OSFI has announced:

the results of its latest solvency testing of federally regulated private pension plans.

As part of its regular monitoring activities, OSFI tracks the ratio of plan assets to plan liabilities for the 400 defined benefit plans it regulates. The results show that the average estimated solvency ratio of federally regulated defined benefit private pension plans at December 31, 2008 was 0.85, a decrease from 0.98 as reported in June 2008.

One of my favourite examples of boneheaded compensation schemes has always been the Soviet system for evaluating tractor factories’ meeting of goals set in five year plans. They weren’t evaluated on quality of tractors. They weren’t evaluated on quantity of tractors. They were evaluated on weight of tractors. Guess which world economy had the heaviest tractors?

But maybe now I have a new favourite: the SEC system for evaluation of case officers:

The SEC and Finra receive thousands of complaints each year. SEC enforcement offices were evaluated on the number of cases, or “stats,” they brought in, rather than on the seriousness or difficulty of action, said Walter Ricciardi, the agency’s deputy chief of enforcement from 2005 through 2008, in a speech April 1 in New York.

“So if you brought an Enron, that’s one,” Ricciardi said. “If you brought a WorldCom, that’s two.” Delisting 135 defunct companies in a week for failing to file annual reports gave an enforcer 135 cases to count, he said.

But there’s some good news in the bond world, anyway:

JPMorgan Chase & Co., the second- largest U.S. bank by assets, plans to sell dollar-denominated debt without the backing of the U.S. government for the first time since August, according to a person familiar with the transaction.

The New York-based bank plans to sell 10-year notes in a benchmark offering, said the person, who declined to be identified because terms aren’t set. Benchmark typically means at least $500 million.

There are rumours about that the objective of this issue is not so much as to get the money as to establish a market clearing price.

But naturally, recessions mean there are some losers: General Growth and Abitibi have filed for creditor protection.

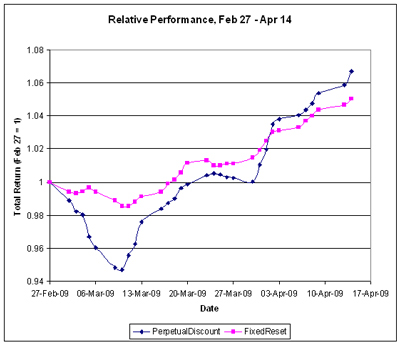

Yet another solidly positive day for preferred shares on continued relatively heavy volume. PerpetualDiscounts outperformed – as might be expected, given that their duration is now officially well in excess of the FixedResets.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5988 % | 936.6 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.5988 % | 1,514.7 |

| Floater | 5.21 % | 5.19 % | 70,376 | 15.19 | 2 | 0.5988 % | 1,170.1 |

| OpRet | 5.12 % | 4.63 % | 144,882 | 3.88 | 15 | 0.4263 % | 2,125.6 |

| SplitShare | 6.69 % | 9.84 % | 45,204 | 5.64 | 3 | 0.7985 % | 1,726.7 |

| Interest-Bearing | 6.17 % | 10.29 % | 28,087 | 0.68 | 1 | 0.1030 % | 1,931.6 |

| Perpetual-Premium | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.6993 % | 1,623.7 |

| Perpetual-Discount | 6.72 % | 6.82 % | 147,512 | 12.83 | 71 | 0.6993 % | 1,495.4 |

| FixedReset | 5.94 % | 5.37 % | 694,673 | 4.59 | 35 | 0.3152 % | 1,895.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BMO.PR.L | Perpetual-Discount | -1.64 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 21.26 Evaluated at bid price : 21.54 Bid-YTW : 6.85 % |

| PWF.PR.L | Perpetual-Discount | -1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 18.22 Evaluated at bid price : 18.22 Bid-YTW : 7.04 % |

| TD.PR.R | Perpetual-Discount | 1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 21.45 Evaluated at bid price : 21.45 Bid-YTW : 6.56 % |

| W.PR.H | Perpetual-Discount | 1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 20.25 Evaluated at bid price : 20.25 Bid-YTW : 6.85 % |

| BAM.PR.N | Perpetual-Discount | 1.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 14.30 Evaluated at bid price : 14.30 Bid-YTW : 8.42 % |

| BNS.PR.O | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 21.39 Evaluated at bid price : 21.71 Bid-YTW : 6.47 % |

| RY.PR.C | Perpetual-Discount | 1.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 18.40 Evaluated at bid price : 18.40 Bid-YTW : 6.37 % |

| RY.PR.H | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 22.72 Evaluated at bid price : 22.85 Bid-YTW : 6.29 % |

| CM.PR.D | Perpetual-Discount | 1.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 20.76 Evaluated at bid price : 20.76 Bid-YTW : 6.96 % |

| PWF.PR.G | Perpetual-Discount | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 21.26 Evaluated at bid price : 21.26 Bid-YTW : 6.98 % |

| GWO.PR.H | Perpetual-Discount | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 7.01 % |

| POW.PR.B | Perpetual-Discount | 1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 18.84 Evaluated at bid price : 18.84 Bid-YTW : 7.16 % |

| BAM.PR.O | OpRet | 1.19 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 22.11 Bid-YTW : 8.43 % |

| SLF.PR.B | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 17.31 Evaluated at bid price : 17.31 Bid-YTW : 7.02 % |

| BNS.PR.M | Perpetual-Discount | 1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 17.64 Evaluated at bid price : 17.64 Bid-YTW : 6.41 % |

| IAG.PR.A | Perpetual-Discount | 1.29 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 15.70 Evaluated at bid price : 15.70 Bid-YTW : 7.42 % |

| POW.PR.D | Perpetual-Discount | 1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 18.01 Evaluated at bid price : 18.01 Bid-YTW : 7.00 % |

| MFC.PR.C | Perpetual-Discount | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 16.95 Evaluated at bid price : 16.95 Bid-YTW : 6.73 % |

| ELF.PR.G | Perpetual-Discount | 1.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 14.65 Evaluated at bid price : 14.65 Bid-YTW : 8.19 % |

| BNS.PR.L | Perpetual-Discount | 1.67 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 17.65 Evaluated at bid price : 17.65 Bid-YTW : 6.41 % |

| MFC.PR.B | Perpetual-Discount | 1.73 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 17.61 Evaluated at bid price : 17.61 Bid-YTW : 6.69 % |

| BNS.PR.N | Perpetual-Discount | 1.76 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 20.81 Evaluated at bid price : 20.81 Bid-YTW : 6.34 % |

| PWF.PR.K | Perpetual-Discount | 1.83 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 18.35 Evaluated at bid price : 18.35 Bid-YTW : 6.78 % |

| BNA.PR.C | SplitShare | 2.03 % | Asset coverage of 1.7-:1 as of February 28, according to the company … which really should have updated their website by now. Asset Coverage is probably 1.8+:1 by now, based on BAM.A’s improvement from 16.88 to 18.60. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2019-01-10 Maturity Price : 25.00 Evaluated at bid price : 13.06 Bid-YTW : 13.45 % |

| HSB.PR.C | Perpetual-Discount | 2.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 18.66 Evaluated at bid price : 18.66 Bid-YTW : 6.91 % |

| GWO.PR.F | Perpetual-Discount | 2.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 21.70 Evaluated at bid price : 21.70 Bid-YTW : 6.88 % |

| CM.PR.K | FixedReset | 2.65 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 23.57 Evaluated at bid price : 23.61 Bid-YTW : 4.59 % |

| BAM.PR.M | Perpetual-Discount | 2.69 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 14.50 Evaluated at bid price : 14.50 Bid-YTW : 8.30 % |

| BAM.PR.I | OpRet | 3.27 % | YTW SCENARIO Maturity Type : Soft Maturity Maturity Date : 2013-12-30 Maturity Price : 25.00 Evaluated at bid price : 24.32 Bid-YTW : 6.27 % |

| POW.PR.A | Perpetual-Discount | 3.71 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 20.12 Evaluated at bid price : 20.12 Bid-YTW : 7.02 % |

| POW.PR.C | Perpetual-Discount | 4.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-04-16 Maturity Price : 20.95 Evaluated at bid price : 20.95 Bid-YTW : 6.98 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| MFC.PR.D | FixedReset | 94,057 | Desjardins crossed 25,000 at 25.47. YTW SCENARIO Maturity Type : Call Maturity Date : 2019-07-19 Maturity Price : 25.00 Evaluated at bid price : 25.45 Bid-YTW : 6.38 % |

| RY.PR.X | FixedReset | 91,502 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-23 Maturity Price : 25.00 Evaluated at bid price : 25.82 Bid-YTW : 5.64 % |

| CM.PR.L | FixedReset | 79,619 | Nesbitt crossed 24,600 at 25.95; CIBC crossed 38,000 at 25.90. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 25.83 Bid-YTW : 5.72 % |

| NA.PR.P | FixedReset | 76,610 | CIBC crossed 38,000 at 25.82. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-03-17 Maturity Price : 25.00 Evaluated at bid price : 25.78 Bid-YTW : 5.78 % |

| HSB.PR.E | FixedReset | 75,721 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 25.37 Bid-YTW : 6.38 % |

| TD.PR.K | FixedReset | 75,635 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 25.71 Bid-YTW : 5.71 % |

| There were 38 other index-included issues trading in excess of 10,000 shares. | |||