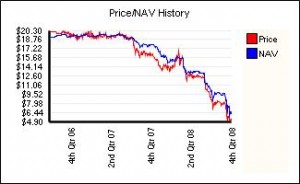

Accrued Interest brings us up to date on US Municipals. He mentioned delevering of closed end funds frantically trying to redeem their Auction Rate Securities … First Trust Advisors redeemed one tranche on Sept. 24, then another tranche Oct. 2 … of the same paper! The symbol (of the “Capital Units”, shall we say) of the fund is FPI and it has not been having a nice time:

FPI invests in tax-advantaged preferreds, but the delevering principal is the same as with municipal funds.

Ten year municipals are trading 50bp over treasuries – before tax effects – which is unusual to say the least. States and cities aren’t doing so well in this market:

Tax-exempt borrowers this week sold less than 15 percent of a typical week’s sales, data compiled by Bloomberg show, and their costs to borrow long term soared to the highest in eight years. Congress passed a $700 billion financial-market rescue plan today designed to unlock credit markets, urged on by California Governor Arnold Schwarzenegger’s warning that his and other states may need emergency loans without it.

…

States and cities have postponed more than $12 billion in note and bond deals since Lehman Brothers Holdings Inc. declared bankruptcy on Sept. 15, according to data compiled by Bloomberg. California may run out of cash at the end of the month if the state can’t sell billions in short-term debt, Treasurer Bill Lockyer, a Democrat, said Oct. 1.

Assiduous Readers will remember Mr. Lockyer – he’s made many unintentionally hilarious statements about investor behaviour … but should be more careful with what he wishes for.

The Citigroup/Wachovia/Wells Fargo fight promises to be entertaining – who has the most influential regulators?

“The FDIC stands behind its previously announced agreement with Citigroup,” FDIC Chairman Sheila Bair said in a statement today. “The FDIC will be reviewing all proposals and working with the primary regulators of all three institutions to pursue a resolution that serves the public interest.”

Emergency changes allow ideas to be tested in unexpected ways. I remember reading about a professor in the States who had gone so far as to attempt to estimate the effect on climate of jet plane contrails. All very thorough and meticulous, I’m sure, but how could his calculations ever be tested? He got his chance when air traffic over North America was shut down in the wake of 9/11.

And so it is with this moronic short-selling ban. The WSJ publicized some Credit Suisse research and there are a few bits and pieces here and there similarly examining actual data. Basically, the ban has increased volatility and increased transaction costs. This ban will provide grist for academic mills for a long time to come … I may start making a book on when the regulators will come forward and admit ‘We don’t understand the first thing about markets, we panicked and we were wrong’. Should be about maybe next week, eh?

As it happens, they rescinded the ban … its last day will be Wednesday 8th. Surprisingly, the press release makes no mention of staff resignations.

I’ve added material to the post Synthetic Extended Deposit Insurance – the Critique.

CIBC has entered into a risk-sharing agreement with Cerberus:

Canadian Imperial Bank of Commerce, which has taken more writedowns than any Canadian lender during the financial crisis, said Cerberus Capital Management LP will invest $1.05 billion in its U.S. real estate portfolio, helping the bank reduce risk.

…

The real estate portfolio has a notional value of about $6.3 billion and consists of mortgage-backed securities and collateralized debt obligations. The assets have been written down “by a material amount,” Lalonde said, with a fair value of $1.08 billion at July 31.

…

“CIBC has given away a portion of what appears to be the economic value of the underlying assets to protect the accounting (i.e. mark-to-market) downside,” National Bank Financial analyst Robert Sedran said in a note to investors.

PerpetualDiscounts off a bit today, marking their ninth consecutive down day. The weighted-mean-average pre-tax bid-YTW is now 6.38%, equivalent to 8.93% at the standard 1.4x equivalency factor. Long Corporates are now at about 6.75, making the pre-tax interest-equivalent spread about 218bp.

| Note that these indices are experimental; the absolute and relative daily values are expected to change in the final version. In this version, index values are based at 1,000.0 on 2006-6-30. The Fixed-Reset index was added effective 2008-9-5 at that day’s closing value of 1,119.4 for the Fixed-Floater index. |

|||||||

| Index | Mean Current Yield (at bid) | Mean YTW | Mean Average Trading Value | Mean Mod Dur (YTW) | Issues | Day’s Perf. | Index Value |

| Ratchet | N/A | N/A | N/A | N/A | 0 | N/A | N/A |

| Fixed-Floater | 4.84% | 4.95% | 80,743 | 15.57 | 6 | -0.7350% | 1,062.1 |

| Floater | 5.40% | 5.44% | 48,810 | 14.79 | 2 | -0.8375% | 745.0 |

| Op. Retract | 5.10% | 5.23% | 124,115 | 3.69 | 14 | -0.2790% | 1,025.5 |

| Split-Share | 5.84% | 8.20% | 56,441 | 4.10 | 12 | +0.3760% | 964.2 |

| Interest Bearing | 6.44% | 7.40% | 43,164 | 3.76 | 3 | +0.9056% | 1,071.5 |

| Perpetual-Premium | 6.33% | 6.37% | 55,114 | 13.36 | 1 | +0.7347% | 980.3 |

| Perpetual-Discount | 6.31% | 6.38% | 178,759 | 13.38 | 70 | -0.0424% | 849.6 |

| Fixed-Reset | 5.16% | 5.05% | 1,130,057 | 15.26 | 10 | -0.3707% | 1,100.0 |

| Major Price Changes | |||

| Issue | Index | Change | Notes |

| SBC.PR.A | SplitShare | -5.1777% | Asset coverage of 1.9+:1 as of October 2, according to Brompton Group. Now with a pre-tax bid-YTW of 7.11% based on a bid of 9.34 and a hardMaturity 2012-11-30 at 10.00. Sadly, the capital units are trading at around NAV, making the monthly retraction a chancy thing. Still … the Annual Retraction is at the end of December. |

| IAG.PR.A | PerpetualDiscount | -4.6101% | Now with a pre-tax bid-YTW of 6.92% based on a bid of 16.76 and a limitMaturity. |

| LBS.PR.A | SplitShare | -3.3120% | Asset coverage of just under 2.0:1 as of October 2, according to Brompton Group. Now with a pre-tax bid-YTW of 7.52% based on a bid of 9.05 and a hardMaturity 2013-11-29. The capital units are at a premium, making a monthly retraction a speculative proposition, but the annual retraction is at the end of November. |

| BAM.PR.J | OpRet | -2.7708% | Now with a pre-tax bid-YTW of 9.11% based on a bid of 19.30 and a softMaturity 2018-3-30 at 25.00. Compare with BAM.PR.H (6.73% to 2012-3-30), BAM.PR.I (7.17% to 2013-12-30) and BAM.PR.O (8.97% to 2013-6-30); and with the perpetuals at about 7.80%. |

| CM.PR.P | PerpetualDiscount | -2.7638% | Now with a pre-tax bid-YTW of 7.13% based on a bid of 19.35 and a limitMaturity. |

| CM.PR.K | FixedReset | -2.6369% | Now with a pre-tax bid-YTW of 5.43% based on a bid of 24.00 and a limitMaturity. |

| TD.PR.P | PerpetualDiscount | -2.5980% | Now with a pre-tax bid-YTW of 6.05% based on a bid of 22.12 and a limitMaturity. |

| BCE.PR.C | FixFloat | -1.8750% | |

| CM.PR.E | PerpetualDiscount | -1.7632% | Now with a pre-tax bid-YTW of 7.20% based on a bid of 19.50 and a limitMaturity. |

| POW.PR.D | PerpetualDiscount | -1.5633% | Now with a pre-tax bid-YTW of 6.89% based on a bid of 18.26 and a limitMaturity. |

| BCE.PR.G | FixFloat | -1.4989% | |

| GWO.PR.G | PerpetualDiscount | -1.4354% | Now with a pre-tax bid-YTW of 6.36% based on a bid of 20.60 and a limitMaturity. |

| CU.PR.B | PerpetualDiscount | -1.3682% | Now with a pre-tax bid-YTW of 6.19% based on a bid of 24.51 and a limitMaturity. |

| PWF.PR.H | PerpetualDiscount | -1.1106% | Now with a pre-tax bid-YTW of 6.33% based on a bid of 23.15 and a limitMaturity. |

| BAM.PR.K | Floater | -1.0947% | |

| NA.PR.L | PerpetualDiscount | -1.0096% | Now with a pre-tax bid-YTW of 6.29% based on a bid of 19.61 and a limitMaturity. |

| BNS.PR.N | PerpetualDiscount | +1.0054% | Now with a pre-tax bid-YTW of 5.81% based on a bid of 22.59 and a limitMaturity. |

| PWF.PR.L | PerpetualDiscount | +1.2054% | Now with a pre-tax bid-YTW of 6.46% based on a bid of 20.15 and a limitMaturity. |

| W.PR.J | PerpetualDiscount | +1.8887% | Now with a pre-tax bid-YTW of 6.87% based on a bid of 20.50 and a limitMaturity. |

| BAM.PR.M | PerpetualDiscount | +1.9066% | Now with a pre-tax bid-YTW of 7.74% based on a bid of 15.50 and a limitMaturity. |

| ENB.PR.A | PerpetualDiscount | +1.9523% | Now with a pre-tax bid-YTW of 5.92% based on a bid of 23.50 and a limitMaturity. |

| WFS.PR.A | SplitShare | +2.1352% | Asset coverage of just under 1.6:1 as of September 25, according to Mulvihill. Now with a pre-tax bid-YTW of 11.41% based on a bid of 8.61 and a hardMaturity 2011-6-30. Below $9, some might find even the regular monthly retraction to be attractive. |

| STW.PR.A | InterestBearing | +2.1352% | Asset coverage of just under 1.7:1 as of September 25, according to Middlefield. Now with a pre-tax bid-YTW of 6.65% (mostly as interest) based on a bid of 9.91 and a hardMaturity 2009-12-31. |

| FTN.PR.A | SplitShare | +3.2073% | Asset coverage of 2.2+:1 as of September 30 according to the company. Now with a pre-tax bid-YTW of 7.10% based on a bid of 9.01 and a hardMaturity 2014-12-1 at 10.00. The capital unit closed at 10.42, and the Special Annual Concurrent Retraction is this month … so it might be worth checking out this possibility. |

| ELF.PR.G | PerpetualDiscount | +3.2787% | Now with a pre-tax bid-YTW of 7.59% based on a bid of 15.75 and a limitMaturity. |

| LFE.PR.A | SplitShare | +3.913% | Asset coverage of 2.2+:1 as of September 15 according to the company. Now with a pre-tax bid-YTW of 6.51% based on a bid of 9.56 and a hardMaturity 2012-12-1 at 10.00 |

| BMO.PR.H | PerpetualDiscount | +3.9803% | Now with a pre-tax bid-YTW of 6.36% based on a bid of 21.16 and a limitMaturity. |

| BNA.PR.C | SplitShare | +6.0671% | Asset coverage of 3.2+:1 as of August 31 according to the company. Coverage now of 2.5+:1 based on BAM.A at 26.16 and 2.4 BAM.A held per preferred. Now with a pre-tax bid-YTW of 11.21% (!) based on a bid of 14.86 and a hardMaturity 2019-1-10 at 25.00. Compare with BNA.PR.A (9.62% to 2010-9-30) and BNA.PR.B (9.75% to 2016-3-25). |

| Volume Highlights | |||

| Issue | Index | Volume | Notes |

| NTL.PR.G | Scraps (would be Ratchet, but there are credit concerns) | 170,875 | |

| MFC.PR.B | PerpetualDiscount | 169,900 | Now with a pre-tax bid-YTW of 6.13% based on a bid of 19.16 and a limitMaturity. |

| NTL.PR.F | Scraps (would be Ratchet but there are credit concerns) | 154,557 | |

| GWO.PR.F | FixFloat | 56,562 | Now with a pre-tax bid-YTW of 5.97% based on a bid of 24.86 and a limitMaturity. |

| BNS.PR.K | PerpetualDiscount | 34,825 | Now with a pre-tax bid-YTW of 5.72% based on a bid of 21.00 and a limitMaturity. |

| TD.PR.P | PerpetualDiscount | 23,855 | Now with a pre-tax bid-YTW of 6.05% based on a bid of 22.12 and a limitMaturity. |

| PWF.PR.L | PerpetualDiscount | 17,325 | Now with a pre-tax bid-YTW of 6.46% based on a bid of 20.15 and a limitMaturity. |

There were eleven other index-included $25-pv-equivalent issues trading over 10,000 shares today.

Scary article on Globe and Mail website indicating Canadian banks are getting caught up in the turmoil and refusing to lend to each other. Maybe it’s time our bank CEO’s came totally clean on their exposure to the mess so we can decide, with full clarity, whether we want to stay invested in them.

Maybe it’s time our bank CEO’s came totally clean on their exposure to the mess

Why do you think they haven’t come clean already?

I’m no big fan of Canadian banks, but they’ve dodged the bullet on this one. However, they do manage to screw up monumentally every 20-years or so, and they’re about due.

With respect to the other concerns in today’s Globe … I note that there are more ‘For Sale’ signs on my street than usual, and one of them, at least, has a note from the broker stating ‘Buy this house and I’ll pay cash for yours!’. That sign wouldn’t even have been thought of last year!

Why do you think they haven’t come clean already?

The Cerberus CIBC deal. Didn’t these banks take hundreds of millions (if not billions) in write downs six or seven months ago all the while assuring us that was it? Now CIBC comes out and tells us they made a 1.05 billion deal with Cerberus for the “rest” of their exposure. I think there’s a veritable “sh__load still to come! If bankers in Europe and even Bank of Scotland (the Scots are notoriously frugal you know) got caught up to the degree they have, to think our genii in banking are pretty much immune is naive indeed.

CIBC’s exposures to the US Residential Mortgage Market is summarized in the table “Total Exposures” in their 3Q08 Earnings Release (page 12 of the PDF). They can’t guarantee that there won’t be further losses, any more than I can guarantee that my fund won’t suffer future losses even though the September 30 valuation is meticulously marked to market.

The CIBC / Cerberus deal is interesting. I’ve been saying for the past – maybe nine? – months that the big problem with sub-prime paper is that the market price is completely divorced from the fundamentals … nobody wants to have it on their books and therefore have to explain it to their clients or shareholders at any price.

And, you may remember, it is my fearless prediction that TARP will fail for the same reason MLEC failed … why would banks sell perfectly good (sub-prime) assets to Treasury at a yield of 15-20% in order to make loans to Mom & Pop at 8%? It makes no sense; they won’t participate unless they’re on the edge of bankruptcy.

So anyway, in the Cerberus deal, CIBC is giving up a big chunk of their upside to reduce their exposure to mark-to-market accounting.

Checked out the link you provided Mr. Hymas. Much too convoluted and complicated for me. Scares me even further to tell the truth as from what little I’m able to glean they seem to think they have “hedges” and “insurance” and we all know that going forward that ain’t necessarily the case anymore as CDS etc. are a major problem themselves. I hope I’m wrong, but I’m sticking with the original prediction and we ain’t seen nothin’ yet here in the Great White. It would be beyond belief if all the world’s banks are on the verge of teetering – except ours. That only our financial institutions’ CEO’s had the presence and forethought not to “go for broke” as it were. It would be nice, but I don’t believe it. They won’t lend to each other. That tells me none have been forthcoming even to each other let alone shareholders and the public. Each has a ton of stuff, on and off the books, and they know it. They know it because they hold it themselves and suspect the other of holding a like, if not more, amount.

only our financial institutions’ CEO’s had the presence and forethought not to “go for broke” as it were.

This time, they were (mostly) lucky. Banks are notorious for group-think and this time around, Canadians weren’t part of the group. TD is a market darling at the moment, but I remember the MBA crisis and their near-death experience of the late eighties.

They won’t lend to each other.

Other reasons that banks have to hoard cash is fear that their customers will draw on their credit lines and that they might face a wave of withdrawals from their own depositors. In every crisis, banks hoard cash.