CreditSights has recommended against the CIT restructuring:

CIT Group Inc. bondholders should sell their investments as efforts by the 101-year-old commercial lender to restructure have “very little hope of succeeding,” according to CreditSights Inc.

CIT Chief Executive Officer Jeffrey Peek is seeking to cut at least $5.7 billion of debt through a swap of unsecured obligations for preferred shares and new secured notes maturing later. The New York-based commercial finance company is also asking creditors to approve a pre-packaged bankruptcy if it misses the exchange target.

“Currently CIT’s interest expense is too high, it cannot borrow economically to fund new business, and its liquidity is stressed,” CreditSights analysts Adam Steer, David Hendler and Jesse Rosenthal in New York wrote in an Oct. 4 report. “After digging through the details of the exchange offer and subsequent liquidity plans, we believe CIT’s plan has very little hope of succeeding.”

Investors that hold onto CIT bonds should accept the pre- packaged option, the analysts wrote.

Sub-prime mortgage packages are recovering from fire-sale prices:

Typical prices for the most-senior prime-jumbo securities rose 2 cents on the dollar last week to 84 cents, according to Barclays Capital data. Similar bonds backed by Alt-A loans with a few years of fixed rates increased 2 cents to 60 cents. The jumbo bonds are up from about 75 cents three months earlier, while the Alt-A bonds have climbed from 47 cents.

The debt has jumped from 63 cents for the jumbos and 35 cents for Alt-As in mid-March, as investors accept lower potential yields amid a rally across debt markets and traders anticipate demand from the U.S. Public-Private Investment Program. Investment funds, banks, insurers and Wall Street brokers have been among buyers, according to Scott Buchta, head of investment strategy at Guggenheim Capital Markets LLC in Chicago.

…

Advantus Capital Management Inc., which oversees about $14 billion, is telling investors as it seeks more cash to buy devalued mortgage bonds they’d be better off with managers like it that aren’t part of the PPIP and thus have more freedom in selecting assets. The marketing underscores PPIP managers’ difficulty immediately raising the maximum amounts allowed and the possibility they may hold back on buying until prices drop.PPIP managers Invesco, AllianceBernstein Holding LP and Marathon Asset Management LP have told potential investors they are targeting annual returns of at least 18 percent, according to a Sept. 2 memo by M. Timothy Corbett, chief investment officer of the Connecticut Retirement Plans and Trust Funds.

Amid the higher prices among eligible securities, “the likelihood of generating those types of returns are becoming remote, unless one were to take ever-riskier bets,” Dean Di Bias, high-yield mortgage portfolio manager at St. Paul, Minnesota-based Advantus, said in an interview last month.

Citigroup is sick and tired of doing all the paperwork for passive investors for free:

Citigroup Inc., the U.S. bank that got a $45 billion bailout last year, will revamp its North American brokerage business so that financial advisers charge ongoing fees instead of commissions on stock and fund sales.

The “strategic shift” will begin immediately, with the assignment of 600 bank-branch-based brokers to teams, New York- based Citigroup said today in a statement. Customers who think they’re better off paying commissions can do so by calling representatives at the company’s National Investor Center in San Antonio, the company said.

Frankly, I’m not sure what to make of changes in pending derivative collateral legislation:

House Financial Services Committee Chairman Barney Frank released a 187-page draft bill on Oct. 2 aimed at tightening oversight of the $592 trillion derivatives market. The measure, drawn from the Obama administration’s proposals, would require the most common and actively traded over-the-counter derivatives contracts to be bought and sold on exchanges or processed through a regulated trading platform.

The National Association of Manufacturers, U.S. Chamber of Commerce and the Business Roundtable, three of the biggest trade associations in Washington, lobbied Congress and the administration to exempt derivatives “end-users” from new rules and collateral requirements. End-users employ derivatives to hedge a risk to their operations, such as swings in interest rates, foreign currency shifts or changes in commodities prices.

…

The draft would expand the administration’s exemption of end-users from collateral and clearing requirements. The administration proposal, released Aug. 11, would give a dispensation only to companies that use so-called hedge accounting. Frank’s proposal would exempt all end-user transactions and would let companies post non-cash items as collateral to satisfy margin requirements, Coleman said.

… but I’ll venture to suggest that it means lots of work for lawyers, anyway! It should also be noted that the change results in the ‘tax on derivatives use’ becomes a ‘tax on speculation’, which will hurt depth of market.

Barney Frank, by the way, thinks that since TARP equity-loans against good assets have worked out well, it’s time to extend the programme to bad assets:

House Financial Services Committee Chairman Barney Frank said he plans to introduce legislation next week to steer $2 billion in rescue funds repaid by U.S. banks to foreclosure relief for unemployed workers.

Funds from the $700 billion Troubled Asset Relief Program should be loaned to Americans without jobs and at risk of losing their homes, Frank said today in a telephone interview. Frank has said the program will be extended beyond its December expiration for foreclosure relief and to help community banks.

The SEC is continuing its search for infallable credit analysts:

When calculating net capital, broker-dealers are permitted to take a lower capital charge, called a “haircut,” for certain types of securities that are rated investment grade by an NRSRO.

As the Commission stated in proposing to remove references to NRSROs from the Net Capital Rule, broker-dealers are sophisticated market participants regulated by at least one self-regulatory organization. Accordingly, the Commission expressed its preliminary belief that broker-dealers would be able to assess the creditworthiness of the securities they own without undue hardship.30 In lieu of the references to NRSROs in the Net Capital Rule, the Commission proposed substituting two subjective standards for credit risk and liquidity risk. For the purposes of determining haircuts on commercial paper, the Commission proposed to replace the current NRSRO ratings-based criterion with a requirement that the instrument be subject to a minimal amount of credit risk and have sufficient liquidity such that it can be sold at or near its carrying value almost immediately.

…

Notwithstanding the Commission’s belief that broker-dealers have the financial sophistication and resources to make these determinations,33 the Commission stated that it would be appropriate, as one means of complying with the proposed amendments, for broker-dealers that wished to continue to rely on credit ratings of NRSROs to do so.34

The majority of the commenters to the Commission’s proposal to remove references to NRSROs from the Net Capital Rule were opposed to the change.35 Generally, commenters stated that they preferred the existing rule because it is a bright line objective test that is relatively inexpensive to utilize.

…

The Commission also requests comments on the following specific questions:

- • Are there factors other than creditworthiness and liquidity that should be required to be considered in determining the appropriate haircut for a proprietary securities position?

- • What would be the cost to broker-dealers to develop, document, and enforce internal procedures to evaluating the creditworthiness and liquidity of proprietary securities positions?

- • Do certain broker-dealers lack sufficient resources or expertise to independently assess the creditworthiness of securities?

I have no problem with allowing broker-dealers to assess credit risk themselves; this might even increase pressure to repeal Regulation FD, which is the most serious impediment to investors’ credit analysis. I don’t have any expectation of such analyses being better, however; merely different.

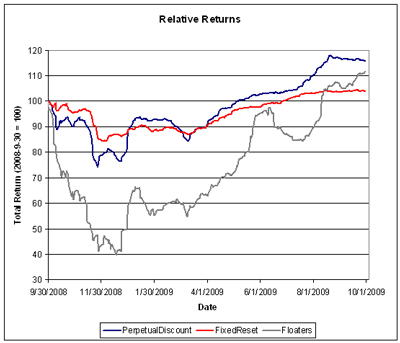

Another day of declines for preferred shares, with PerpetualDiscounts down 15bp on the day and FixedResets losing 6bp. The market is getting a little sloppier, according to HIMIPref™’s curve-fitting algorithms.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.7625 % | 1,503.1 |

| FixedFloater | 5.78 % | 4.02 % | 47,753 | 18.57 | 1 | -1.4652 % | 2,659.1 |

| Floater | 2.59 % | 3.01 % | 102,845 | 19.74 | 3 | -0.7625 % | 1,877.8 |

| OpRet | 4.89 % | -5.65 % | 125,606 | 0.09 | 15 | 0.0000 % | 2,278.8 |

| SplitShare | 6.39 % | 6.61 % | 713,092 | 3.99 | 2 | -0.2200 % | 2,068.0 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0000 % | 2,083.7 |

| Perpetual-Premium | 5.82 % | 5.84 % | 146,624 | 13.77 | 11 | -0.1698 % | 1,867.2 |

| Perpetual-Discount | 5.80 % | 5.86 % | 211,938 | 14.15 | 61 | -0.1523 % | 1,779.6 |

| FixedReset | 5.49 % | 4.07 % | 439,751 | 4.07 | 41 | -0.0551 % | 2,108.4 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNS.PR.J | Perpetual-Discount | -1.51 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 22.60 Evaluated at bid price : 23.50 Bid-YTW : 5.55 % |

| BAM.PR.G | FixedFloater | -1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 25.00 Evaluated at bid price : 18.83 Bid-YTW : 4.02 % |

| ENB.PR.A | Perpetual-Premium | -1.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 24.45 Evaluated at bid price : 24.69 Bid-YTW : 5.63 % |

| CU.PR.B | Perpetual-Premium | -1.26 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 24.78 Evaluated at bid price : 25.08 Bid-YTW : 6.05 % |

| BAM.PR.K | Floater | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 13.15 Evaluated at bid price : 13.15 Bid-YTW : 3.01 % |

| BAM.PR.B | Floater | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 13.15 Evaluated at bid price : 13.15 Bid-YTW : 3.01 % |

| MFC.PR.E | FixedReset | -1.09 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-10-19 Maturity Price : 25.00 Evaluated at bid price : 26.37 Bid-YTW : 4.47 % |

| PWF.PR.H | Perpetual-Discount | -1.05 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 24.07 Evaluated at bid price : 24.42 Bid-YTW : 5.99 % |

| SLF.PR.B | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 19.98 Evaluated at bid price : 19.98 Bid-YTW : 6.06 % |

| SLF.PR.A | Perpetual-Discount | -1.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 20.02 Evaluated at bid price : 20.02 Bid-YTW : 5.98 % |

| POW.PR.B | Perpetual-Discount | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 21.97 Evaluated at bid price : 22.36 Bid-YTW : 5.99 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TRP.PR.A | FixedReset | 199,824 | Recent new issue. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.30 Bid-YTW : 4.37 % |

| GWO.PR.L | Perpetual-Discount | 71,130 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 24.30 Evaluated at bid price : 24.50 Bid-YTW : 5.80 % |

| TD.PR.I | FixedReset | 50,905 | RBC crossed 15,000 at 27.81; National crossed 22,700 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.77 Bid-YTW : 4.04 % |

| TD.PR.K | FixedReset | 38,599 | RBC crossed 20,000 at 27.81. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.80 Bid-YTW : 4.02 % |

| TD.PR.E | FixedReset | 36,715 | National crossed 26,500 at 27.81. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.79 Bid-YTW : 3.93 % |

| SLF.PR.B | Perpetual-Discount | 36,664 | Dundee bought 10,300 from anonymous at 20.11. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2039-10-05 Maturity Price : 19.98 Evaluated at bid price : 19.98 Bid-YTW : 6.06 % |

| There were 36 other index-included issues trading in excess of 10,000 shares. | |||