It’s a red-letter day! A Trump appointee has said something sensible!

Hassett, in subsequent interview on Fox News Sunday, said that if he ran the BLS and had “the biggest downward revision in 50 years, I would have a really, really detailed report explaining why it happened.”

Imagine that! Wanting a thorough understanding of how the revision happened before taking tough-guy action! Will wonders never cease?

Of course, this guy Hassett has a history:

I started doing some digging on Hassett after lunch and discovered that he had coauthored a book called Dow 36,000.

Written in 1999, Dow 36,000 argued that for structural reasons, the stock market was wildly undervalued and was poised to take off like a rocket. Hassett and his coauthor, James K. Glassman, said that 1999 represented a unique moment during which stocks were, as an asset class, undervalued by something like 350 percent:

[The s]ingle most important fact about stocks at the dawn of the twenty-first century: They are cheap. . . . If you are worried about missing the market’s big move upward, you will discover that it is not too late. Stocks are now in the midst of a one-time-only rise to much higher ground—to the neighborhood of 36,000 on the Dow Jones industrial average.

You may remember 1999 as the eve of the dotcom bust. Rather than being poised to make a big move upward, the stock market was at the top of an irrationally exuberant5 bubble.

When Dow 36,000 was published, the Dow Industrial Average was 10,273. That was October. Three months later the bubble popped. By October 2002 the Dow was 7,286.

So, take it as you will. Hassett is a leading contender for Fed chairman, God help us.

Speaking of jobs numbers, Canada’s July number was pretty awful:

Canadian job seekers and young workers are struggling through the dog days of summer even as the labour market shows limited strain from U.S. tariffs.

Statistics Canada on Friday reported 41,000 job losses last month, while economists had expected a slight gain.

The unemployment rate was unchanged at 6.9 per cent in July as StatCan said the number of job seekers held steady month-to-month.

The economy lost 51,000 full-time positions in July, and the bulk of the losses were in the private sector. The information, culture and recreation sector led the drop in employment, followed by construction.

…

Average hourly wages meanwhile rose 3.3 per cent on an annual basis in July, up a tick from June.

Darcy Keith reports:

Money markets are pricing in modestly higher odds that the Bank of Canada will cut interest rates at its upcoming policy meetings this year following surprisingly weak Canadian employment data this morning.

…

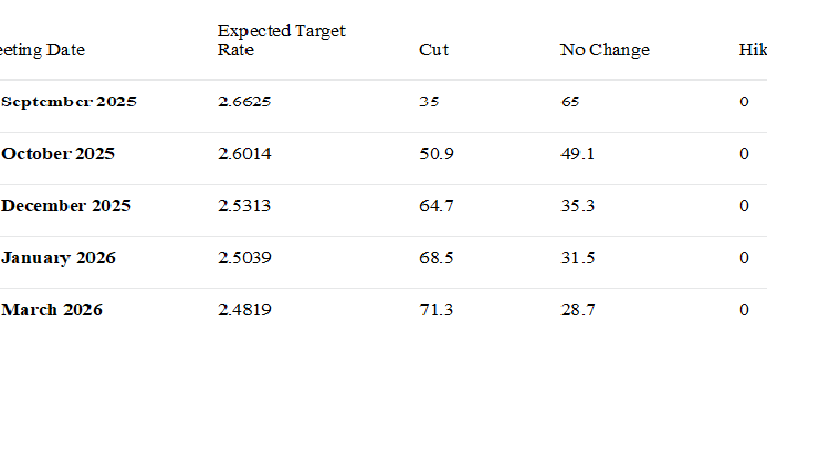

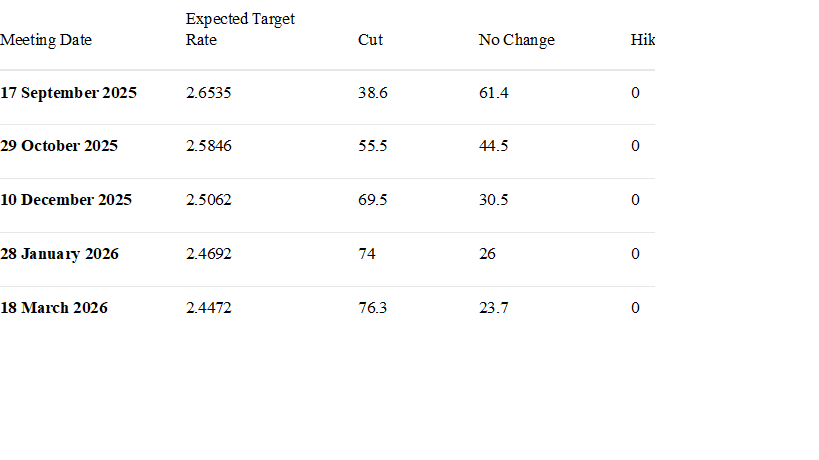

Here’s how implied probabilities of future interest rate moves stood in swaps markets moments after the 830 am ET data, according to LSEG data. The overnight rate now resides at 2.75 per cent. While the bank moves in quarter-point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

Pre-release Money Market

Post-release Money Market

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 6.92 % | 7.37 % | 38,757 | 13.06 | 1 | 0.0000 % | 2,391.0 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0254 % | 4,598.5 |

| Floater | 6.61 % | 6.90 % | 40,510 | 12.63 | 3 | -0.0254 % | 2,650.2 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0112 % | 3,682.7 |

| SplitShare | 4.75 % | 4.23 % | 48,874 | 2.39 | 7 | 0.0112 % | 4,397.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0112 % | 3,431.4 |

| Perpetual-Premium | 5.80 % | -3.67 % | 114,509 | 0.08 | 2 | 0.4582 % | 3,072.7 |

| Perpetual-Discount | 5.60 % | 5.72 % | 44,585 | 14.29 | 30 | 0.2377 % | 3,343.4 |

| FixedReset Disc | 5.59 % | 6.08 % | 113,641 | 13.33 | 37 | 0.4109 % | 3,035.4 |

| Insurance Straight | 5.52 % | 5.60 % | 58,788 | 14.38 | 18 | -0.4101 % | 3,272.1 |

| FloatingReset | 5.27 % | 5.33 % | 34,575 | 14.88 | 1 | 0.1211 % | 3,740.1 |

| FixedReset Prem | 5.89 % | 5.12 % | 115,134 | 2.55 | 17 | -0.1505 % | 2,625.5 |

| FixedReset Bank Non | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.4109 % | 3,102.8 |

| FixedReset Ins Non | 5.27 % | 5.60 % | 71,280 | 14.20 | 15 | 0.8382 % | 3,041.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| MFC.PR.L | FixedReset Ins Non | -5.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 22.23 Evaluated at bid price : 22.80 Bid-YTW : 5.83 % |

| MFC.PR.C | Insurance Straight | -4.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 20.50 Evaluated at bid price : 20.50 Bid-YTW : 5.58 % |

| ENB.PR.Y | FixedReset Disc | -1.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 20.25 Evaluated at bid price : 20.25 Bid-YTW : 6.69 % |

| SLF.PR.C | Insurance Straight | -1.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 21.34 Evaluated at bid price : 21.34 Bid-YTW : 5.28 % |

| GWO.PR.H | Insurance Straight | -1.45 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 21.46 Evaluated at bid price : 21.72 Bid-YTW : 5.65 % |

| RY.PR.S | FixedReset Prem | -1.06 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2029-02-24 Maturity Price : 25.00 Evaluated at bid price : 26.07 Bid-YTW : 4.51 % |

| BN.PR.X | FixedReset Disc | 1.44 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 19.66 Evaluated at bid price : 19.66 Bid-YTW : 6.07 % |

| FTS.PR.M | FixedReset Disc | 1.63 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 22.68 Evaluated at bid price : 23.68 Bid-YTW : 5.79 % |

| POW.PR.A | Perpetual-Discount | 1.66 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 24.21 Evaluated at bid price : 24.50 Bid-YTW : 5.77 % |

| POW.PR.D | Perpetual-Discount | 1.82 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 22.12 Evaluated at bid price : 22.40 Bid-YTW : 5.63 % |

| MFC.PR.F | FixedReset Ins Non | 1.83 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 18.33 Evaluated at bid price : 18.33 Bid-YTW : 5.82 % |

| BN.PF.E | FixedReset Disc | 2.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 21.51 Evaluated at bid price : 21.80 Bid-YTW : 6.25 % |

| ENB.PR.D | FixedReset Disc | 2.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 21.10 Evaluated at bid price : 21.10 Bid-YTW : 6.43 % |

| BN.PF.F | FixedReset Disc | 3.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 22.68 Evaluated at bid price : 23.65 Bid-YTW : 6.17 % |

| SLF.PR.G | FixedReset Ins Non | 3.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 18.65 Evaluated at bid price : 18.65 Bid-YTW : 5.85 % |

| GWO.PR.N | FixedReset Ins Non | 6.79 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 16.51 Evaluated at bid price : 16.51 Bid-YTW : 6.35 % |

| MFC.PR.Q | FixedReset Ins Non | 10.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 23.51 Evaluated at bid price : 25.30 Bid-YTW : 5.48 % |

| BN.PR.T | FixedReset Disc | 10.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 20.16 Evaluated at bid price : 20.16 Bid-YTW : 6.37 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PF.E | FixedReset Disc | 240,789 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 23.94 Evaluated at bid price : 24.79 Bid-YTW : 5.80 % |

| BEP.PR.G | FixedReset Ins Non | 54,100 | YTW SCENARIO Maturity Type : Call Maturity Date : 2026-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.11 Bid-YTW : 4.81 % |

| SLF.PR.E | Insurance Straight | 47,300 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 21.40 Evaluated at bid price : 21.40 Bid-YTW : 5.33 % |

| IFC.PR.E | Insurance Straight | 40,000 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 23.65 Evaluated at bid price : 23.94 Bid-YTW : 5.49 % |

| ENB.PR.T | FixedReset Disc | 35,257 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 22.24 Evaluated at bid price : 22.81 Bid-YTW : 6.30 % |

| BN.PF.K | Ratchet | 29,200 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2055-08-08 Maturity Price : 22.00 Evaluated at bid price : 16.00 Bid-YTW : 7.37 % |

| There were 4 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| See TMX DataLinx: ‘Last’ != ‘Close’ and the posts linked therein for an idea of why these quotes are so horrible. | ||

| Issue | Index | Quote Data and Yield Notes |

| PWF.PR.P | FixedReset Disc | Quote: 18.38 – 24.68 Spot Rate : 6.3000 Average : 3.4697 YTW SCENARIO |

| ENB.PR.B | FixedReset Disc | Quote: 20.65 – 24.00 Spot Rate : 3.3500 Average : 2.2342 YTW SCENARIO |

| ENB.PF.E | FixedReset Disc | Quote: 21.22 – 23.50 Spot Rate : 2.2800 Average : 1.4316 YTW SCENARIO |

| PWF.PF.A | Perpetual-Discount | Quote: 19.97 – 21.50 Spot Rate : 1.5300 Average : 0.8814 YTW SCENARIO |

| MFC.PR.C | Insurance Straight | Quote: 20.50 – 21.81 Spot Rate : 1.3100 Average : 0.7791 YTW SCENARIO |

| MFC.PR.L | FixedReset Ins Non | Quote: 22.80 – 24.19 Spot Rate : 1.3900 Average : 0.9084 YTW SCENARIO |