The markets giveth and the markets taketh away.

The trouble started in Europe, when BNP Paribas halted redemptions on some hedge funds, due to an inability to find a bid on some of their holdings.

“The complete evaporation of liquidity in certain market segments of the U.S. securitization market has made it impossible to value certain assets fairly regardless of their quality or credit rating,” BNP Paribas said in a statement.

This caused panic – or, at least, a major recalculation of just how bad things actually are. Overnight LIBOR increased 53bp and the European Central Bank stepped up to flood the system with cash. There is, as yet, no word on whether they have started renting helicopters. Similarly, the Fed pumped in liquidity (albeit not so much) and the Bank of Canada proudly announced that its employees showed up for work today.

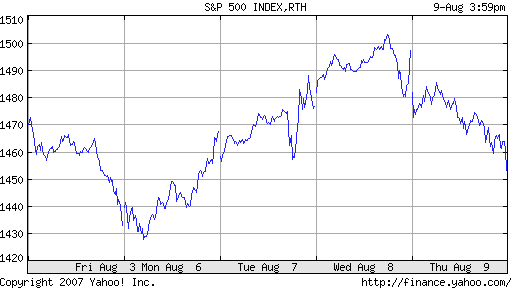

The stock market did not like being reminded of sub-prime and showed its displeasure in both the US and Canada. The market is so upset that it has been knocked back all the way to where it was on Monday at about 2pm:

As might be imagined, the bond markets did interesting things. The flood of short-term money from the central banks sent two-year Treasury yields sharply lower. Fears that this money might fuel inflation steepened the curve considerably, both in the US and Canada. It would be really, really nice to see a decent term premium again, y’know? The WSJ has a round-up of reactions to the liquidity pumping.

Thirty-day Fed-Fund Futures are now indicating a rate of 5.20% for August and 4.73% for next February, but it’s an open question about how reliable this predictor is. There’s a lot of arbitrage problems with this contract – it’s hard to short Treasury Bills – as well as segmentation problems.

In stories of continuing interest, Joseph Stiglitz blames the sub-prime mess on Greenspan & Bush and Brad Setser has some things to say about China’s Reserve Policy sabre-rattling.

The preferred share market saw increased volumes today – back to normal levels, perhaps even normal+, with three issues trading in excess of 100,000 shares without being internal crosses or dividend capture plays.

PerpetualDiscount managed to squeak out another daily gain, while perpetualPremiums fell a bit, but nothing too exciting.

In keeping with the “flight to quality” theme, a number of lower-rated issues not included in the indices performed poorly today: NTL.PR.G, -2.89%; HPF.PR.B, -1.71%; DC.PR.A, -1.66%; EPP.PR.A, -1.45%; NTL.PR.F, -1.16%; and our friend from yesterday, YPG.PR.B, -1.14%. I will note that DBRS rates HPF.PR.B as Pfd-2(low), but I don’t understand why.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30 | |||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | 4.75% | 4.78% | 29,515 | 15.96 | 1 | +0.0410% | 1,045.0 |

| Fixed-Floater | 4.99% | 4.98% | 127,739 | 14.19 | 8 | -0.1018% | 1,020.9 |

| Floater | 4.88% | 0.33% | 74,315 | 8.18 | 4 | -0.1992% | 1,048.6 |

| Op. Retract | 4.82% | 3.89% | 83,087 | 2.95 | 16 | +0.1512% | 1,024.4 |

| Split-Share | 5.04% | 4.64% | 101,688 | 3.91 | 15 | -0.0949% | 1,045.9 |

| Interest Bearing | 6.25% | 6.71% | 64,530 | 4.62 | 3 | -0.7418% | 1,032.2 |

| Perpetual-Premium | 5.53% | 5.18% | 101,910 | 5.65 | 24 | -0.0459% | 1,024.2 |

| Perpetual-Discount | 5.07% | 5.11% | 309,389 | 15.32 | 39 | +0.0278% | 977.5 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| BSD.PR.A | InterestBearing | -1.7989% | Very volatile lately! Asset coverage is down to 1.86:1 as of August 3, down from 1.97:1 on July 13. Now with a pre-tax bid-YTW of 7.47% based on a bid of 9.28 and a hardMaturity 2015-3-31 at 10.00. |

| BAM.PR.M | PerpetualDiscount | -1.4151% | So much for yesterday’s gains! Now with a pre-tax bid-YTW of 5.77% based on a bid of 20.90 and a limitMaturity. |

| WFS.PR.A | SplitShare | -1.0721% | Probably the “World Financial” part of its name that did it! Had asset coverage of 2.13:1 as of July 31. Now with a pre-tax bid-YTW of 5.02% based on a bid of 10.15 and a hardMaturity 2011-6-30 at 10.00. |

| PWF.PR.J | OpRet | +1.0074% | Now with a pre-tax bid-YTW of 3.93% based on a bid of 26.07 and either a call 2009-5-30 at 25.75 OR a softMaturity 2013-7-30 at 25.00. Take your pick. Anything in between will be pretty much the same as well. |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| GWO.PR.X | OpRet | 262,683 | Nesbitt crossed 200,000 at 26.85, then another 50,000 at the same price. Nice tickets! Assiduous readers will remember my fascination with this issue. Now with a pre-tax bid-YTW of 3.68% based on a bid of 26.66 and a call 2009-10-30 at 26.00. Or a whopping 3.70% if it hangs on until its softMaturity 2013-9-29 at 25.00. That’s 5.15% interest equivalent. I suppose that’s OK, but you can get slightly over 5% on a bank deposit note for about the same term, and about 5.4% on GWL 10-year paper … so why give up seniority AND increase negative convexity? Some things in this life puzzle me. |

| TD.PR.N | OpRet | 103,400 | Nesbitt crossed 100,000 at 25.85. Now with a pre-tax bid-YTW of 4.07% based on a bid of 25.81 and a softMaturity 2014-1-30 at 25.00. |

| TD.PR.M | OpRet | 102,500 | The busy boys at Nesbitt crossed 100,000 at 26.11. Now with a pre-tax bid-YTW of 3.91% based on a bid of 26.14 and a softMaturity 2013-10-30 at 25.00. |

| BNS.PR.M | PerpetualDiscount | 67,830 | Nesbitt crossed 50,000 at 23.06. Now with a pre-tax bid-YTW of 4.92% based on a bid of 23.00 and a limitMaturity. |

| GWO.PR.I | PerpetualDiscount | 64,939 | Now with a pre-tax bid-YTW of 5.05% based on a bid of 22.56 and a limitMaturity. |

There were twenty-six other $25-equivalent index-included issues trading over 10,000 shares today.