The Bank of England has released its Quarterly Bulletin 2Q09, filled with the usual charts and top-quality research.

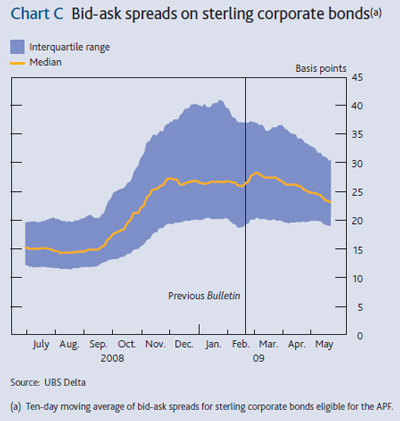

Corporate bond liquidity, as measured by bid/offer spreads, is healing:

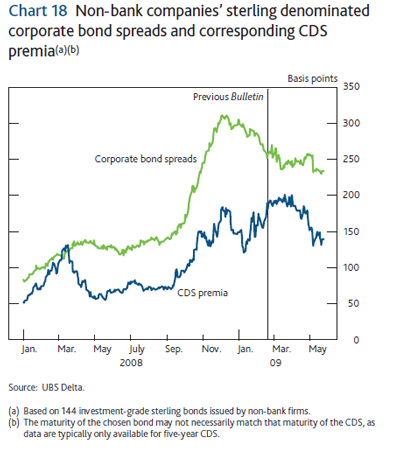

There is still a huge CDS basis, implying poor ability to borrow for leverage:

In addition to the general review, there are longer “Research and Analysis” articles on:

- Quantitative Easing

- Public Attitudes to Inflation and Monetary Policy

- The Economics and Estimation of Negative Equity

- Summaries of recent Boe Working Papers

Sadly, there is no chart of the decomposition of corporate bond spreads into default / default uncertainty / liquidity. It is my understanding that the system has been so stressed that they are reviewing all their embedded assumptions and calculations in their model to take a view on whether they can still trust it. A lot of quant models have blown up over the past two years!