The Bank for International Settlements has released a working paper by Paolo Angelini, Laurent Clerc, Vasco Cúrdia, Leonardo Gambacorta, Andrea Gerali, Alberto Locarno, Roberto Motto, Werner Roeger, Skander Van den Heuvel and Jan Vlček titled BASEL III: Long-term impact on economic performance and fluctuations:

We assess the long-term economic impact of the new regulatory standards (the Basel III reform), answering the following questions. (1) What is the impact of the reform on long-term economic performance? (2) What is the impact of the reform on economic fluctuations? (3) What is the impact of the adoption of countercyclical capital buffers on economic fluctuations? The main results are the following. (1) Each percentage point increase in the capital ratio causes a median 0.09 percent decline in the level of steady state output, relative to the baseline. The impact of the new liquidity regulation is of a similar order of magnitude, at 0.08 percent. This paper does not estimate the benefits of the new regulation in terms of reduced frequency and severity of financial crisis, analysed in BCBS (2010b). (2) The reform should dampen output volatility; the magnitude of the effect is heterogeneous across models; the median effect is modest. (3) The adoption of countercyclical capital buffers could have a more sizeable dampening effect on output volatility.

The FDIC has released its 4Q10 Quarterly Banking Profile with highlights:

- Banks Earned $21.7 Billion in Fourth Quarter as Recovery Continues

- Full-Year Net Income of $87.5 Billion Is Highest Since 2007

- Asset Quality Improves for Third Consecutive Quarter

- Institutions Set Aside Half as Much for Loan Losses as a Year Earlier

- 157 Insured Institutions Failed During 2010

Former Fed governor Hoenig is taking a hard line on Too-Big-To-Fail:

Federal Reserve Bank of Kansas City President Thomas Hoenig said U.S. regulators should avert another crisis by breaking up large financial institutions that pose a threat “to our capitalistic system.”

“I am convinced that the existence of too-big-to-fail financial institutions poses the greatest risk to the U.S. economy,” Hoenig said today in a speech in Washington. “They must be broken up. We must not allow organizations operating under the safety net to pursue high-risk activities and we cannot let large organizations put our financial system at risk.”

The full speech makes some interesting points:

At the Federal Reserve Bank of Kansas City, we estimated the ratings and funding advantage for the five largest U.S. banking organizations during this crisis. In June 2009, these organizations had senior, long-term bank debt that was rated four notches higher on average than it would have been based on just the actual condition of the banks, with one bank given an eight notch upgrade for being too big to fail. Looking at the yield curve, this four-notch advantage translates into more than a 160 basis point savings for debt with two years to maturity and over 360 basis points at seven years to maturity.

…

So long as we have systemic organizations operating under the government’s protection, we will face the matter of whether we have the will to allow the market and bankruptcy to resolve them. In a major crisis, there will always be an overwhelming impulse to avoid putting such institutions through receivership. Always, it is feared that public confidence will be shattered, creditors or depositors at other institutions will panic, and that there are too many connections that will bring down other institutions. In addition, important services will be lost and the international activities will be too complex to resolve.Many of these fears are likely overstated. I maintain the view that the long-term consequences are much more severe if we fail to take action to end this cycle of repeated crises. In an environment where market participants are truly at risk, they will be much more likely to take steps to protect themselves, thus reducing the side effects of resolutions, and a failed institution’s essential activities can be continued through bridge banks and other means.

Glad to hear it! Instead of weekend bail-outs, lets have weekend bankruptcies, with governments if necessary, providing Debtor in Possession financing at a punitive interest rate rather than equity infusions.

The Bank for International Settlements has released a working paper by Richhild Moessner, Feng Zhu and Colin Ellis titled Measuring disagreement in UK consumer and central bank inflation forecasts:

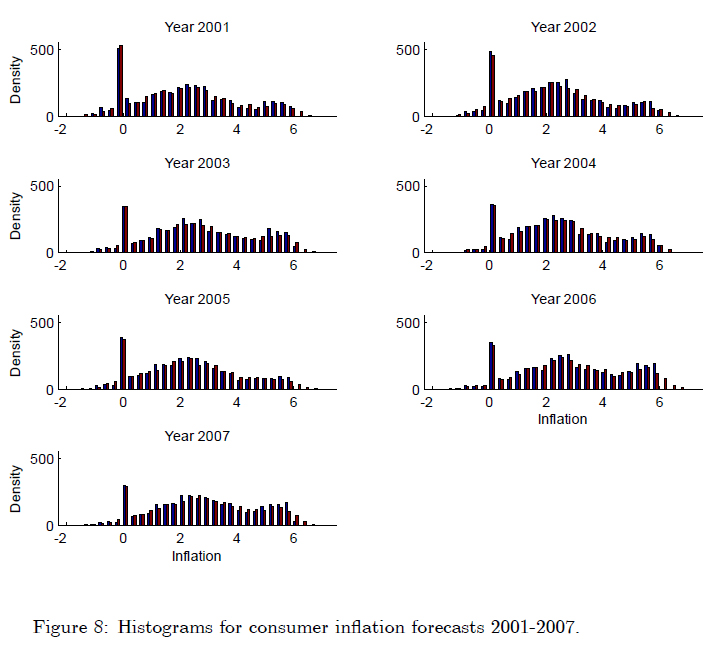

We provide a new perspective on disagreement in inflation expectations by examining the full probability distributions of UK consumer inflation forecasts based on an adaptive bootstrap multimodality test. Furthermore, we compare the inflation forecasts of the Bank of England’s Monetary Policy Committee (MPC) with those of UK consumers, for which we use data from the 2001-2007 February GfK NOP consumer surveys. Our analysis indicates substantial disagreement among UK consumers, and between the MPC and consumers, concerning one-year-ahead inflation forecasts. Such disagreement persisted throughout the sample, with no signs of convergence, consistent with consumers’ inflation expectations not being “well-anchored” in the sense of matching the central bank’s expectations. UK consumers had far more diverse views about future inflation than the MPC. It is possible that the MPC enjoyed certain information advantages which allowed it to have a narrower range of inflation forecasts.

I found the charts of consumer expectations enlightening:

An Instinet analyst opines that the TMX-LSX merger will be blocked:

But she argued such positives were outweighed by the fact that LSE would have a slight edge in governance (getting the CEO seat and one more board seat) and that Canada’s influence could be watered down further in coming years.

…

One of the biggest hurdles may be intangible — the symbolic importance of having a national exchange company.“Canadian policy seeks to ensure Canada’s “ownership” of its culture. As the Toronto and Montreal Exchanges are important at both strategic and symbolic levels, we do not believe that the government will feel comfortable ceding control of either. While the least concrete, this factor may ultimately prove to be one of the most important determinants in Minister Clement’s decision,” [director of global trading research at brokerage firm Instinet] Ms. [Alison] Crosthwait wrote, adding that public opinion will play a big role.

Gee, I’m sure glad business sense doesn’t enter the equation! That would really complicate matters!

It was a gloomy day in the Canadian preferred share market, with PerpetualDiscounts down 17bp, FixedResets losing 15bp and DeemedRetractibles giving up 14bp. Volatility continued to be on the low side, with only five entries in the Performance Highlights table, albeit all negatives. Volume was heavy.

PerpetualDiscounts now yield 5.61%, equivalent to 7.85% interest at the standard equivalency factor of 1.4x. Long corporates now yield about 5.5%, so the pre-tax interest-equivalent spread is now 235bp, a significant increase from the 225bp reported on February 16. It will be remembered that comparability of these levels over the long term has been compromised by drastic changes to index composition necessitated by OSFI’s refusal to grandfather extant preferreds when new capital rules come into force.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0238 % | 2,392.2 |

| FixedFloater | 4.75 % | 3.47 % | 16,587 | 19.08 | 1 | 0.2187 % | 3,586.0 |

| Floater | 2.50 % | 2.27 % | 49,678 | 21.56 | 4 | 0.0238 % | 2,582.9 |

| OpRet | 4.83 % | 3.88 % | 92,073 | 2.19 | 8 | 0.0242 % | 2,387.3 |

| SplitShare | 5.33 % | 0.19 % | 248,160 | 0.80 | 4 | 0.0806 % | 2,474.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0242 % | 2,183.0 |

| Perpetual-Premium | 5.75 % | 5.54 % | 123,964 | 1.29 | 9 | -0.2246 % | 2,031.6 |

| Perpetual-Discount | 5.55 % | 5.61 % | 129,329 | 14.41 | 15 | -0.1724 % | 2,108.8 |

| FixedReset | 5.26 % | 3.87 % | 190,867 | 3.01 | 54 | -0.1476 % | 2,255.5 |

| Deemed-Retractible | 5.21 % | 5.29 % | 387,358 | 8.25 | 53 | -0.1422 % | 2,079.6 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| FTS.PR.H | FixedReset | -1.36 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-07-01 Maturity Price : 25.00 Evaluated at bid price : 25.40 Bid-YTW : 3.84 % |

| GWO.PR.H | Deemed-Retractible | -1.22 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.46 Bid-YTW : 5.74 % |

| CU.PR.B | Perpetual-Premium | -1.10 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2012-07-01 Maturity Price : 25.00 Evaluated at bid price : 25.12 Bid-YTW : 5.58 % |

| BNS.PR.Z | FixedReset | -1.02 % | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.35 Bid-YTW : 4.18 % |

| BMO.PR.P | FixedReset | -1.01 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2015-03-27 Maturity Price : 25.00 Evaluated at bid price : 26.34 Bid-YTW : 3.97 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TRP.PR.A | FixedReset | 197,606 | Nesbitt crossed 125,000 at 25.75 and 50,000 at 25.80. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.77 Bid-YTW : 3.95 % |

| BNS.PR.K | Deemed-Retractible | 113,817 | Nesbitt crossed 80,000 at 24.50; TD crossed 25,000 at the same price. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 24.47 Bid-YTW : 5.13 % |

| TD.PR.M | OpRet | 75,318 | RBC crossed 45,700 at 25.65; Desjardins crossed 28,700 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2012-05-30 Maturity Price : 25.25 Evaluated at bid price : 25.59 Bid-YTW : 3.82 % |

| TD.PR.G | FixedReset | 72,859 | Nesbitt crossed 20,000 at 27.00; TD crossed blocks of 25,000 and 12,500 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 26.94 Bid-YTW : 3.92 % |

| SLF.PR.B | Deemed-Retractible | 65,012 | Nesbitt crossed 50,000 at 23.80. YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 23.76 Bid-YTW : 5.53 % |

| CM.PR.L | FixedReset | 64,139 | RBC crossed 50,000 at 27.47. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.41 Bid-YTW : 3.56 % |

| There were 55 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BNS.PR.Z | FixedReset | Quote: 24.35 – 25.00 Spot Rate : 0.6500 Average : 0.4759 YTW SCENARIO |

| TRI.PR.B | Floater | Quote: 23.00 – 23.97 Spot Rate : 0.9700 Average : 0.8607 YTW SCENARIO |

| CU.PR.B | Perpetual-Premium | Quote: 25.12 – 25.42 Spot Rate : 0.3000 Average : 0.1914 YTW SCENARIO |

| TRP.PR.B | FixedReset | Quote: 25.05 – 25.43 Spot Rate : 0.3800 Average : 0.2735 YTW SCENARIO |

| BAM.PR.J | OpRet | Quote: 26.86 – 27.30 Spot Rate : 0.4400 Average : 0.3429 YTW SCENARIO |

| FTS.PR.E | OpRet | Quote: 26.35 – 26.64 Spot Rate : 0.2900 Average : 0.2089 YTW SCENARIO |