Spanish CDSs hit a new high:

The cost of insuring against a Spanish default jumped to a record as Prime Minister Mariano Rajoy struggles to prevent the nation from becoming the fourth euro-region member to need a bailout.

Credit-default swaps on Spain rose 17 basis points to 498 as of 4 p.m. in London, surpassing the previous all-time high closing price of 493, according to CMA. The contracts are up from 431 at the start of the month and 380 at the end of 2011, signalling a deterioration in investor perceptions of credit quality.

…

The rate on Spain’s 10-year note rose 17 basis points today to 5.99 percent, 21 basis points up from a week ago.

Given the fun ‘n’ games with Greek CDSs, I think that if I were buying European sovereign CDSs, I would want the trigger to be something other than formal default – maybe have something triggered by subordination to other instruments, or IMF loans.

A lot of Europeans are voting with their feet … or ATM card, anyway:

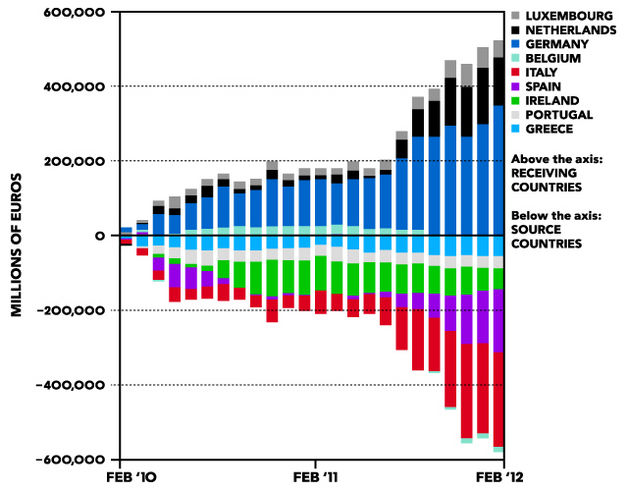

This analysis suggests that capital flight is happening on a scale unprecedented in the euro era — mainly from Spain and Italy to Germany, the Netherlands and Luxembourg (see chart). In March alone, about 65 billion euros left Spain for other euro- zone countries. In the seven months through February, the relevant debts of the central banks of Spain and Italy increased by 155 billion euros and 180 billion euros, respectively. Over the same period, the central banks of Germany, the Netherlands and Luxembourg saw their corresponding credits to other euro- area central banks grow by about 360 billion euros.

There’s more trouble at Air Canada:

Air Canada … is warning travellers of flight disruptions, saying some pilots are staging an illegal walkout.

There were cancellations of roughly 30 departures and 30 arrivals on Friday morning at Toronto’s Pearson International Airport, mostly affecting Air Canada, said airport spokesman Scott Armstrong.

This is easy to fix, fortunately. If Air Canada is so important that the Feds have to take away the right to strike, then the longer-term solution is to make Air Canada less important. Give the Emirates rights to the Toronto-Dubai route! Allow cabotage! Let anybody fly between any two points, as long as they meet safety standards and have bought the landing rights in a competitive auction!

BPO Properties, proud issuer of BPO.PR.F, BPO.PR.H, BPO.PR.J, BPO.PR.K, BPO.PR.K, BPO.PR.L, BPO.PR.N, BPO.PR.P and BPO.PR.R, was confirmed at Pfd-3 by DBRS:

DBRS has today confirmed the Issuer Rating of BPO Properties Ltd. (BPO or the Company) at BBB and its Cumulative Redeemable Preferred Shares rating at Pfd-3, with trends at Stable. The BBB rating incorporates the following credit strengths: (1) BPO has strong ownership and an experienced management team; (2) BPO has a premier Class-A to AAA office portfolio, located in the downtown markets in three of Canada’s largest office markets, namely Toronto, Calgary and Vancouver, featuring a number of flagship office properties, such as First Canadian Place, Bay Adelaide Centre West Tower, Bay Wellington Tower, Exchange Tower and Bankers Hall; (3) the portfolio has strong occupancy levels, which are above market comparables in each of its markets, with exception to Toronto; and (4) BPO’s reasonable credit metrics and certain debt restrictions.

Conversely, the rating incorporates the following associated risks: (1) BPO’s portfolio’s heavy concentration in the downtown markets of Toronto and Calgary; (2) significant property concentration with the Company’s top five properties, accounting for approximately 54.8% of the Company’s total leasable area in the portfolio; (3) above-average tenant concentration (however, this concern is somewhat mitigated by the high creditworthiness of the Company’s top 15 tenants).

…

The stable outlook takes into consideration DBRS’s expectation for reasonable growth in operating cash flow in 2012, mainly due to the continued lease-up of Bay Adelaide Centre West Tower. In addition, minimal lease maturities in 2012 should continue to contribute stable cash flow and limit the Company’s exposure to market conditions and re-tenanting costs. DBRS expects BPO to maintain a good liquidity position and positive free cash flow position. The Company has no active commercial development projects and has manageable near-term capital commitments. Overall, DBRS expects BPO’s financial profile to remain stable in 2012, with support from higher cash flow levels and reasonable financial flexibility to fund manageable capital commitments (mainly maturing mortgages).

New rules for dark orders on Canadian exchanges will go into effect in in October:

The new framework involves several elements. Among them:

- Visible orders will have execution priority over dark orders on the same marketplace at the same price.

- In order to trade with a dark order, smaller orders must receive a minimum level of price improvement, which is defined as one trading increment or half a trading increment for securities with a bid-ask spread of one trading increment.

- The IIROC has the ability to designate a minimum size for dark orders, although it isn’t doing so at this time.

I confess that I have not yet looked at the details.

The CME had an incident today illustrative of the frictions between visible and dark trading:

Local traders in the CME Group Inc. (CME)’s Eurodollar options pit walked off the job today to protest a block trade yesterday.

“These guys that stand in there all day and make prices would have loved to participate in that particular price, but they weren’t able to,” Rocco Chierici, a broker at R.J. O’Brien & Associates on the floor of the Chicago Mercantile Exchange, said in a telephone interview.

Prices for the block trades of options on Eurodollar futures were higher than offers in the pit, which wouldn’t be allowed in open-outcry trading, Chierici said.

…

“There are rules that prohibit that in the pit, but you can circumvent the pit” in a block trade, Chierici said. “I believe they wanted to make the point that the system is not fair.”Six block trades totaling 215,200 options traded at 8:11 a.m. Chicago time yesterday, according to CME Group’s website. The trade was rolling positions from April contracts, which expired today, into June contracts.

“The block trade in question was managed by longstanding rules and processes of our exchanges,” Michael Shore, a CME Group spokesman, said in an e-mail. “It was a legitimate, well- managed trade, which was executed within one tick of the market and in one trade.”

It was a mixed day for the Canadian preferred share market, with PerpetualPremiums up 12bp, while both FixedResets and DeemedRetractibles were off 1bp. The Performance Highlights table is comprised entirely of Floating Rate issues (the fact that they are all BAM issues is not indicative – BAM is the only issuer in these indices at this time). Volume was absurdly low.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -1.0214 % | 2,309.9 |

| FixedFloater | 4.47 % | 3.82 % | 34,917 | 17.75 | 1 | -2.7002 % | 3,528.0 |

| Floater | 3.13 % | 3.14 % | 45,559 | 19.39 | 3 | -1.0214 % | 2,494.1 |

| OpRet | 4.76 % | 3.06 % | 45,056 | 1.15 | 5 | -0.0459 % | 2,507.5 |

| SplitShare | 5.25 % | -4.99 % | 81,065 | 0.67 | 4 | 0.0694 % | 2,691.4 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0459 % | 2,292.9 |

| Perpetual-Premium | 5.47 % | -3.05 % | 85,890 | 0.13 | 23 | 0.1191 % | 2,221.9 |

| Perpetual-Discount | 5.16 % | 5.10 % | 131,810 | 15.28 | 10 | -0.2511 % | 2,416.7 |

| FixedReset | 5.02 % | 3.00 % | 182,519 | 2.19 | 67 | -0.0063 % | 2,395.8 |

| Deemed-Retractible | 4.97 % | 3.82 % | 202,830 | 2.88 | 46 | -0.0128 % | 2,306.7 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.G | FixedFloater | -2.70 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-04-13 Maturity Price : 22.17 Evaluated at bid price : 21.26 Bid-YTW : 3.82 % |

| BAM.PR.B | Floater | -1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-04-13 Maturity Price : 16.77 Evaluated at bid price : 16.77 Bid-YTW : 3.15 % |

| BAM.PR.K | Floater | -1.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2042-04-13 Maturity Price : 16.80 Evaluated at bid price : 16.80 Bid-YTW : 3.14 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.J | Deemed-Retractible | 102,400 | Called for redemption. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-04-30 Maturity Price : 25.75 Evaluated at bid price : 25.97 Bid-YTW : 3.34 % |

| BNS.PR.Z | FixedReset | 94,061 | Desjardins crossed 49,600 at 25.13; TD crossed 30,000 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.11 Bid-YTW : 3.14 % |

| BMO.PR.J | Deemed-Retractible | 59,059 | TD crossed 50,000 at 25.70. YTW SCENARIO Maturity Type : Call Maturity Date : 2016-02-25 Maturity Price : 25.00 Evaluated at bid price : 25.70 Bid-YTW : 3.90 % |

| ENB.PR.D | FixedReset | 57,075 | Nesbitt crossed 40,000 at 25.56. YTW SCENARIO Maturity Type : Call Maturity Date : 2018-03-01 Maturity Price : 25.00 Evaluated at bid price : 25.55 Bid-YTW : 3.69 % |

| RY.PR.A | Deemed-Retractible | 56,591 | RBC crossed 50,000 at 25.60. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-24 Maturity Price : 25.25 Evaluated at bid price : 25.56 Bid-YTW : 4.11 % |

| BMO.PR.K | Deemed-Retractible | 53,202 | RBC crossed 50,000 at 26.60. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-11-25 Maturity Price : 26.00 Evaluated at bid price : 26.57 Bid-YTW : 2.57 % |

| There were 11 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PR.G | FixedFloater | Quote: 21.26 – 21.90 Spot Rate : 0.6400 Average : 0.4444 YTW SCENARIO |

| MFC.PR.G | FixedReset | Quote: 25.38 – 25.69 Spot Rate : 0.3100 Average : 0.1891 YTW SCENARIO |

| SLF.PR.G | FixedReset | Quote: 24.76 – 25.03 Spot Rate : 0.2700 Average : 0.1725 YTW SCENARIO |

| CM.PR.K | FixedReset | Quote: 26.22 – 26.69 Spot Rate : 0.4700 Average : 0.3782 YTW SCENARIO |

| BAM.PR.Z | FixedReset | Quote: 25.63 – 25.88 Spot Rate : 0.2500 Average : 0.1597 YTW SCENARIO |

| HSB.PR.C | Deemed-Retractible | Quote: 25.65 – 25.89 Spot Rate : 0.2400 Average : 0.1677 YTW SCENARIO |