I have, on occasion, suggested that resource stocks make an appropriate hedge to the inflation risk embodied by a position in PerpetualDiscounts. With this in mind, it is heartening to see a Bank of Canada Discussion Paper titled Are Commodity Prices Useful Leading Indicators of Inflation?:

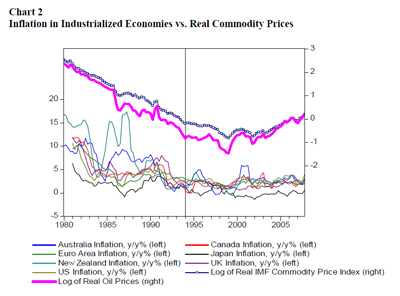

Commodity prices have increased dramatically and persistently over the past several years, followed by a sharp reversal in recent months. These large and persistent movements in commodity prices raise questions about their implications for global inflation. The process of globalization has motivated much debate over whether global factors have become more important in driving the inflation process. Since commodity prices respond to global demand and supply conditions, they are a potential channel through which foreign shocks could influence domestic inflation. The author assesses whether commodity prices can be used as effective leading indicators of inflation by evaluating their predictive content in seven major industrialized economies. She finds that, since the mid-1990s in those economies, commodity prices have provided significant signals for inflation. While short-term increases in commodity prices can signal inflationary pressures as early as the following quarter, the size of this link is relatively small and declines over time. The results suggest that monetary policy has generally accommodated the direct effects of short-term commodity price movements on total inflation. While indirect effects of short-term commodity price movements on core inflation have remained relatively muted, more persistent movements appear to influence inflation expectations and signal changes in both total and core inflation at horizons relevant for monetary policy. The results also suggest that commodity price movements may provide larger signals for inflation in the commodity-exporting countries examined than in the commodity-importing economies.

I will admit that the link drawn in this paper is reversed from my thesis: I am not so much concerned about what causes inflation, as I am with determining what will retain its value in the event of inflation. Still, the more links the better, say I, and I will leave for others to show a link between commodity prices and resource stock returns.