The Boston Fed has released a paper by Judit Montoriol-Garriga and Evan Sekeris titled A Question of Liquidity: The Great Banking Run of 2008?:

The current financial crisis has given rise to a new type of bank run, one that affects both the banks’ assets and liabilities. In this paper we combine information from the commercial paper market with loan level data from the Survey of Terms of Business Loans to show that during the 2007-2008 financial crises banks suffered a run on credit lines. First, as in previous crises, we find an increase in the usage of credit lines as commercial spreads widen, especially among the lowest quality firms. Second, as the crises deepened, firms drew down their credit lines out of fear that the weakened health of their financial institution might affect the availability of the funds going forward. In particular, we show that these precautionary draw-downs are strongly correlated with the perceived default risk of their bank. Finally, we conclude that these runs on credit lines have weakened banks further, curtailing their ability to effectively fulfill their role as financial intermediaries.

The authors note:

In order to test this hypothesis we used Credit Default Swap prices for the largest banks in our sample as a measure of how stressed the bank is perceived to be by the market. After controlling for other parameters, we found that banks with high CDS prices experienced significantly higher draw downs than banks with lower ones. In other words, when a bank was thought to be at high risk of default, firms that had credit lines with them were more likely to use them than if their credit line was with a healthier bank. This was a run on the banks by investors who ran away from the financial paper market which in turn triggered a run by borrowers of the weakest banks. This sequence of events was made possible by the combination of an increased reliance on the commercial paper market by financial institutions for their short term liquidity needs and the, often lax, underwriting of credit lines during the good years.

The authors suggest a hard look at the capital treatment of off-balance sheet committments:

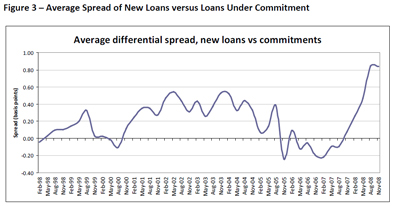

However, lower quality firms can use the lines of credit that they negotiated prior to the crisis at significantly better terms when credit standards were lax. Banks find themselves lending to these businesses at spreads that no longer reflect the risk they are exposed to. These “forced” loans crowd-out new loans to either lower risk businesses or to equally risky businesses but with spreads that better reflect their financial health.

In light of this inefficient use of credit lines in the 2007-2008 crisis, one may call into question whether the current regulatory framework is appropriate to deal with situations of market illiquidity. In particular, regulators may need to reconsider the regulation on bank capital requirements for off-balance sheet items such as unused commitments, and more generally, strengthen prudential oversight of liquidity risk management.

[…] This type of run was discussed in the post A Question of Liquidity: The Great Banking Run of 2008 […]

[…] make more sense, since CIT was drawing on credit lines with a pre-arranged spread. The Boston Fed looked at this issue. It is also my understanding that a lot of new lines are being negotiated as a spread off of CDS […]