The Bank for International Settlements has released the BIS Quarterly Review, March 2010, with articles:

- Overview: sovereign risk jolts markets

- Highlights of international banking and financial market activity

- The architecture of global banking: from international to multinational?

- Exchange rates during financial crises

- The dependence of the financial system on central bank and government support

- The term “macroprudential”: origins and evolution

They put the tempest in the teapot regarding sovereign CDS in context:

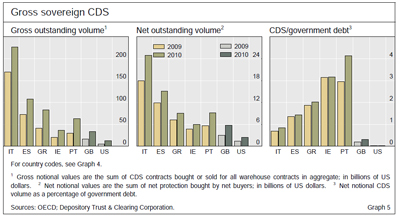

Activity in the CDS market for developed country sovereign debt increased significantly as investors adjusted their exposure to sovereign risk. This market was virtually non-existent only a few years back, when sovereign CDS were mostly on emerging market economies, but has since grown rapidly. This increase in activity resulted in significantly higher outstanding volumes of CDS contracts (Graph 5, left-hand panel). Nevertheless, the amount of sovereign risk which is actually reallocated via CDS markets is much more limited than the gross outstanding volumes would suggest. The sovereign reallocated risk is captured by the net outstanding amount of CDS contracts, which takes into account that many CDS contracts offset each other and therefore do not result in any actual transfer of credit risk. Net CDS positions on Portugal amounted to only 5% of outstanding Portuguese government debt. For other countries, including Greece, the ratio of sovereign CDS contracts to government debt was even lower (Graph 5, right-hand panel).

Another item of interest is the long-dated paper in the GBP market:

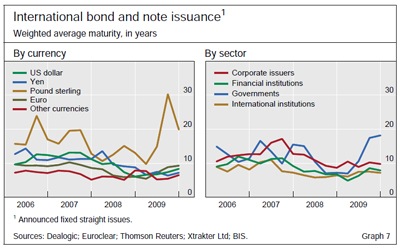

Borrowers adjusted their debt profile to lock in cheap funding costs. They repaid money market instruments (with maturities of less than one year) and floating rate bonds and notes by $141 billion and $71 billion, respectively. Meanwhile, they issued fixed rate bonds and notes to the tune of $492 billion. The average maturity of fixed rate bonds and notes rose from a low of 6.3 years in the first quarter of 2009 to 9.8 years in the third. It then declined slightly to 9.3 years in the final quarter. This, however, was entirely due to the extraordinarily high average maturity of sterling-denominated bonds issued in the third quarter (Graph 7, left-hand panel), when the UK government and a various special purpose vehicles securitising mortgages issued a number of very large bonds with maturities of up to 57 years. In the fourth quarter, sterling-denominated bonds still had longer maturities on average than those in other currencies, perhaps reflecting the high appetite for such paper by UK pension funds, forced to match their assets and liabilities on a mark to market. basis.[footnote] Governments in particular lengthened the maturities of their debt, to almost 20 years (Graph 7, right-hand panel).

Footnote: This issue is explored in some detail in the box on page 7 of the March 2006 BIS Quarterly Review.