Assiduous Readers will remember David Rosenberg’s thesis that liquidations by resource-dependent Sovereign Wealth Funds are an important factor in the horrible markets, as discussed on February 2. Well, there’s some more fuel coming for that fire!

Sovereign wealth funds may withdraw $404.3 billion from global stock markets this year if crude prices stay between $30 to $40 per barrel as oil-rich nations seek to shore up their finances, according to the Sovereign Wealth Fund Institute.

The value of listed equities held by the world’s largest wealth funds will probably drop to $2.64 trillion this year, from about $3.04 trillion at the end of 2015, the Las Vegas-based SWFI said in an e-mailed report sent Monday. Withdrawals are set to approximately double from last year, when sovereign funds sold about $213.4 billion of equities, it said.

…

Norway, the world’s biggest wealth fund, hasn’t been “impervious to the oil glut” either, the SWFI report said.Officials who supervise the $780 billion fund haven’t even discussed the possibility of shifting strategy, according to Egil Matsen, who last month started as the new deputy central bank governor in charge of oversight of the investor. The government this year plans to make its first withdrawal since the fund got its first capital infusion in 1996.

Meanwhile, hedge funds are moving onto the NYSE floor:

Citadel Securities and Global Trading Systems LLC recently agreed to buy NYSE floor-trading businesses, putting their computers on the same team as humans working at the lower Manhattan facility. They’re joining other automated market makers, Virtu Financial Inc. and IMC, who now oversee nearly all transactions on the floor.

…

Once their deals close, GTS and the market-making division of Citadel LLC will each oversee the trading of more than 1,000 securities. Along with Virtu and IMC, the high-speed traders will have a chance to build relationships with the listed companies whose stocks they manage.

…

Before a corporation lists its stock through an initial public offering, they interview and select the designated market maker that oversees their shares. NYSE requires the company and its trader to speak regularly.

…

Big brokers like Goldman Sachs Group Inc. and Bank of America Corp. once ruled the NYSE floor. Over time, as regulation and technology hurdles steepened, the banks sold their floor operations. Once GTS’s purchase of Barclays Plc’s NYSE business closes in the second quarter, no bank will have a designated market maker operation on the floor.Jamil Nazarali, head of Citadel Execution Services, said that firms like his are better equipped technologically than banks to handle market making at NYSE.

“The equity markets are nearly completely automated, and the banks just don’t have the market-making capabilities we do,” Nazarali said. “It’s not an accident that the banks have left the floor.”

It’s nice to see technologically focussed firms doing well:

Cantor Fitzgerald, the Knight Capital Group and the Susquehanna International Group have all capitalized on the E.T.F. explosion.

And as these firms have grown, so has the demand for a new breed of Wall Street trader — one who can build financial models and write computer code but who also has the guts to spot a market anomaly and bet big with the firm’s capital.

In a word, these are not your suit-and-tie bond and stock traders of yore, riding the commuter train into Manhattan. They are, instead, the pick of the global brain crop.

Here is a small sample of Jane Street’s main traders: Tao Wang (doctorate in philosophy and finance from the National University of Singapore), Min Zhu (master’s in chemistry, Columbia), Brett Harrison (master’s in computer science with a focus in artificial intelligence, Harvard) and Srihari Seshadri (bachelor’s in computer science, Carnegie Mellon).

For large asset management firms like BlackRock, Vanguard and Invesco, the business of rolling out one E.T.F. after another has become a major profit center. But in many ways, the real money is being made by the trading firms that specialize in making a market in these securities.

Assiduous Reader prefobsessed has sent me a link to another Barry Critchley piece, Two tales of preferred redemption, Rona and RioCan REIT. I have updated the post REI.PR.A To Be Redeemed with some commentary.

The Norwegians remind us that anti-money-laundering laws and bureaucracies are pointless:

A study of 40 European jihadi cells by the Norwegian Defence Research Establishment found that the vast majority were financed by members’ own legitimate activities. One of the San Bernardino shooters took out a legitimate loan for $28,500 to finance the attack, rather than receiving the proverbial briefcase of cash from a foreign operative.

“One of the trends we’re seeing is local and parochial sources of income” for terrorist groups, [associate political scientist at the RAND institute Colin] Clarke agrees. He says that terrorist attacks are relatively inexpensive, and can be funded through local petty crime or credit loans. “If you plan to martyr yourself you’re not too concerned with your credit score,” he adds.

Update, 2016-4-20: There was more discussion of this on November 23, 2015

It was a mixed day for the Canadian preferred share market, with PerpetualDiscounts off 3bp, FixedResets gaining 14bp and DeemedRetractibles down 21bp. Lots of churn is evident in the Performance Highlights table. Volume was above average.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

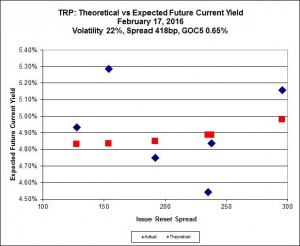

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 16.50 to be $0.96 rich, while TRP.PR.C, resetting 2021-1-30 at +154, is $0.75 cheap at its bid price of 10.63.

This analysis includes the new issue with a deemed price of 25.00.

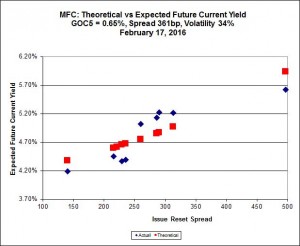

Most expensive is the new issue, resetting at +497bp on 2021-6-19, deemed at 25.00 to be 1.10 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 16.90 to be 1.45 cheap.

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 13.41 to be $1.03 cheap. BAM.PF.E, resetting at +255bp on 2020-3-31 is bid at 17.06 and appears to be $1.37 rich.

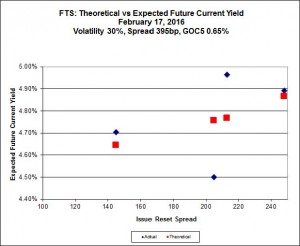

FTS.PR.K, with a spread of +205bp, and bid at 15.25, looks $0.64 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 14.51 and is $0.50 cheap.

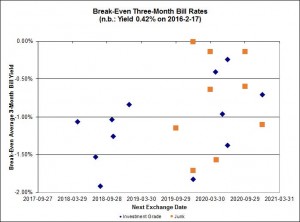

Investment-grade pairs predict an average three-month bill yield over the next five-odd years of -0.87%, with one outlier above 0.00% and one below -2.00%. There are thre junk outliers above 0.00%.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 5.30 % | 6.46 % | 14,620 | 16.08 | 1 | 0.5512 % | 1,471.2 |

| FixedFloater | 7.77 % | 6.80 % | 23,504 | 15.40 | 1 | 0.6584 % | 2,559.4 |

| Floater | 4.97 % | 5.18 % | 78,788 | 15.13 | 4 | -0.2100 % | 1,542.4 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0175 % | 2,750.5 |

| SplitShare | 4.85 % | 5.78 % | 75,303 | 2.69 | 6 | 0.0175 % | 3,218.6 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0175 % | 2,511.3 |

| Perpetual-Premium | 5.83 % | 5.80 % | 83,884 | 13.91 | 6 | 0.0199 % | 2,530.4 |

| Perpetual-Discount | 5.77 % | 5.81 % | 98,539 | 14.15 | 33 | -0.0263 % | 2,506.7 |

| FixedReset | 5.70 % | 5.12 % | 208,138 | 14.40 | 84 | 0.1355 % | 1,783.9 |

| Deemed-Retractible | 5.33 % | 5.78 % | 125,145 | 6.88 | 34 | -0.2113 % | 2,534.3 |

| FloatingReset | 3.12 % | 5.18 % | 49,831 | 5.50 | 16 | -0.2614 % | 1,960.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| PWF.PR.Q | FloatingReset | -5.32 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 10.50 Evaluated at bid price : 10.50 Bid-YTW : 4.90 % |

| GWO.PR.N | FixedReset | -4.76 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.01 Bid-YTW : 11.54 % |

| RY.PR.M | FixedReset | -4.61 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 16.98 Evaluated at bid price : 16.98 Bid-YTW : 4.93 % |

| RY.PR.J | FixedReset | -3.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 4.90 % |

| GWO.PR.O | FloatingReset | -3.31 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 10.80 Bid-YTW : 12.42 % |

| BAM.PF.F | FixedReset | -3.18 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 17.04 Evaluated at bid price : 17.04 Bid-YTW : 5.51 % |

| MFC.PR.F | FixedReset | -2.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.10 Bid-YTW : 11.39 % |

| SLF.PR.H | FixedReset | -2.45 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.74 Bid-YTW : 10.05 % |

| PWF.PR.P | FixedReset | -2.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 11.55 Evaluated at bid price : 11.55 Bid-YTW : 4.89 % |

| BMO.PR.T | FixedReset | -2.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 16.66 Evaluated at bid price : 16.66 Bid-YTW : 4.60 % |

| CIU.PR.C | FixedReset | -1.80 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 9.83 Evaluated at bid price : 9.83 Bid-YTW : 5.05 % |

| NA.PR.W | FixedReset | -1.60 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 15.34 Evaluated at bid price : 15.34 Bid-YTW : 5.07 % |

| HSB.PR.C | Deemed-Retractible | -1.58 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.32 Bid-YTW : 5.83 % |

| TRP.PR.E | FixedReset | -1.55 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 16.50 Evaluated at bid price : 16.50 Bid-YTW : 4.93 % |

| W.PR.J | Perpetual-Discount | -1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 22.84 Evaluated at bid price : 23.12 Bid-YTW : 6.13 % |

| TD.PF.D | FixedReset | -1.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 17.79 Evaluated at bid price : 17.79 Bid-YTW : 4.89 % |

| RY.PR.I | FixedReset | -1.37 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.03 Bid-YTW : 4.60 % |

| CM.PR.Q | FixedReset | -1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 18.15 Evaluated at bid price : 18.15 Bid-YTW : 4.80 % |

| RY.PR.Z | FixedReset | -1.34 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 16.92 Evaluated at bid price : 16.92 Bid-YTW : 4.49 % |

| GWO.PR.R | Deemed-Retractible | -1.26 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.18 Bid-YTW : 7.31 % |

| TRP.PR.A | FixedReset | -1.13 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 13.15 Evaluated at bid price : 13.15 Bid-YTW : 5.21 % |

| BAM.PR.C | Floater | -1.09 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 9.10 Evaluated at bid price : 9.10 Bid-YTW : 5.27 % |

| BAM.PR.K | Floater | -1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 9.25 Evaluated at bid price : 9.25 Bid-YTW : 5.18 % |

| MFC.PR.G | FixedReset | 1.03 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.90 Bid-YTW : 8.92 % |

| MFC.PR.N | FixedReset | 1.11 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.79 Bid-YTW : 8.74 % |

| FTS.PR.G | FixedReset | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 14.51 Evaluated at bid price : 14.51 Bid-YTW : 5.02 % |

| MFC.PR.M | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.95 Bid-YTW : 8.68 % |

| BAM.PF.G | FixedReset | 1.14 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 17.70 Evaluated at bid price : 17.70 Bid-YTW : 5.34 % |

| TD.PR.Y | FixedReset | 1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.13 Bid-YTW : 4.40 % |

| SLF.PR.J | FloatingReset | 1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.50 Bid-YTW : 11.88 % |

| BAM.PR.T | FixedReset | 1.25 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 13.75 Evaluated at bid price : 13.75 Bid-YTW : 5.60 % |

| CU.PR.C | FixedReset | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 15.90 Evaluated at bid price : 15.90 Bid-YTW : 4.86 % |

| BNS.PR.P | FixedReset | 1.31 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.99 Bid-YTW : 3.74 % |

| TRP.PR.G | FixedReset | 1.33 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 17.80 Evaluated at bid price : 17.80 Bid-YTW : 5.13 % |

| BMO.PR.Y | FixedReset | 1.41 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 18.72 Evaluated at bid price : 18.72 Bid-YTW : 4.61 % |

| BNS.PR.C | FloatingReset | 1.47 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.33 Bid-YTW : 5.18 % |

| IFC.PR.C | FixedReset | 1.61 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.75 Bid-YTW : 9.77 % |

| BMO.PR.Q | FixedReset | 1.80 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.12 Bid-YTW : 7.82 % |

| BNS.PR.Z | FixedReset | 1.81 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 19.16 Bid-YTW : 6.96 % |

| CIU.PR.A | Perpetual-Discount | 1.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 19.68 Evaluated at bid price : 19.68 Bid-YTW : 5.88 % |

| PWF.PR.A | Floater | 1.96 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 10.42 Evaluated at bid price : 10.42 Bid-YTW : 4.56 % |

| MFC.PR.K | FixedReset | 2.19 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.52 Bid-YTW : 9.57 % |

| MFC.PR.L | FixedReset | 2.19 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.80 Bid-YTW : 9.46 % |

| MFC.PR.J | FixedReset | 2.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.70 Bid-YTW : 8.89 % |

| TD.PF.E | FixedReset | 2.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 18.26 Evaluated at bid price : 18.26 Bid-YTW : 4.89 % |

| MFC.PR.I | FixedReset | 2.54 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.26 Bid-YTW : 8.71 % |

| HSE.PR.E | FixedReset | 2.57 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 15.36 Evaluated at bid price : 15.36 Bid-YTW : 6.94 % |

| NA.PR.Q | FixedReset | 2.68 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.00 Bid-YTW : 4.88 % |

| TRP.PR.B | FixedReset | 2.80 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 9.91 Evaluated at bid price : 9.91 Bid-YTW : 5.01 % |

| BAM.PR.X | FixedReset | 2.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 12.25 Evaluated at bid price : 12.25 Bid-YTW : 5.37 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PF.G | FixedReset | 326,018 | RBC crossed blocks of 250,000 and 25,000, both at 25.40. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 23.28 Evaluated at bid price : 25.40 Bid-YTW : 5.21 % |

| RY.PR.Q | FixedReset | 112,850 | Scotia crossed 21,900 at 25.41; RBC crossed 50,000 at 25.47. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 23.28 Evaluated at bid price : 25.43 Bid-YTW : 5.13 % |

| NA.PR.X | FixedReset | 108,416 | Recent new issue. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 23.20 Evaluated at bid price : 25.17 Bid-YTW : 5.46 % |

| BNS.PR.E | FixedReset | 64,240 | Desjardins crossed 40,000 at 25.52. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-22 Maturity Price : 23.28 Evaluated at bid price : 25.41 Bid-YTW : 5.12 % |

| SLF.PR.E | Deemed-Retractible | 63,072 | RBC crossed 50,000 at 20.30. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 20.16 Bid-YTW : 7.68 % |

| BMO.PR.Q | FixedReset | 50,025 | TD crossed 20,000 at 18.20. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.12 Bid-YTW : 7.82 % |

| There were 43 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BAM.PF.F | FixedReset | Quote: 17.04 – 18.40 Spot Rate : 1.3600 Average : 0.9407 YTW SCENARIO |

| MFC.PR.K | FixedReset | Quote: 15.52 – 16.25 Spot Rate : 0.7300 Average : 0.4859 YTW SCENARIO |

| RY.PR.M | FixedReset | Quote: 16.98 – 17.90 Spot Rate : 0.9200 Average : 0.6832 YTW SCENARIO |

| TRP.PR.E | FixedReset | Quote: 16.50 – 17.60 Spot Rate : 1.1000 Average : 0.8724 YTW SCENARIO |

| PWF.PR.Q | FloatingReset | Quote: 10.50 – 11.90 Spot Rate : 1.4000 Average : 1.1910 YTW SCENARIO |

| BNS.PR.F | FloatingReset | Quote: 17.83 – 18.49 Spot Rate : 0.6600 Average : 0.4705 YTW SCENARIO |