Incompetent Portfolio Managers now have a new object of veneration: the Globe and Mail has published a hagiography of St. Busseri the Crybaby after he squared his rot for a good boo-hoo-hoo:

Mr. Busseri found himself in the crosshairs of what he called a “character assassination” attempt by TriNorth.

The attack came in the form of a published group letter that criticized his management skills at previous jobs, including his stint restructuring Environmental Management Solutions Inc., a onetime proxy battle target now known as Englobe Corp.

“When you’re married and have kids, it’s disturbing and disappointing when people behave like this,” Mr. Busseri said. “It feels like intimidation.”

The published group letter makes interesting reading:

Busseri has no record of creating shareholder value as a leader of a public company.

The facts are:

• From October 2004 to January 2008, while Busseri was President and CEO and a Board Member of EnGlobe Corp. (TSX: EG) the company share price fell 58%.

• The TSX Composite rose 56% over the same period.

• Between 2004 and 2007, EnGlobe had cumulative operating losses of about $8.2 million, on $317 million of revenues

• Busseri led Capital Environmental Resources Inc. (later re-named Waste Services Inc.) from 1997 until his departure in August 2000.

• In the last 14 months of Busseri’s tenure, Capital / Waste Services share price fell 73%.

• The S&P rose 17% over the same period.

• Busseri was no longer employed with the company after Capital / Waste Services reported a loss of $6.6 million – its largest loss ever.

• Busseri recently left the position of Executive Vice President at Hanfeng Evergreen Inc. in April 2009 after a four-month tenure.

Um … where’s the character assassination? Where’s the stuff that makes marriage and kids such an issue?

I have no idea who is better suited to lead Trinorth. I don’t care. It makes no difference to me. But in mounting his proxy battle, Busseri has necessarily voiced his opinion on the competence of Trinorth’s board:

It is clear to the Concerned Shareholders that the Current Board – the same directors being nominated by management of TriNorth – are either unable or unwilling to preserve, protect and build value for all shareholders.

OK, so he’s got an opinion. It’s necessarily an opinion. So the competence of the person giving that opinion is fair game. I see nothing in the Trinorth letter that is objectionable: they didn’t make any allegations regarding his personal life; they stuck very closely to the man’s business track record.

When I read someone’s opinion about the markets, I want to know their track records – which is why opinions from journalists and sell-side analysts are ignored, although data is always gratefully received. I suppose, in Mr. Busseri’s eyes – and in the eyes of the extremely sympathetic Globe reporters – my desire to review performance track records when assessing opinion makes me a Bad Person. And, I suppose, non-disclosure of performance history is to be considered an entirely reasonable adjunct to dispensing portfolio advice.

The Basel Committee on Banking Supervision has expanded:

The Basel Committee on Banking Supervision decided to broaden its membership and to invite as new members representatives from the G20 countries that are not currently in the Basel Committee. These are Argentina, Indonesia, Saudi Arabia, South Africa and Turkey. In addition, Hong Kong SAR and Singapore have also been invited to become members. The Basel Committee’s governing body will likewise be expanded to include central bank governors and heads of supervision from these new member organisations.

Since the New Activism will create a lot of jobs for ex-regulators, it’s important that regulators everywhere have a chance to burnish their resumes!

The Bank of Canada has published a new working paper by Bruno Feunou, Jean-Sebastian Fontaine and Romeo Tedongap, The Equity Premium and the Volatility Spread: The Role of Risk-Neutral Skewness:

We introduce the Homoscedastic Gamma [HG] model where the distribution of returns is characterized by its mean, variance and an independent skewness parameter under both measures. The model predicts that the spread between historical and risk-neutral volatilities is a function of the risk premium and of skewness. In fact, the equity premium is twice the ratio of the volatility spread to skewness. We measure skewness from option prices and test these predictions. We find that conditioning on skewness increases the predictive power of the volatility spread and that coefficient estimates accord with theory. In short, the data do not reject the model’s implications for the equity premium. We also check the model’s implications for option pricing and show that the information content of skewness leads to improved in-sample and out-of-sample pricing performances as well as improved hedging performances. Our results imply that expanding around the Gaussian density is restrictive and does not offer sufficient flexibility to match the skewness and kurtosis implicit in option data. Finally, we document the term structure of option-implied volatility, skewness and kurtosis and find that time-dependence in returns has a greater impact on skewness.

I do not pretend to be an expert on option pricing theory, but the paper looks very interesting!

Mark Carney made a speech today – nothing much new, but he wants to create new jobs for regulators:

Fourth, all countries must accept their responsibilities for promoting an open, flexible, and resilient international monetary system. Responsibility means recognizing spillovers between economies and financial systems and working to mitigate those that could amplify adverse dynamics. It means submitting to peer review within the Financial Stability Board and external review by the International Monetary Fund.

Treasuries bounced back when the long bond auction did not go as badly as expected:

The yield on the 10-year note fell nine basis points, or 0.09 percentage point, to 3.86 percent, after climbing as high as 4.0038 percent, at 4:40 p.m. in New York, according to BGCantor Market Data. The yield last touched 4 percent on Oct. 16. The 3.125 percent security maturing in May 2019 rose 23/32, or $7.19 per $1,000 face amount, to 94.

The 30-year bond yield fell seven basis points to 4.69 percent. It earlier touched 4.8391 percent, the highest since October 2007.

The bonds sold today drew a yield of 4.72 percent, the highest since August 2007. The average forecast by eight bond- trading firms surveyed by Bloomberg News was 4.80 percent. The sale is a reopening of the $14 billion 30-year bond auction on May 7, which drew a yield of 4.288 percent.

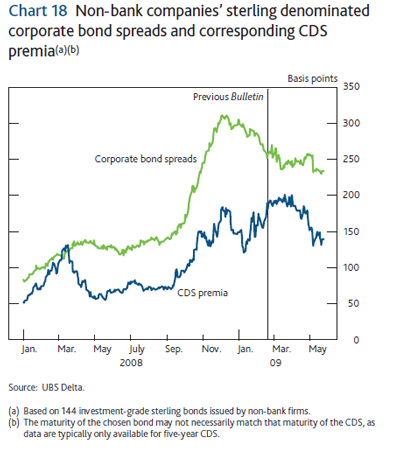

Incidentally, those who are impressed by how much long corporates have tightened may be interested to learn … it ain’t just Canada:

One veteran salesman and friend of the blog notes that there are no sellers and only buyers. He offers that volume is lighter than one would expect because the street is not carrying much paper and that has made some paper very prices.

By way of example of the steaminess of the market he cited the McDonald 2018 bond which traded at T + 90 today. One month ago the bond was at 150 and two months ago around 20.

There is a 2035 Walmart which traded + 105 yesterday. That boond was T+ 200 a month ago.

The rally is relentless and marches on.

Mind you, that’s not as impressive as it sounds. A month ago, long Treasuries were at 4.18%.

PerpetualDiscounts shone today on continued heavy volume.

HIMIPref™ Preferred Indices

These values reflect the December 2008 revision of the HIMIPref™ Indices

Values are provisional and are finalized monthly |

| Index |

Mean

Current

Yield

(at bid) |

Median

YTW |

Median

Average

Trading

Value |

Median

Mod Dur

(YTW) |

Issues |

Day’s Perf. |

Index Value |

| Ratchet |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

1.7608 % |

1,312.2 |

| FixedFloater |

7.10 % |

5.60 % |

30,066 |

16.16 |

1 |

-1.6699 % |

2,123.8 |

| Floater |

2.89 % |

3.26 % |

85,801 |

19.11 |

3 |

1.7608 % |

1,639.3 |

| OpRet |

4.99 % |

3.80 % |

146,570 |

3.62 |

14 |

0.3178 % |

2,186.5 |

| SplitShare |

5.80 % |

5.92 % |

59,455 |

4.25 |

3 |

0.3666 % |

1,879.7 |

| Interest-Bearing |

5.99 % |

7.61 % |

24,108 |

0.54 |

1 |

0.0000 % |

1,989.2 |

| Perpetual-Premium |

0.00 % |

0.00 % |

0 |

0.00 |

0 |

0.2625 % |

1,739.0 |

| Perpetual-Discount |

6.32 % |

6.31 % |

160,503 |

13.44 |

71 |

0.2625 % |

1,601.6 |

| FixedReset |

5.69 % |

4.84 % |

550,668 |

4.37 |

39 |

-0.1111 % |

2,006.7 |

| Performance Highlights |

| Issue |

Index |

Change |

Notes |

| IAG.PR.C |

FixedReset |

-1.74 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.36

Bid-YTW : 5.81 % |

| BAM.PR.G |

FixedFloater |

-1.67 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 25.00

Evaluated at bid price : 15.31

Bid-YTW : 5.60 % |

| BNS.PR.Q |

FixedReset |

-1.57 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 24.47

Evaluated at bid price : 24.52

Bid-YTW : 4.65 % |

| BNS.PR.L |

Perpetual-Discount |

-1.43 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 18.64

Evaluated at bid price : 18.64

Bid-YTW : 6.13 % |

| GWO.PR.J |

FixedReset |

-1.15 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-01-30

Maturity Price : 25.00

Evaluated at bid price : 25.86

Bid-YTW : 5.12 % |

| BNA.PR.C |

SplitShare |

1.10 % |

YTW SCENARIO

Maturity Type : Hard Maturity

Maturity Date : 2019-01-10

Maturity Price : 25.00

Evaluated at bid price : 15.66

Bid-YTW : 10.76 % |

| BAM.PR.K |

Floater |

1.13 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 12.00

Evaluated at bid price : 12.00

Bid-YTW : 3.27 % |

| NA.PR.K |

Perpetual-Discount |

1.19 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 23.51

Evaluated at bid price : 23.80

Bid-YTW : 6.21 % |

| HSB.PR.E |

FixedReset |

1.53 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-07-30

Maturity Price : 25.00

Evaluated at bid price : 27.00

Bid-YTW : 4.83 % |

| BAM.PR.I |

OpRet |

1.56 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2013-12-30

Maturity Price : 25.00

Evaluated at bid price : 24.05

Bid-YTW : 6.44 % |

| ENB.PR.A |

Perpetual-Discount |

1.70 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 24.26

Evaluated at bid price : 24.56

Bid-YTW : 5.63 % |

| BAM.PR.J |

OpRet |

1.70 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2018-03-30

Maturity Price : 25.00

Evaluated at bid price : 22.25

Bid-YTW : 7.11 % |

| BAM.PR.H |

OpRet |

1.84 % |

YTW SCENARIO

Maturity Type : Soft Maturity

Maturity Date : 2012-03-30

Maturity Price : 25.00

Evaluated at bid price : 25.05

Bid-YTW : 5.60 % |

| MFC.PR.C |

Perpetual-Discount |

2.29 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 17.85

Evaluated at bid price : 17.85

Bid-YTW : 6.34 % |

| CU.PR.B |

Perpetual-Discount |

2.43 % |

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2012-07-01

Maturity Price : 25.00

Evaluated at bid price : 25.31

Bid-YTW : 5.65 % |

| TRI.PR.B |

Floater |

3.14 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 16.76

Evaluated at bid price : 16.76

Bid-YTW : 2.37 % |

| IAG.PR.A |

Perpetual-Discount |

4.42 % |

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 17.50

Evaluated at bid price : 17.50

Bid-YTW : 6.60 % |

| Volume Highlights |

| Issue |

Index |

Shares

Traded |

Notes |

| BMO.PR.H |

Perpetual-Discount |

157,200 |

Nesbitt crossed 100,000 at 22.00; Scotia crossed 50,000 at the same price.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 21.64

Evaluated at bid price : 21.92

Bid-YTW : 6.09 % |

| BAM.PR.P |

FixedReset |

115,840 |

Recent new issue.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-10-30

Maturity Price : 25.00

Evaluated at bid price : 25.57

Bid-YTW : 6.58 % |

| MFC.PR.E |

FixedReset |

88,153 |

Recent new issue.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-10-19

Maturity Price : 25.00

Evaluated at bid price : 25.22

Bid-YTW : 5.49 % |

| PWF.PR.I |

Perpetual-Discount |

67,970 |

Nesbitt crossed 50,000 at 23.00.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 22.69

Evaluated at bid price : 22.91

Bid-YTW : 6.65 % |

| RY.PR.D |

Perpetual-Discount |

55,180 |

RBC crossed 25,000 at 18.52.

YTW SCENARIO

Maturity Type : Limit Maturity

Maturity Date : 2039-06-11

Maturity Price : 18.47

Evaluated at bid price : 18.47

Bid-YTW : 6.16 % |

| CM.PR.L |

FixedReset |

52,643 |

National crossed 25,000 at 27.15.

YTW SCENARIO

Maturity Type : Call

Maturity Date : 2014-05-30

Maturity Price : 25.00

Evaluated at bid price : 27.06

Bid-YTW : 4.85 % |

| There were 60 other index-included issues trading in excess of 10,000 shares. |