Derek DeCloet (last mentioned on PrefBlog regarding a column about regulatory pay scales) has written a column in the Globe titled Pull the Plug on Raters’ Special Status in which he discusses the repeal of the exemption given to credit rating agencies under National Policy 51-201 (to be horrifyingly precise, he discusses Regulation FD, which is the regulatory policy of some foreign country. But in Canada, it’s NP 51-201).

His source material for the column was a speech by David Einhorn, which was reported briefly by PrefBlog on April 18:

From the oh-hell-I’ve-run-out-of-time-here’s-some-links Department comes a speech by David Einhorn of GreenLight Capital, referenced by another blog. Einhorn is always thoughtful and entertaining, although it must be remembered that at all times he is talking his book. The problem with the current speech is that there is not enough detail – for instance, he equates Carlyle’s leverage of 30:1 which was based on GSE paper held naked with brokerages leverage, which is (er, I meant to say “should be”, of course!) hedged – to a greater or lesser degree, depending upon the institution’s committment to moderately sane risk management. But there are some interesting nuggets in the speech that offer food for thought.

Mr. DeCloet first takes care to establish his credentials as a hard nosed analyst, getting straight to the facts of any matter placed before him:

The markets’ most powerful brand is a letter (well, three letters): “AAA.” Or at least it was, until the rating agencies – Standard & Poor’s, Moody’s and others – debased it by handing it out the way parade clowns throw bonbons at little children.

Denigrating the ratings agencies is very fashionable!

Mr. DeCloet does not specify the nature of the debasement, nor does he show how he, or anybody else, did better without the benefit of hindsight. Track records are considered somewhat old-fashioned, these days, and three-hundred pound slobs at baseball parks denigrating the athletes between hot dog bites are considered the epitome of judicious analysts.

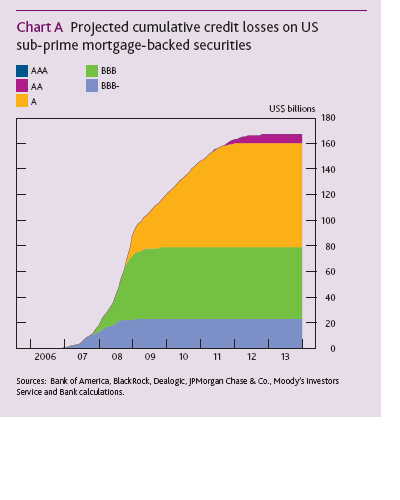

For those who are interested, I will reprint some material from the BoE Financial Stability Report, showing expected losses by sub-prime tranche:

Chart A also shows how the projected losses affect securities of different seniority. The more junior securities, with lower credit ratings, bear the first losses. But losses are projected to rise to levels that would eventually affect AA-rated securities. AAA-rated securities do not incur losses in this projection. But there is sufficient uncertainty that even these top-rated securities could conceivably bear some losses. For example, if all seriously delinquent mortgages defaulted after a year and the LGD rate was 55%, projected credit losses would reach US$193 billion, or 23% of outstanding principal. This loss rate would be high enough to affect some AAA-rated sub-prime mortgage-backed securities.

Good heavens, here we are in the middle of a financial cataclysm, and the BoE says “some AAA-rated sub-prime mortgage-backed securities” at the center of it could conceivably be affected.

Gee, Mr. DeCloet, can you get me some of those bonbons? They look pretty good to me!

He then arrives at his main point:

So the rating agencies’ role is a serious one, far more important than that of, say, equity analysts. If Citigroup’s crack research department says Royal Bank is about to be hit with $5-billion in losses, investors can choose to sell, ignore it or just laugh. But beyond that, it doesn’t really affect real-life business decisions. But if S&P were to say the same thing – watch out. The difference is the insider status.

I take issue with that last statement. I assert that there are two differences with an impact that exceeds insider status: reputation and regulation.

Reputation comes from the lengthy track record of the major agencies. They make available their transition analyses which show that – for all their errors and occasional spectacular folly – their advice is pretty good. Much better than most of their detractors, at any rate! Problems occur when investors place blind confidence in the ratings (everything should be checked), misuse the ratings (they are advice on credit. They are not advice on market prices or liquidity or tomorrow’s headline. What’s more, they are credit opinions, not credit facts) or, simply, do not diversify enough (if taking a small position in something is good, taking a large position is not necessarily better).

The problems with regulation is due to the extraordinary confidence placed in the credit ratings agencies – and in the ability of the marketplace to value credit in a sober and analytical manner – by the regulators. Basel I placed far too high confidence in the credit ratings of a bank’s holdings as a measure of its risk, and some regulators did not impose an assets to capital multiple cap on the banks under their supervision as a safety check. Among other things, this meant that there was an entire marketplace for AAA tranches with all the buyers buying the same thing for the same reasons … and that engendered a huge amount of “cliff risk”, sometimes referred to as “crowded trades” (as indicated by BoC Governor Carney in March).

The agencies, on the other hand, have just been trucking along, making their quota of mistakes and dispensing their advice, as they have done for the past 100-odd years.

For all that I disagree with his arguments, I agree with Mr. DeCloet’s conclusion: National Policy 51-201 (and Regulation FD) should be revised, to eliminate the insider advantage held by CRAs that freely distribute the fruits of their labours. The current (April) edition of Advisor’s Edge Report has an article by me on this very subject … the article is currently embargoed for republishing purposes, but will be made available on PrefBlog in the near future.

Update, 2008-5-21: For the article, see Opinion: Credit Ratings – Investors in a Bind.

[…] number of regulatory links today! In another post, I discussed Derek DeCloet’s column in today’s Globe, but there were other […]

[…] I mentioned this recent article briefly in the post DeCloet & National Policy 51-201. […]