The Federal Reserve Board of St. Louis has published an article by Richard G. Anderson, Charles S. Gascon, and Yang Liu titled Doubling Your Monetary Base and Surviving: Some International Experience:

The authors examine the experience of selected central banks that have used large-scale balancesheet expansion, frequently referred to as “quantitative easing,” as a monetary policy instrument. The case studies focus on central banks responding to the recent financial crisis and Nordic central banks during the banking crises of the 1990s; others are provided for comparison purposes. The authors conclude that large-scale balance-sheet increases are a viable monetary policy tool provided the public believes the increase will be appropriately reversed.

The authors review current and past examples of central bank balance sheet expansion and conclude:

During the past two decades, large increases — and decreases — in central bank balance sheets have become a viable monetary policy tool. Historically, doubling or tripling a country’s monetary base was a recipe for certain higher inflation. Often such increases occurred only as part of a failed fiscal policy or, perhaps, as part of a policy to defend the exchange rate. Both economic models and central bank experience during the past two decades suggest that such changes are useful policy tools if the public understands the increase is temporary and if the central bank has some credibility with respect to desiring a low, stable rate of inflation. We find little increased inflation impact from such expansions.

For monetary policy, our study suggests several findings:

- (i) A large increase in a nation’s balance sheet over a short time can be stimulative.

- (ii) The reasons for the action should be communicated. Inflation expectations do not move if households and firms understand the reason(s) for policy actions so long as the central bank can credibly commit to unwinding the expansion when appropriate.

- (iii) The type of assets purchased matters less than the balance-sheet expansion.

- (iv) When the crisis has passed, the balance sheet should be unwound promptly.

Econbrowser’s James Hamilton has presented a review of QE2 and concludes:

I agree with John that the primary effects of QE2 come from restructuring the maturity of government debt, and that any effects one claims for such a move are necessarily modest. But unlike John, I believe those modest effects are potentially helpful.

Just to reiterate, my position is that when you combine the Fed’s actions with the Treasury’s, the net effect has been a lengthening rather than shortening of the maturity structure:

given the modest size, pace, and focus of QE2, and given the size and pace at which the Treasury has been issuing long-term debt, the announced QE2 would have been associated with a move in the maturity structure of the opposite direction from that analyzed in our original research. The effects of the combined actions by the Treasury and the Fed would be to increase rather than decrease long-term interest rates.

He has also noted the effects on commodity prices:

I feel that there is a pretty strong case for interpreting the recent surge in commodity prices as a monetary phenomenon. Now that we know there’s a response when the Fed pushes the QE pedal, the question is how far to go.

My view has been that the Fed needs to prevent a repeat of Japan’s deflationary experience of the 1990s, but that it also needs to watch commodity prices as an early indicator that it’s gone far enough in that objective. In terms of concrete advice, I would worry about the potential for the policy to do more harm than good if it results in the price of oil moving above $90 a barrel.

And we’re uncomfortably close to that point already.

Oil is now over USD 90/bbl.

Another effect I haven’t seen discussed much is a reversal of crowding-out:

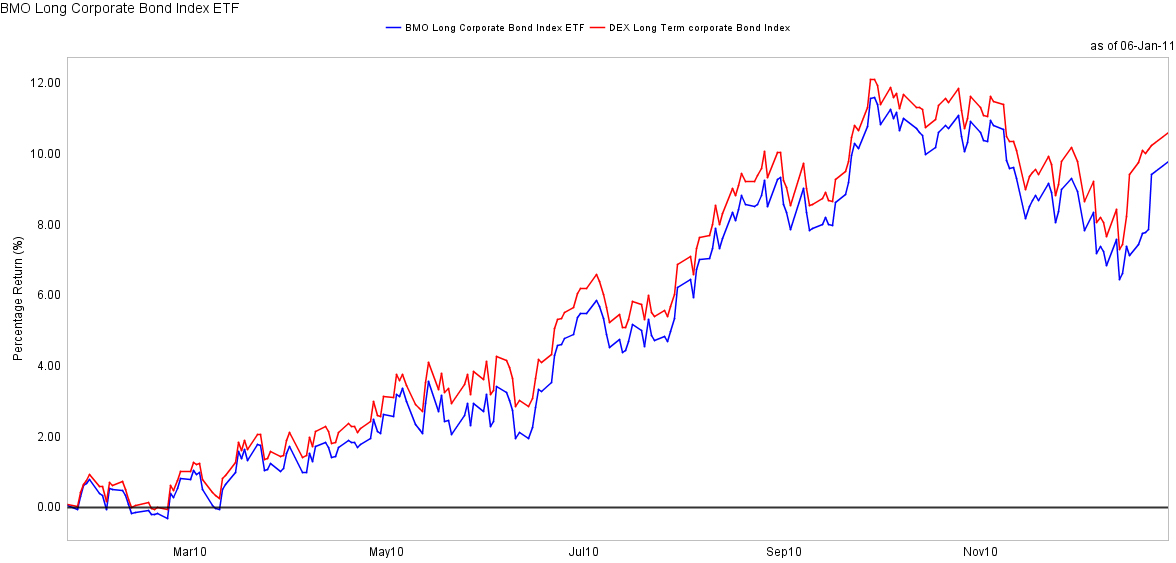

Company bond sales in the U.S. reached a record this week and relative yields on investment- grade debt shrank to the narrowest since May as money managers boosted bets economic growth is gaining momentum.

Issuance soared to $48.5 billion, eclipsing the $46.9 billion raised in the week ended May 8, 2009, as General Electric Co.’s finance unit sold $6 billion of notes in the largest offering in 11 months, according to data compiled by Bloomberg. Investment-grade bond spreads narrowed to 162 basis points, or 1.62 percentage points, more than Treasuries, Bank of America Merrill Lynch index data show.

Appetite for corporate debt is growing after annual sales topped $1 trillion for the second consecutive year as the securities return more than Treasuries.

…

Foreign borrowers dominated U.S. sales this week, with companies from Sydney-based Macquarie Group Ltd. to the U.K.’s Barclays Plc accounting for 57 percent of the total, Bloomberg data show.

…

“The expectation coming into this year was that Yankee issuance would be heavy,” said Jim Probert, managing director and head of investment grade capital markets at Bank of America Merrill Lynch. “There’s enough maturing debt coming out of European financials in particular that they needed to be in the marketplace, and right now, U.S. dollars is a good alternative, in addition to euros.”

Meanwhile, Janet L. Yellen, the Fed’s Vice-Chair, has delivered a speech titled The Federal Reserve’s Asset Purchase Program:

As inflation has trended downward, measures of underlying inflation have fallen somewhat below the levels of about 2 percent or a bit less that most Committee participants judge to be consistent, over the longer run, with the FOMC’s dual mandate. In particular, a modest positive rate of inflation over time allows for a slightly higher average level of nominal interest rates, thereby creating more scope for the FOMC to respond to adverse shocks. A modest positive inflation rate also reduces the risk that such shocks could result in deflation, which can be associated with poor macroeconomic performance.

…

Figure 3 depicts the results of such a simulation exercise, as reported in a recent research paper by four Federal Reserve System economists. For illustrative purposes, the simulation imposes the assumption that the purchases of $600 billion in longer-term Treasury securities are completed within about a year, that the elevated level of securities holdings is then maintained for about two years, and that the asset position is then unwound linearly over the following five years.

This trajectory of securities holdings causes the 10-year Treasury yield to decline initially about 1/4 percentage point and then gradually return toward baseline over subsequent years. That path of longer-term Treasury yields leads to a significant pickup in real gross domestic product (GDP) growth relative to baseline and generates an increase in nonfarm payroll employment that amounts to roughly 700,000 jobs.

…

Inflation and bank reserves. A second reason that some observers worry that the Fed’s asset purchase programs could raise inflation is that these programs have increased the quantity of bank reserves far above pre-crisis levels. I strongly agree with one aspect of this argument–the notion that an accommodative monetary policy left in place too long can cause inflation to rise to undesirable levels. This notion would be true regardless of the level of bank reserves and pertains as well in situations in which monetary policy is unconstrained by the zero bound on interest rates. Indeed, it is one reason why the Committee stated that it will review its asset purchase program regularly in light of incoming information and adjust the program as needed to meet its objectives. We recognize that the FOMC must withdraw monetary stimulus once the recovery has taken hold and the economy is improving at a healthy pace. Importantly, the Committee remains unwaveringly committed to price stability and does not seek inflation above the level of 2 percent or a bit less than that, which most FOMC participants see as consistent with the Federal Reserve’s mandate.

The research paper referenced in conjunction with Figure 3 is Have We Underestimated the Likelihood and Severity of Zero Lower Bound Events? by Hess Chung, Jean-Philippe Laforte, David Reifschneider and John C. Williams:

Before the recent recession, the consensus among researchers was that the zero lower bound (ZLB) probably would not pose a significant problem for monetary policy as long as a central bank aimed for an inflation rate of about 2 percent; some have even argued that an appreciably lower target inflation rate would pose no problems. This paper reexamines this consensus in the wake of the financial crisis, which has seen policy rates at their effective lower bound for more than two years in the United States and Japan and near zero in many other countries. We conduct our analysis using a set of structural and time series statistical models. We find that the decline in economic activity and interest rates in the United States has generally been well outside forecast confidence bands of many empirical macroeconomic models. In contrast, the decline in inflation has been less surprising. We identify a number of factors that help to account for the degree to which models were surprised by recent events. First, uncertainty about model parameters and latent variables, which were typically ignored in past research, significantly increases the probability of hitting the ZLB. Second, models that are based primarily on the Great Moderation period severely understate the incidence and severity of ZLB events. Third, the propagation mechanisms and shocks embedded in standard DSGE models appear to be insufficient to generate sustained periods of policy being stuck at the ZLB, such as we now observe. We conclude that past estimates of the incidence and effects of the ZLB were too low and suggest a need for a general reexamination of the empirical adequacy of standard models. In addition to this statistical analysis, we show that the ZLB probably had a first-order impact on macroeconomic outcomes in the United States. Finally, we analyze the use of asset purchases as an alternative monetary policy tool when short-term interest rates are constrained by the ZLB, and find that the Federal Reserve’s asset purchases have been effective at mitigating the economic costs of the ZLB. In particular, model simulations indicate that the past and projected expansion of the Federal Reserve’s securities holdings since late 2008 will lower the unemployment rate, relative to what it would have been absent the purchases, by 1½ percentage points by 2012. In addition, we find that the asset purchases have probably prevented the U.S. economy from falling into deflation.