Greek spreads are getting ridiculous:

The yield on Greece’s 2-year bond topped 30 percent for the first time and the cost of protecting Greece against default climbed 280 basis points to a record 2,050 basis points, according to prices compiled by CMA.

The US Senate did something sensible!:

The U.S. Senate voted to eliminate a tax credit and a tariff for ethanol production, providing the strongest signal yet that Congress will curtail subsidies for corn-based biofuel.

The 73-27 vote exceeded the 60-vote threshold needed to advance the measure as part of an economic development bill. Still, the legislation isn’t likely to become law, and the vote indicated that it will be difficult for ethanol supporters to extend the 45-cent-a-gallon tax break and the 54-cent-a-gallon tariff beyond their scheduled Dec. 31 expiration.

There must have been a blue moon recently because the House did something sensible, too:

The budget of the Commodity Futures Trading Commission would be cut by 15 percent, or $30 million, under a measure passed by the U.S. House.

The Republican spending bill approved today would reduce the agency’s budget to $172 million from its current level of $202 million. The CFTC is responsible for writing most of the new rules to govern derivatives trades made by banks including Goldman Sachs Group Inc. (GS) and Morgan Stanley. (MS)

Bank of Canada Governor Mark “Ban the Bond” Carney continued his crusade for Central Planning yesterday, with a speech titled Housing in Canada:

Since 2008, the federal government has taken a series of prudent and timely measures to tighten mortgage insurance requirements in order to support the long-term stability of the Canadian housing market. These will reduce the possibility that prices are further driven up simply through higher leverage.

No broad-brush policy making for Mr. Carney! Rationing is much preferable to the free market, since it makes the rationers more important. As the Globe noted:

Mr. Carney strongly suggested that the central bank continues to see narrow financial regulation, like steps taken by the Finance Department to make it harder for some Canadians to get a mortgage, as a more appropriate tool than rate hikes for taming the domestic side of the equation.

What should be done, if anything? I am fully prepared to concede that housing prices in Canada have the potential to become harmful; and, for the sake of an argument, am prepared to listen to anybody who cares to argue that we have now reached that point. Well, let’s take a look at another snippet from the speech:

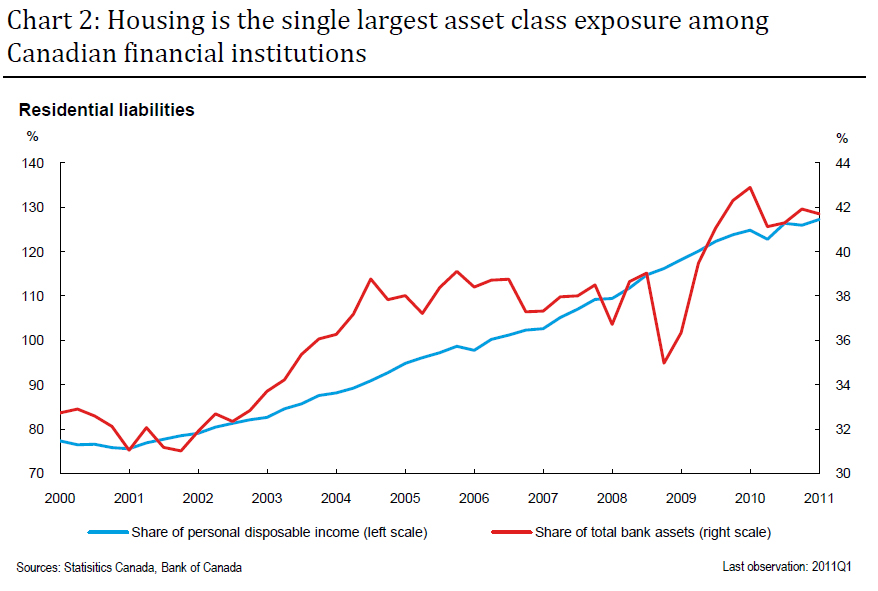

A home purchase triggers the biggest liability most families will ever take on. The value of housing-related debt in Canada has nearly tripled over the past decade to $1.3 trillion. This debt is also the single largest exposure for Canadian financial institutions, with real estate loans making up more than 40 per cent of the assets of Canadian banks, up from about 30 per cent a decade ago (Chart 2).

The obvious answer to this problem – assuming that careful study confirms that this is a problem, which I rather suspect it would – is not to ration credit to those using it for proper purposes, but to introduce counter-cyclical capital requirements on banks. Currently, a mortgage attracts a 35% Risk-Weight for bank capital calculation purposes. OK, keep that, but then say … ‘if your bank has more than 35% real-estate exposure, the Risk-Weight on the amount over 35% is 40%. And the Risk-Weight on the amount over 40% is 45%. This is infinitely preferable to micro-managing banks’ credit decisions and creating a morrass of complex rules to be applied (or ignored, if you’re good friends with the loan officer) at the retail level.

BIS has often warned about the tsunami of maturities soon to be experienced by global banks. So is Moody’s:

Of the the roughly US$11-trillion in long-term bank debt outstanding globally, nearly half will come due between now and the end of 2014, according to Moody’s.

The sudden rise in maturing debt “leaves the banking system exposed to refinancing risk” as the current low-interest rate environment is not expected to continue indefinitely, the rating agency said in a report on Thursday.

According to Moody’s, about US$3.4-trillion, or 33%, will come due by the end of 2012, and $4.9-trillion (45%) by the end of 2013.

…

Moody’s said the most likely scenario as banks deal with the challenge is higher funding costs and lower profitability.

New book idea: “The Statement of Dorian Yellow”, in which an investor shows the world the statment of most of his invetments, with YLO issues being kept secret.

| YLO Issues, 2011-6-16 | |||||

| Ticker | Quote 6/15 |

Quote 6/16 |

Bid YTW 6/16 |

YTW Scenario 6/16 |

Performance 6/16 (bid/bid) |

| YLO.PR.A | 23.23-29 | 23.10-15 | 9.60% | Soft Maturity 2012-12-30 |

-0.55% |

| YLO.PR.B | 15.57-90 | 15.51-68 | 14.76% | Soft Maturity 2017-06-29 |

-0.39% |

| YLO.PR.C | 13.75-90 | 13.36-45 | 12.17% | Limit Maturity | -2.83% |

| YLO.PR.D | 13.94-19 | 13.61-65 | 12.21% | Limit Maturity | -2.37% |

It was a downish day on the Canadian preferred share market, with PerpetualDiscounts flat, FixedResets flat and DeemedRetractibles down 7bp. There were no performance highlights, but volume was really good, with quite a few issues trading in good size.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0816 % | 2,471.8 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | -0.0816 % | 3,717.6 |

| Floater | 2.45 % | 2.22 % | 41,353 | 21.75 | 4 | -0.0816 % | 2,668.9 |

| OpRet | 4.88 % | 3.07 % | 65,537 | 0.37 | 9 | 0.0646 % | 2,429.2 |

| SplitShare | 5.25 % | -0.07 % | 64,611 | 0.49 | 6 | -0.0513 % | 2,496.3 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.0646 % | 2,221.2 |

| Perpetual-Premium | 5.66 % | 5.13 % | 145,861 | 0.92 | 12 | -0.0230 % | 2,073.7 |

| Perpetual-Discount | 5.46 % | 5.58 % | 118,468 | 14.44 | 18 | -0.0047 % | 2,177.6 |

| FixedReset | 5.16 % | 3.32 % | 204,097 | 2.81 | 57 | 0.0040 % | 2,311.3 |

| Deemed-Retractible | 5.08 % | 4.90 % | 294,001 | 8.19 | 47 | -0.0748 % | 2,151.8 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| No individual gains or losses exceeding 1%! | |||

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TD.PR.M | OpRet | 426,000 | Nesbitt crossed 423,000 at 25.70. Nice ticket! YTW SCENARIO Maturity Type : Call Maturity Date : 2011-07-16 Maturity Price : 25.50 Evaluated at bid price : 25.70 Bid-YTW : 2.27 % |

| TD.PR.Y | FixedReset | 211,600 | Nesbitt crossed blocks of 105,000 and 100,000, both at 26.26. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-11-30 Maturity Price : 25.00 Evaluated at bid price : 26.24 Bid-YTW : 3.28 % |

| TRI.PR.B | Floater | 152,985 | Nesbitt crossed 150,000 at 23.25. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-06-16 Maturity Price : 22.99 Evaluated at bid price : 23.26 Bid-YTW : 2.22 % |

| TD.PR.I | FixedReset | 129,300 | Nesbitt crossed 120,000 at 27.48. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.43 Bid-YTW : 3.32 % |

| BNS.PR.X | FixedReset | 119,013 | Nesbitt crossed 100,000 at 27.45. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-25 Maturity Price : 25.00 Evaluated at bid price : 27.40 Bid-YTW : 3.16 % |

| BNS.PR.P | FixedReset | 115,151 | Nesbitt crossed blocks of 20,000 atnd 65,000 at 26.15. RBC crossed 25,000 at the same price. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-05-25 Maturity Price : 25.00 Evaluated at bid price : 26.12 Bid-YTW : 2.88 % |

| TD.PR.K | FixedReset | 110,885 | Nesbitt crossed 100,000 at 27.52. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-30 Maturity Price : 25.00 Evaluated at bid price : 27.43 Bid-YTW : 3.32 % |

| TD.PR.E | FixedReset | 108,020 | Nesbitt crossed 100,000 at 27.42. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-05-30 Maturity Price : 25.00 Evaluated at bid price : 27.32 Bid-YTW : 3.26 % |

| TRP.PR.A | FixedReset | 101,276 | Nesbitt crossed 80,000 at 25.89. YTW SCENARIO Maturity Type : Call Maturity Date : 2015-01-30 Maturity Price : 25.00 Evaluated at bid price : 25.75 Bid-YTW : 3.68 % |

| There were 48 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| FTS.PR.F | Perpetual-Discount | Quote: 23.30 – 23.95 Spot Rate : 0.6500 Average : 0.4102 YTW SCENARIO |

| GWO.PR.F | Deemed-Retractible | Quote: 25.31 – 25.78 Spot Rate : 0.4700 Average : 0.3425 YTW SCENARIO |

| SLF.PR.E | Deemed-Retractible | Quote: 22.60 – 22.87 Spot Rate : 0.2700 Average : 0.1708 YTW SCENARIO |

| BAM.PR.J | OpRet | Quote: 26.60 – 26.97 Spot Rate : 0.3700 Average : 0.2895 YTW SCENARIO |

| RY.PR.I | FixedReset | Quote: 26.06 – 26.32 Spot Rate : 0.2600 Average : 0.1811 YTW SCENARIO |

| BAM.PR.M | Perpetual-Discount | Quote: 21.30 – 21.53 Spot Rate : 0.2300 Average : 0.1604 YTW SCENARIO |

“Currently, a mortgage attracts a 35% Risk-Weight for bank capital calculation purposes.”

A bigger part of the problem might be that CMHC insured mortgages attract 0% risk weight for bank capital calculation purposes. So what would that imply… somehow getting such mortgages to attract higher weightings?

You are quite right about the CMHC.

One possibility is to cap the amount of mortgages insured by the CMHC. Perhaps progressive surcharges on the rates are required; perhaps the available insurance could be auctioned (e.g., once the CMHC has insured more than $X in mortgages, it then holds auctions in $10-million chunks: winning the auction allows you to insure $10-million more in mortgages).