As noted in MAPF Portfolio Composition: February 2015, the fund now has a fairly large allocation to FixedResets, although this segment remains below index weight.

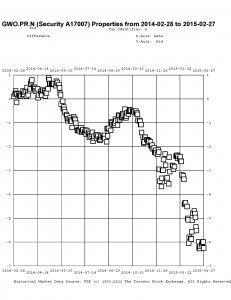

As these were largely purchased with proceeds of sales of DeemedRetractibles from the same issuer, it is interesting to look at the price trend of some of the Straight/FixedReset pairs. We’ll start with GWO.PR.N / GWO.PR.I; the fund sold the latter to buy the former at a takeout of about $1.00 in mid-June, 2014; relative prices over the past year are plotted as:

Given that the February month-end take-out was $6.25, this is clearly a trade that has not worked out very well.

In July, 2014, I reported sales of SLF.PR.D to purchase SLF.PR.G at a take-out of about $0.15:

There were similar trades in August, 2014 (from SLF.PR.C) at a take-out of $0.35. The February month-end take-out (bid price SLF.PR.D less bid price SLF.PR.G) was $6.45, so that hasn’t worked very well either.

The trend paused in September, 2014 and, indeed, can be said to have reversed, with the fund selling SplitShares (PVS.PR.B at 25.25-30) to purchase PerpetualDiscounts (BAM.PR.M / BAM.PR.N at about 21.25), a trade which worked out favourably and has been sort-of reversed (into PVS.PR.D) in November 2014.

In October 2014 there was another bit of counterflow, as the fund sold more SplitShares (CGI.PR.D at about 25.25) to purchase more PerpetualDiscounts (CU.PR.F and CU.PR.G, at about 21.25) which again worked out well and was reversed in November, selling the CU issues at about 22.45 to purchase low-spread FixedResets (TRP.PR.A and TRP.PR.B) at about 21.50 and 18.75 (post dividend equivalent), which was basically down by transaction costs at November month-end, but a significant loser by December month-end.

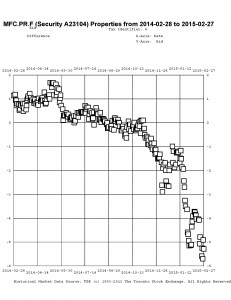

And November saw the third insurer-based sector swap, as the fund sold MFC.PR.C to buy the FixedReset MFC.PR.F at a post-dividend-adjusted take-out of about $0.85 … given a February month-end take-out of about $5.29, that’s another regrettable trade, although another piece executed in December at a take-out of $1.57 has less badly.

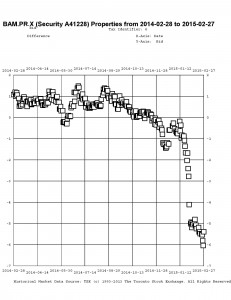

This trend is not restricted to the insurance sector, which I expect will become subject to NVCC rules in the relatively near future and are thus subject to the same redemption assumptions I make for DeemedRetractibles. Other pairs of interest are BAM.PR.X / BAM.PR.N:

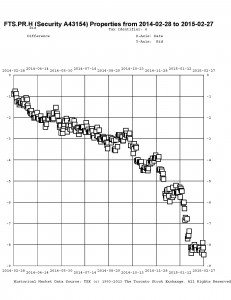

… and FTS.PR.H / FTS.PR.J:

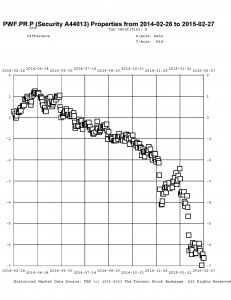

… and PWF.PR.P / PWF.PR.S:

I will agree that the fund’s trades highlighted in this post may be decried as cases of monumental bad timing, but I should point out that in May, 2014, the fund was 63.9% Straight / 9.5% FixedReset

while in February 2015 the fund was 35% Straight / 50% FixedReset & FloatingReset (The latter figures include allocations from those usually grouped as ‘Scraps’). Given that the indices are roughly 30% Straight / 60% FixedReset & FloatingReset, it is apparent that the fund was extremely overweighted in Straights / underweighted in FixedResets in May 2014 and that this qualitative tilt remains, but is no longer extreme. However, HIMIPref™ analytics have been heavily favouring low-spread issues and the fund’s holdings are overwhelmingly of this type.

Summarizing the charts above in tabular form, we see:

| FixedReset | Straight | Take-out December 2013 |

Take-out MAPF Trade |

Take-out December 2014 |

Take-out January 2014 |

Take-out February 2014 |

| GWO.PR.N 3.65%+130 |

GWO.PR.I 4.5% |

($0.04) | $1.00 | $2.95 | $5.80 | $6.25 |

| SLF.PR.G 4.35%+141 |

SLF.PR.D 4.45% |

($1.29) | $0.25 | $2.16 | $6.12 | $6.45 |

| MFC.PR.F 4.20%+141 |

MFC.PR.C 4.50% |

($1.29) | $0.86 | $1.20 | $5.15 | $5.29 |

| BAM.PR.X 4.60%+180 |

BAM.PR.N 4.75% |

($2.06) | $0.17 | $4.11 | $5.39 | |

| FTS.PR.H 4.25%+145 |

FTS.PR.J 4.75% |

$0.60 | $5.68 | $7.36 | $8.47 | |

| PWF.PR.P 4.40%+160 |

PWF.PR.S 4.80% |

($0.67) | $3.00 | $6.28 | $6.63 | |

| The ‘Take-Out’ is the bid price of the Straight less the bid price of the FixedReset; approximate execution prices are used for the “MAPF Trade” column. Bracketted figures in the ‘Take-Out’ columns indicate a ‘Pay-Up’ | ||||||

So why is all this happening? One should take care in explaining market movements, but it is my belief that in the latter half of 2013 we were dealing with the ‘taper tantrum’ – the market’s fears that Fed tapering and subsequent tapering would lead to massive spikes in yields; this led to a great preference for FixedResets over Straights. Now, with the economic news getting less inflationary with every news story and Europe and Japan desperately trying to reflate their sluggish economies, the market seems to think that these rate increases are still a long way off … leading to a great preference for Straights over FixedResets.

In addition, the graphs show a sharp spike in early December, during which the low-spread FixedResets were very badly hurt; I believe this to be due to a combination of tax-loss selling and a panicky response to the 29% reduction in the TRP.PR.A dividend.

And in January it just got worse with Canada yields plummeting after the Bank of Canada rate cut with speculation rife about future cuts although this has recently become less emphatic.

There was some good discussion about what is going on in the comments to the January 29 market action report. I take the view that we’ve seen this show before: during the Credit Crunch, Floaters got hit extremely badly (to the point at which their fifteen year total return was negative) because (as far as I can make out) their dividend rate was dropping (as it was linked to Prime) while the yields on other perpetual preferred instruments were skyrocketing (due to credit concerns). Thus, at least some investors insisted on getting long term corporate yields from rates based on short-term government policy rates. And it’s happening again!

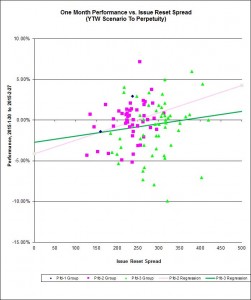

Here’s the February performance for FixedResets that had a YTW Scenario of ‘To Perptuity’ at mid-month. The correlations for both the Pfd-2 Group and the Pfd-3 Group are both so poor that the regression lines are essentially meaningless: 7% and 1%, respectively:

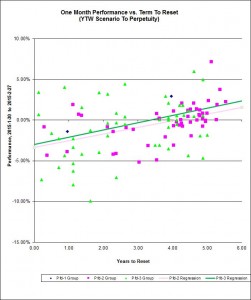

However, the chart for the same data showing performance against term-to-reset is significantly better, with correlations of 23% and 7%:

James, i am fairly certain that interest rates will rise at some point in our lifetime… these rate reset preferred, imo, are extremely cheap. The bank of Canada made a mistake in cutting rates. I think they realize that, and will take the opportunity to adjust when the Fed starts raising. Leaving rates this low, for this long, will certainly cause misallocation of resources (as if it hasnt already).

And i dont buy this deflation argument. to me, CPI is not an indicator of inflation.

Leaving rates this low, for this long, will certainly cause misallocation of resources (as if it hasnt already).

Yes, and to some extent we’re seeing that in already in Canadian housing prices – people are looking at this cheap money and deciding to borrow to the hilt to buy non-productive assets instead of investing in businesses.

I’m beginning to wonder whether or not the assumptions of interest rate policy are broken – or at least starting to bend. Central banking was invented in Victorian England, near the dawn of the industrial age, when to get rich – seriously rich – you needed to beg, borrow or steal enough money to build a factory or a railroad. Nowadays you just have to live with your parents for a few extra years and write code in the garage.

Investment simply isn’t as central to the economy as it used to be – although it will never disappear completely, of course.

And i dont buy this deflation argument. to me, CPI is not an indicator of inflation.

There are certainly criticisms of measured inflation, but what else is there? I expressed my views in the comments to the November 21 post.