Much to investors’ relief, the previously scheduled end of the world was cancelled today, which was considered good news for both American and Canadian equities. A good day all ’round, in fact, as Treasuries rose, dutifully followed by Canadas.

It is entirely possible that this exuberance has been caused by reports that Stephen Harper said there had been a lot of easy credit internationally, suggesting the recent turmoil was a reassessment of risk. We shall all sleep better tonight provided, of course, that the cheques resulting from massive redemptions of US Junk Funds don’t bounce. Meanwhile, Flaherty says he’s from the government and he’s here to help us.

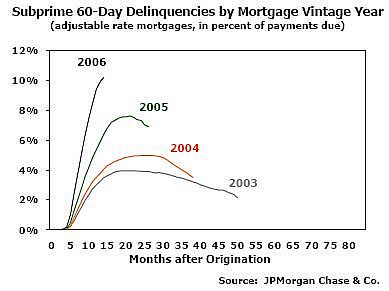

Sub-Prime had a bad day amongst some indications that credit standards spiralled downwards over the past few years:

It makes one feel at least a little bit more sympathetic to the ratings agencies criticized for over-optimism!

Fed Funds contracts are showing a Fed easing ahead, but this is not necessarily a logical conclusion, especially considering that Europe might tighten.

Rio Tinto’s financing of its Alcan takeover is reported to be doing well.

As far as prefs are concerned … BSN.PR.A has been removed from the HIMIPref™ universe, due to its redemption.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30 | |||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | 4.85% | 4.88% | 28,446 | 15.80 | 1 | -0.3704% | 1,035.6 |

| Fixed-Floater | 4.95% | 5.01% | 130,654 | 14.16 | 8 | +0.6142% | 1,027.6 |

| Floater | 4.87% | -0.15% | 75,136 | 8.20 | 4 | -0.0197% | 1,049.9 |

| Op. Retract | 4.84% | 3.95% | 84,865 | 3.29 | 16 | +0.0008% | 1,022.0 |

| Split-Share | 5.04% | 4.56% | 108,886 | 3.86 | 15 | -0.0563% | 1,046.2 |

| Interest Bearing | 6.32% | 6.85% | 62,002 | 4.62 | 3 | -0.5324% | 1,020.7 |

| Perpetual-Premium | 5.52% | 5.17% | 105,558 | 5.66 | 24 | +0.0763% | 1,025.1 |

| Perpetual-Discount | 5.08% | 5.12% | 320,279 | 15.31 | 39 | -0.0660% | 974.5 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| BSD.PR.A | InterestBearing | -2.4731% | Even worse than yesterday, and now it’s just getting silly. It hit a new low of 8.40. Asset coverage is about 1.9:1 after a big hit in July. But it’s still not junk! Now with a pre-tax bid-YTW of 7.83% (as interest) based on a bid of 9.07 and a hardMaturity 2015-3-31 at 10.00. |

| BAM.PR.N | PerpetualDiscount | -2.0515% | Are the underwriters finally getting serious about clearing this out? New low today of 20.50. Now with a pre-tax bid-YTW of 5.86% based on a bid of 20.53 and a limitMaturity. |

| RY.PR.A | PerpetualDiscount | -1.0667% | Dropping back after yesterday’s gain. Now with a pre-tax bid-YTW of 5.00% based on a bid of 22.26 and a limitMaturity. |

| BAM.PR.G | FixFloat | +2.5717% | Can we take this as meaning that the BAM.PR.N price doesn’t indicate revulsion at the Brookfield name? |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| RY.PR.K | OpRet | 97,510 | RBC crossed 90,000 at 24.95. Callable at par commencing 2007-9-23; softMaturity 2008-8-23. |

| BNS.PR.J | PerpetualPremium | 52,971 | Desjardins crossed 50,000 at 25.85. Now with a pre-tax bid-YTW of 4.81% based on a bid of 25.66 and a call 2013-11-28 at 25.00. |

| BNS.PR.K | PerpetualDiscount | 26,070 | RBC bought 10,000 from Nesbitt at 24.40. Now with a pre-tax bid-YTW of 4.95% based on a bid of 24.37 and a limitMaturity. |

| CM.PR.I | PerpetualDiscount | 18,975 | Now with a pre-tax bid-YTW of 5.10% based on a bid of 23.16 and a limitMaturity. |

| TD.PR.O | PerpetualDiscount | 16,750 | Now with a pre-tax bid-YTW of 4.97% based on a bid of 24.50 and a limitMaturity. |

There were Ten other $25-equivalent index-included issues trading over 10,000 shares today.

[…] It turned out that the end of the world, previously thought to have been cancelled, was merely postponed; a few proponents of the Efficient Market Hypothesis (strong form) received bruises in the rush to the exits but, as they themselves noted, they probably would have got them anyway. […]

[…] Continuing the recovery from Thursday’s loss. Now with a pre-tax bid-YTW of 7.42% based on a bid of 9.30 and a hardMaturity 2015-3-31 at 10.00. […]