In the comments to another post, Assiduous Reader mpisni asks:

Hi James, Recently we have seen issues rated at lower ratings take some big hits ( FTS, SLF, ) but the recent issues in the 5.6% to 6 % range have remained relatively unaffected.

Is this because of the dividend rate, higher ratings ?

How will these issues prices be effected down the road and how much will rates have to increase to see negative effects on their prices

Thanks James

I don’t really have a LOT of time to deal with this right now, but …

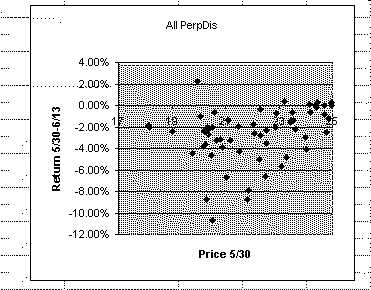

I’ve uploaded an Excel Spreadsheet showing the following data:

- ticker

- 5/30 YTW

- 5/30 Price

- DBRS Rating

- Total Return 5/30-6/13 (bid side)

The spreadsheet includes a graph!

You can play with these data as much as you like … and if anybody can answer any of mpisni‘s questions (particularly the implicit “When will this be over?” part) … let me know!

If I had to give an answer and if my answer had to assume rationality of the market over any given two-week period (both of these are rather big ifs), I’d suggest that one hypothesis to test would be that

- The market is anticipating further increases in long yields

- Therefore, it is marking the “negative convexity” yield-premium down really low, since it assumes that there is no potential for capital gains being given up

See my article on convexity if you don’t have a clue what I’m blathering about.

Update: Note that this is a hot issue because it appears the preferred share market has hit a new 15-month trough … particularly, I think, when today is finally over!

Update: OK, there are two more possibilities:

- The price paid for convexity was too much on 5/30; the market’s just readjusting … well … all I can say is: I don’t buy it.

- Brokers are dumping their losers. Retail stockbrokers seek to avoid criticism. They’ve been getting worried calls from unsophisticated clients all year about ‘How come that new issue you sold me is down so much?’ They’re making the judgement that, at the very least, recovery is not imminent and simply dumping it. The near-par stuff isn’t getting dumped because they’re not getting any calls about that stuff.

Update: Yet another possibility! I know of at least one stockbroker who, last November, was aggressively getting his clients into preferreds on the grounds that when the BCE issues got redeemed, a tsunami of money would boost prices of existing issues.

Some such clients might be getting a little dubious about the “when”.