Equities popped today on the back of oil:

The Standard & Poor’s 500 Index rose 1.7 percent to 1,926.82 at 4 p.m. in New York, capping its first three-day advance this year and closing at a two-week high. The Dow climbed 257.42 points, or 1.6 percent, to 16,453.83. The Nasdaq Composite Index gained 2.2 percent. About 9.2 billion shares traded hands on U.S. exchanges, 14 percent above the three-month average.

…

Equity gains are coming virtually as fast as the losses that sent the S&P 500 to its worst start to any year, with almost half of 2016’s decline made up in three days. The rally today occurred as oil climbed more than 5 percent, Federal Reserve officials expressed caution on the economy and data on manufacturing was better than forecast.

On the other hand, Japan auctioned 5-year bonds with a negative yield:

Japan’s government got paid to borrow at a five-year note auction for the first time on Thursday after the central bank adopted a negative interest-rate policy on Jan. 29. The sale drew an average yield of minus 0.138 percent. Japan is following Germany, Switzerland and Denmark in being able to attract buyers even as yields fall below zero.

One of the many benefits of High Frequency Trading may be the arbitrage between the cash and futures markets:

The close relationship between market volatility and trading activity is a long-established fact in financial markets. In recent years, much of the trading in U.S. Treasury and equity markets has been associated with nearly simultaneous trading between the leading cash and futures platforms. The striking cross-activity patterns that arise in both high-frequency cross-market trading and related cross-market order book changes in U.S. Treasury markets are also witnessed in other asset classes and naturally lead to the question that we investigate in this post of how the cross-market component of overall trading activity is related to volatility.

The chart below displays a measure of cross-market activity for the ten-year Treasury note cash and futures markets (left column) and the S&P 500 cash and futures markets (right column) across different millisecond offsets. Of note is the pronounced asymmetry of the spike in the measure at +5 milliseconds for the S&P 500 compared with the ten-year U.S. Treasury. The much higher spike for the positive 5 millisecond offset is consistent with the often-cited dominant role played by the S&P futures market in price discovery. Leaving this asymmetry aside, the spikes in cross-market activity on October 15 and 16, 2014, stand out as being well-aligned with the heightened volatility and trading observed on those days. Cross-market trading and quoting activity thus appears to be related to variations in market volatility, which can create (short-lived) dislocations in relative valuations as market participants respond to news about fundamentals or market activity itself.

It was a superb day for the Canadian preferred share market, with PerpetualDiscounts up 19bp, FixedResets winning 142bp and DeemedRetractibles gaining 12bp. Unsurprisingly, the Performance Highlights table is both enormous and dominated by FixedReset winners, with many issues gaining over 5%. Volume was very high.

For as long as the FixedReset market is so violently unsettled, I’ll keep publishing updates of the more interesting and meaningful series of FixedResets’ Implied Volatilities. This doesn’t include Enbridge because although Enbridge has a large number of issues outstanding, all of which are quite liquid, the range of Issue Reset Spreads is too small for decent conclusions. The low is 212bp (ENB.PR.H; second-lowest is ENB.PR.D at 237bp) and the high is a mere 268 for ENB.PF.G.

Remember that all rich /cheap assessments are:

» based on Implied Volatility Theory only

» are relative only to other FixedResets from the same issuer

» assume constant GOC-5 yield

» assume constant Implied Volatility

» assume constant spread

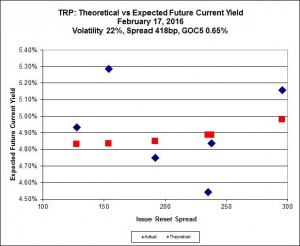

Here’s TRP:

TRP.PR.E, which resets 2019-10-30 at +235, is bid at 16.51 to be $1.16 rich, while TRP.PR.C, resetting 2021-1-30 at +154, is $0.97 cheap at its bid price of 10.36.

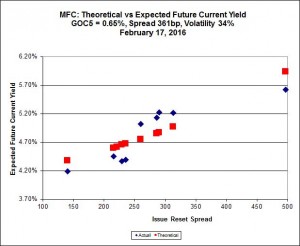

This analysis includes the new issue with a deemed price of 25.00.

Most expensive is the new issue, resetting at +497bp on 2021-6-19, deemed at 25.00 to be 1.32 rich, while MFC.PR.G, resetting at +290bp on 2016-12-19, is bid at 16.99 to be 1.25 cheap.

The cheapest issue relative to its peers is BAM.PR.R, resetting at +230bp on 2016-6-30, bid at 13.00 to be $1.46 cheap. BAM.PF.E, resetting at +255bp on 2020-3-31 is bid at 17.31 and appears to be $1.62 rich.

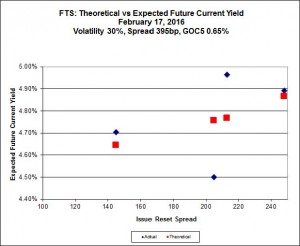

FTS.PR.K, with a spread of +205bp, and bid at 15.00, looks $0.81 expensive and resets 2019-3-1. FTS.PR.G, with a spread of +213bp and resetting 2018-9-1, is bid at 14.00 and is $0.58 cheap.

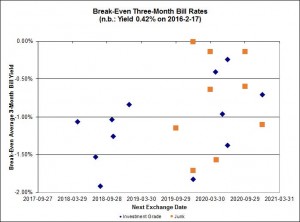

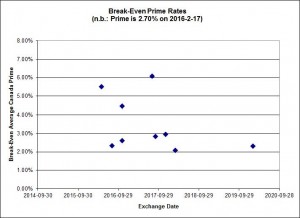

Investment-grade pairs predict an average three-month bill yield over the next five-odd years of -0.72%, with four outliers above 0.00%. There are two junk outliers above 0.00%.

Shall we just say that this exhibits a high level of confidence in the continued rapacity of Canadian banks?

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 5.71 % | 6.94 % | 15,457 | 15.53 | 1 | 1.2810 % | 1,366.4 |

| FixedFloater | 7.88 % | 6.89 % | 24,873 | 15.30 | 1 | 1.7722 % | 2,523.8 |

| Floater | 5.20 % | 5.41 % | 81,003 | 14.76 | 4 | 3.2983 % | 1,473.9 |

| OpRet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3516 % | 2,746.5 |

| SplitShare | 4.81 % | 5.75 % | 74,386 | 2.67 | 6 | 0.3516 % | 3,213.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3516 % | 2,507.6 |

| Perpetual-Premium | 5.85 % | 5.82 % | 83,019 | 13.87 | 6 | 0.1000 % | 2,522.5 |

| Perpetual-Discount | 5.80 % | 5.84 % | 99,678 | 14.13 | 33 | 0.1897 % | 2,493.1 |

| FixedReset | 5.74 % | 5.11 % | 211,852 | 14.43 | 84 | 1.4227 % | 1,768.5 |

| Deemed-Retractible | 5.34 % | 5.81 % | 123,857 | 6.89 | 34 | 0.1153 % | 2,529.7 |

| FloatingReset | 3.11 % | 5.02 % | 49,790 | 5.51 | 16 | 0.4631 % | 1,967.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BNS.PR.B | FloatingReset | -1.50 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.08 Bid-YTW : 5.19 % |

| GWO.PR.O | FloatingReset | -1.33 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.15 Bid-YTW : 12.10 % |

| BNS.PR.C | FloatingReset | -1.15 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 21.50 Bid-YTW : 5.02 % |

| TD.PR.Y | FixedReset | -1.06 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.32 Bid-YTW : 4.22 % |

| TRP.PR.F | FloatingReset | 1.01 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 11.04 Evaluated at bid price : 11.04 Bid-YTW : 5.42 % |

| TD.PF.B | FixedReset | 1.03 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.70 Evaluated at bid price : 16.70 Bid-YTW : 4.58 % |

| PWF.PR.K | Perpetual-Discount | 1.07 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 21.47 Evaluated at bid price : 21.73 Bid-YTW : 5.74 % |

| FTS.PR.G | FixedReset | 1.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 14.00 Evaluated at bid price : 14.00 Bid-YTW : 5.17 % |

| MFC.PR.G | FixedReset | 1.13 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.99 Bid-YTW : 9.04 % |

| RY.PR.J | FixedReset | 1.16 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.40 Evaluated at bid price : 17.40 Bid-YTW : 4.90 % |

| CM.PR.Q | FixedReset | 1.19 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.91 Evaluated at bid price : 17.91 Bid-YTW : 4.84 % |

| SLF.PR.I | FixedReset | 1.23 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.50 Bid-YTW : 9.20 % |

| TD.PF.E | FixedReset | 1.27 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 18.30 Evaluated at bid price : 18.30 Bid-YTW : 4.85 % |

| BAM.PR.E | Ratchet | 1.28 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 25.00 Evaluated at bid price : 11.86 Bid-YTW : 6.94 % |

| BNS.PR.Y | FixedReset | 1.30 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 18.75 Bid-YTW : 7.00 % |

| BMO.PR.M | FixedReset | 1.30 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.31 Bid-YTW : 4.03 % |

| RY.PR.W | Perpetual-Discount | 1.31 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 22.88 Evaluated at bid price : 23.15 Bid-YTW : 5.30 % |

| POW.PR.D | Perpetual-Discount | 1.36 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 21.33 Evaluated at bid price : 21.60 Bid-YTW : 5.85 % |

| RY.PR.M | FixedReset | 1.43 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.07 Evaluated at bid price : 17.07 Bid-YTW : 4.87 % |

| W.PR.K | FixedReset | 1.47 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 22.83 Evaluated at bid price : 24.10 Bid-YTW : 5.48 % |

| TRP.PR.A | FixedReset | 1.58 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 13.53 Evaluated at bid price : 13.53 Bid-YTW : 5.02 % |

| CM.PR.P | FixedReset | 1.72 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 4.79 % |

| BNS.PR.D | FloatingReset | 1.74 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.58 Bid-YTW : 7.73 % |

| PVS.PR.D | SplitShare | 1.75 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2021-10-08 Maturity Price : 25.00 Evaluated at bid price : 23.30 Bid-YTW : 6.17 % |

| BAM.PR.G | FixedFloater | 1.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 25.00 Evaluated at bid price : 12.06 Bid-YTW : 6.89 % |

| TD.PF.F | Perpetual-Discount | 1.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 22.12 Evaluated at bid price : 22.46 Bid-YTW : 5.49 % |

| BMO.PR.T | FixedReset | 1.98 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.52 Evaluated at bid price : 16.52 Bid-YTW : 4.61 % |

| HSE.PR.A | FixedReset | 2.08 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 8.35 Evaluated at bid price : 8.35 Bid-YTW : 7.09 % |

| NA.PR.Q | FixedReset | 2.17 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 22.63 Bid-YTW : 5.16 % |

| FTS.PR.I | FloatingReset | 2.39 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 9.42 Evaluated at bid price : 9.42 Bid-YTW : 5.02 % |

| FTS.PR.M | FixedReset | 2.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 5.16 % |

| PWF.PR.T | FixedReset | 2.68 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 19.53 Evaluated at bid price : 19.53 Bid-YTW : 4.06 % |

| BAM.PR.T | FixedReset | 2.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 13.37 Evaluated at bid price : 13.37 Bid-YTW : 5.72 % |

| SLF.PR.J | FloatingReset | 2.78 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 11.45 Bid-YTW : 11.92 % |

| MFC.PR.L | FixedReset | 2.80 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.78 Bid-YTW : 9.66 % |

| FTS.PR.K | FixedReset | 2.81 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 15.00 Evaluated at bid price : 15.00 Bid-YTW : 4.79 % |

| BAM.PF.G | FixedReset | 2.94 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 5.37 % |

| BAM.PF.F | FixedReset | 3.00 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.51 Evaluated at bid price : 17.51 Bid-YTW : 5.33 % |

| HSE.PR.E | FixedReset | 3.42 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 15.10 Evaluated at bid price : 15.10 Bid-YTW : 7.18 % |

| BAM.PR.R | FixedReset | 3.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 13.00 Evaluated at bid price : 13.00 Bid-YTW : 5.74 % |

| BAM.PF.B | FixedReset | 3.88 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.06 Evaluated at bid price : 16.06 Bid-YTW : 5.38 % |

| BAM.PR.Z | FixedReset | 3.91 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.99 Evaluated at bid price : 16.99 Bid-YTW : 5.52 % |

| CM.PR.O | FixedReset | 4.06 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.65 Evaluated at bid price : 16.65 Bid-YTW : 4.71 % |

| TRP.PR.G | FixedReset | 4.10 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.50 Evaluated at bid price : 17.50 Bid-YTW : 5.28 % |

| MFC.PR.N | FixedReset | 4.19 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 16.90 Bid-YTW : 8.82 % |

| BAM.PR.K | Floater | 4.24 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 8.86 Evaluated at bid price : 8.86 Bid-YTW : 5.41 % |

| MFC.PR.M | FixedReset | 4.45 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 17.13 Bid-YTW : 8.70 % |

| BAM.PR.C | Floater | 4.46 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 8.67 Evaluated at bid price : 8.67 Bid-YTW : 5.53 % |

| HSE.PR.G | FixedReset | 4.52 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 15.26 Evaluated at bid price : 15.26 Bid-YTW : 7.10 % |

| BAM.PF.A | FixedReset | 4.53 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.30 Evaluated at bid price : 17.30 Bid-YTW : 5.35 % |

| SLF.PR.H | FixedReset | 4.96 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 14.60 Bid-YTW : 10.14 % |

| GWO.PR.N | FixedReset | 5.20 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.75 Bid-YTW : 10.83 % |

| MFC.PR.K | FixedReset | 5.44 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 15.50 Bid-YTW : 9.77 % |

| MFC.PR.F | FixedReset | 5.48 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 12.31 Bid-YTW : 11.39 % |

| BAM.PR.B | Floater | 5.77 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 8.80 Evaluated at bid price : 8.80 Bid-YTW : 5.44 % |

| SLF.PR.G | FixedReset | 6.37 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2025-01-31 Maturity Price : 25.00 Evaluated at bid price : 13.52 Bid-YTW : 10.17 % |

| BAM.PR.X | FixedReset | 7.04 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 12.31 Evaluated at bid price : 12.31 Bid-YTW : 5.30 % |

| BAM.PF.E | FixedReset | 7.12 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 17.31 Evaluated at bid price : 17.31 Bid-YTW : 5.03 % |

| PWF.PR.Q | FloatingReset | 8.50 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 10.85 Evaluated at bid price : 10.85 Bid-YTW : 4.74 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| FTS.PR.M | FixedReset | 155,067 | TD crossed 21,000 at 15.90, followed by blocks of 100,000 and 19,000, both at 16.00. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 16.00 Evaluated at bid price : 16.00 Bid-YTW : 5.16 % |

| FTS.PR.H | FixedReset | 151,934 | Scotia crossed blocks of 52,800 and 95,400, both at 11.20. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 11.16 Evaluated at bid price : 11.16 Bid-YTW : 4.83 % |

| BAM.PR.K | Floater | 114,575 | TD crossed 100,000 at 8.70. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 8.86 Evaluated at bid price : 8.86 Bid-YTW : 5.41 % |

| TD.PF.G | FixedReset | 95,049 | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 23.25 Evaluated at bid price : 25.31 Bid-YTW : 5.21 % |

| BMO.PR.Y | FixedReset | 90,020 | Scotia crossed blocks of 50,000 and 25,000, both at 18.25. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 18.23 Evaluated at bid price : 18.23 Bid-YTW : 4.71 % |

| RY.PR.Q | FixedReset | 83,277 | RBC crossed 10,000 at 25.40. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2046-02-17 Maturity Price : 23.28 Evaluated at bid price : 25.44 Bid-YTW : 5.11 % |

| There were 56 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| FTS.PR.H | FixedReset | Quote: 11.16 – 12.35 Spot Rate : 1.1900 Average : 0.7183 YTW SCENARIO |

| MFC.PR.H | FixedReset | Quote: 18.12 – 19.12 Spot Rate : 1.0000 Average : 0.6328 YTW SCENARIO |

| CIU.PR.C | FixedReset | Quote: 9.82 – 10.57 Spot Rate : 0.7500 Average : 0.4374 YTW SCENARIO |

| FTS.PR.G | FixedReset | Quote: 14.00 – 15.00 Spot Rate : 1.0000 Average : 0.6993 YTW SCENARIO |

| TRP.PR.I | FloatingReset | Quote: 10.75 – 12.00 Spot Rate : 1.2500 Average : 1.0157 YTW SCENARIO |

| TRP.PR.A | FixedReset | Quote: 13.53 – 14.19 Spot Rate : 0.6600 Average : 0.4437 YTW SCENARIO |