Assiduous Readers will be aware of my admiration for American institutions. The politics may be crazy – and I feel that the SEC has been compromised by politicization – but there’s no doubt but that the finest quality ingredients go into the sausage-making process, regardless of what one might think of the final product. The latest example of this is living-will regulations:

U.S. regulators approved two sets of guidelines that banks including Citigroup Inc. (C) and JPMorgan Chase & Co. (JPM) will have to follow in drafting plans to protect the broader economy in the event of their own collapse.

The Federal Deposit Insurance Corp. board voted unanimously today to release a joint final rule laying out what the largest and most complex financial firms must include in so-called living wills they’re required to file. The panel also approved contingency planning guidelines for insured banks.

…

Regulators are requiring financial firms to file plans that are developed under the context of the bankruptcy code, with each designed to give a blueprint for how a firm could be taken apart. Subsidiaries with critical operations or core functions would also have to be addressed in resolution plans, a senior FDIC official said before today’s meeting.

Can you imagine? Requiring the plans to be compatible with the bankruptcy code that has been developed globally over three hundred years, adjusted, tweaked and refined in response to every conceivable contingency? It’s unheard of! It’s brilliant! I think the FDIC board members should all get Nobel Prizes, and that’s just for starters.

The Italian 5-year auction didn’t go too well:

Italian borrowing costs jumped at a 6.5 billion-euro ($8.8 billion) bond auction as contagion from Europe’s debt crisis leaves investors shunning the region’s most-indebted nations.

The Rome-based Treasury sold 3.9 billion euros of a new benchmark five-year bond to yield 5.6 percent, up from 4.93 percent when similar-maturity securities were sold on July 14.

Greece is finally getting some good advice:

Greece should default on its bonds to stop a deterioration of the economy, said Mario Blejer, a former Bank of England adviser who took the reins of Argentina’s central bank after its 2001 default on $95 billion.

“Greece should default, and default big,” Blejer, who was an adviser to Bank of England Governor Mervyn King from 2003 to 2008, said in an interview in Buenos Aires. “You can’t jump over a chasm in two steps.”

Rescue programs backed by the International Monetary Fund and European Central Bank are “recession creating” efforts that will leave Greece saddled with more debt relative to the size of its economy in coming years and stifle growth, Blejer said. A Greek default would push Portugal to do the same and would put Ireland “under tremendous pressure to at least symbolically default” on some of its debt, he added.

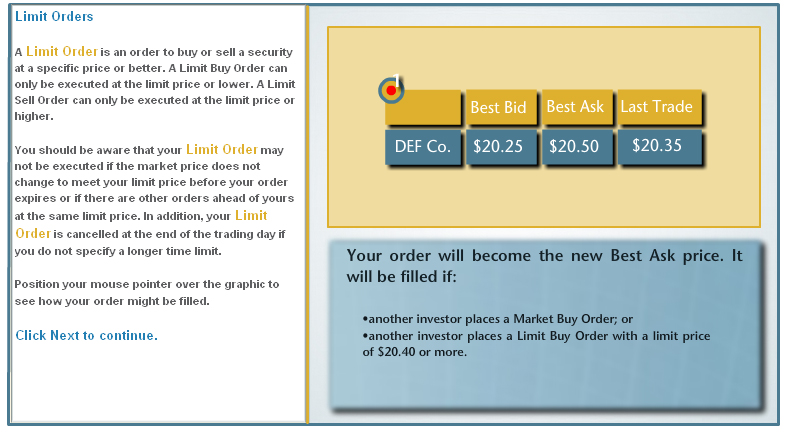

IIROC has published a rather cutesy Guide to Trading on Equity Markets. The interactive graphics are in desperate need of proof-reading … for example, item #5, purportedly indicating the “last trade” on the explanation of buy and sell orders is misplaced; while the explanation of limit orders illustrates the instruction “Sell 500 @ 20.00” with an explanation of the consequences if the order had in fact been “Sell 500 @ 20.40”. Good old IIROC, always good for a laugh.

The situation with TRE options is a disgrace:

Shareholders of Sino-Forest Corp. (TRE-T4.81—-%) aren’t the only ones with headaches after the Ontario Securities Commission halted trading in the company’s shares.

Investors who thought they were buying insurance using “put” options against a decline in the forestry company’s shares are facing the prospect that their protection could be worthless.

…

Last week, the OSC extended the cease-trade order to Jan. 25, 2012. During the four-month break, about 9,000 put options are scheduled to expire. Each put allows the holder to sell 100 shares at a predetermined price.

…

The issue first flared up on Aug. 26 when the Canadian Derivatives and Clearing Corp., which oversees options trading in Canada, announced that Sino-Forest options could not be exercised while trading in the stock was halted. That rattled investors who held put contracts that were now frozen.After discussions with the investors, the CDCC filed a request with the OSC asking for permission to allow some investors to exercise the options.

It is requesting special treatment for contracts that were purchased as protection against a long position in the shares. That means anyone who bought puts purely for speculative purposes will still be out of luck if the OSC approves the request.

I’m surprised at two things – mainly that such a situation isn’t common enough that it was foreseen and provided for in the contract specifications. It seems to me – at first blush – that the most logical way to address the problem is to extend the expiration date of the options by a term equal to the term of the cease trading order.

CDCC’s press release states:

In accordance with CDCC prior practice, CDCC made application to the OSC on September 7, 2011 for an order varying the Cease Trade Order to permit the outstanding put contracts to be exercised.

OSC staff are considering CDCC’s application and have advised CDCC that, if OSC staff determine it is appropriate to recommend that the requested variation order be granted, OSC staff may recommend that a condition be included in the variation order that limits the relief to holders of outstanding put contracts who are not current or former members of management or other insiders of Sino-Forest Corporation.

However, the application for the variance states:

CDCC members will be informed that if they (or their clients or other beneficiaries) wish to exercise a Put Contract, they must currently own the shares to make good delivery.

Even this wouldn’t be so bad, if you could at least sell your puts to somebody who did own shares (or who was short the puts already) – but the Montreal Exchange reports no trading in TRE options since the cease-trading order became effective. And I don’t know whether it would be legal to borrow the shares required to make good delivery.

If you were given the task of thinking up a response to such a situation most harmful to market integrity, you would suggest treating puts differently according to the moral virtue of the holder (speculators, of course, being EVIL! EVIL! EVIL!).

I don’t know much about the intricacies of the option market, but would dearly love to be guided to some authoritative discussion of the topic by somebody who does.

DBRS regards favourably the decision by Industrial Alliance Insurance and Financial Services Inc. (IAG or the Company; Subordinated Debentures rated “A”, Claims Paying Ability rated IC-2, and Non-Cumulative Preferred Shares rated Pfd-2 (high)) to privately place six million common shares worth close to $200 million with the Caisse de dépôt et placement du Québec. Pro forma the new issue, the new shares will represent 6.7% of the Company’s 90 million in outstanding common shares. The Company’s solvency ratio will increase by 14 percentage points as of June 30, 2011, to 208%. Ostensibly, the raising of capital at this time was a reaction to the recent weakness in the global economy as suggested by soft equity markets and continued downward pressure on interest rates. Both market developments could result in a required increase in actuarial reserves, which could erode earnings in the short run. To issue new capital in the current uncertain economic and market environment is therefore regarded as prudent.

IAG has been increasing its exposure to equity markets by virtue of segregated fund guarantees, increased equity assets held opposite long-tailed liabilities, and through the impact on management fee income in both the segregated fund operations and in the IA Clarington mutual fund operation. The Company is also exposed to falling interest rates. While IAG, like most life insurance companies, is dynamically hedging some of these market exposures, it is increasingly exposed to financial market volatility, which justifies the decision to increase its regulatory capital relative to the peer group.

IAG has stated:

The Company considers that its solvency ratio will remain above 175% as long as the S&P/TSX remains above 9,600 points (compared to 10,600 points without this issue) and will remain above 150% as long as the S&P/TSX remains above 8,100 points (compared to 8,800 points without this issue).

It was a mixed day on the Canadian preferred share market, with PerpetualDiscounts winning 16bp, FixedResets up 10bp and DeemedRetractibles losing 3bp. There was good volatility, all positive and dominated by BAM – perhaps the market forgot that all those issues went ex-Dividend today. Volume was low.

| HIMIPref™ Preferred Indices These values reflect the December 2008 revision of the HIMIPref™ Indices Values are provisional and are finalized monthly |

|||||||

| Index | Mean Current Yield (at bid) |

Median YTW |

Median Average Trading Value |

Median Mod Dur (YTW) |

Issues | Day’s Perf. | Index Value |

| Ratchet | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.8084 % | 2,154.9 |

| FixedFloater | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.8084 % | 3,241.0 |

| Floater | 3.02 % | 3.34 % | 62,376 | 18.92 | 3 | 0.8084 % | 2,326.8 |

| OpRet | 4.81 % | 2.00 % | 62,882 | 1.65 | 8 | 0.3805 % | 2,461.1 |

| SplitShare | 5.38 % | 1.56 % | 54,744 | 0.46 | 4 | -0.0983 % | 2,494.1 |

| Interest-Bearing | 0.00 % | 0.00 % | 0 | 0.00 | 0 | 0.3805 % | 2,250.4 |

| Perpetual-Premium | 5.62 % | 4.51 % | 123,673 | 1.09 | 16 | 0.0652 % | 2,115.0 |

| Perpetual-Discount | 5.27 % | 5.32 % | 114,723 | 14.98 | 14 | 0.1560 % | 2,259.5 |

| FixedReset | 5.14 % | 3.00 % | 202,273 | 2.63 | 59 | 0.0983 % | 2,334.5 |

| Deemed-Retractible | 5.04 % | 4.61 % | 241,234 | 7.79 | 46 | -0.0278 % | 2,199.9 |

| Performance Highlights | |||

| Issue | Index | Change | Notes |

| BAM.PR.O | OpRet | 1.05 % | YTW SCENARIO Maturity Type : Option Certainty Maturity Date : 2013-06-30 Maturity Price : 25.00 Evaluated at bid price : 25.90 Bid-YTW : 2.82 % |

| BAM.PR.P | FixedReset | 1.05 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2014-09-30 Maturity Price : 25.00 Evaluated at bid price : 27.15 Bid-YTW : 3.90 % |

| BAM.PR.N | Perpetual-Discount | 1.11 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-13 Maturity Price : 21.96 Evaluated at bid price : 22.29 Bid-YTW : 5.33 % |

| BAM.PR.B | Floater | 1.22 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-13 Maturity Price : 15.61 Evaluated at bid price : 15.61 Bid-YTW : 3.36 % |

| POW.PR.D | Perpetual-Discount | 1.23 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-13 Maturity Price : 24.30 Evaluated at bid price : 24.60 Bid-YTW : 5.15 % |

| BAM.PR.R | FixedReset | 1.35 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-13 Maturity Price : 23.39 Evaluated at bid price : 25.71 Bid-YTW : 3.78 % |

| FTS.PR.E | OpRet | 1.47 % | YTW SCENARIO Maturity Type : Call Maturity Date : 2013-06-01 Maturity Price : 25.75 Evaluated at bid price : 26.99 Bid-YTW : 2.00 % |

| BAM.PR.K | Floater | 1.48 % | YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-13 Maturity Price : 15.70 Evaluated at bid price : 15.70 Bid-YTW : 3.34 % |

| Volume Highlights | |||

| Issue | Index | Shares Traded |

Notes |

| TRP.PR.C | FixedReset | 85,275 | RBC crossed 30,000 at 26.10; TD crossed 45,000 at the same price. YTW SCENARIO Maturity Type : Limit Maturity Maturity Date : 2041-09-13 Maturity Price : 23.53 Evaluated at bid price : 26.10 Bid-YTW : 2.87 % |

| RY.PR.T | FixedReset | 54,200 | RBC crossed 50,000 at 27.35. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-08-24 Maturity Price : 25.00 Evaluated at bid price : 27.30 Bid-YTW : 3.11 % |

| BNS.PR.P | FixedReset | 52,235 | RBC crossed 50,000 at 25.95. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-04-25 Maturity Price : 25.00 Evaluated at bid price : 25.95 Bid-YTW : 2.98 % |

| NA.PR.M | Deemed-Retractible | 46,367 | RBC crossed 22,800 at 26.90. YTW SCENARIO Maturity Type : Call Maturity Date : 2013-05-15 Maturity Price : 26.00 Evaluated at bid price : 26.95 Bid-YTW : 3.78 % |

| CM.PR.J | Deemed-Retractible | 40,750 | YTW SCENARIO Maturity Type : Hard Maturity Maturity Date : 2022-01-31 Maturity Price : 25.00 Evaluated at bid price : 25.36 Bid-YTW : 4.41 % |

| TD.PR.G | FixedReset | 38,791 | RBC crossed 25,000 at 27.31. YTW SCENARIO Maturity Type : Call Maturity Date : 2014-04-30 Maturity Price : 25.00 Evaluated at bid price : 27.23 Bid-YTW : 3.00 % |

| There were 22 other index-included issues trading in excess of 10,000 shares. | |||

| Wide Spread Highlights | ||

| Issue | Index | Quote Data and Yield Notes |

| BNA.PR.E | SplitShare | Quote: 23.07 – 24.04 Spot Rate : 0.9700 Average : 0.7158 YTW SCENARIO |

| PWF.PR.A | Floater | Quote: 20.90 – 22.00 Spot Rate : 1.1000 Average : 0.8669 YTW SCENARIO |

| BMO.PR.P | FixedReset | Quote: 26.54 – 27.00 Spot Rate : 0.4600 Average : 0.3133 YTW SCENARIO |

| BAM.PR.O | OpRet | Quote: 25.90 – 26.35 Spot Rate : 0.4500 Average : 0.3316 YTW SCENARIO |

| ELF.PR.F | Perpetual-Discount | Quote: 23.10 – 23.41 Spot Rate : 0.3100 Average : 0.2313 YTW SCENARIO |

| SLF.PR.G | FixedReset | Quote: 25.10 – 25.35 Spot Rate : 0.2500 Average : 0.1805 YTW SCENARIO |