The fund underperformed in November, largely due to a steep decline in the prices of SLF issues, which form a significant part of the fund’s holdings.

The fund’s Net Asset Value per Unit as of the close November 30 was $10.4511.

| Returns to November 30, 2011 | |||

| Period | MAPF | Index | CPD according to Claymore |

| One Month | -0.39% | +0.41% | +0.11% |

| Three Months | -4.87% | +0.72% | +0.10% |

| One Year | +0.56% | +6.19% | +3.81% |

| Two Years (annualized) | +9.17% | +9.21% | N/A |

| Three Years (annualized) | +31.70% | +17.22% | +14.37% |

| Four Years (annualized) | +18.34% | +6.23% | |

| Five Years (annualized) | +13.26% | +3.54% | |

| Six Years (annualized) | +12.12% | +3.68% | |

| Seven Years (annualized) | +11.28% | +3.84% | |

| Eight Years (annualized) | +11.73% | +4.11% | |

| Nine Years (annualized) | +13.68% | +4.50% | |

| Ten Years (annualized) | +12.05% | +4.31% | |

| The Index is the BMO-CM “50” | |||

| MAPF returns assume reinvestment of distributions, and are shown after expenses but before fees. | |||

| CPD Returns are for the NAV and are after all fees and expenses. | |||

| * CPD does not directly report its two-year returns. | |||

| Figures for Omega Preferred Equity (which are after all fees and expenses) for 1-, 3- and 12-months are +0.19%, +0.41% and +4.57%, respectively, according to Morningstar after all fees & expenses. Three year performance is +14.91%. | |||

| Figures for Jov Leon Frazer Preferred Equity Fund Class I Units (which are after all fees and expenses) for 1-, 3- and 12-months are +0.32%, +0.46% and ++2.22% respectively, according to Morningstar | |||

| Figures for Manulife Preferred Income Fund (formerly AIC Preferred Income Fund) (which are after all fees and expenses) for 1-, 3- and 12-months are +0.17%, +0.28% & +3.53%, respectively | |||

| Figures for Horizons AlphaPro Preferred Share ETF (which are after all fees and expenses) for 1-, 3- and 12-months are +0.29%, +0.57% & +4.64%, respectively. | |||

MAPF returns assume reinvestment of dividends, and are shown after expenses but before fees. Past performance is not a guarantee of future performance. You can lose money investing in Malachite Aggressive Preferred Fund or any other fund. For more information, see the fund’s main page. The fund is available either directly from Hymas Investment Management or through a brokerage account at Odlum Brown Limited.

The fund’s returns in November were hurt by a steep decline in the price of SLF preferreds, which have been afflicted in recent months by relatively poor financial results and bouts of selling (see Who’s Selling all the SLF Preferreds? and Moody’s puts SLF on Review-Negative).

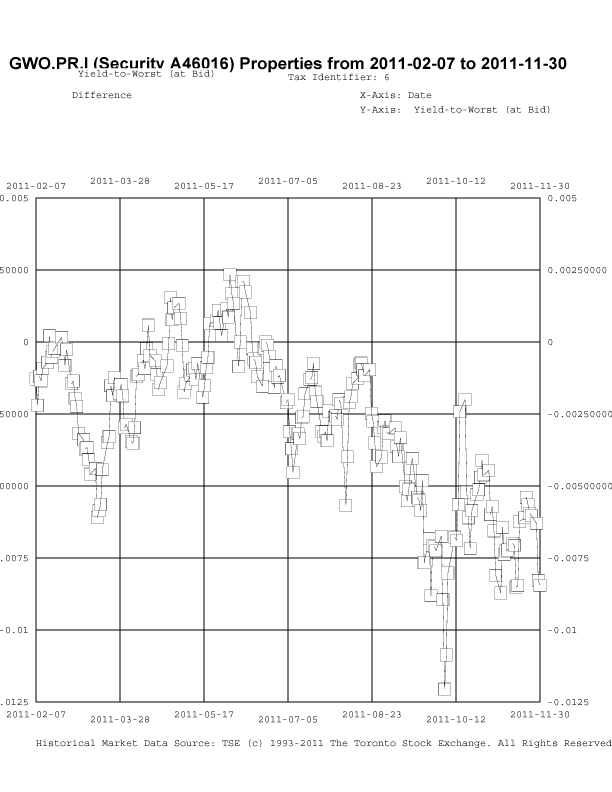

For example, the difference in the YTWs of GWO.PR.I and SLF.PR.E (which have the same annual dividend of 1.125) are shown below since the OSFI announcement that extant issues without the NVCC clause would not be grandfathered (note that this announcement applied only to banks; there is still no official word on the status of preferreds issued by insurance holding companies, although I continue to expect that the bank rules will eventually apply).

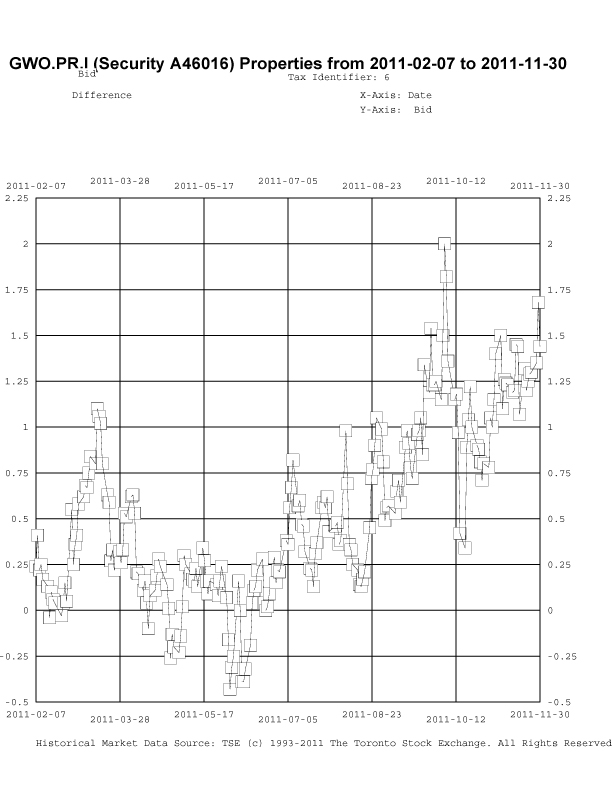

Similarly, we can look at the difference in prices between the two issues:

The charts Yield Difference and Bid Price Difference are available in PDF format.

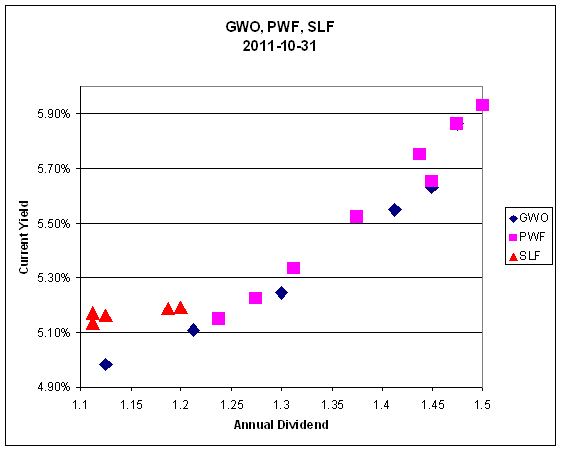

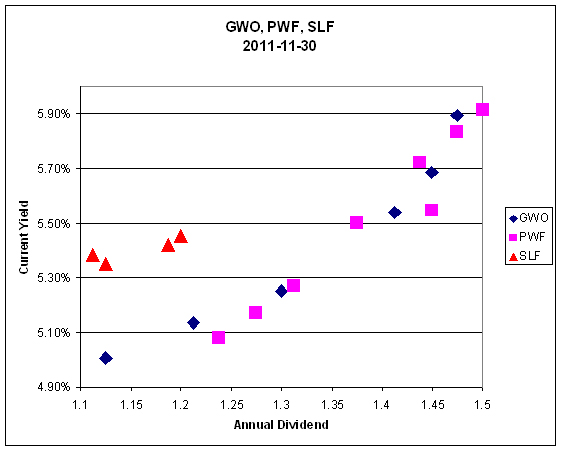

Another way to look at the situation is compare the SLF issues with PWF and GWO, as was done in the post Who’s Selling All the SLF Preferred?.

Now, I certainly agree that GWO is a better credit than SLF and deserves a little bit of premium pricing – but the current situation goes far beyond what I consider reasonable. What is also very interesting is the observation that the market is sharply differentiating between SLF and GWO, but not between GWO and its unregulated parent, PWF.

Sometimes everything works … sometimes the trading works, but sectoral shifts overwhelm the increment … sometimes nothing works. The fund seeks to earn incremental return by selling liquidity (that is, taking the other side of trades that other market participants are strongly motivated to execute), which can also be referred to as ‘trading noise’. There were a lot of strongly motivated market participants during the Panic of 2007, generating a lot of noise! Unfortunately, the conditions of the Panic may never be repeated in my lifetime … but the fund will simply attempt to make trades when swaps seem profitable, without worrying about the level of monthly turnover.

There’s plenty of room for new money left in the fund. I have shown in recent issues of PrefLetter that market pricing for FixedResets is demonstrably stupid and I have lots of confidence – backed up by my bond portfolio management experience in the markets for Canadas and Treasuries, and equity trading on the NYSE & TSX – that there is enough demand for liquidity in any market to make the effort of providing it worthwhile (although the definition of “worthwhile” in terms of basis points of outperformance changes considerably from market to market!) I will continue to exert utmost efforts to outperform but it should be borne in mind that there will almost inevitably be periods of underperformance in the future.

The yields available on high quality preferred shares remain elevated, which is reflected in the current estimate of sustainable income.

| Calculation of MAPF Sustainable Income Per Unit | ||||||

| Month | NAVPU | Portfolio Average YTW |

Leverage Divisor |

Securities Average YTW |

Capital Gains Multiplier |

Sustainable Income per current Unit |

| June, 2007 | 9.3114 | 5.16% | 1.03 | 5.01% | 1.2857 | 0.3628 |

| September | 9.1489 | 5.35% | 0.98 | 5.46% | 1.2857 | 0.3885 |

| December, 2007 | 9.0070 | 5.53% | 0.942 | 5.87% | 1.2857 | 0.4112 |

| March, 2008 | 8.8512 | 6.17% | 1.047 | 5.89% | 1.2857 | 0.4672 |

| June | 8.3419 | 6.034% | 0.952 | 6.338% | 1.2857 | $0.4112 |

| September | 8.1886 | 7.108% | 0.969 | 7.335% | 1.2857 | $0.4672 |

| December, 2008 | 8.0464 | 9.24% | 1.008 | 9.166% | 1.2857 | $0.5737 |

| March 2009 | $8.8317 | 8.60% | 0.995 | 8.802% | 1.2857 | $0.6046 |

| June | 10.9846 | 7.05% | 0.999 | 7.057% | 1.2857 | $0.6029 |

| September | 12.3462 | 6.03% | 0.998 | 6.042% | 1.2857 | $0.5802 |

| December 2009 | 10.5662 | 5.74% | 0.981 | 5.851% | 1.0819 | $0.5714 |

| March 2010 | 10.2497 | 6.03% | 0.992 | 6.079% | 1.0819 | $0.5759 |

| June | 10.5770 | 5.96% | 0.996 | 5.984% | 1.0819 | $0.5850 |

| September | 11.3901 | 5.43% | 0.980 | 5.540% | 1.0819 | $0.5832 |

| December 2010 | 10.7659 | 5.37% | 0.993 | 5.408% | 1.0000 | $0.5822 |

| March, 2011 | 11.0560 | 6.00% | 0.994 | 5.964% | 1.0000 | $0.6594 |

| June | 11.1194 | 5.87% | 1.018 | 5.976% | 1.0000 | $0.6645 |

| September | 10.2709 | 6.10% Note |

1.001 | 6.106% | 1.0000 | $0.6271 |

| November, 2011 | 10.4511 | 6.02% Note |

1.004 | 6.044% | 1.0000 | $0.6317 |

| NAVPU is shown after quarterly distributions of dividend income and annual distribution of capital gains. Portfolio YTW includes cash (or margin borrowing), with an assumed interest rate of 0.00% The Leverage Divisor indicates the level of cash in the account: if the portfolio is 1% in cash, the Leverage Divisor will be 0.99 Securities YTW divides “Portfolio YTW” by the “Leverage Divisor” to show the average YTW on the securities held; this assumes that the cash is invested in (or raised from) all securities held, in proportion to their holdings. The Capital Gains Multiplier adjusts for the effects of Capital Gains Dividends. On 2009-12-31, there was a capital gains distribution of $1.989262 which is assumed for this purpose to have been reinvested at the final price of $10.5662. Thus, a holder of one unit pre-distribution would have held 1.1883 units post-distribution; the CG Multiplier reflects this to make the time-series comparable. Note that Dividend Distributions are not assumed to be reinvested. Sustainable Income is the resultant estimate of the fund’s dividend income per current unit, before fees and expenses. Note that a “current unit” includes reinvestment of prior capital gains; a unitholder would have had the calculated sustainable income with only, say, 0.9 units in the past which, with reinvestment of capital gains, would become 1.0 current units. |

||||||

| DeemedRetractibles are comprised of all Straight Perpetuals (both PerpetualDiscount and PerpetualPremium) issued by BMO, BNS, CM, ELF, GWO, HSB, IAG, MFC, NA, RY, SLF and TD, which are not exchangable into common at the option of the company (definition refined in May). These issues are analyzed as if their prospectuses included a requirement to redeem at par on or prior to 2022-1-31, in addition to the call schedule explicitly defined. See OSFI Does Not Grandfather Extant Tier 1 Capital, CM.PR.D, CM.PR.E, CM.PR.G: Seeking NVCC Status and the January, February, March and June, 2011, editions of PrefLetter for the rationale behind this analysis. | ||||||

| Yields for September, 2011, to November, 2011, were calculated by imposing a cap of 10% on the yields of YLO issues held, in order to avoid their extremely high calculated yields distorting the calculation and to reflect the uncertainty in the marketplace that these yields will be realized. | ||||||

Significant positions were held in DeemedRetractible and FixedReset issues on November 30; all of the former and most of the latter currently have their yields calculated with the presumption that they will be called by the issuers at par prior to 2022-1-31. This presents another complication in the calculation of sustainable yield. The fund also holds a position in a SplitShare (BNA.PR.C) and an OperatingRetractible Scrap (YLO.PR.B) which also have their yields calculated with the expectation of a maturity at par, a somewhat dubious assumption in the latter case.

However, if the entire portfolio except for the PerpetualDiscounts were to be sold and reinvested in these issues, the yield of the portfolio would be the 5.79% shown in the MAPF Portfolio Composition: November 2011 analysis (which is greater than the 5.32% index yield on November 30). Given such reinvestment, the sustainable yield would be $10.4511 * 0.0579 = $0.6051, down from the $10.4924 * 0.0598 = $0.6274 reported for October, but an increase from the $10.2709 * 0.0584 = $0.5998 reported in September.

Different assumptions lead to different results from the calculation, but the overall positive trend is apparent. I’m very pleased with the results! It will be noted that if there was no trading in the portfolio, one would expect the sustainable yield to be constant (before fees and expenses). The success of the fund’s trading is showing up in

- the very good performance against the index

- the long term increases in sustainable income per unit

As has been noted, the fund has maintained a credit quality equal to or better than the index; outperformance is due to constant exploitation of trading anomalies.

Again, there are no predictions for the future! The fund will continue to trade between issues in an attempt to exploit market gaps in liquidity, in an effort to outperform the index and keep the sustainable income per unit – however calculated! – growing.