The Bank of England has released the 2010 Q1 Quarterly Bulletin, with articles on:

- Markets and operations

- Interpreting equity price movements since the start of the financial crisis

- The Bank’s balance sheet during the crisis

- Changes in output, employment and wages during recessions in the United Kingdom

- Summaries of recent Bank of England working papers

- …and other topics

The first section had some notes on bank financing:

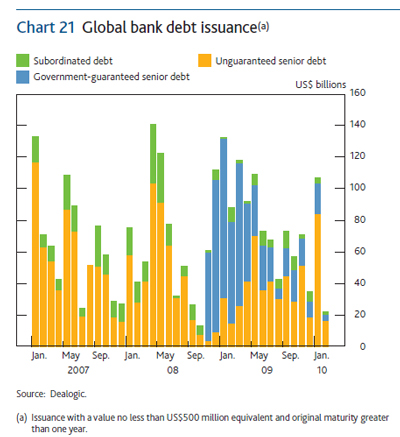

At longer horizons, banks face a challenge to secure funding to replace government-sponsored schemes which will expire over the next couple of years. As part of their strategy to address this funding gap, banks issued a significant amount of senior debt over recent months (Chart 21). This included record issuance from UK banks in January, although issuance was markedly weaker in February. And while many government-guarantee schemes continued, some banking sectors reduced their dependence on these.

Contacts also reported that banks were increasingly looking to securitisation and covered bond markets to raise funds. Covered bond issuance continued to increase; including from banks whose issuance was not eligible for ECB purchase. Prospects for issuance of mortgage-backed securities also reportedly improved. Total issuance in the first months of 2010 remained limited (Chart 22), despite individual issues by, for example, Lloyds Banking Group and Co-operative Bank. Other banks were reported to be preparing for future issuance, however, including the possibility of issues that do not give the investor an option to sell back the debt.

However, despite recent debt issuance, contacts highlighted that for many banks the combined pace of long-term funding was not yet sufficient to meet refinancing needs without some corresponding reduction in assets. And while capital markets remained open for banks to issue subordinated debt, contacts noted that banks may have little incentive to issue such securities in light of the uncertainty about prospective changes to prudential regulation. Specifically, the Basel Committee on Banking Supervision released a consultative document that raised questions about whether new issuance would be counted as capital going forward.

Retail bond investors will find the new LSE programme of interest:

In response to demand from retail investors, on 1 February 2010 the London Stock Exchange launched a new electronic order system for bonds. Similar to arrangements for individuals to deal in shares, the new service offers continuous two-way pricing for trading in increments of as little as £1 for gilts and £1,000 for corporate bonds. Normally these investments would trade in units of £50,000.

Initially, 49 gilts and ten corporate bonds are available for trading including securities issued by a range of large companies and a bond issued specifically for this new service by Royal Bank of Scotland. The new market is supported by dedicated market makers.

I can’t say I found the paper on dividends all that interesting, but some readers might:

Equity markets have experienced large price movements since the financial crisis began in mid-2007. Understanding the factors that drive equity prices is important for policymakers as they may contain information about the future course of the economy. This article uses a simple model to decompose recent equity price movements into changes in earnings expectations, the risk-free rate and the equity risk premium. Indicative evidence suggests that changes in earnings expectations can account for some, but by no means all, of the shifts in equity prices since mid-2007. Policy actions by central banks and governments are likely to have supported equity prices, for example by lowering government bond yields and reducing the likelihood of more severe downside risks to the economy materialising. The latter may also have contributed to a fall in the implied level of the equity risk premium, which had increased sharply during the financial crisis.

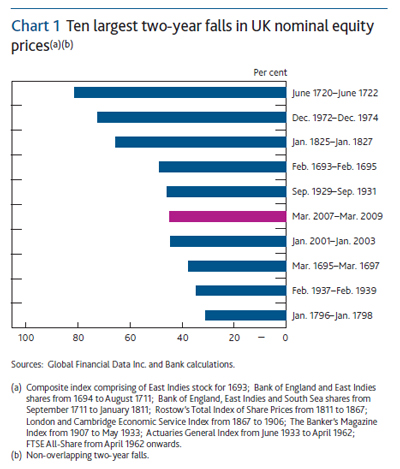

One reason I like the BoE publications is the time series:

So just be glad we didn’t have another 1720 (South Sea Bubble) all over again! You want to whimper about asset bubbles? You don’t know NUTHIN’ about bubbles!