)

Yield to Worst : 6.4414 % |

| TCA.PR.Y |

Perpetual-Discount |

1.47 % |

Yield-to-Worst (at Bid) : 6.35 %

Evaluated at bid price : 44.1000

Call 2014-04-04 YTM: 8.40 % [Restricted: 8.40 %] (Prob: 7.44 %)

Limit Maturity 2039-01-06 YTM: 6.35 % [Restricted: 6.35 %] (Prob: 92.56 %)

Yield to Worst : 6.3484 % |

| HSB.PR.D |

Perpetual-Discount |

1.47 % |

Yield-to-Worst (at Bid) : 7.35 %

Evaluated at bid price : 17.2000

Limit Maturity 2039-01-06 YTM: 7.35 % [Restricted: 7.35 %] (Prob: 100.00 %)

Yield to Worst : 7.3452 % |

| BCE.PR.I |

FixedFloater |

1.58 % |

Yield-to-Worst (at Bid) : 7.42 %

Evaluated at bid price : 15.3900

Limit Maturity 2039-01-06 YTM: 7.42 % [Restricted: 7.42 %] (Prob: 100.00 %)

Yield to Worst : 7.4171 % |

| NA.PR.K |

Perpetual-Discount |

1.63 % |

Yield-to-Worst (at Bid) : 7.24 %

Evaluated at bid price : 20.6100

Limit Maturity 2039-01-06 YTM: 7.24 % [Restricted: 7.24 %] (Prob: 100.00 %)

Yield to Worst : 7.2416 % |

| TD.PR.S |

FixedReset |

1.64 % |

Yield-to-Worst (at Bid) : 4.28 %

Evaluated at bid price : 22.2000

Call 2013-08-30 YTM: 7.81 % [Restricted: 7.81 %] (Prob: 8.05 %)

Call 2018-08-30 YTM: 5.77 % [Restricted: 5.77 %] (Prob: 0.77 %)

Limit Maturity 2039-01-06 YTM: 4.28 % [Restricted: 4.28 %] (Prob: 91.18 %)

Yield to Worst : 4.2844 % |

| BCE.PR.G |

FixedFloater |

1.64 % |

Yield-to-Worst (at Bid) : 7.28 %

Evaluated at bid price : 15.5000

Limit Maturity 2039-01-06 YTM: 7.28 % [Restricted: 7.28 %] (Prob: 100.00 %)

Yield to Worst : 7.2815 % |

| BAM.PR.J |

OpRet |

1.68 % |

Yield-to-Worst (at Bid) : 10.64 %

Evaluated at bid price : 17.5400

Soft Maturity 2018-03-30 YTM: 10.64 % [Restricted: 10.64 %] (Prob: 100.00 %)

Yield to Worst : 10.6445 % |

| PWF.PR.I |

Perpetual-Discount |

1.69 % |

Yield-to-Worst (at Bid) : 7.28 %

Evaluated at bid price : 21.1100

Limit Maturity 2039-01-06 YTM: 7.28 % [Restricted: 7.28 %] (Prob: 100.00 %)

Yield to Worst : 7.2758 % |

| TRI.PR.B |

Floater |

1.77 % |

Yield-to-Worst (at Bid) : 5.37 %

Evaluated at bid price : 11.5000

Limit Maturity 2039-01-06 YTM: 5.37 % [Restricted: 5.37 %] (Prob: 100.00 %)

Yield to Worst : 5.3674 % |

| RY.PR.H |

Perpetual-Discount |

1.83 % |

Yield-to-Worst (at Bid) : 6.78 %

Evaluated at bid price : 21.2000

Limit Maturity 2039-01-06 YTM: 6.78 % [Restricted: 6.78 %] (Prob: 100.00 %)

Yield to Worst : 6.7792 % |

| TD.PR.Y |

FixedReset |

1.93 % |

Yield-to-Worst (at Bid) : 4.48 %

Evaluated at bid price : 21.8500

Call 2013-11-30 YTM: 8.17 % [Restricted: 8.17 %] (Prob: 6.04 %)

Call 2018-11-30 YTM: 6.07 % [Restricted: 6.07 %] (Prob: 0.46 %)

Limit Maturity 2039-01-06 YTM: 4.48 % [Restricted: 4.48 %] (Prob: 93.50 %)

Yield to Worst : 4.4819 % |

| PWF.PR.L |

Perpetual-Discount |

1.94 % |

Yield-to-Worst (at Bid) : 7.32 %

Evaluated at bid price : 17.8400

Limit Maturity 2039-01-06 YTM: 7.32 % [Restricted: 7.32 %] (Prob: 100.00 %)

Yield to Worst : 7.3189 % |

| SLF.PR.D |

Perpetual-Discount |

1.99 % |

Yield-to-Worst (at Bid) : 7.30 %

Evaluated at bid price : 15.4100

Limit Maturity 2039-01-06 YTM: 7.30 % [Restricted: 7.30 %] (Prob: 100.00 %)

Yield to Worst : 7.2961 % |

| PWF.PR.K |

Perpetual-Discount |

2.05 % |

Yield-to-Worst (at Bid) : 7.06 %

Evaluated at bid price : 17.9400

Limit Maturity 2039-01-06 YTM: 7.06 % [Restricted: 7.06 %] (Prob: 100.00 %)

Yield to Worst : 7.0592 % |

| CM.PR.J |

Perpetual-Discount |

2.07 % |

Yield-to-Worst (at Bid) : 6.93 %

Evaluated at bid price : 16.2900

Limit Maturity 2039-01-06 YTM: 6.93 % [Restricted: 6.93 %] (Prob: 100.00 %)

Yield to Worst : 6.9346 % |

| GWO.PR.H |

Perpetual-Discount |

2.10 % |

Yield-to-Worst (at Bid) : 7.19 %

Evaluated at bid price : 17.0500

Limit Maturity 2039-01-06 YTM: 7.19 % [Restricted: 7.19 %] (Prob: 100.00 %)

Yield to Worst : 7.1860 % |

| BNA.PR.C |

SplitShare |

2.15 % |

Yield-to-Worst (at Bid) : 19.04 %

Evaluated at bid price : 9.0400

Hard Maturity 2019-01-10 YTM: 19.04 % [Restricted: 19.04 %] (Prob: 100.00 %)

Yield to Worst : 19.0370 % |

| PWF.PR.A |

Floater |

2.17 % |

Yield-to-Worst (at Bid) : 5.06 %

Evaluated at bid price : 12.2600

Limit Maturity 2039-01-06 YTM: 5.06 % [Restricted: 5.06 %] (Prob: 100.00 %)

Yield to Worst : 5.0629 % |

| BMO.PR.K |

Perpetual-Discount |

2.18 % |

Yield-to-Worst (at Bid) : 6.94 %

Evaluated at bid price : 19.2500

Limit Maturity 2039-01-06 YTM: 6.94 % [Restricted: 6.94 %] (Prob: 100.00 %)

Yield to Worst : 6.9382 % |

| W.PR.J |

Perpetual-Discount |

2.21 % |

Yield-to-Worst (at Bid) : 7.84 %

Evaluated at bid price : 18.0000

Limit Maturity 2039-01-06 YTM: 7.84 % [Restricted: 7.84 %] (Prob: 100.00 %)

Yield to Worst : 7.8391 % |

| BCE.PR.Z |

FixedFloater |

2.40 % |

Yield-to-Worst (at Bid) : 7.93 %

Evaluated at bid price : 14.5100

Limit Maturity 2039-01-06 YTM: 7.93 % [Restricted: 7.93 %] (Prob: 100.00 %)

Yield to Worst : 7.9293 % |

| BMO.PR.J |

Perpetual-Discount |

2.46 % |

Yield-to-Worst (at Bid) : 6.69 %

Evaluated at bid price : 17.1100

Limit Maturity 2039-01-06 YTM: 6.69 % [Restricted: 6.69 %] (Prob: 100.00 %)

Yield to Worst : 6.6874 % |

| PWF.PR.G |

Perpetual-Discount |

2.47 % |

Yield-to-Worst (at Bid) : 7.28 %

Evaluated at bid price : 20.7600

Limit Maturity 2039-01-06 YTM: 7.28 % [Restricted: 7.28 %] (Prob: 100.00 %)

Yield to Worst : 7.2752 % |

| BCE.PR.A |

FixedFloater |

2.50 % |

Yield-to-Worst (at Bid) : 7.13 %

Evaluated at bid price : 16.4100

Limit Maturity 2039-01-06 YTM: 7.13 % [Restricted: 7.13 %] (Prob: 100.00 %)

Yield to Worst : 7.1266 % |

| NA.PR.L |

Perpetual-Discount |

2.59 % |

Yield-to-Worst (at Bid) : 7.08 %

Evaluated at bid price : 17.4600

Limit Maturity 2039-01-06 YTM: 7.08 % [Restricted: 7.08 %] (Prob: 100.00 %)

Yield to Worst : 7.0843 % |

| STW.PR.A |

InterestBearing |

2.59 % |

Yield-to-Worst (at Bid) : 11.47 %

Evaluated at bid price : 9.5000

Hard Maturity 2009-12-31 YTM: 11.47 % [Restricted: 11.27 %] (Prob: 100.00 %)

Yield to Worst : 11.4674 % |

| CU.PR.B |

Perpetual-Discount |

2.68 % |

Yield-to-Worst (at Bid) : 6.62 %

Evaluated at bid price : 23.0000

Call 2011-07-01 YTM: 10.47 % [Restricted: 10.47 %] (Prob: 9.42 %)

Call 2012-07-01 YTM: 9.00 % [Restricted: 9.00 %] (Prob: 3.96 %)

Limit Maturity 2039-01-06 YTM: 6.62 % [Restricted: 6.62 %] (Prob: 86.61 %)

Yield to Worst : 6.6159 % |

| BNA.PR.A |

SplitShare |

2.70 % |

Yield-to-Worst (at Bid) : 12.50 %

Evaluated at bid price : 22.8000

Hard Maturity 2010-09-30 YTM: 12.50 % [Restricted: 12.50 %] (Prob: 100.00 %)

Yield to Worst : 12.5006 % |

| LFE.PR.A |

SplitShare |

2.78 % |

Yield-to-Worst (at Bid) : 6.48 %

Evaluated at bid price : 9.6000

Hard Maturity 2012-12-01 YTM: 6.48 % [Restricted: 6.48 %] (Prob: 100.00 %)

Yield to Worst : 6.4803 % |

| PPL.PR.A |

SplitShare |

2.81 % |

Yield-to-Worst (at Bid) : 7.55 %

Evaluated at bid price : 9.1500

Hard Maturity 2012-12-01 YTM: 7.55 % [Restricted: 7.55 %] (Prob: 100.00 %)

Yield to Worst : 7.5529 % |

| BAM.PR.H |

OpRet |

2.93 % |

Yield-to-Worst (at Bid) : 11.82 %

Evaluated at bid price : 21.1000

Soft Maturity 2012-03-30 YTM: 11.82 % [Restricted: 11.82 %] (Prob: 100.00 %)

Yield to Worst : 11.8242 % |

| POW.PR.D |

Perpetual-Discount |

3.00 % |

Yield-to-Worst (at Bid) : 7.06 %

Evaluated at bid price : 17.8300

Limit Maturity 2039-01-06 YTM: 7.06 % [Restricted: 7.06 %] (Prob: 100.00 %)

Yield to Worst : 7.0602 % |

| ALB.PR.A |

SplitShare |

3.03 % |

Yield-to-Worst (at Bid) : 14.05 %

Evaluated at bid price : 20.7300

Hard Maturity 2011-02-28 YTM: 14.05 % [Restricted: 14.05 %] (Prob: 100.00 %)

Yield to Worst : 14.0550 % |

| BAM.PR.G |

FixedFloater |

3.11 % |

Yield-to-Worst (at Bid) : 9.95 %

Evaluated at bid price : 11.6000

Limit Maturity 2039-01-06 YTM: 9.95 % [Restricted: 9.95 %] (Prob: 100.00 %)

Yield to Worst : 9.9491 % |

| CIU.PR.A |

Perpetual-Discount |

3.20 % |

Yield-to-Worst (at Bid) : 7.26 %

Evaluated at bid price : 16.1100

Limit Maturity 2039-01-06 YTM: 7.26 % [Restricted: 7.26 %] (Prob: 100.00 %)

Yield to Worst : 7.2622 % |

| FFN.PR.A |

SplitShare |

3.29 % |

Yield-to-Worst (at Bid) : 10.28 %

Evaluated at bid price : 7.8600

Hard Maturity 2014-12-01 YTM: 10.28 % [Restricted: 10.28 %] (Prob: 100.00 %)

Yield to Worst : 10.2752 % |

| TD.PR.P |

Perpetual-Discount |

3.37 % |

Yield-to-Worst (at Bid) : 6.44 %

Evaluated at bid price : 20.4500

Limit Maturity 2039-01-06 YTM: 6.44 % [Restricted: 6.44 %] (Prob: 100.00 %)

Yield to Worst : 6.4379 % |

| BAM.PR.O |

OpRet |

3.48 % |

Yield-to-Worst (at Bid) : 13.90 %

Evaluated at bid price : 17.8500

Option Certainty 2013-06-30 YTM: 13.90 % [Restricted: 13.90 %] (Prob: 100.00 %)

Yield to Worst : 13.9048 % |

| RY.PR.B |

Perpetual-Discount |

3.54 % |

Yield-to-Worst (at Bid) : 6.29 %

Evaluated at bid price : 19.0000

Limit Maturity 2039-01-06 YTM: 6.29 % [Restricted: 6.29 %] (Prob: 100.00 %)

Yield to Worst : 6.2858 % |

| BMO.PR.H |

Perpetual-Discount |

3.83 % |

Yield-to-Worst (at Bid) : 6.80 %

Evaluated at bid price : 19.8100

Limit Maturity 2039-01-06 YTM: 6.80 % [Restricted: 6.80 %] (Prob: 100.00 %)

Yield to Worst : 6.8044 % |

| TCA.PR.X |

Perpetual-Discount |

4.00 % |

Yield-to-Worst (at Bid) : 6.37 %

Evaluated at bid price : 43.9500

Call 2013-11-14 YTM: 8.67 % [Restricted: 8.67 %] (Prob: 6.75 %)

Limit Maturity 2039-01-06 YTM: 6.37 % [Restricted: 6.37 %] (Prob: 93.25 %)

Yield to Worst : 6.3721 % |

| FTN.PR.A |

SplitShare |

4.14 % |

Yield-to-Worst (at Bid) : 8.11 %

Evaluated at bid price : 8.5500

Hard Maturity 2015-12-01 YTM: 8.11 % [Restricted: 8.11 %] (Prob: 100.00 %)

Yield to Worst : 8.1137 % |

| SBC.PR.A |

SplitShare |

4.21 % |

Yield-to-Worst (at Bid) : 9.47 %

Evaluated at bid price : 8.6600

Hard Maturity 2012-11-30 YTM: 9.47 % [Restricted: 9.47 %] (Prob: 100.00 %)

Yield to Worst : 9.4662 % |

| CU.PR.A |

Perpetual-Discount |

4.26 % |

Yield-to-Worst (at Bid) : 6.39 %

Evaluated at bid price : 23.0000

Call 2011-03-31 YTM: 10.73 % [Restricted: 10.73 %] (Prob: 8.80 %)

Call 2012-03-31 YTM: 8.99 % [Restricted: 8.99 %] (Prob: 4.18 %)

Limit Maturity 2039-01-06 YTM: 6.39 % [Restricted: 6.39 %] (Prob: 87.01 %)

Yield to Worst : 6.3914 % |

| FBS.PR.B |

SplitShare |

4.36 % |

Yield-to-Worst (at Bid) : 9.50 %

Evaluated at bid price : 8.8500

Hard Maturity 2011-12-15 YTM: 9.50 % [Restricted: 9.50 %] (Prob: 100.00 %)

Yield to Worst : 9.4998 % |

| SLF.PR.A |

Perpetual-Discount |

4.41 % |

Yield-to-Worst (at Bid) : 6.93 %

Evaluated at bid price : 17.3000

Limit Maturity 2039-01-06 YTM: 6.93 % [Restricted: 6.93 %] (Prob: 100.00 %)

Yield to Worst : 6.9337 % |

| ELF.PR.F |

Perpetual-Discount |

4.59 % |

Yield-to-Worst (at Bid) : 8.14 %

Evaluated at bid price : 16.4000

Limit Maturity 2039-01-06 YTM: 8.14 % [Restricted: 8.14 %] (Prob: 100.00 %)

Yield to Worst : 8.1417 % |

| FIG.PR.A |

InterestBearing |

6.16 % |

Yield-to-Worst (at Bid) : 11.70 %

Evaluated at bid price : 7.7500

Hard Maturity 2014-12-31 YTM: 11.70 % [Restricted: 11.70 %] (Prob: 100.00 %)

Yield to Worst : 11.7020 % |

| BAM.PR.M |

Perpetual-Discount |

6.21 % |

Yield-to-Worst (at Bid) : 9.91 %

Evaluated at bid price : 12.1500

Limit Maturity 2039-01-06 YTM: 9.91 % [Restricted: 9.91 %] (Prob: 100.00 %)

Yield to Worst : 9.9133 % |

| BAM.PR.N |

Perpetual-Discount |

7.08 % |

Yield-to-Worst (at Bid) : 9.95 %

Evaluated at bid price : 12.1000

Limit Maturity 2039-01-06 YTM: 9.95 % [Restricted: 9.95 %] (Prob: 100.00 %)

Yield to Worst : 9.9549 % |

| IAG.PR.A |

Perpetual-Discount |

7.11 % |

Yield-to-Worst (at Bid) : 6.95 %

Evaluated at bid price : 16.7200

Limit Maturity 2039-01-06 YTM: 6.95 % [Restricted: 6.95 %] (Prob: 100.00 %)

Yield to Worst : 6.9478 % |