Mikhail Chernov & Philippe Mueller: The Term Structure of Inflation Expectations:

The ten-year inflation premium declines from six to zero per cent during the post-monetary-experiment period. This decline suggests that long-run inflation expectations became more stable over time. Further, we reestimate our model every quarter and find that the long-run expectations have declined over time from 6% to 2%. The inflation persistence declined and the term structure of inflation expectations became flat over time. This evidence suggests that monetary policy became better anchored.

One implication of anchored inflation expectations is that it should be easier to forecast inflation and yields. Consistent with this prediction, we find that the model that incorporates both yields nd surveys dominates in out-of-sample forecasting of both inflation and yields. These results lead us to conclude that information in surveys is extremely important for establishing the links between inflation expectations and yields.

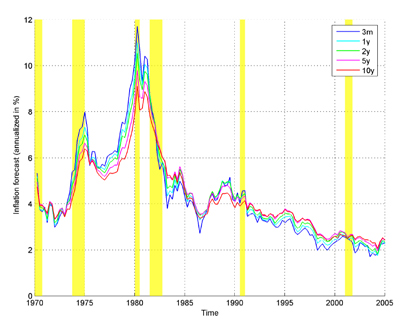

Figure 4 shows the time-series of the inflation expectations at multiple horizons. These expectations are computed from AO. In contrast to the survey forecasts in Figure 1, these objective, or marginal, expectations can be computed each period at any horizon.

The term structure effects are pronounced. The inflation curve becomes inverted in 1973, right before the recession, and continues to be inverted until early 1982. This period coincides with the unstable period of monetary policy during the Burns and Miller chairmanship of the US Federal Bank and the monetary policy experiment under Volcker’s chairmanship. The curve became inverted again briefly in the early part of Greenspan’s tenure from 1987 to 1991. afterwards, it had a normal, nearly flat, shape.

The out-of-sample analysis of the model suggests that monetary policy became more effective over time. The long-run expectations are anchored at about 2%. The term structure of inflation expectations has flattened out over time. This suggests that the arrival of new data does not affect long-run expectations much, perhaps because the monetary policy is expected to address all short term fluctuations successfully.