Mr Joseph S Tracy, Executive Vice President of the Federal Reserve Bank of New York, gave a speech titled A strategy for the 2011 economic recovery:

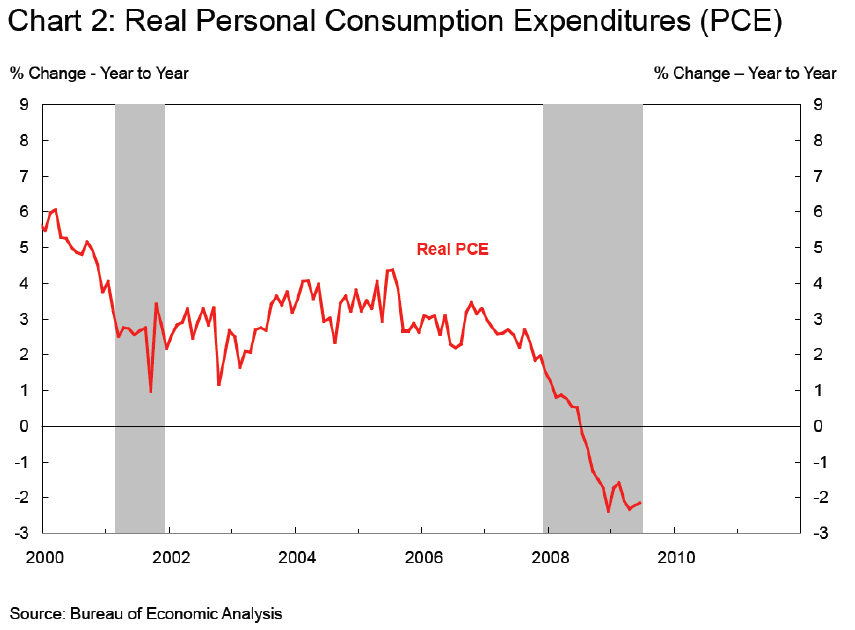

The Great Recession distinguished itself from earlier recessions in terms of its severity rather than its length. There was a decline in real output relative to trend of $1.1 trillion or 8 percent (Chart 1). This contraction brought the level of real output back to its level in 2006. In most recessions, consumption growth slows but remains positive. In this recession, there was an actual decline in consumption rather than just a slowdown (Chart 2). When households need to cut back on their consumption, they typically do so first with durable goods – for example, by delaying the decision to replace a car or to trade up to a nicer house. It is no surprise then that auto sales dropped significantly (Chart 3). Housing starts had been declining since late 2005, and the decline continued during the recession (Chart 4). Producers reacted quickly to the sharp decline in consumer demand, but inventories still rose sharply relative to sales (Chart 5).

How many more stories like the following must we read before the current craze for paid government informants dies down?

An immigration officer tried to rid himself of his wife by adding her name to a list of terrorist suspects.

He used his access to security databases to include his wife on a watch list of people banned from boarding flights into Britain because their presence in the country is ‘not conducive to the public good’.

As a result the woman was unable for three years to return from Pakistan after travelling to the county to visit family.

The tampering went undetected until the immigration officer was selected for promotion and his wife name was found on the suspects’ list during a vetting inquiry.

Interesting opinion on the Canadian bond market:

In order to maximize value in their bond portfolios, investors should limit exposure to Canada’s corporate bond market, one of the most expensive and least diversified of its kind in the world, says Ed Devlin, executive vice president and portfolio manager at PIMCO Canada Corp.

“The fundamental problem with the Canadian corporate bond market is that there is are too many investors chasing too few issuers,” Mr. Devlin said in a recent note to clients.

He noted that 59% of Canada’s main corporate bond benchmark is concentrated in just 10 issuers. By comparison the percentage of the index concentrated in 10 issuers is 20% in the U.S., 26% in Great Britain and 35% in the Eurozone.

Just another reason to start marketting Maple bonds to Canadians … it will never happen. Maple issuers don’t make a point of hiring Canadian ex-regulators.

It was a good day on the Canadian preferred share market as PerpetualDiscounts were up 18bp while FixedResets gained 4bp. The Bozo Spread (Current Yield PerpetualDiscounts less Current Yield FixedResets) is now zero!

The market was well-behaved, with no entries at all in the Performance Highlights.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.2377 % | 2,393.3 |

| FixedFloater | 4.75 % | 3.45 % | 24,754 | 19.17 | 1 | -0.8658 % | 3,584.4 |

| Floater | 2.50 % | 2.29 % | 45,970 | 21.54 | 4 | -0.2377 % | 2,584.2 |

| OpRet | 4.82 % | 3.44 % | 69,738 | 2.26 | 8 | -0.0723 % | 2,387.6 |

| SplitShare | 5.28 % | 1.41 % | 364,948 | 0.85 | 4 | 0.2900 % | 2,472.9 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0723 % | 2,183.3 |

| Perpetual-Premium | 5.63 % | 5.26 % | 142,230 | 5.14 | 26 | 0.0242 % | 2,036.2 |

| Perpetual-Discount | 5.26 % | 5.27 % | 275,331 | 15.03 | 51 | 0.1823 % | 2,093.2 |

| FixedReset | 5.26 % | 3.58 % | 288,505 | 3.01 | 52 | 0.0427 % | 2,270.1 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| No individual gains or losses exceeding 1%! | |||

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| CM.PR.I | Perpetual-Discount | 89,824 | Desjardins crossed 15,000 at 23.61 and 25,000 at 23.65. TD crossed 10,000 at 23.65 and finally Desjardins crossed another 10,200 at 23.67. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-02-01 Maturity Price : 23.41 Evaluated at bid price : 23.63 Bid-YTW : 4.99 % |

| SLF.PR.F | FixedReset | 76,530 | Nesbitt crossed 75,000 at 27.10. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-07-30 Maturity Price : 25.00 Evaluated at bid price : 27.10 Bid-YTW : 3.63 % |

| RY.PR.Y | FixedReset | 54,175 | Nesbitt crossed 50,000 at 27.25. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-12-24 Maturity Price : 25.00 Evaluated at bid price : 27.25 Bid-YTW : 3.56 % |

| GWO.PR.J | FixedReset | 53,829 | Nesbitt crossed 50,000 at 26.90. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-01-30 Maturity Price : 25.00 Evaluated at bid price : 26.85 Bid-YTW : 3.55 % |

| CM.PR.L | FixedReset | 52,130 | RBC crossed 50,000 at 27.54. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.42 Bid-YTW : 3.47 % |

| RY.PR.H | Perpetual-Premium | 48,100 | RBC crossed 44,100 at 26.30. YTW SCENARIO Maturity Type : Call Maturity Date : 2017-06-23 Maturity Price : 25.00 Evaluated at bid price : 26.26 Bid-YTW : 4.70 % |

| There were 49 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| SLF.PR.G | FixedReset | Quote: 25.50 – 26.25 Spot Rate : 0.7500 Average : 0.4409 |

| BNS.PR.T | FixedReset | Quote: 27.06 – 27.40 Spot Rate : 0.3400 Average : 0.2512 |

| ELF.PR.G | Perpetual-Discount | Quote: 20.10 – 20.47 Spot Rate : 0.3700 Average : 0.2824 |

| BNS.PR.Y | FixedReset | Quote: 25.02 – 25.25 Spot Rate : 0.2300 Average : 0.1502 |

| FTS.PR.H | FixedReset | Quote: 25.55 – 25.99 Spot Rate : 0.4400 Average : 0.3703 |

| CM.PR.K | FixedReset | Quote: 26.60 – 26.91 Spot Rate : 0.3100 Average : 0.2419 |