Christopher Reid, Frédéric Dion and Ian Christensen, Real Return Bonds: Monetary Policy Credibility and Short-Term Inflation Forecasting, Bank of Canada Review, Autumn 2004:

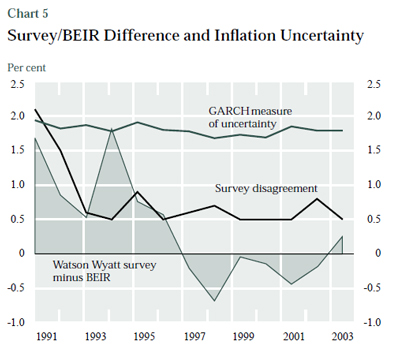

Chart 5 shows two proxies of long-run inflation uncertainty. The first is a measure of the disagreement among forecasters who responded to the Watson Wyatt survey, calculated as the difference between the upper and lower quartiles of reported inflation expectations at the 4- to 14-year horizon. The second measure is inflation uncertainty over a 5-year forecast horizon derived from a GARCH model developed by Crawford and Kasumovich (1996).

Côté et al. (1996) suggest that the increase in the BEIR [Break-Even Inflation Rate, Nominals less RRBs] in 1994, which was not accompanied by a similar move in survey measures, may reflect an increase in the inflation-risk premium. If changes in the premium for inflation uncertainty are an important factor in explaining movements in the BEIR, then sharp movements in these proxies should be associated with similar movements in the BEIR. Yet both measures fail to indicate a rise in inflation uncertainty in 1994 or a significant decline in 1997. Crawford and Kasumovich’s measure of inflation uncertainty fell dramatically during the 1980s but has been relatively stable since 1992. Similarly, survey disagreement fell between 1991 and 1994 but was relatively stable afterwards. The simplest explanation is that deviations of the BEIR from survey measures of inflation expectations are the result of some phenomenon other than changes in uncertainty regarding inflation.